The recent incident of Celsius concealing the loss of tens of thousands of ETH has attracted the attention of the community, and it is believed that the decoupling of stETH and ETH will become more and more serious. If you look at the data on the chain, you can find that some institutions are selling stETH. However, from Lido’s official statement on the current situation, it seems like a good opportunity to grab a bargain.

Introduction of Lido Protocol stETH

stETH is an ETH2 pledge certificate provided by the pledge protocol Lido, allowing users to obtain liquidity while staking to obtain rewards.whenEthereumWhen the merger is completed and the beacon chain is open to claim, users who hold stETH can exchange stETH back to ETH on a 1:1 basis.

According to its mechanism, stETH is provided to stakers as a liquidity compensation scheme. As the merger date approaches, the price of stETH should gradually become equal to ETH. However, recently, it was found that the price decoupling of the ETH-stETH liquidity pool on Curve has deteriorated. One stETH can only be exchanged for regarding 0.954 ETH, and the proportion of the pool is also unbalanced, and the proportion of stETH is close to 80%.

What prompted its decoupling?

According to previous reports, Paradigm researcher Hasu said that the decline in stETH prices is mainly due to liquidation risks. As long as users put stETH on lending platforms (eg: Aave) as collateral, when the market falls, they may face liquidation, resulting in a large number of stETH sales and imbalances in the Curve pool.

Researching several topics today for our new episode of @marketcapping and one is sticking out to me as a major concern. $stETH / $ETH peg is in rough shape and running out of liquidity fast.

Compiling my thoughts to get more eyes on this…

— Small Cap Scientist

(@SmallCapScience) June 10, 2022

(@SmallCapScience) June 10, 2022

This situation was exacerbated by the Celsius scandal. According to a post by DeFi researcher Small Cap Scientist, Celsius owns regarding 450,000 stETH (~$1.5 billion), which they lent regarding $1.2 billion following depositing it in Aave as collateral, and most of these loans are currently About 50,000 ETH (~$85 million) in redemption demand per week to repay customers’ redemption requests.

In addition, in addition to the $70 million lost due to the Stakehound incident, Celsius also lost $50 million in BTC due to the BadgerDao hack in December last year, and in the Terra incident, 500 million UST was urgently withdrawn before it crashed. Judging from the above events, the company’s economic situation and investment choices are indeed worrying.

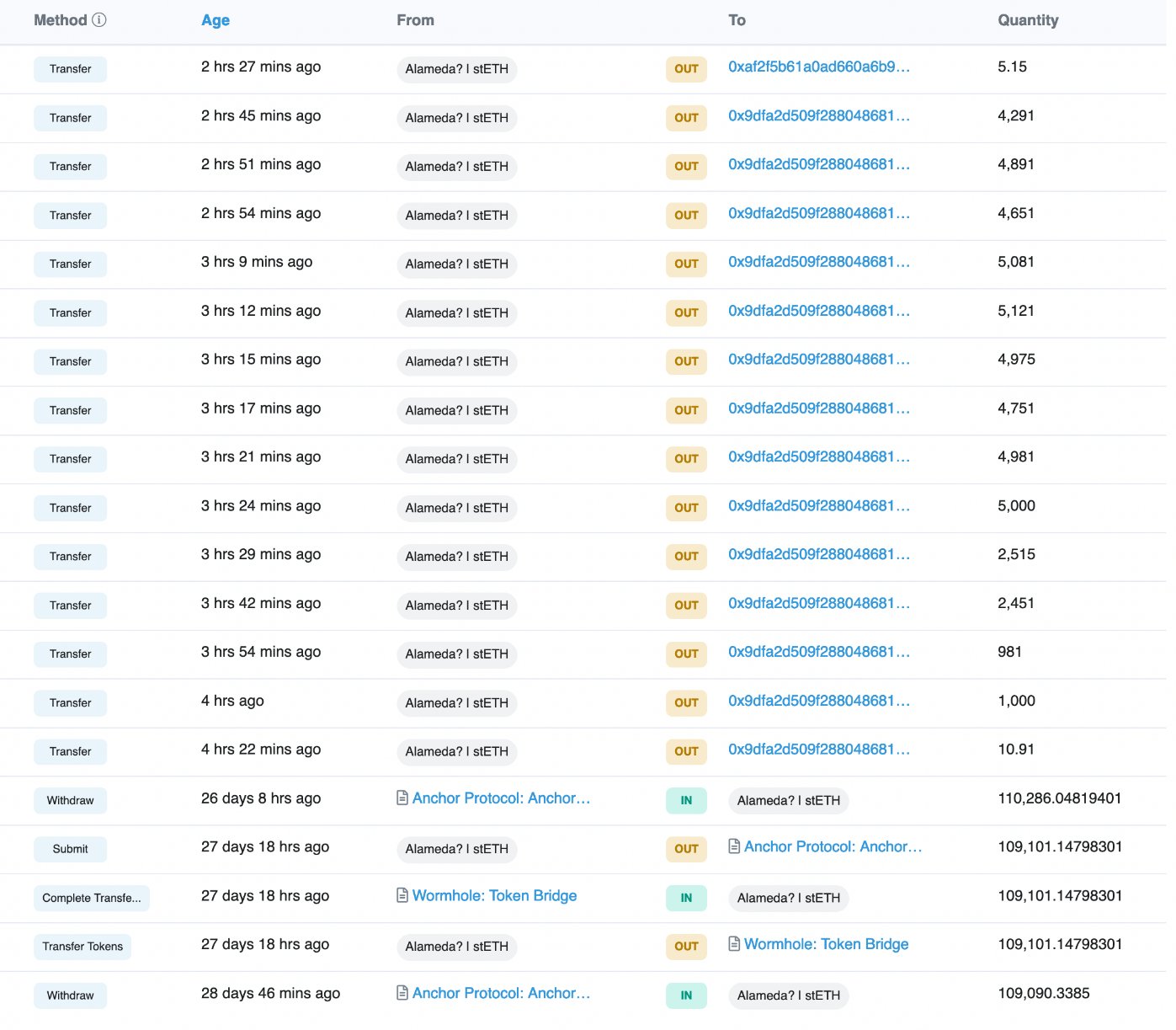

Most dangerous to Small Cap Scientist, though, is that Alameda withdrew regarding 50,000 stETH of liquidity on Wednesday (8) regardless of slippage losses. Alameda, as an investor who reacts quickly to market movements and one of seven investors who hold a large amount of stETH, may further trigger a run.

Lack of liquidity will lead to losses

As mentioned in the Celsius scandal, a large part of Celsius’ ETH position is stETH. According to the current 5% slippage and insufficient exchange depth, if stETH must be used to repay customer positions, it may cause huge losses.Controlling losses depends largely on Celsius’ short-term liquidity, andEthereumWhether the merger can proceed smoothly according to the schedule.

There”s BILLIONS in leveraged bets on the Eth PoS activation via AAVE & Lido”s synthetic ETH token stETH.

1) Stake ETH in Lido for stETH

2) Deposit stETH in AAVE & borrow ETH

3)

One problem: you can”t unwind this trade.

If stETH:ETH peg fails, many ETH bulls will be rekt.

— Brad Mills  (@bradmillscan) June 4, 2022

(@bradmillscan) June 4, 2022

In response to this phenomenon, Podcast program MIM host Brad Mills also said on Twitter that there are too many retail investors using Lido and Aave to make profits with excessive leverage, and the following is their approach:

Under this operation, if the price of stETH can be stably linked to ETH, retail investors will get more profits than simply staking. However, this method is irreversible, because stETH can only be exchanged through a decentralized exchange, so when retail investors find that the price of stETH falls unbearable, in addition to margin calls, they can only endure the high slippage of the exchange Click or watch the position get liquidated.

That is to say, once the redemption pressure of stETH cannot be reduced and the price of ETH continues to fall, Celsius and investors who use excessive leverage will face significant losses.

Lido’s appearance

Staked ETH issued by Lido is backed 1:1 with ETH staking deposits.

The exchange rate between stETH:ETH does not reflect the underlying backing of your staked ETH, but rather a fluctuating secondary market price.

— Lido (@LidoFinance) June 10, 2022

for the current decoupling status. Lido said on Twitter that stETH: The exchange rate between ETHs is not directly related to the underlying assets, but only reflects the price fluctuations in the secondary market and creates opportunities for others to buy stETH at a steep discount.

“In the past month, a series of events have disrupted stETH: ETH’s exchange rate, including the crash of Terra, widespread deleveraging in the market, and the current withdrawal of many funds from lending platforms (referring to Celsius). In the merger and opening of ETH claims Later, redeeming stETH effectively provides current stETH buyers with a discount over 1-year worth of staking earnings,” Lido said.

This article sorts out the decoupling of stETH, and Alameda also sells; Lido: The opportunity to buy stETH at a deep discount first appeared on Chain News ABMedia.