Enter 2022.04.27 09:54

Edited 2022.04.27 09:54

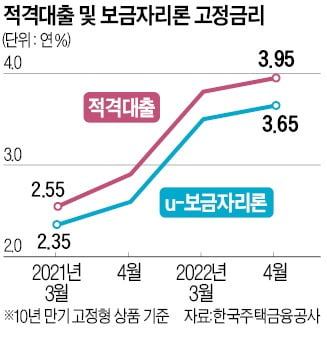

May qualifying loan interest rate 4.4%… ‘Best’ in 7 years and 10 months

After exhausting the limit of the Nonghyup in the second quarter… other banks’ limits

“Eligible loan interest rates become similar to general loan products”

photo = Yonhap News

#. Park Jeong-eun (pseudonym), who is due to pay the balance of the sale with a qualified loan in June, has a lot of trouble these days. This is because of the news that the interest rate on eligible loans will rise to 4.4% in May. He said, “I’m thinking regarding whether I should reduce the interest burden even a little by looking at insurance companies’ subsidy,” he said.

As interest rates began to rise in earnest, eligible loans, which are policy finance, also broke through the 4% range. As borrowers are hesitant to borrow, the 2Q limit for eligible loans is showing a generous amount. It is a different atmosphere from the sell-out march in the first quarter.

According to the Korea Housing Finance Corporation on the 27th, the interest rate for eligible loans as of May was 4.4% per annum, up 0.45 percentage points from the previous month. Considering that it was 3% in June of last year, it means that it has risen by regarding 1.5 percentage points in less than a year. This is the highest level in 7 years and 10 months since June 2014 (4.23%).

Eligible loans are long-term, fixed-rate loan products that are supplied by metalsmiths through banks, etc. There are no income requirements, and non-homeowners or single-homeowners with disposal conditions can apply. You can borrow up to 500 million won at a fixed interest rate if you meet the conditions such as a house price of 900 million won or less.

The reason the qualifying loan interest rate has exceeded the 4% range is the surge in the 5-year government bond. “In March and April, the interest rate on the five-year government bond rose by more than 0.80 percentage points for two months, raising the cost of financing sharply, so an interest rate adjustment was inevitable.” We have decided to increase it by only 0.45 percentage points,” he said.

As interest rates on qualifying loans are also rising, a different atmosphere from the first quarter of last year is being sensed. Nonghyup Bank exhausted its limit within two days of selling eligible loans, and other banks are expected to reduce their limit quickly. However, due to interest rate hikes, the limit is still wide enough.

As of the previous day, Busan Bank had exhausted 20% of its 2Q limit (100 billion won) of eligible loans, and Hana Bank also had only 25% of its loan out. Hana Bank’s second quarter limit is regarding 250 billion won. Woori Bank has exhausted its 50% limit as of the 22nd.

Considering that last quarter sold out in a row, the limit exhaustion rate is rather slow. Woori Bank exhausted its 33 billion won qualifying loan limit in one day in January, and NH Nonghyup Bank also exhausted its qualifying loan limit for the first quarter in two days. As other banks applied for subsidy loans, Hana Bank and Busan Bank exhausted their eligible loan limits in regarding a month in the first quarter.

An official from a commercial bank explained, “Currently, the interest rates of general loan products and eligible loans are similar.

The extension of the loan maturity to 40 years, led by some banks, is also interpreted as a factor slowing the rate of exhaustion of eligible loans. Since the beginning of this year, regional banks such as Busan and Daegu Bank have introduced products with a maturity of 40 years, and Hana Bank has recently extended the maturity of products for subsidized products to 40 years. Other banks are also considering extending the loan maturity to 40 years.

Last year, for the first time, Jugeumgong introduced the first 40-year Judamage as policy financial products such as eligible loans and Bogeumjari loans. The 40-year maturity, which was only available in policy financial products, is being extended to the entire banking sector.

Longer maturities have the effect of increasing loan capacity even if DSR (total debt repayment system) regulations continue. For example, if you borrow 500 million won from the main loan at an annual rate of 4.5% (35-year maturity) in an equal repayment method, the monthly principal and interest is regarding 2.37 million won. If the maturity is extended to 40 years under the same conditions, the monthly principal and interest will be regarding 2.25 million won, and the monthly principal and interest will decrease by 120,000 won.

Eunbit Koh, reporter at Hankyung.com [email protected]