Preliminary data released by the University of Michigan on Friday (16th) showed that the consumer confidence index rose to 59.5 in September, the highest since April this year, but was still lower than market expectations of 60, and the previous value was 58.2. At the same time, consumer expectations for short-term and long-term inflation have declined due to lower oil prices.

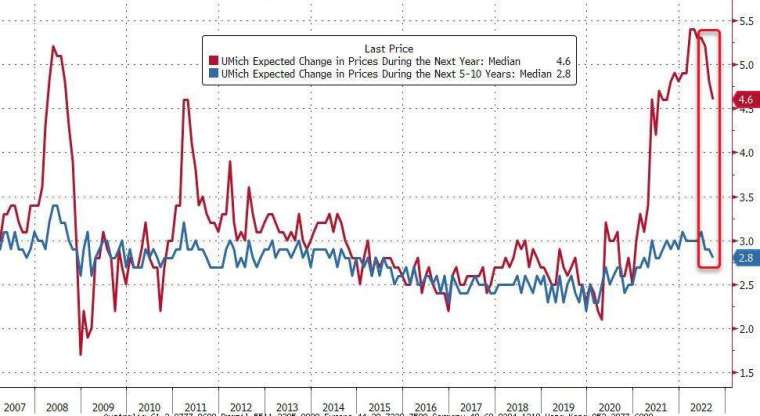

In terms of inflation expectations, which have attracted much attention from the market, the initial value of inflation expectations in September 1 fell to 4.6% from the final value of 4.8% in August, the lowest since September 2021. Earlier this year, the short-term inflation expectations were once It reached 5.4%, the highest level since 1981. Five-year inflation expectations also slipped to 2.8% from a final 2.9% in August, the lowest level since July 2021.

While fewer consumers cited shortages and gasoline prices fell, other measures of inflation, such as food and housing costs, were accelerating and fairly broad, the report showed. The annual growth rate of the consumer price index (CPI) and the core inflation rate in August released this week were higher than expected, which means that inflation is still hot.

In terms of other sub-indexes, the initial value of the current situation in August was reported at 58.9, which was lower than the expected 60.8, slightly higher than the previous value of 58.6, which was a new high since May; the initial value of the August expectations index was reported at 59.9, which was not only higher than the expected 59.7 but also higher than The previous value was 58, a new high since April.

The report also pointed out that purchases of durable goods such as automobiles and home appliances are still near record lows. Despite the drop in inflation expectations, consumers are less optimistic regarding their financial prospects, with some 42% still saying high prices are eroding their living standards, down from a high of 49% in July.

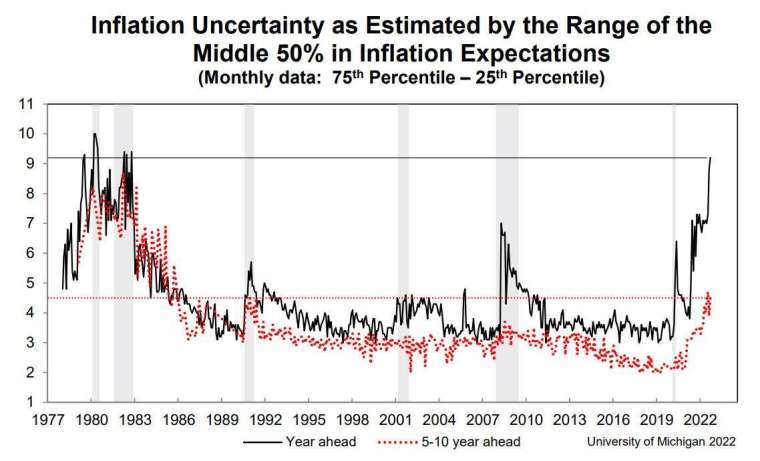

However, consumers showed signs of uncertainty regarding the economic trajectory following a marked improvement in consumer confidence in August. As the UM report points out, it is still unclear whether the improvement in inflation will continue, as consumers still exhibit a great deal of uncertainty regarding the trajectory of future prices, with uncertainty regarding short-term inflation reaching levels not seen since 1982. A new high, while uncertainty regarding long-term inflation rose to 4.5 from 3.9, well above 3.4 in September last year.

Inflation expectations are likely to remain relatively volatile in the coming months as conflicting messages regarding prices add to consumer uncertainty, said Joanne Hsu, director of the University of Michigan’s Consumer Confidence Survey.

Bloomberg economist Eliza Winger said preliminary results from the U of M consumer sentiment survey showed the price outlook remained favorable, but that was only a small consolation for the Federal Reserve as core inflation remained high. Under the circumstances, the risk of prices rising once more still exists. All in all, the data suggest that the Fed is likely to raise rates by 3 yards (75 basis points) rather than 4 yards (100 basis points) at its September meeting.

Consumer confidence affects economic growth in the coming months, pessimism will dampen spending levels, which will affect the economy, and optimism will help the economy going forward.