2023-08-04 16:11:26

The Paris Stock Exchange rose 0.75% on Friday, driven by better than expected figures for the US job market and by the results of Crédit Agricole.

The star CAC 40 index rose 54.54 points to 7,315.07 points. On Thursday, it closed down 0.72%, hurt by rising rates in the bond market, discouraging equity market investors who preferred to recoup their gains.

Over the week, the Paris market lost 2.16%, ending a series of three consecutive weeks of increases.

The publication of the US Department of Labor report was the main macroeconomic event expected this week.

The US economy created 187,000 jobs in July, less than the 200,000 expected by economists. In addition, the figures for May and June have been revised down by 49,000 jobs in total.

These figures “a little lower than expected” are “good news” for the markets according to Lionel Melka, partner at Swann Capital.

He adds that “this shows that the American job market is a little less overheated than we thought”, an issue for the American central bank, the Fed, which has been fighting for more than a year once morest inflation. high, fueled in part by wage increases.

From this perspective, a slowdown in the US job market is therefore paradoxically good news and has reassured investors. In response, interest rates on US debt eased significantly.

That of the 10-year French government bond stood at 3.08% around 3:45 p.m. GMT, once morest 3.13% at the close on Thursday.

Successful season for Crédit Agricole

Crédit Agricole on Friday published record results in the second quarter. Its Casa entity, listed on the Paris Stock Exchange and bringing together the main businesses of the banking group apart from the regional banks, posted 6.7 billion euros in revenue between April and June (+ 18.8%) for just over 2 billion euros in net profit (+24.7%), unheard of.

These results exceeded the expectations of analysts polled by the data provider Factset and the financial agency Bloomberg, and were welcomed by investors. The action soared 6.14% to 11.86 euros, the best performance of the session within the CAC40.

Crédit Agricole has also announced that its private banking subsidiary is in the process of acquiring a majority stake in its Belgian competitor Degroof Petercam.

Societe Generale also rose 2.28% to 25.40 euros, BNP Paribas took 1.72% to 59.29 euros and the insurer Axa 2.01% to 27.46 euros.

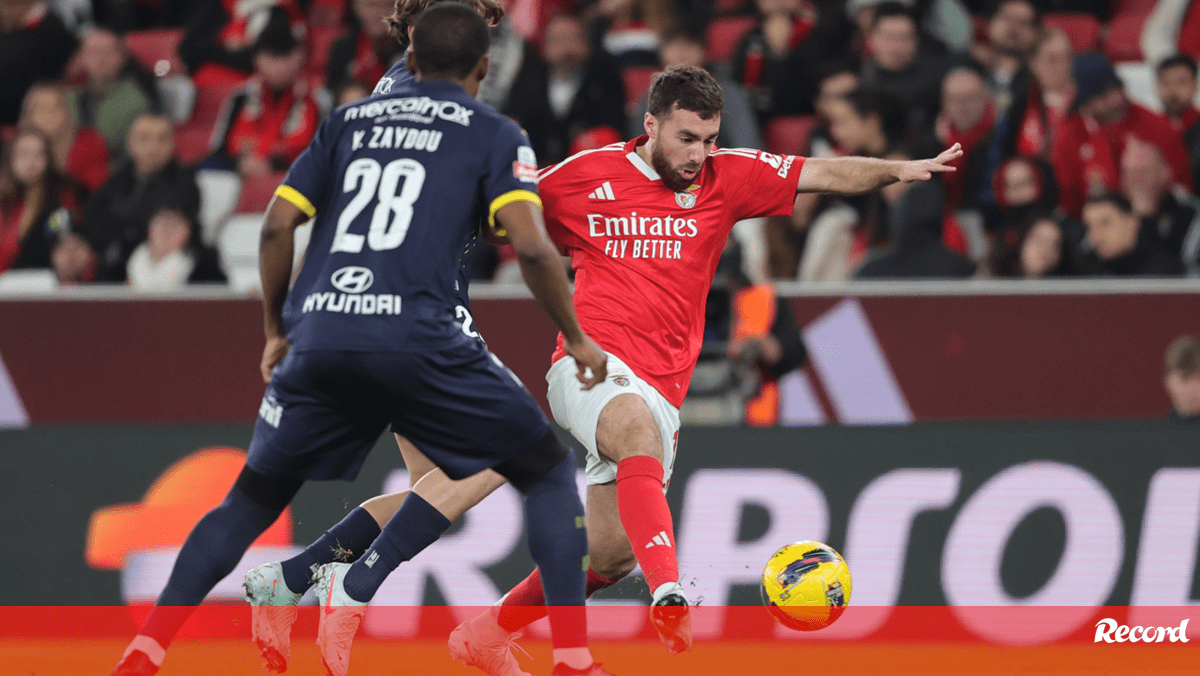

End of the match at Olympique Lyonnais

Following the takeover bid for Olympique Lyonnais shares filed by Eagle Football, the holding company of American multimillionaire John Textor now holds 87.81% of the club’s capital, announced Friday the French stock market policeman.

Eagle Football had indicated that it had no intention of removing OL from the Paris Stock Exchange following this operation.

The Olympique Lyonnais Groupe share fell by 16.94% to 2.06 euros, a “logical” movement according to Lionel Melka, because “the event which had led to the rise in the share has disappeared, so the price goes down” .

Casino descended from a cran chez S&P

Ratings agency S&P Global Ratings downgraded Casino one notch to ‘CC’, expecting ‘imminent’ default if billionaire Daniel Kretinsky’s deal to take over the food retailer comes to an end .

The Casino share rose 1.69% to 2.52 euros, but that of its parent company Rallye fell 22.28% to 0.24 euros.

1691171839

#Paris #Stock #Exchange #rebounds #American #employment