news

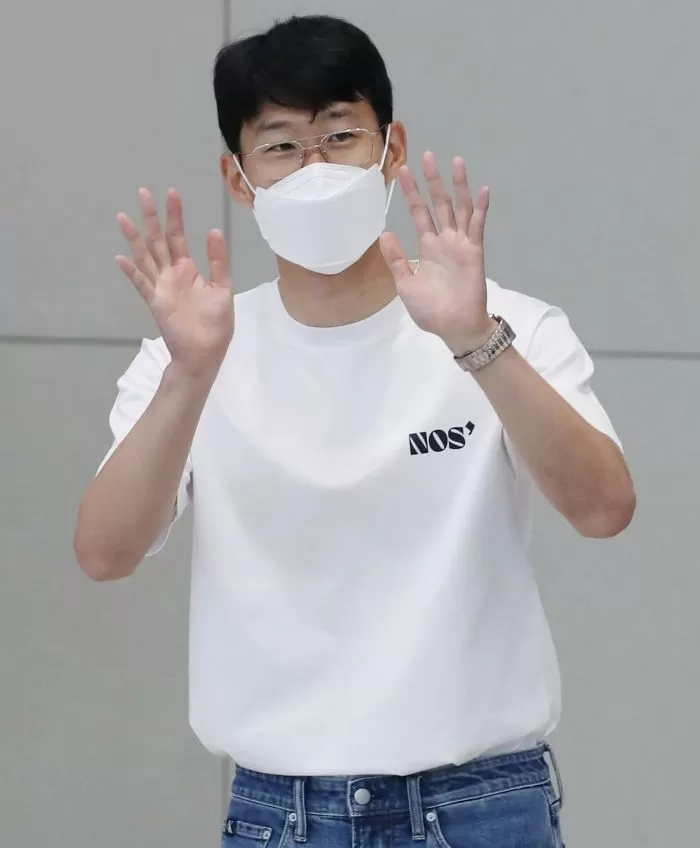

[인사이트] Reporter Seong Dong-kwon = Tottenham Hotspur’s Son Heung-min returned home with the Premier League top scorer title for the first time as an Asian.

Heung-Min Son, who must have been tired from the forced march towards the Champions League throughout the season, must have needed a rest right away.

There must have been a lot of places that he wanted to go and eat in Korea, which he had been visiting for a long time, but the place Heung-Min Son found was none other than the office of an accounting firm.

On the 26th, it was reported that Son Heung-min visited an accounting firm located in Yongsan.

news

news

According to the industry, Heung-Min Son visited the office to check last year’s global income tax return, which was represented by an accounting firm.

For athletes who play abroad, paying income tax is quite a complicated matter because the part regarding ‘domestic residents’ is not certain.

Heung-Min Son files an annual global income tax return not only to the UK but also to the National Tax Service of Korea.

Son Heung-min, who received an annual salary of regarding 16 billion won and an model fee of more than 3 billion won, reflects his will to pay taxes thoroughly.

news

news

It is a common case for foreign football players to be in a difficult situation due to taxes.

Cristiano Ronaldo (Manchester United) was charged with evading 14.7 million euros (approximately 18.6 billion won) in taxes on portrait rights profits using a company in the British Virgin Islands while playing for Real Madrid.

In 2019, a Spanish court sentenced Ronaldo to a fine of 18.8 million euros (regarding 24.2 billion won) and probation for 23 months.

Lionel Messi (Paris Saint-Germain) was also sentenced to 21 months in prison by a Spanish court in 2016 for evading taxes on 4.16 million euros (regarding 5.5 billion won) of portrait rights income by establishing a ghost company (offshore company) between 2007 and 2009. there is a bar

In this situation, it was a moment when Son Heung-min’s thoroughness in managing taxes by visiting an accounting firm as soon as he returned to Korea shined once once more.