2023-12-28 16:14:23

The number of aspects of political, economic and social life covered by the reforms proposed by President Javier Milei in his first two weeks in power is immeasurable. It is estimated that the number of laws, resolutions and regulations that would be modified exceeds 1,200.

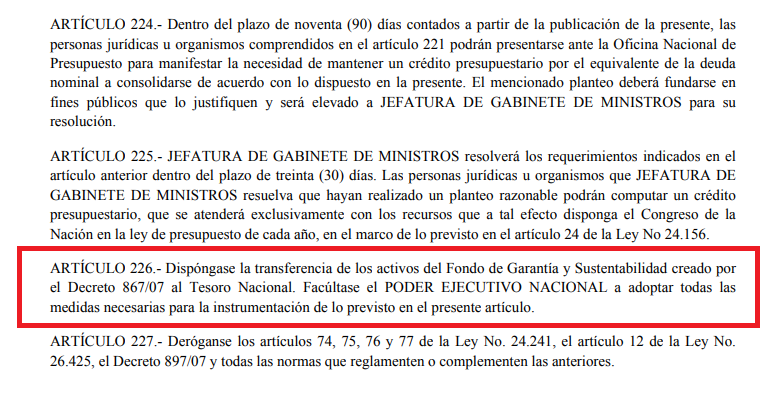

However, one of the points addressed by the Omnibus Law that entered Congress yesterday to be discussed in the extraordinary sessions, generates enormous controversy. This is Article 226 that transfers the ownership of the Sustainability Guarantee Fund (FGS) to the National Treasuryand grants the President of the Nation the powers to freely dispose of the funds, without the need to request parliamentary authorization.

The text of article 226 of the Omnibus Law project literally says: «Provide the transfer of the assets of the Guarantee and Sustainability Fund created by Decree 867/07 to the National Treasury. The NATIONAL EXECUTIVE POWER is empowered to adopt all necessary measures for the implementation of the provisions of this article.

The measure implies a virtual definancing of the Argentine pension system and it might be the prelude to the return to the private capitalization system. Besides, puts in the hands of the President a multimillion-dollar box in dollars, which might be used for the most diverse purposesamong which can range from the cancellation of public debt, to the normalization of the liabilities of the Central Bank (BCRA) or the dollarization of the economy.

What is the FGS

The Sustainability Guarantee Fund of the Public Distribution Regime (FGS) It was created through Decree 897/2007 during the presidency of Néstor Kirchner. The following year the Argentine Integrated Pension System (SIPA) was created, and from that moment The funds managed by the Retirement and Pension Fund Administrators (AFJP) were transferred in the form of financial assets to the FGS.

In practice, the FGS functions as a tool to finance productive projects that encouraged economic development and the creation of registered work. The SIPA is structured through an intergenerational solidarity system, in which The pension contributions of active workers finance workers who are in their passive stage. In this way, the conception of the FGS is countercyclical, in that by seeking a higher level of activity, greater resources are generated for the pension system.

Since the Sustainability Guarantee Fund (FGS) is an asset of the SIPA, it is therefore the money that makes the entire pay-as-you-go pension system solvent in the long term.

But in strict accounting terms, The FGS is fundamentally regarding the patrimonial support of the pension system as a whole.. Attentive to the difficulties that the SIPA has been experiencing for years in solving all the beneficiaries, and Since the FGS is an asset of the SIPA, it is therefore the money that makes the entire pension system solvent in the long term..

What does it mean for the FGS to pass to the National Treasury?

It is essential to understand the magnitude and depth of the decision to transfer the FGS to the orbit of the Executive Branch, and its virtual liquidation. In short, remove the FGS from the ANSES and liquidate the assets that are part of it, It is equivalent to dissolving the assets that give strength to the pension system in the long term, to address current economic policy priorities..

There is no precision regarding what may happen in the future with the current configuration of the Argentine Integrated Pension System (SIPA)nor regarding the possible reforms that the government has in relation to the way in which pension benefits are calculated.

Liquidating the assets that are part of it is equivalent to dissolving the assets that give strength to the pension system in the long term, to address current economic policy priorities.

Even so, it is not necessary to be a specialist in pension issues to notice that The dissolution of the FGS opens the door for the return to a capitalization system for pension benefits. Without the funds that make the pay-as-you-go system solvent, the economistic view that predominates in the government will soon point out that the system “is broken” and needs to be privatized.

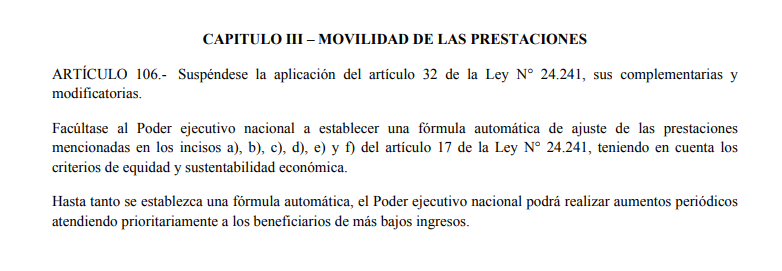

What is known for certain is that the same Omnibus Law in which it is established that the FGS passes into the orbit of the National Treasury, also suspends the current pension mobility formula. Article 106 literally says: «The application of article 32 of Law No. 24,241, its complementary and

modifications. The national executive branch is empowered to establish an automatic formula for adjusting the benefits mentioned in sections a), b), c), d), e) and f) of article 17 of Law No. 24,241, taking into account the criteria of equity and economic sustainability. Until an automatic formula is established, the national executive branch may make periodic increases giving priority to the lowest-income beneficiaries.

The simplest translation of Article 106 is that Retirees and pensioners will stop receiving quarterly increases established by law, and will depend on the good will of President Javier Milei to obtain an increase in their benefits.

In addition, if the Omnibus Law is approved, The suspension of increases would begin to take effect from the first quarter of 2024, just when the worst of inflation will begin to hit income in pesos, according to what President Milei himself anticipated.

How much is the FGS and what would it be used for?

According to the data offered by the National Social Security Administration (ANSES), At the time of its constitution in 2008, the Sustainability Guarantee Fund (FGS) had a total valuation of US$23.7 billion. As these are financial assets that operate and are quoted on the market, and a fund that invests and has shares in different companies in various sectors of the economy, their price evolved over time.

Prior to the arrival of Mauricio Macri to power, At the end of 2015, the valuation of the FGS had grown by 179% and reached US$66,200.. Four years later at the end of 2019, the valuation of the FGS had fallen 47% to $35 billion.

The latest data available is that published by ANSES last November 2023. In it, The organization reported that the current valuation of the FGS amounts to US$ 76,000 million. There is criticism of the calculation method, because in November the official reference exchange rate was only $350. If, however, the current official exchange rate of $800 were taken as a reference, the current valuation of the FGS would reach US$33.5 billion.

Without fear of exaggeration, The FGS is the most important fund that exists in the country today, whether in the public or private sphere. This is a multi-million dollar fund, which will be in the hands of President Milei for his discretionary use.

There is no data or precision regarding the use that might be given to the FGS once it is at the disposal of the Executive Branch. The reality is that if the Omnibus Law is approved, President Milei might discretionally use retirees’ money to pay debt, to deactivate “the Leliqs bomb,” and even to dollarize the economy.

- u$s 76.000

- It is the latest valuation of the Sustainability Guarantee Fund published in November by ANSES.

1703780117

#Treasury #retirees #money