The UK’s transition to a service-dominated economy is accelerating, with manufacturing’s share of economic output reaching historic lows and the country standing out from its global peers.

The latest data shows that the structure of the economy is changing rapidly, driven by global trends as well as domestic factors such as Brexit and growth increasingly focused on London.

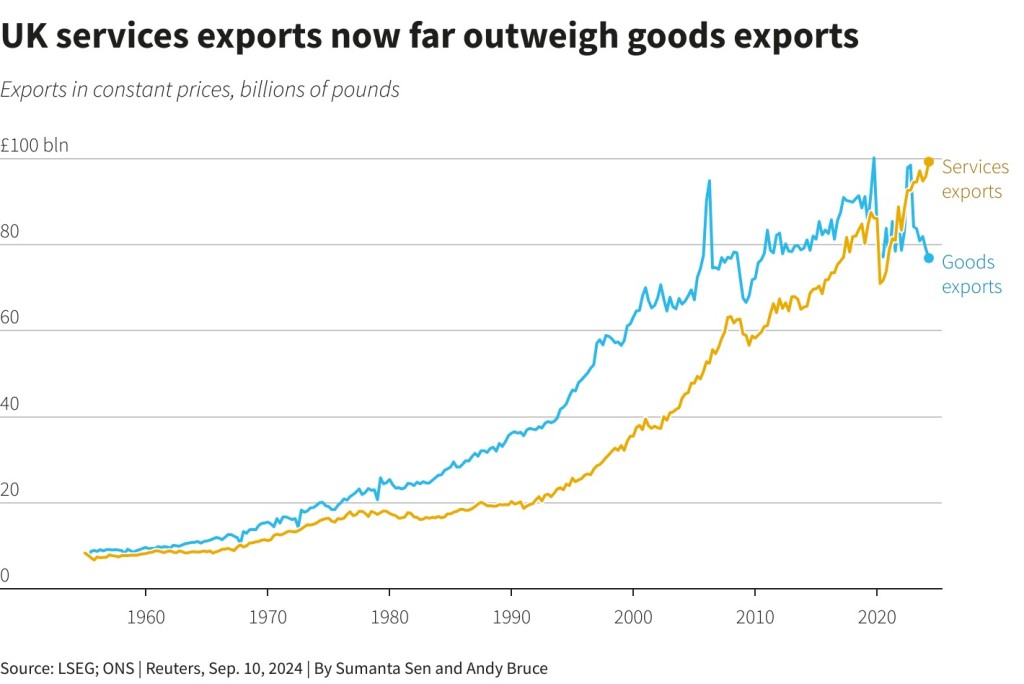

Britain now exports more services (including finance, accounting, legal advice, management consulting and advertising) than goods, the highest among the Group of Seven major advanced economies. And the gap is widening fast.

Meanwhile, official figures show manufacturing’s share of British economic output fell to a record low of 9.2% in the second quarter of this year, down from 9.9% before the COVID-19 pandemic, according to Reuters calculations based on national accounts data.

Although industrial output is almost a fifth higher than it was in the mid-2000s, that growth has stalled in recent years. Instead, the services sector has become the engine of the UK’s sluggish economic growth in recent years. It now accounts for 81.2% of the UK economy’s GDP, up from less than 80% before the pandemic.

The line charts show the shares of services and manufacturing in UK economic output between 1997 and 2024.

The Office for National Statistics has not updated its estimates of each industry’s share of the economy since the pandemic wreaked havoc on the national accounts, but an update is scheduled for September 30. It is likely to confirm a fall in manufacturing’s share of the economy. Trade body Make UK said this could pose a problem for the image of British manufacturing, although British manufacturers will remain an important part of global supply chains, as well as a major source of employment and destination for international investment.

“What we’re really concerned about… is how manufacturing is perceived in the UK and the rest of the world,” said Faheen Khan, senior economist at manufacturing association Make UK.

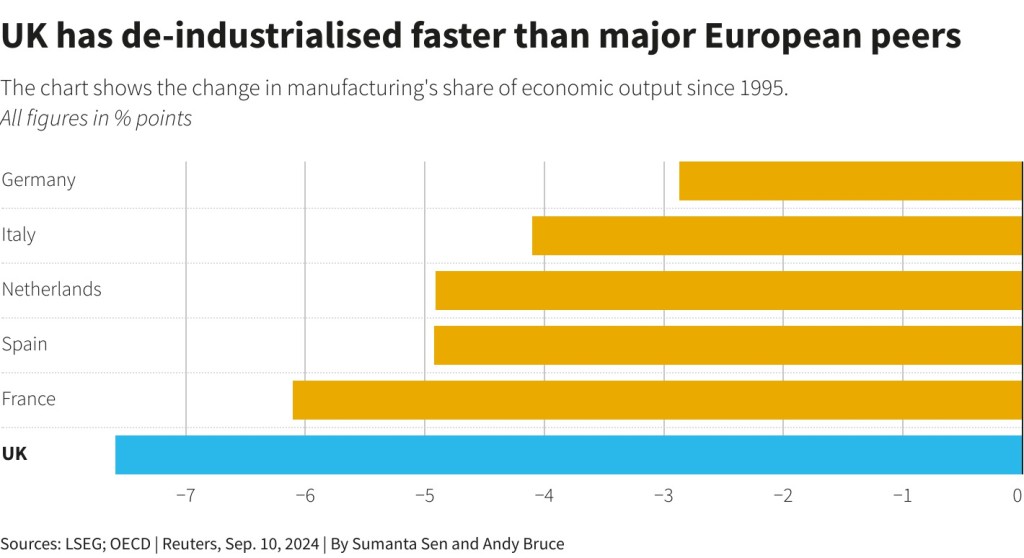

Since the mid-1990s, the share of manufacturing in the UK economy has fallen faster than in any other major European economy.

Khan said it was vital that Prime Minister Keir Starmer’s new Labour government implements a coherent, long-term industrial strategy, something the UK has lacked in recent decades despite various attempts that have all proved short-lived. Manufacturers will be looking for more details on October 30.

The dominance of the services sector helps explain the widening regional divide between the services hub of London and the country’s industrial heartlands, such as the Midlands and the north of England. Starmer has promised to close that gap.

London’s share of the national economy has grown by more than 3 percentage points since 2000 to 24%, with no other UK region increasing its share over the same period.

Trade has been transformed

The shift towards services is particularly evident in trade data. The UK has exported more services than goods for six quarters in a row, something not seen in trade data since the 1950s.

Britain exported a record £99.3 billion ($129.6 billion) in services in the second quarter. But it exported just £76.9 billion in goods – roughly the same as in the late 2000s, adjusted for inflation.

“Global demand for services is very much the driver, but the UK is also gaining market share,” said Sophie Hale, chief economist at the Resolution Foundation think tank.

The rise has been driven by professional services such as accountancy, outsourcing and law firms, rather than by financial services exports, which have fallen in real terms to levels around 20 years ago – perhaps due to Brexit.

While the UK does not face tariffs when selling goods to the EU, business groups and survey data suggest that goods exporters still find it harder to trade due to customs delays, more forms to fill out and other non-tariff barriers.

“Most assessments suggest that this has depressed UK trade, which is particularly important for manufacturing,” said Rob Wood, chief UK economist at consultancy Pantheon Macroeconomics.

He said he expected the services sector to become even more dominant in the UK economy.

“Governments can make decisions that will change the industrial mix – you can change education, you can change infrastructure, you can create incentives for investment,” Wood said. “But there’s nothing on the horizon, so the shift is likely to continue.”

It was previously reported that Belarusians were secretly developing software for British nuclear submarines.

Important part of the economy, and there are opportunities to innovate and compete in niche markets.

Table of Contents

The UK’s Shift to a Service-Dominated Economy: A New Era of Growth and Challenges

The United Kingdom’s economy is undergoing a significant transformation, with the service sector emerging as the dominant force driving growth, while manufacturing’s share of economic output reaches historic lows. This shift is driven by global trends, as well as domestic factors such as Brexit and the increasing focus on London as a hub for services. In this article, we will delve into the implications of this transition and what it means for the UK’s economy and future growth prospects.

A Service-Led Economy

The latest data reveals that the UK exports more services than goods, a trend that is accelerating rapidly. The service sector now accounts for 81.2% of the UK’s GDP, up from less than 80% before the pandemic. This growth is largely driven by professional services such as accountancy, outsourcing, and law firms, rather than financial services exports, which have fallen in real terms to levels around 20 years ago, likely due to Brexit.

In contrast, manufacturing’s share of British economic output has fallen to a record low of 9.2% in the second quarter of this year, down from 9.9% before the COVID-19 pandemic. While industrial output is almost a fifth higher than it was in the mid-2000s, growth has stalled in recent years.

Regional Divide

The dominance of the service sector is also contributing to a widening regional divide between London and the country’s industrial heartlands, such as the Midlands and the north of England. London’s share of the national economy has grown by more than 3 percentage points since 2000 to 24%, with no other UK region increasing its share over the same period.

Trade Transformation

The shift towards services is particularly evident in trade data. The UK has exported more services than goods for six quarters in a row, a trend not seen in trade data since the 1950s. Britain exported a record £99.3 billion in services in the second quarter, while goods exports remain stagnant, roughly at the same level as in the late 2000s, adjusted for inflation.

Challenges and Opportunities

The UK’s transition to a service-dominated economy poses both challenges and opportunities. The growth of the service sector has driven economic growth, but it also raises concerns about the image of British manufacturing and the need for a coherent, long-term industrial strategy. The dominance of services has also contributed to a widening regional divide, which needs to be addressed.

The UK’s manufacturing sector faces significant challenges, including the impact of Brexit on trade and the need to adapt to new technologies and global trends. However, British manufacturers remain an

How is the UK’s transition to a service-dominated economy affecting its manufacturing sector?

The UK’s Transition to a Service-Dominated Economy: A Shift Away from Manufacturing

The United Kingdom’s economy is undergoing a significant transformation, with the manufacturing sector’s share of economic output reaching historic lows. The country is increasingly becoming a service-dominated economy, driven by global trends and domestic factors such as Brexit and growth focused on London. This shift has far-reaching implications for the country’s industrial base, regional development, and national identity.

Manufacturing’s Share of Economic Output Hits Record Low

According to recent data, manufacturing’s share of British economic output has fallen to a record low of 9.2% in the second quarter of 2023, down from 9.9% before the COVID-19 pandemic. Meanwhile, the services sector has become the engine of the UK’s economic growth, accounting for 81.2% of the country’s GDP, up from less than 80% before the pandemic.

This trend is evident in the UK’s trade data, with the country exporting more services than goods for six quarters in a row, a phenomenon not seen since the 1950s. The services sector, including finance, accounting, legal advice, management consulting, and advertising, is driving the country’s economic growth, while manufacturing is facing significant challenges.

A Widening Gap with Global Peers

The UK’s shift towards a service-dominated economy sets it apart from its global peers. Among the Group of Seven major advanced economies, Britain has the highest share of services in its economic output. The country’s manufacturing sector has been declining faster than any other major European economy since the mid-1990s.

Regional Divide and Industrial Strategy

The dominance of the services sector has contributed to the widening regional divide between the services hub of London and the country’s industrial heartlands, such as the Midlands and the north of England. Prime Minister Keir Starmer’s new Labour government has promised to close this gap, which is essential for promoting balanced regional development and addressing the regional disparities in economic growth.

The lack of a coherent, long-term industrial strategy has been a significant hurdle for the UK’s manufacturing sector. Manufacturers are looking forward to more details on the government’s plan to support the sector, particularly in the context of Brexit and the need to diversify trade relationships.

Implications for British Manufacturing

The decline of manufacturing’s share of economic output poses a challenge for the image of British manufacturing, which is an important part of global supply chains, a significant source of employment, and a major destination for international investment. However, the sector’s decline does not necessarily mean a loss of competitiveness or a decline in economic significance.

Conclusion

The UK’s transition to a service-dominated economy is an irreversible trend, driven by global forces and domestic factors. While this shift presents opportunities for growth and innovation, it also poses significant challenges for the country’s industrial base, regional development, and national identity.

The government must prioritize the development of a coherent, long-term industrial strategy that supports the manufacturing sector, promotes regional development, and addresses the regional disparities in economic growth. By doing so, the UK can ensure a balanced and sustainable economic growth that benefits all regions and industries.

Optimized Keywords:

Service-dominated economy

UK manufacturing sector

Economic output

Global peers

Regional divide

Industrial strategy

Brexit

Trade relationships

Government policy

Economic growth

* Regional development

Meta Description:

The UK’s economy is shifting towards a service-dominated economy, with manufacturing’s share of economic output reaching historic lows. What are the implications of this trend for the country’s industrial base, regional development, and national identity?