2023-04-26 09:12:00

Original title: The US dollar fell nearly 50 points, and the US heavyweight data hit!Gold bulls are brewing a bigger outbreak, and the price of gold is expected to rise by regarding $17

24K99 News On Wednesday (April 26) in the European market, the U.S. dollar index maintained its intraday decline and is now at 101.38, a sharp drop of nearly 50 points within the day; spot gold strengthened slightly during the day, and the price of gold is currently around $1998 per ounce.

(Source of the 60-minute chart of the US dollar index: 24K99)

FXStreet analyst Dhwani Mehta pointed out that the technical picture is still in favor of gold bulls, and as gold prices break through the 21-day moving average once more, gold prices may test $2,015 per ounce. Investors are now focused on U.S. economic data.

On Tuesday, renewed fears of a U.S. banking crisis led to a dominance of the risk-off theme and revived safe-haven demand for U.S. Treasuries, pushing U.S. Treasury yields sharply lower. The yield on the benchmark 10-year Treasury note fell 9 basis points on the day, while the yield on the rate-sensitive two-year note fell 13 basis points. Gold prices benefited from a plunge in U.S. Treasury yields.

First Republic Bank’s recent announcement of a sharp drop in deposits reminds people that financial stability risks have not completely subsided. UBS also announced earlier that its first-quarter profit plummeted by 52%, missing expectations.

Spot gold closed at $1,997.13 per ounce on Tuesday, up $8.11 or 0.41%, and hit a peak of $2,003.83 per ounce during the day.

Mehta noted that the dollar had stalled its uptrend during Wednesday’s session, prompting gold to rise for a third straight session.

Markets will also focus on U.S. front-line data later in the North American session – durable goods orders data, which might provide fresh insight into the state of the U.S. economy ahead of Thursday’s release of preliminary first-quarter gross domestic product (GDP), Mehta said. clue.

U.S. durable goods orders data for March is scheduled to be released at 20:30 Hong Kong time on Wednesday.The initial monthly rate of U.S. durable goods orders in March is expected to rebound by 0.8%, the previous value fell by 1%, while the initial monthly rate of non-defense capital durable goods orders excluding aircraft in March is expected to rise by 0.2%, and the previous value fell by 0.1%.Weak U.S. data might reinforce dovish Fed expectations, triggering a fresh round of dollar declines, Mehta said.

Meanwhile, earnings reports from Boeing and Meta are also due on Wednesday, which might once more have a big impact on broader market sentiment and ultimately the dollar and gold prices.

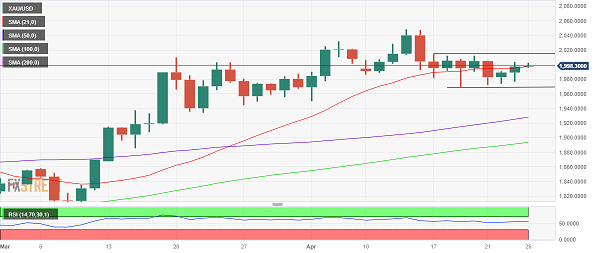

The latest technical analysis of gold

Mehta said that from the daily chart, gold prices closed yesterday to regain the 21-day moving average (then at $1,995/oz), and briefly broke through the $2,000/oz mark. Currently gold sellers continue to lurk above $2,000/oz.

Mehta pointed out that if gold bulls can find a strong foothold above $2,000 an ounce, then the price of gold might see a new round of gains and rise to static resistance at $2,015 an ounce.gold priceThe next upside target is $2,020/oz, and if it breaks through, the previous yearly high of $2,032/oz will be tested.

The 14-day relative strength index (RSI) is pointing to the upside above the mid-line, suggesting more upside for gold prices.

(Source of spot gold daily chart: FXStreet)

On the other hand, Mehta said that if gold prices fail to break through the psychological mark of $2,000 an ounce, it will strengthen the bearish pressure and push the price back towards the recent range low around $1,975 an ounce.

If the price of gold falls further, the price of gold will challenge the static support level of $1970 / oz. Once this support level is broken, the price of gold may start a new downward trend and fall towards the confluence of the key psychological level and the low of April 3 at $1950 / oz ounce.

At 17:07 Hong Kong time, spot gold was at $1997.92 an ounce.

]]>Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article represent only the author himself. Sohu is an information release platform, and Sohu only provides information storage space services.

1682516237

#U.S #dollar #plummeted #points #heavyweight #data #United #States #comingGold #bulls #brewing #bigger #outbreak #price #gold #expected #rise #17_Mehta_Spot_Breakthrough