2023-06-01 02:53:00

The Ministry of Finance, the Bank of Japan, and the Financial Services Agency held an extraordinary meeting just following the USD/JPY rose to a year-to-date high of 140.93 yen.

This week, May 30 (Tuesday), the Ministry of Finance, the Bank of Japan, and the Financial Services Agency held a special tripartite meeting.

After the meeting, Finance Minister Kanda said, “Various risk factors have been pointed out, such as the US debt ceiling problem and the bankruptcy problem. However, it was just following the US dollar strengthened and the yen weakened to the year-to-date high of 140.93 yen.In fact, discussions were held regarding the weaker yen.I think that’s what it means.

(source:TradingView)

Regarding the exchange rate, he said, “It is important for the exchange rate to reflect the fundamentals and move in a stable manner, and excessive fluctuations are not desirable. If necessary, we will continue to respond appropriately.” ,It was the usual cliche, but still the sense of caution spreadWe come.

It is natural for the market to be wary of intervention, considering the course of last year.It has become difficult to accumulate yen selling positions

because last year(2022)Because there was a similar movement in

Last year, the strong US dollar and the weak yen became clear from March.

[* Related articles here! ]

⇒Is there a possibility that the Bank of Japan will expand the permissible range of long-term interest rate fluctuations at its monetary policy meeting on June 16-17? If it expands, the exchange rate will appreciate considerably (Masato Imai, June 16, 2022)

That was the end of the story for the time being, but as the yen continued to depreciate, the tripartite meeting was held once more on September 8 (Thursday), and on September 22 (Thursday), the first US dollar selling/yen buying intervention took place. was carried out.

[* Related articles here! ]

⇒1 US dollar = 145 yen level is the level that currency authorities are aware of, but the trend of strong US dollar and weak yen cannot be changed by foreign exchange intervention. A policy to buy the US dollar firmly when the US dollar appreciation is corrected (September 29, 2022, Masato Imai)

⇒USD/JPY still has room to rise! In the medium term, 150 yen is also in sight. The only concern is the risk of intervention by the Japanese government. The trend of US dollar appreciation will continue until the peak of US interest rate hikes can be seen! (Masato Imai, September 22, 2022)

Even at the stage of last year, just because there was a tripartite meeting,There was much skepticism regarding whether the intervention would actually take place.butThe government decided to intervene in foreign exchangeDid.

Because of this situation from last year,Markets are naturally wary of interventionThat’s what I mean.

As in the past, the US dollar yen and the cross yen(Currency pairs other than the US dollar and the yen)So, it has become difficult to accumulate yen selling positions.

Looking at the US dollar/yen chart, it’s not strange that there will be an adjustment. If the yen depreciates to around 142-145 yen, it is time to intervene.

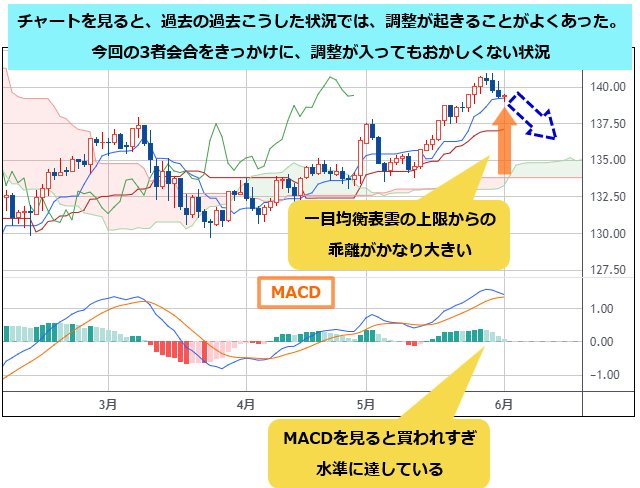

Looking at the daily chart of the US dollar/yen, as a result of the one-sided rise so far, the deviation from the upper limit of the Ichimoku Cloud is quite large. Also, looking at the MACD, it has reached overbought levels.

Charts don’t always move the same as they have in the past, but in the past such situations have often resulted in corrections.

It wouldn’t be surprising if this tripartite meeting triggered an adjustment.Therefore,need to be vigilantI think.

(source:TradingView)

If the market adjusts autonomously, the Ministry of Finance will do nothing,If the yen depreciates further from here, intervention to sell the US dollar and buy the yen will finally become a reality.I think it will come with

The level depends on the speed,Around 142-145 yenI personally don’t think so.

(source:TradingView)

The economic indicators that will come out by the FOMC in regarding two weeks will be important.If interest rate hikes continue, the US dollar/yen pair, which fell due to corrections, may rise once more.

Now that we have entered June from today, the FOMC that is attracting attention(U.S. Federal Open Market Commission)came regarding two weeks later.

CME(Chicago Mercantile Exchange)Looking at the FF ratefutures market, it is currently the mainstream to keep interest rates unchanged.There is still a 35% chance of an interest rate hike of 0.25%, so attention is increasing.

is.

(*Editor’s note: “FF rate” is the federal funds rate, also known as the FF rate. US policy rate)

I think there are quite a few FOMC members who are honestly at a loss.In that senseIndicators that will appear before the FOMC are important

It’s going to be

[* Related articles here! ]⇒

How to know breaking economic indicators in near real time? Of course, it is attractive that you can use it for free! I actually used it!yesterday(May 31st)

The number of vacancies announced in the U.S. Employment Trends Survey was 10.103 million, a strong result that greatly exceeded expectations.US employment data to be released tomorrow, Friday, June 2nd, and US CPI(Consumer Price Index)US PPI(wholesale price index)

Attention is drawn to results such asIf interest rate hikes continue, there is a high possibility that the US dollar/yen, which fell once due to corrections, will rise once more.

increase. Keep an eye on the metric results.

Short-term US dollar/yen and cross-yen shorts. The US dollar/yen pair is targeting a maximum of around 137 yen.As a trail,Short-term USD/JPY and cross-JPY shorts mainly due to recognition that yen-buying is likely to occur in the near term

I’m doing it toUSD/JPYUp to regarding 137 yen level

USD/JPY daily chart(source:TradingView

)

[Zai FX! Notice from the editorial department]Zai FX!but familiarMasato ImaiAfter receiving a report fromZai FX!will deliver“Zai FX! FX premium delivery With Masato Imai(Monthly fee: 5,500 yen (tax included))」

Zai FX!Premium delivery with Masato Imai

This is a practical paid e-mail magazine that provides a compact explanation of the day’s news, predictions regarding future exchange rate movements, and as much information as possible regarding Mr. Imai’s position.“Zai FX! FX premium delivery With Masato Imai”for10 days free trial period

1685590390

#dollaryen #pair #short #yen #level #future #wouldnt #strange #threeparty #meeting #triggered #adjustment #rise #yen #intervention #finally #realityMasato #Imais #happen #Japanese #economy #global #economy #ZaiFX