In the second half of 2022, non-fungible tokens, i.e. NFTs, were increasingly relegated to the background, and many believed that the popularity of NFTs would slowly decline in the future. However, the increase in the price of Ethereum has proven to be beneficial for NFT sales for several reasons.

According to the latest data, the sales volume of NFTs increased by 5% in the last week. This further increased the volume to $242 million, of which Ethereum accounted for $195 million, or 80% of the total volume.

In addition, as can be seen in the figure above, the daily volume of Ethereum on OpenSea, the world’s largest NFT marketplace, increased throughout January 2023.

Nearly $24 million worth of ETH has been burned in the past seven days

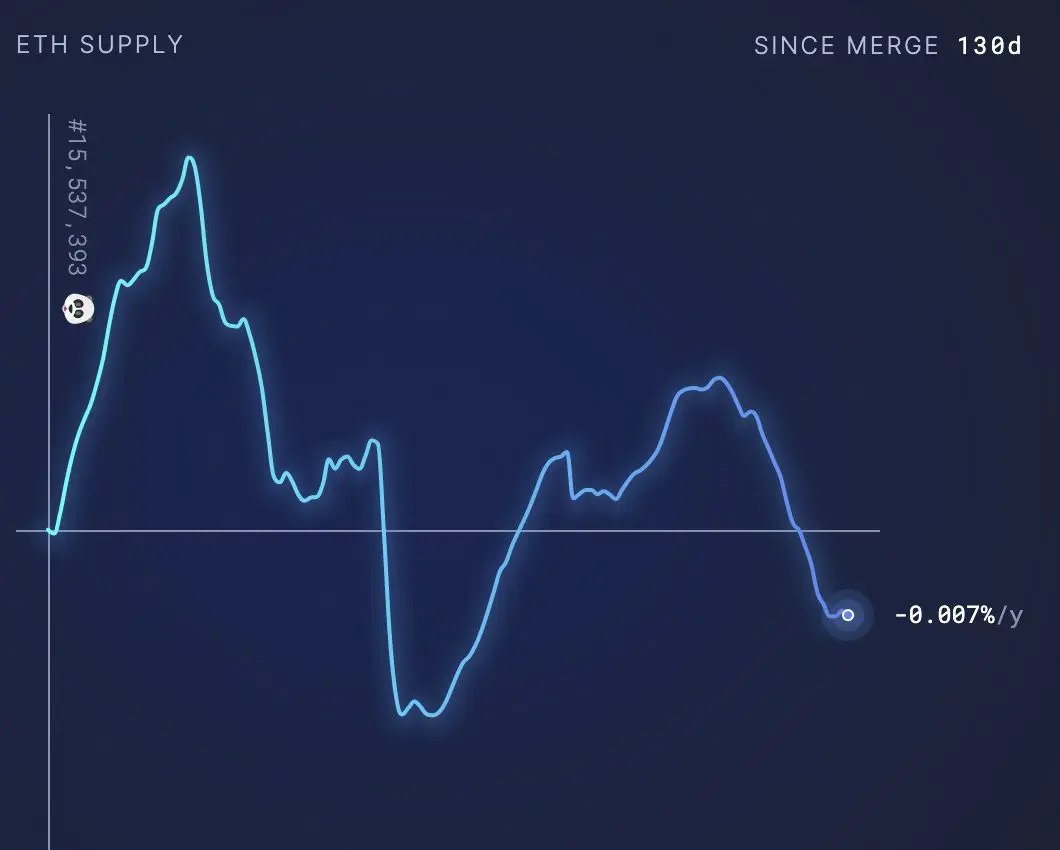

The surge in NFT sales contributed to an increase in transactions on the Ethereum network, which ultimately led to more ETH being burned. Since the number of tokens burned exceeded the total amount of ETH mined, the network is once once more experiencing deflation. As highlighted by ultrasound.money, ETH’s annual inflation rate has fallen to -0.07%.

In the past seven days, more than 14,700 tokens have been burned, which is equivalent to nearly $24 million at the current exchange rate.

As you can see from the chart above, this was not the first time that Ethereum was hit by deflation. Back in November, following the FTX crash, ETH also proved to be deflationary following the annual inflation rate dropped to 0.029%.

The rate of daily burning has increased significantly in the past six months

In August 2021 it is EIP-1559 (Ethereum Improvement Proposal) update changed the management of transaction fees, so the structure of blockchain transaction fees has also completely changed. Since EIP correlates with the amount of ETH burned by network activity, the more transactions there are, the more ETH is destroyed.

According to data from Etherscan, daily burning has increased dramatically in the previous six months, fluctuating between 1,000 and 2,000 ETH on average. Even on January 18th, the daily burn was close to 2,700 ETH, at the time of writing this value has decreased to 1,928.3 ETH.

Also, the spike in burn rate is recent for Ethereum with an increase in the exchange rate may also be related. At the time of writing, the coin is trading at $1,601, which is down 2% in the last 24 hours, but the price has increased by more than 31% in the last 30 days.