2023-06-05 14:55:01

The FCI (common investment funds) are one of the alternatives that Argentines have to protect their savings from the high and growing inflation and in the face of great uncertainty, considering that The 2023 elections are unpredictable and in a context of great economic fragility.

The investments chosen by Argentine society in May are a symptom of its great fears in economic matters this year: inflation and devaluation jump. It is no coincidence that the FCIs that offer to tie savings to the evolution of the official dollar or the consumer price index (CPI) have expanded last month.

According to data from Adcap Grupo Financiero, the “dollar linked” FCIs were the winners in May with net subscriptions of $46 billion, which already represents 7.5% of the assets under management of the industry. It should be remembered that, as part of the renegotiation of the Extended Facilities Agreement between Argentina and the International Monetary Fund (IMF), it was agreed to accelerate the rate of crawling peg.

In other words, the Government promised to devalue the official exchange rate above the increase in the general level of prices to try to gradually reduce the spread with parallel quotes and increase the real exchange rate. An example of the latter is that on Monday, May 29, the so-called Banco Nación dollar registered its largest daily increase in absolute terms since the PASO crisis in August 2019.

- $46.000.000.000

- Net subscriptions to dollar linked FCIs in the month of May.

The FCIs tied to the Reference Stabilization Coefficient (CER) are those that intend to follow the evolution of inflation and the CPI. Regarding these, from Adcap Grupo Financiero they indicated that daily closings with a positive balance have been registered, and that in the last 7 days there were net subscriptions for $1,500 million. The inflationary escalation and the sensation of spiralization are behind these figures.

Paula Gándara, chief investment officer (CIO) of Adcap Asset Management, pointed out that “As we move further into the election cycle, investors turn to more conservative instruments. before the search to protect itself from the volatility of the market». In turn, he added that “in the same macroeconomic context, in which exchange rate adjustment expectations rise, the demand for devaluation coverage deepened.” Finally, he indicated that “the weak demand for CER assets might also intensify in the face of attractive yields, due to accelerating inflation.”

As we enter the electoral cycle, investors turn to more conservative instruments in search of sheltering from market volatility.

Paula Gándara, Chief Investment Officer (CIO) of Adcap Asset Management.

FCI: what are they and how to invest in them, bank by bank?

According to the National Securities Commission (CNV), an FCI “is an investment instrument through which a group of people with similar investment objectives contribute their money so that a professional can manage it, investing in a diversified portfolio of assets. » That is to say, you invest in “one place” but simultaneously diversify, which is key to reducing risk and decision volatility. The liquidity of the alternative is due to the fact that the redemption can be made on any business day, and the accreditation usually takes 24 or 48 hours (business days as well).

As we already anticipated, FCIs are a simple way to tie savings to inflation or the evolution of the official exchange rate. To do this, you must request the opening of a principal account in the bank, a process that can generally be done online. Once the account is activated (it takes a few hours from the request), a new FCI can be subscribed in the investments section. You have to choose those of fixed or mixed income that have as a source of performance (benchmark) the Reference Stabilization Coefficient (CER) or the price of the dollar in the official market.

Next, the list of the FCIs that have as benchmark the price of the official dollar and/or with an important participation of dual bonds, by bank.

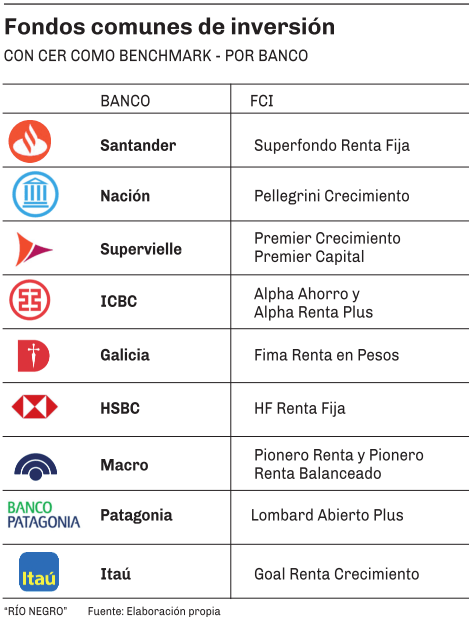

Below is the list of FCIs that are benchmarked by CER (that is, inflation), by bank.

1685977569

#investment #preferred #Argentines #runup #elections