HSBC Vietnam recently released a report called “Vietnam at a glance: “Taking the pulse” of consumers” which provides some reviews of Vietnam’s economic situation in recent times and Comments on export and consumption in the coming time.

The context in the year of the Dragon is forecast to be better than the year of the Cat

HSBC experts analyzed that following a challenging year of the Cat, Vietnam’s context is forecast to improve in the year of the Dragon. While much attention still needs to be paid to the important export cycle, it is equally important to assess how domestic demand is evolving.

HSBC experts said that although it is expected to compensate for the slowdown in the external sector, domestic demand is also under increased pressure but is expected to improve, the initial signs are some stocks in The consumer sector is recovering.

In fact, Vietnam has a large consumption proportion of more than 50% of GDP. Growing at an average annual rate of 7.5% before the pandemic, private consumption has declined significantly since the outbreak, except for the reopening period in 2022.

In particular, personal consumption growth halved in 2023, reflecting the clear impact of the economic slowdown on households. Part of this is due to the asset value volatility effect of the cyclical weakness in the real estate sector, while the other part is due to major changes in consumer behavior since the pandemic.

Consumers tend to be wary of economic fluctuations, thus increasing their propensity to save. Although data for 2023 has not been released, a significantly higher 40% increase in savings rates in 2022 also partly illustrates this trend.

This is even more assured when looking at the Vietnamese labor market. While the unemployment rate remains low at 2.3%, job growth slowed in 2023 and is still heading towards but not yet fully recovering.

HSBC experts emphasized that a large part of Vietnam’s labor market is concentrated in the informal sector, a trend that is no longer new in ASEAN. This proportion in the textile manufacturing sector accounts for nearly half and even reaches 60% in some tourism-related service industries.

Clearly, Vietnam is anxiously awaiting a cyclical recovery in global trade, which is the main hope for the job market. Fortunately, the electronics sector has recently witnessed some positive signs, suggesting that the darkest period of the commercial sector has passed.

The recovery of industries, however, is still uneven

However, each industry is different because the recovery is not completely uniform. Industries that provide a large source of employment such as textiles, garments and footwear have not completely escaped the difficult period. Asia is still in the early stages of trade recovery because more evidence is needed to see a stable and sustainable recovery thanks to strong support from major economies in the world, experts said. HSBC analysis.

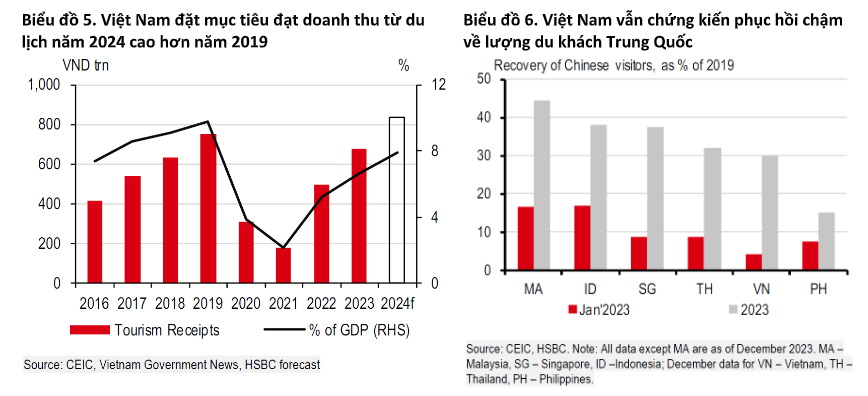

Meanwhile, a full recovery in the tourism sector is also extremely important for the labor market, supporting those working in the service industry. Thanks to favorable policies extending visa-free stays for foreign tourists from a number of countries and granting electronic visas (e-visas) to citizens of all countries from mid-August, Vietnam welcomed regarding 12.6 million foreign visitors (70% of 2019’s level), far exceeding the state’s initial target of 8 million.

The favorable outlook even prompted the Vietnam National Administration of Tourism to set an ambitious target for this year of 17-18 million foreign visitors, nearly reaching the record high of 2019, aiming for a total revenue of 840 million. trillion VND (8% of GDP), exceeding the level of 2019. Based on previous trends, this means that international tourism in 2024 will likely reach regarding 4% of GDP, equivalent to the pre-pandemic average. Asian epidemic.

However, tourism competition in the region is increasingly tense. While the recovery in Chinese tourist arrivals has been slower than expected, a full recovery in ASEAN tourism requires a significant number of Chinese tourists, the largest source of tourism. Countries in the region including Thailand, Malaysia and Singapore have all introduced visa-waiver programs for Chinese visitors, increasing the appeal of an “impromptu trip” for tourists.

HSBC experts point out that the rise of the emerging middle class has attracted the attention of international businesses looking for profit opportunities thanks to the increased spending needs of Vietnamese people. The sharp increase in FDI flows from Japan into the retail and financial services sectors is a notable example. With impressive growth over the past 20 years, the overall increase in wealth has fueled stronger consumer trends, stimulating a shift towards non-essential goods and services.

Although people’s assets are increasing, nearly 80% of the population still do not have or have inadequate access to banking services, according to the Asian Development Bank (ADB). The World Bank’s latest Financial Inclusion data also demonstrates this, showing that Vietnam possesses significant potential to develop formal lending channels, which are still in the early stages. new stage of development.