2023-12-06 16:41:35

© Archyde.com.

Over the decade from 2013 to now, technology stocks have been the dominant performers in generating returns for investors. It helped push the broader market to all-time highs, doubling or tripling annually.

During this time Investing heavily in growth stocks is the fastest path to wealth creation in the stock market.

However, those who weathered the 2020 pandemic and 2022 bear market are well aware that investing thoughtlessly in such stocks does not always guarantee success.

That’s why finding the top tech stocks on the market is one of the most important keys to success. Especially as the market expects the Fed to start cutting interest rates early next year.

But amidst the noise caused by a lot of news and information How do investors navigate it all expertly?

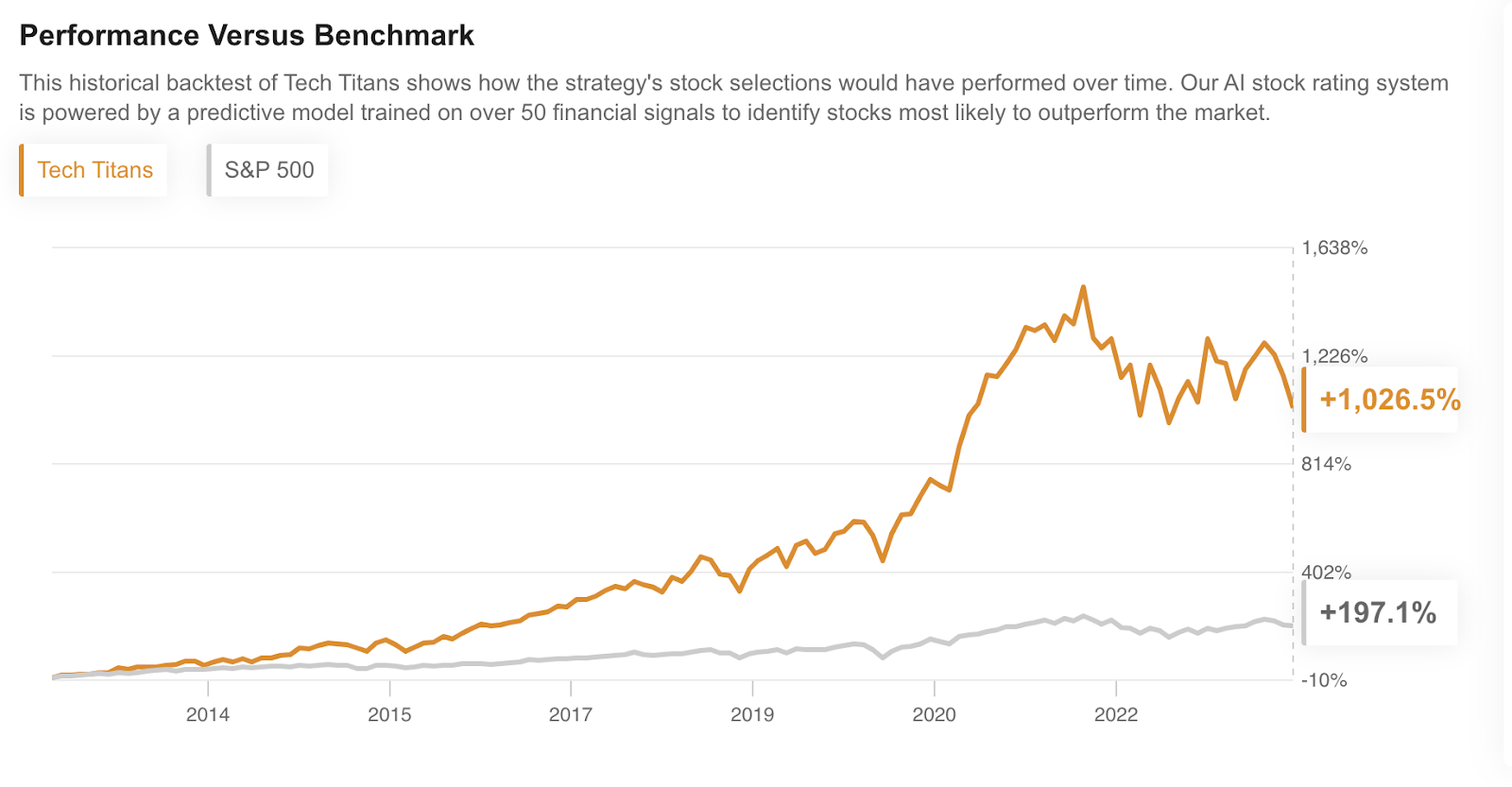

To solve this problem We have created our flagship ProPicks Tech Titans strategy. Using cutting-edge AI models, ProPicks crunches data to deliver only the essential parts of stock picking to you.

Historical data shows that our strategy is winning. It has gained an impressive 950% over the past decade, as shown in the chart below:

Source: InvestingPro ProPicks

Our ‘Tech Titans’ strategy showcases today’s industry leaders. Including emerging businesses that are growing quickly Each has impressive indicators and innovations. Explore the most exciting technology opportunities on the market. It highlights 15 companies at the cutting edge of the sector.

Recognizing the rapid pace of change in the technology industry, our AI algorithm reviews and updates each selection on a monthly basis. This ensures that the most current and promising technology investments are always at the forefront.

We’ll take a deeper look at three strategically focused stocks right now: EPAM Systems, Allegro MicroSystems, and Photronics These are covered in detail below.

InvestingPro users can view all strategies. along with five other ProPicks strategies On our ProPicks gallery page

Not a Pro user yet? Sign up now to get up to 60% off for a limited time only. It’s part of our Extended ProPicks Cyber Monday Sale!

*People reading this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code TT1 and a similar 10% discount on our annual Pro+ plan by using coupon code TT2 at checkout!

1. EPAM Systems (EPAM)

EPAM Systems (NYSE:) provides digital platform engineering and software development services worldwide.

EPAM is known for its expertise in complex software engineering. By working in a variety of industries There are both financial services tourism and consumers Advanced software and technology Business information and media biological sciences and health care

The stock is up 19.4% over the past month and down 21% year-to-date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, EPAM Systems is fairly valued, with an upside of 2.4%.

Most recently in November, Piper Sandler upgraded EPAM Systems to Overweight from Neutral.

important latest news

In November, EPAM Systems reported Q3 earnings of $2.73 per share. on reported revenue of $1.15 billion. Analysts are looking at earnings of 2.56 and expected revenue of $1.14 billion.

For fiscal 2023, the company forecasts earnings per share (EPS) of $10.31-10.39, compared to the consensus of $10.03.

2. Allegro MicroSystems (ALGM)

Allegro Microsystems (NASDAQ:) designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy efficiency systems.

The company sells products primarily to basic equipment manufacturers and suppliers in the automotive and industrial markets. Through direct sales staff Third party distributors Independent sales representative and delivery of goods

The stock is up 5.9% over the past month and down 9.1% year-to-date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, Allegro MicroSystems is undervalued. (Undervalued) with an Upside of 40.9%

As recently as September, BofA Securities initiated coverage on Allegro MicroSystems with a Neutral rating. In July, Wolfe Research began coverage of the stock with its Peerperform rating.

important latest news

In November, Allegro MicroSystems reported Q2 earnings of $0.40 per share on revenue of $275.51 million. Analysts were looking for earnings of $0.37 on revenue of $274.99 million.

In October, Allegro MicroSystems completed the acquisition of Crocus Technology, a leader in advanced TMR sensor technology, for $420 million in cash. This acquisition accelerates Allegro’s TMR roadmap and further strengthens its leadership position in the inspection market. magnetic catch

3. Photronics (PLAB)

Photoronics (NASDAQ:) specializes in the manufacture and sale of photomask products and services. Photomasks are an essential part of integrated circuit manufacturing and flat-panel displays (FPDs). They are essential tools used to transfer circuit patterns to semiconductor wafers, FPD substrates, and electrical and optical components. A variety of calls

The stock is up 14.4% over the past month and 25.9% year-to-date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, Photronics is undervalued. (Undervalued) with an Upside of 32.1%

Most recently in May, Northland Capital Markets downgraded Photoronics to Market Performer from Outperform.

important latest news

In September, Photoronics reported Q3 earnings of $0.51 per share on revenue of $224.2 million. Analysts were looking for $0.52 on revenue of $230 million.

The company also provided guidance for 4Q20, expecting EPS of $0.51-$0.59 per share. vs. consensus of $0.54 and revenue of $222-232 million vs. consensus of $231 million.

Sign up now to get discounts up to 60% and see all options from the ‘Tech Titans’ strategy!

*People reading this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code TT1 and a similar 10% discount on our annual Pro+ plan by using coupon code TT2 at checkout!

1701902333

#strategy #beat #decade #Investing.com