Enter 2022.06.10 07:36

Edited 2022.06.10 07:36

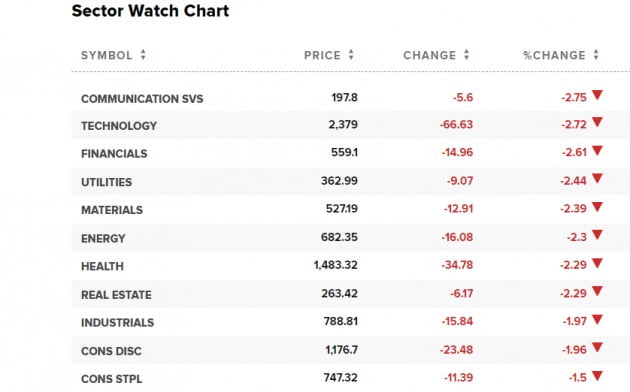

On the 9th (local time), the major indices of the New York Stock Exchange in the United States fell relatively large. A day before the release of the Consumer Price Index for May, the scenario of ‘inflation going high → US central bank (Fed) tightening tightening’ is gaining strength.

The leading index, the S&P 500, closed at 4,017.82, down 2.38% from the previous day, the Nasdaq fell 2.75% to 11,754.23, and the Dow dropped 1.94% to 32,272.79, respectively.

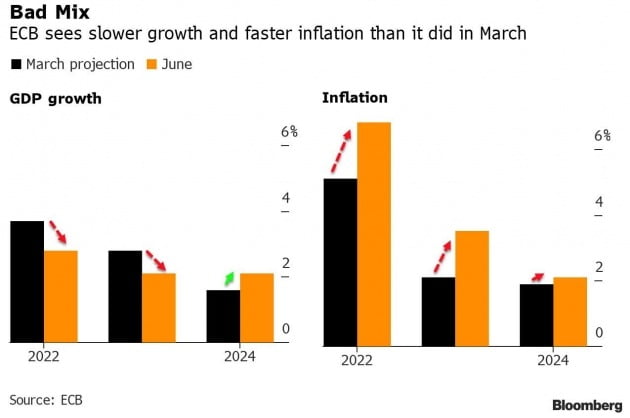

European stock markets were weakened by strong tightening notices from the European Central Bank (ECB). The Eurostocks 50 index closed at 3724.64, down 1.70%.

The ECB left its benchmark interest rate unchanged at its monetary policy meeting, but made it clear that it would “raise interest rates in a row in July and September”. He emphasized that he would raise the rate by 0.25 percentage points in July, but decide the extent of the increase in September according to the inflation outlook. It left open the possibility of a big step (0.5 percentage point increase) at the September meeting. It will be the first time in 11 years if the ECB raises interest rates next month.

The European Central Bank (ECB) announced at a monetary policy meeting on the 9th (local time) that it would raise the key interest rate in July and September. The ECB raised its inflation forecast while downgrading its growth forecast for this year. Courtesy of ECB and Bloomberg

At the same time, we have decided to end the Asset Purchase Program (APP) as of the 1st of next month.

The market is predicting that the US consumer price index for last month, announced on the 10th, would have risen by 8.3% (compared to the same period last year). It is expected that the streak will continue at the same level as the previous one.

Accordingly, the prevailing view is that the Fed will raise interest rates by 0.5 percentage points each next week and at the next regular meeting (July).

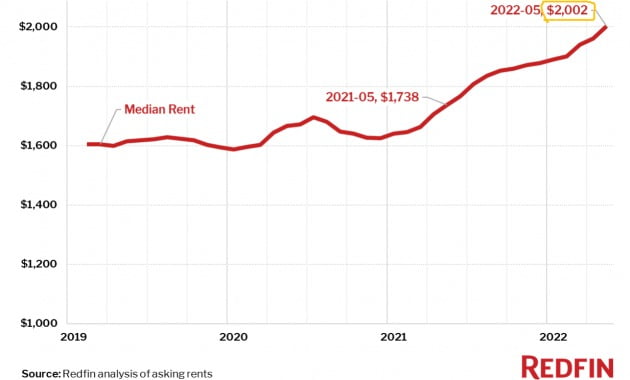

Amid high inflation concerns in the United States, the average monthly rent nationwide surpassed $2,000 last month for the first time ever. Redfin provided

U.S. Treasury yields rose once more.

The 10-year bond yield stood at 3.04% per annum, up 1bp from the previous day. The two-year yield, which reflects changes in monetary policy well, jumped 5 basis points to 2.83% per annum.

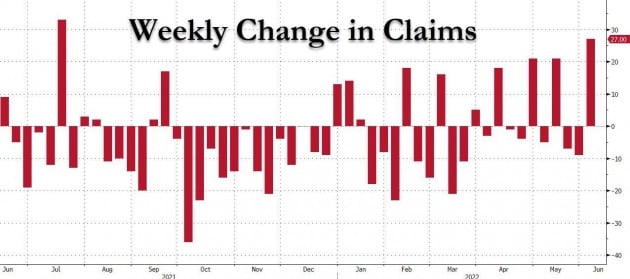

The general interpretation is that the unemployment data were somewhat sluggish, but not enough to prevent the Fed from tightening further.

U.S. jobless claims increased by 27,000 last week compared to the previous week. It was the largest weekly increase since July last year. provided by the US Department of Labor

According to the U.S. Department of Labor, new jobless claims rose 27,000 to 229,000 last week from the previous week. It exceeded analysts’ expectations (an increase of 210,000 people).

Mohamed El-Erian, senior economic adviser to Allianz, said, “The US economy is experiencing 1970s-style stagflation. The basic assumption is that inflation will continue to rise despite interest rate hikes.” His advice is for equity investors to reduce their exposure to risky assets.

International oil prices fell slightly.

On the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) for July contract ended at $121.51 a barrel, down 60 cents from the previous day. On the London ICE Futures Exchange, the price of North Sea Brent crude fell by 51 cents to $123.07 a barrel.

While concerns over supply shortages and prospects of disruption to demand are battling, the general view is that the overall upward pressure is stronger.

In the New York Stock Exchange on the 9th (local time), 11 sectors fell simultaneously. Courtesy of CNBC

Today’s ‘Global Market Now’ issues are as follows.

① Europe also raises interest rates ② Crude oil, shortage of supply or destruction of demand ③ Van Ek “Bitcoin $250,000” ④ The era of US $2,000 per month ⑤ Documentary sign crash once more.

More details can be found on Hankyung Global Market YouTube and Hankyung.com broadcasts.

New York = Correspondent Jo Jae-gil [email protected]