Those for whom the bitcoin exchange rate is really important are already optimistic regarding the period ahead.

The week’s most important cryptocurrency news in one place

America’s largest banks are planning to launch a joint digital wallet. Banks pushing for the partnership include JPMorgan, Bank of America, Wells Fargo, Capital One Financial, US Bancorp, PNC Financial Services Group and Truist Financial. According to their plans, their new wallet will be available to their customers in the second half of 2023. Their primary goal is to compete with PayPal and Apple Pay.

Binance, the world’s largest crypto exchange, mistakenly mixed up customers’ funds. The collateral for some of the crypto assets it issued was kept in the same wallet as the funds belonging to their customers. The exchange issues 94 so-called Binance-peg tokens (B-Tokens) and stores nearly half of the collateral in the Binance 8 cold wallet, wrote the Bloomberg. The wallet contains more tokens than the amount of B-tokens issued. Since the tokens are supposed to be hedged 1:1, according to Bloomberg, the excess indicates that the hedge is mixed with clients’ tokens.

Arizona Republican Senator Wendy Rogers has introduced a bill in the United States that would make bitcoin legal tender in the state of Arizona. The proposed bill would allow government entities to accept bitcoin, but would also allow people to pay taxes or debts in the largest cryptocurrency. This would mean that almost all transactions that might only be done in US dollars might be done in bitcoin.

Bitcoin and the stock market are moving away from each other

Holding crypto assets and the accompanying diversification are back in vogue. Last year, bitcoin and the stock market moved in tandem – but that was mostly due to the fact that the prices of each asset fell. However, in 2023, the Bitcoin/Nasdaq index correlation fell back to the level seen in 2021. And its correlation with gold and bonds has slipped back to almost zero, which means that there is no real co-movement relationship between bitcoin and the price of these instruments.

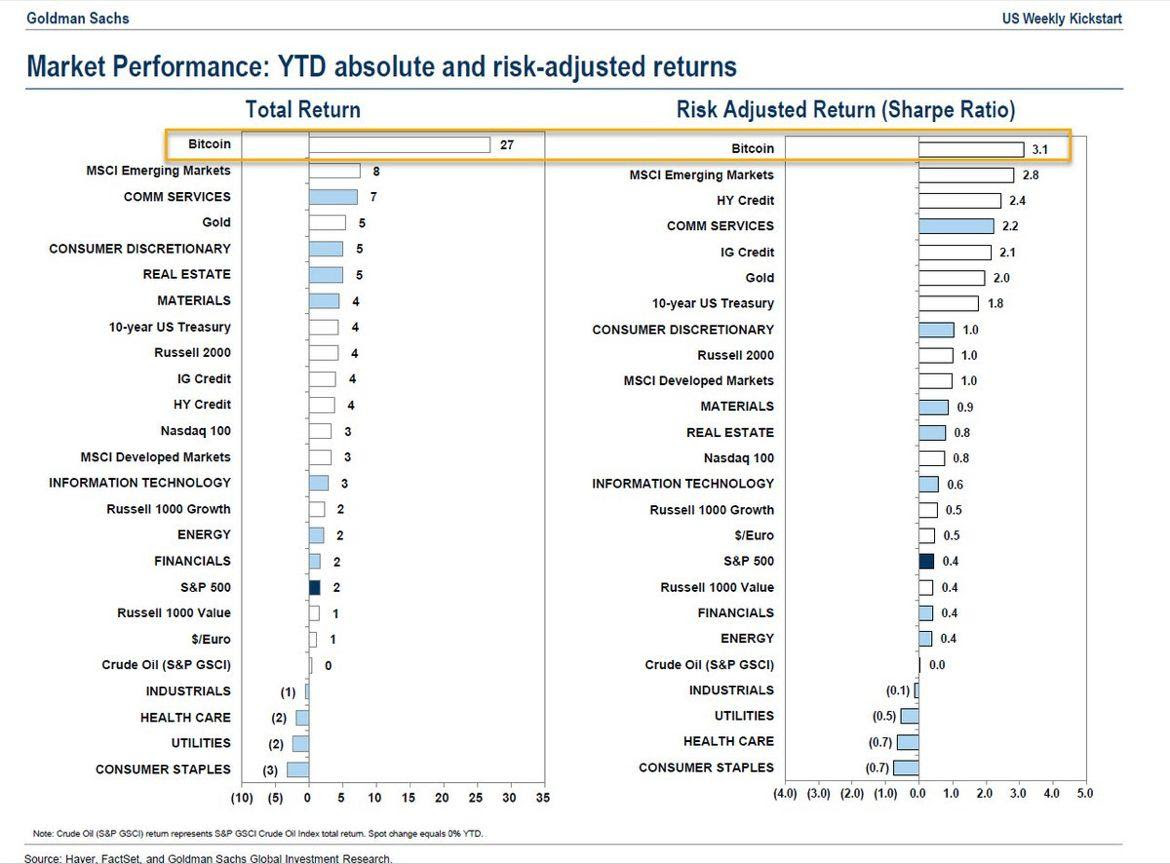

Goldman Sachs this week rated Bitcoin as the best-performing asset of the year so far. In terms of both absolute and risk-adjusted returns in 2023, bitcoin had no competitors. Investors might thus achieve a higher return by holding bitcoin than on emerging market papers and real estate markets, but BTC also brought more than the S&P 500, gold and 10-year Treasury bills.

In the meantime, Bitcoin is already crushing the bigger banks in terms of market capitalization. BTC is currently the 17th most valuable asset in the world by market cap. With a market capitalization of over $400 billion, bitcoin is currently more valuable than any major bank, according to data from CoinMarketCap. And taking into account the total market capitalization of all cryptocurrencies, this value is around $1 trillion.

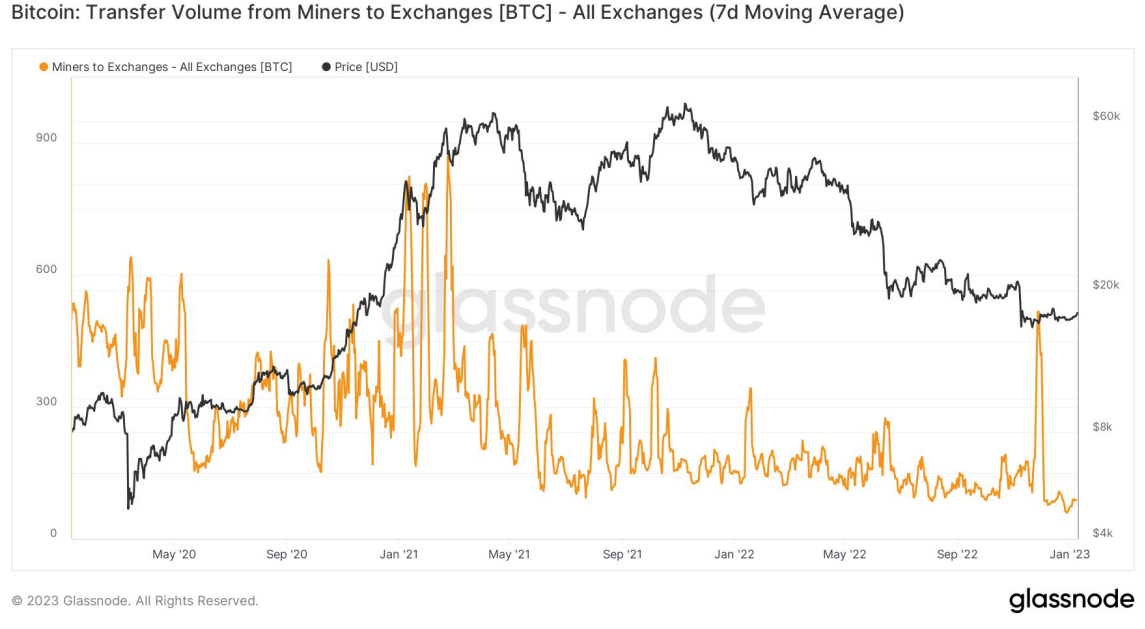

Bitcoin miners have finished selling bitcoins

Intra-blockchain transaction data shows that the amount of BTC transferred from miners’ bitcoin addresses to stock exchanges’ wallets has recently fallen to multi-year lows. This means that there is already less selling pressure, which lowers the price of BTC and shows that the miners are probably already in better liquidity.

Miners hold their bitcoins and don’t sell them because analysts expect further increases.

This is because miners run their mining machines in exchange for bitcoin rewards to maintain the blockchain network. The bitcoin reward for mining a block is sold by miners from time to time to cover operating costs. These costs have increased considerably over the last year due to the rise in energy prices. Some miners filed for bankruptcy protection last year to ensure their operations, but many companies went into liquidation, selling their assets, including their hoarded bitcoins. By doing so, they themselves contributed to the selling pressure of the market.

Falling miner sales mean weaker selling pressure on the bitcoin price and is generally an optimistic sign for the market.

Professional traders are optimists

By examining the metrics of derivative markets, i.e. futures and options trading, we can see how professional traders behave and position themselves in the current market conditions.

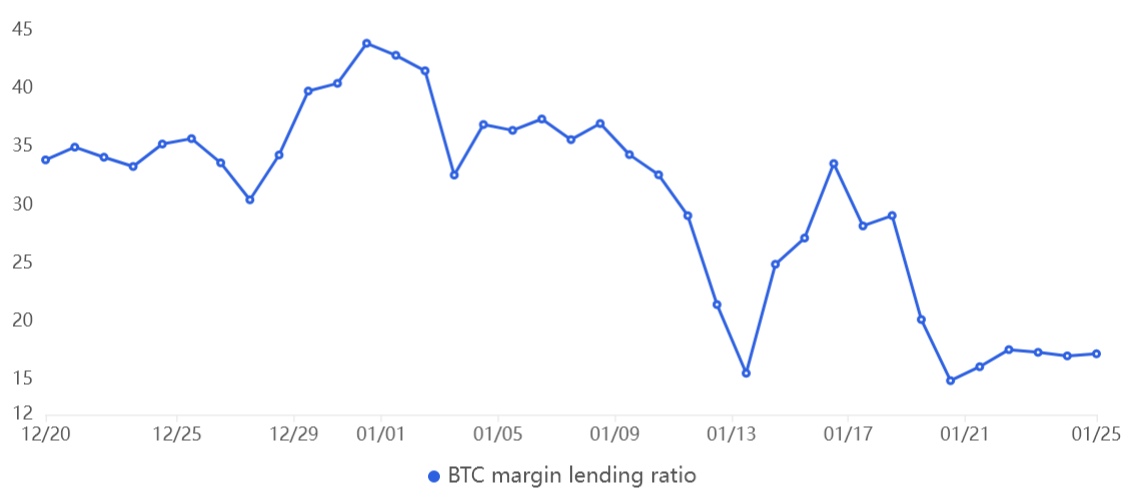

Leveraged bitcoin trading

Leveraged markets provide insight into how professional traders think. Leveraged trading allows investors to borrow cryptocurrency to better leverage their positions.

The chart above shows that OKX’s Trader Leverage Lending Rate increased slightly following January 20th, indicating that professional traders only started increasing their leveraged positions well following Bitcoin broke through the $21,500 resistance.

The indicator on the current site favors stablecoin borrowing and indicates that sellers are not confident in further significant declines, so they are not building leveraged positions for further declines.

Option bitcoin trading

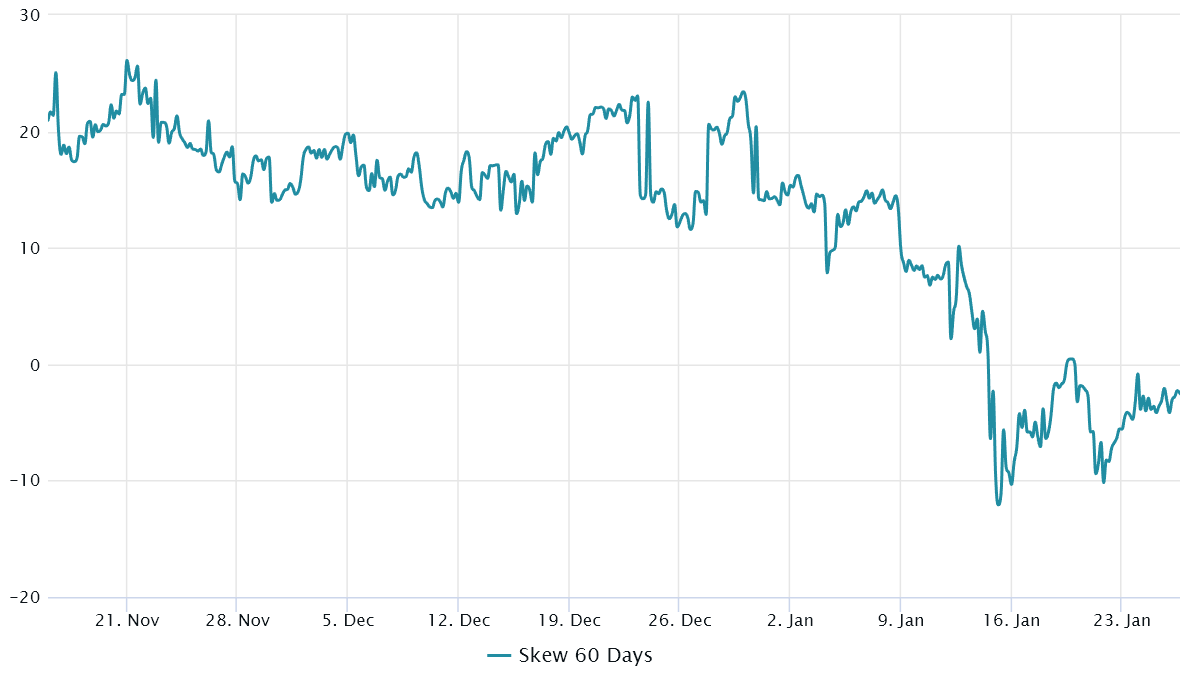

It’s also worth looking at the options markets to understand if the recent rally has made investors more risk-averse. The 25% delta skew indicator shows how optimistic or pessimistic the market is. That is, how much premium are market makers willing to pay for protection once morest a possible upward or downward exchange rate movement.

The 25% delta skew reached the minus 10 threshold on January 21. The move coincides with BTC’s 11.5% rally and subsequent local high of $23,375. From then on, option traders increased their risk-averse attitude towards unexpected exchange rate movements.

The indicator compares similar call and put options. It turns positive when fear dominates the market, as the premium for protective put options is higher than for riskier call options. On the other hand, if greed is the dominant mood, the indicator turns negative.

Currently, a delta skew close to zero indicates that investors are pricing in similar risks to the downside and upside. On the one hand, it seems promising that traders do not want to short Bitcoin in large batches for the time being, but at the same time, option traders were not confident enough to take significant positive positions either.

The longer Bitcoin stays above $22,500, the riskier it becomes for those who bet on BTC falling (short). Despite this, traditional markets still play a fundamental role in creating the trend, so there is little chance that another significant exchange rate movement can be expected before the FED’s decision on February 1st.

Altcoin News

The upward trend of digital devices continued unabated in the fourth week of this year. While BTC reached over $23,000 on Tuesday following a 12% rise, other altcoins were not bored either.

Bitcoin is up 40% since January 1st and ETH is up 35%. Gaming tokens and second-layer protocols led the weekly rise: Axie Infinity (+46%), Ape Coin (+33%), Fantom (+37%) and Near (+29%) all performed outstandingly.

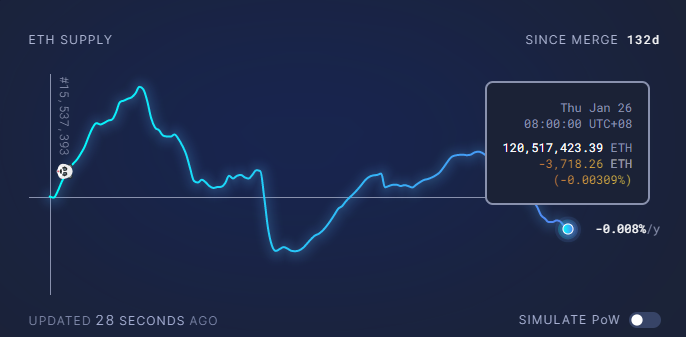

ETH stocks are decreasing

The available supply of ETH has been showing a continuous downward trend since January 15th. This means that the amount of ether burned currently exceeds the amount emitted. According to ultrasound.money, more than 14,700 ETH (worth regarding $24 million) has been burned in the past seven days. About 3400 of this ETH was burned in NFT transactions.

The more deflationary pressure is placed on Ethereum, the greater the opportunity for the price to rise.

BitcoinBázis is available on another social media platform, join us on Discordon!