2024-06-05 16:00:02

The variety of French households with property exceeding $1 million elevated by 50,000 in 2023. France has 827,000 millionaires, rating fifth on the earth.

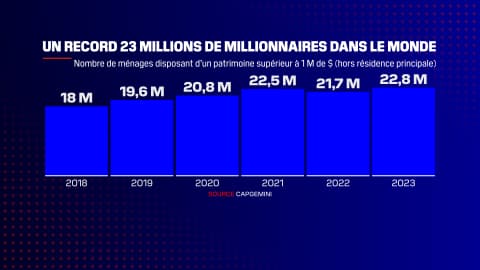

2023 is It’s been a wonderful yr for millionaires world wide. In response to CapGemini’s annual examine, by 2023, there might be almost 23 million households worldwide with property exceeding $1 million (€920,000, excluding main residence). This can be a 5% improve from 2022 and even a 70% improve in 10 years.

Collectively, these millionaires personal a record-breaking fortune of almost $87 trillion, greater than thrice the U.S. GDP.

This progress is essentially as a result of investor enthusiasm for synthetic intelligence, which has triggered inventory markets to soar virtually in every single place on the earth. In France, for instance, the CAC 40 index has risen 17% in a yr.

This helped enhance the variety of millionaires in France, the place the wealthy had their finest yr in Europe. The variety of millionaires elevated by 6.4% in a yr, and total wealth grew by the identical proportion.

France, the massive winner from Brexit

In response to CapGemini, the variety of millionaire households in France reached a file excessive of 827,000 in 2023, a rise of fifty,000 in a single yr. The rise was extra important than in Germany (+34,000), Italy (+26,000), Switzerland (+26,000), the Netherlands (+18,000), the UK (+16,000) or Spain (+14,000).

France is fifth on the earth when it comes to the variety of millionaire households, nicely behind Germany or China, however now nicely forward of the UK, which has 200,000 fewer millionaire households.

Brexit isn’t any stranger to France’s rise and Britain’s decline. Paris has develop into a fallback answer for the worldwide banking elite seeking to go away London.

“World monetary establishments are transferring their high executives to Paris to point out regulators they take them critically,” explains Florence Carr, Accomplice, EY Monetary Providers Workplace, Paris. It’s the buildup of a lot of little engaging issues, just like the high-end surroundings, that makes Paris extra fascinating than different locations, like the superb stage of worldwide faculties, or the truth that you may get on a prepare and be on the Cote d’Azur in regarding 5 hours within the Ivory Coast.”

To this surroundings we should clearly add the favorable evolution of the tax framework lately (abolition of the ISF, institution of a flat tax, and so on.) and the commercial take-off marked by a continued weakening of its attractiveness. For 5 years, France has been on the high of the European rankings for funding initiatives.

Reaching a historic switch of heritage

The buildup of world wealth will undoubtedly reignite the controversy on international taxation. For instance, on the G20 summit, Brazil and France are pushing for a 2% minimal tax on the world’s 3,000 billionaires, which may usher in $250 billion. This undertaking might not succeed as a result of the USA doesn’t approve of it.

Nevertheless, because the child boomers age and disappear, the passing on of this nice legacy will certainly happen.

In France, though retirees make up solely 25% of the entire inhabitants, they personal 40% of family property.

This future asset switch known as the “Nice Switch” as a result of the move of funds that can happen is historic. In response to CapGemini, $80 trillion might be transferred globally within the subsequent 20 years.

That is sure to spark a debate within the coming years in regards to the function the state ought to play on this switch. Ought to we not intervene greater than we do now, or spend a part of this windfall on social transfers?

In any case, the French are principally not in favor of state intervention, as in response to an OpinionWay survey by Les Echos, almost three quarters (74%) consider that French inheritance taxes are already too excessive, and 66% are in favor of lowering them. Solely 11% wish to improve them.

1717684071

#numbers #rising #sooner #Europe