The year has crossed the middle, but the crisis is still at the very beginning of the journey. Analysts and investors fear that bad news will multiply exponentially over the next six months.

What happened bad

- Inflation

- Biggest sell-off in the bond market in forty years

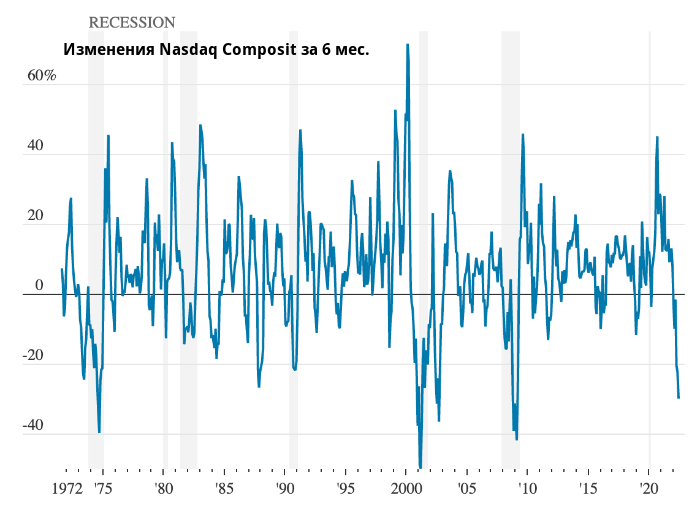

- An almost unprecedented collapse in technology stocks.

- Collapse in the crypto industry

A recession is a threat that investors have been ignoring for months. Whether the economy will be able to withstand this bombing, or fall apart – no one knows. For example, Deutsche Bank customers, according to the latest survey, believe that the economic crisis in the US will come with a 90% probability, and the New York Fed’s recession forecasting model gives it 4.11%.

Meanwhile, the problems of other countries will come back to haunt the Americans. Japan may finally be forced to relent and let bond yields rise. If this happens, the Japanese will begin to sell foreign assets and invest in local paper. In Europe, the Central Bank proposed a plan to save Italy, but we have already gone through this story. If the regulator follows the “too little too late” scheme, the debt crisis will return to the Eurozone, and the markets are not ready for this.

Whatever happens, the markets are not ready for it. If there is a soft landing, stocks will stabilize and recession panic will begin to fade. If there is a recession, the losses will be massive, as investors appear to have only started pricing in such a scenario a few weeks ago.

The good news is that prices have already declined quite a bit, approaching what will sooner or later be a cyclical bottom. The S&P 500 fell 21% in the first half of the year, the biggest drop in six months since 1970. At that time, the economy was in recession. Long-term Treasuries lost 10%, even on coupon payments, the biggest six-month loss since Paul Volcker’s Fed plunged the economy into recession. This was in 1980.

Technology stocks

Source: The Wall Street Journal

How prices reflect recession risk

It’s impossible to tell exactly how markets are pricing the chance of a recession this time around. JP Morgan strategist Nicholas Panigirtzoglou says the easiest way to isolate probability from price action is to compare price declines to the average peak-to-trough of past recessions.

The S&P 500 is down just over 20% and the average drop over the past 11 recessions has been 26%, putting the chance of a recession at almost 80%.

However, much of this year’s sell-off is not related to recession risk. To see this, we need to distinguish between the Fed’s direct and indirect influence on the value of stocks and bonds.

The direct effect is to boost bond yields and lower the valuation of earnings-bearing stocks in the distant future — technology companies are among these. This trend dominated until June: bond yields were rising, growth stocks were crashing, and cheap “value” stocks were doing great. If we exclude the technology sector, it turns out that the economy-sensitive cyclical sectors of the stock market until June 7 were only marginally behind defensive stocks.

Then everything changed. Investors woke up and remembered the indirect consequences of the Fed’s policies that could weaken the economy. This epiphany affected stocks in a different way. A weaker economy means less inflation, which justifies lower bond yields. It also hits cycle-sensitive sectors, so stocks with relatively low valuations tend to suffer more than growth stocks.

Since June 7, cyclical sectors – especially oil and mining stocks – have been in a tailspin. Over the past two weeks, fear of a recession has also crept into the Treasury market, with investors believing the Fed will be forced to cut rates aggressively next year. Yields on 10-year government bonds fell by almost half a percentage point, the biggest decline since the first lockdown. Wall Street analysts are also rushing to revise their earnings forecasts after ignoring the threat of a recession for too long and are now catching up.

What is happening in the world

The market understands that the economic horizon is hidden in thick fog and overcast, so a sudden rain will not scare them. But they will still be soaked to the skin if a deep recession storm hits and flushes corporate profits down the drain.

Many risks can come from outside. Hedge funds are betting that the Bank of Japan will lift control over bonds, which protected them from tightening the policies of global central banks and brought down the yen. If they’re right, and nothing forces the BOJ to take action, Japanese government bond yields will shoot up soon, and so will the yen. Such a sudden reversal would wreak havoc on global markets.

Rising domestic yields and potential foreign exchange losses will force an army of Japanese retail investors to urgently repatriate their capital, which will spur the yen up and increase upward pressure on Treasury bond yields.

Europe has political risks on the agenda. The European Central Bank acted proactively to prevent a crisis in Italy. Now he has to convince the tight-fisted north to accept the deal to underwrite the country’s bonds without imposing unacceptable terms on Italy. If he fails to agree on a sufficient amount, Italy and the Eurozone as a whole will plunge into crisis by autumn.

We can only hope that the recession will be mild, not until next year, or not at all. But the economic data paints a different picture, and the effect of high interest rates hasn’t even reached ordinary households yet. The danger is great, and the markets are still not ready for it.

Prepared by Profinance.ru by materials editions of The Wall Street Journal

MarketSnapshot – ProFinance.Ru news and market events in Telegram

On this topic:

Commodity prices plunge on recession fears

The Ukrainian conflict slows down the global economy

How to Recognize Market Capitulation – Experience from Previous Crashes