2023-06-16 12:00:00

Once the 15 days have elapsed since it was known the agreement between the Gilinski Group and the leaders of the companies of the Grupo Empresarial Antioqueño (GEA) the companies announced how the agreement and contracts will be carried out so that Jgdb, Nugil and IHC (Gilinski companies and their partners) become the majority shareholders and controllers of at least 87% of Nutresa, following the division and delivery of the assets they have in Grupo Sura and Grupo Argos.

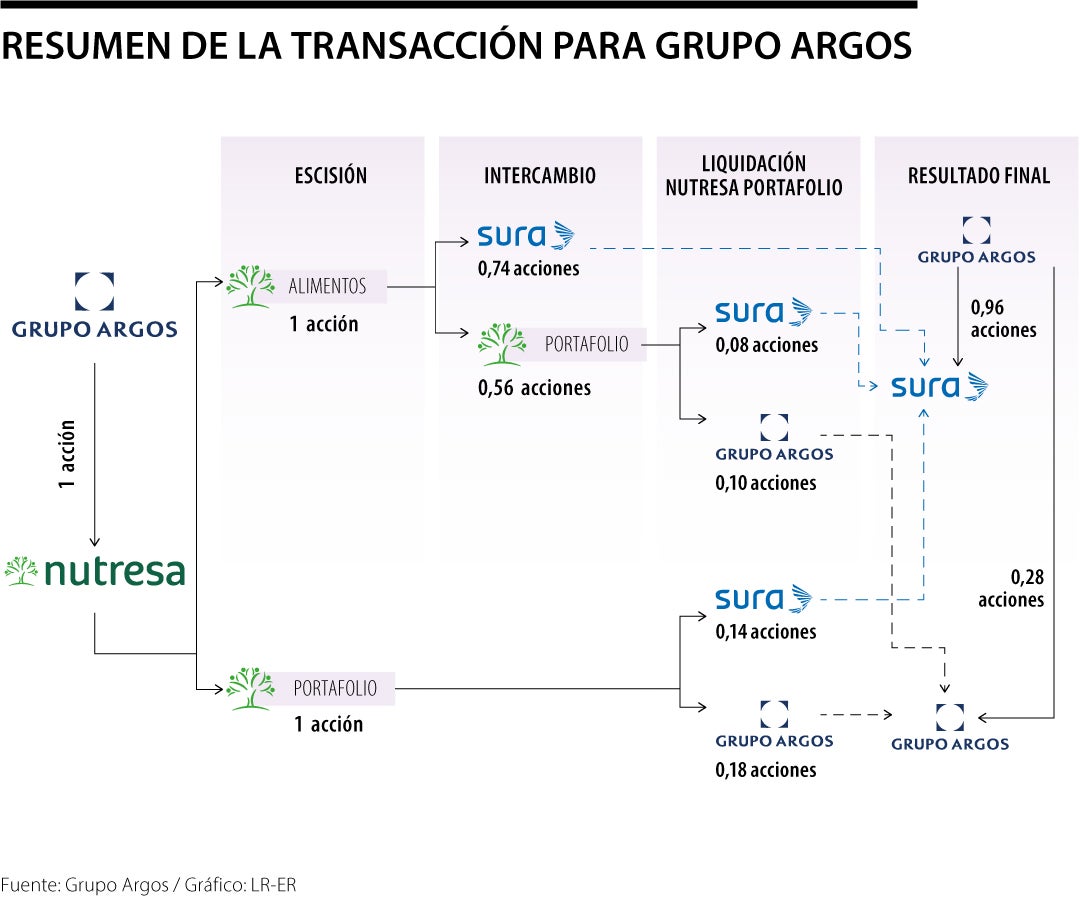

Once regulatory endorsements are obtained, The first step is for Nutresa to call an extraordinary meeting of the Shareholders’ Meeting to separate its business in which a “symmetric spin-off”, which means that for each share of Grupo Nutresa, each shareholder will maintain one share of Nutresa Alimentos and receive one share of Nueva Sociedad Portafolio; the latter is a package that includes the shares that the food company has in Grupo Argos and in Grupo Sura.

Sura added that both companies will be listed on the Colombian Stock Exchange and there for each share of Nutresa, each shareholder will keep one share of the food company and will receive one share of the new company (portfolio).

The second step, once approved by the Assembly, will be make contributions to an autonomous patrimony with three options: “o Grupo Sura contributes the shares it owns in Grupo Nutresa; o Grupo Argos contributes the shares it owns in Nutresa; o Nugil, JGDB and IHC contribute the shares it owns in Grupo Sura”.

A third step is that once the division of Nutresa has been formalized, Nugil will contribute to that equity the shares they receive from Nueva Sociedad Portafolio so that Sura and Argos jointly launch, in the proportion of 78% and 22% respectively, a Public Acquisition Offer (OPA) to all Nutresa shareholders in which they have three options.

- Sell for cash at a value of US$12 per share (there they retain their stake in the new portfolio company).

- Exchange their shares of Nutresa (food) for shares of Grupo Sura and the new company that owns the portfolio. “For each share of Grupo Nutresa (food) the shareholder will receive 0.74 shares of Grupo Sura and 0.56 of the new company that owns the portfolio, so in the end the shareholder will end up receiving a total of 0.96 shares of Grupo Sura and 0 .28 shares of Grupo Argos

- Remain as shareholders in Grupo Nutresa (food)

The OPA will be for a minimum of one share and a maximum of the number of shares equivalent to 23.1% of the total shares of Nutresa Alimentos.

The fourth step is that Upon completion of this takeover bid, Sura and Argos will contribute to this Autonomous Equity the awards received for up to 10.1% of the company and “the acceptances of the OPA received in excess of 10.1% and up to 23.1%, will be paid by Sura and Argos to the shareholders and their value will be reimbursed, at the same price, by IHC to the Offerors”.

After completing these steps, Sura explains that the Autonomous Patrimony will restore the contributions made (by Sura, Argos, Nugil, JGDB and IHC) obtaining as a result the exchange of shares and the company created will be liquidated so that each company remains with its shares as agreed at the beginning.

All the paperwork”contemplates the exchange of 254 million shares of Grupo Nutresa (56%) – with which JGDB, Nugil and IHC Capital Holding would reach an 87% stake in Grupo Nutresa – for 189 million shares of Grupo Sura (41%) and 144 million shares of the new company holding the portfolio (31%). This means that, in this phase of the transaction, for one Nutresa share, Grupo Argos will receive 0.74 shares of Sura and 0.56 shares of the new company that owns the portfolio.”

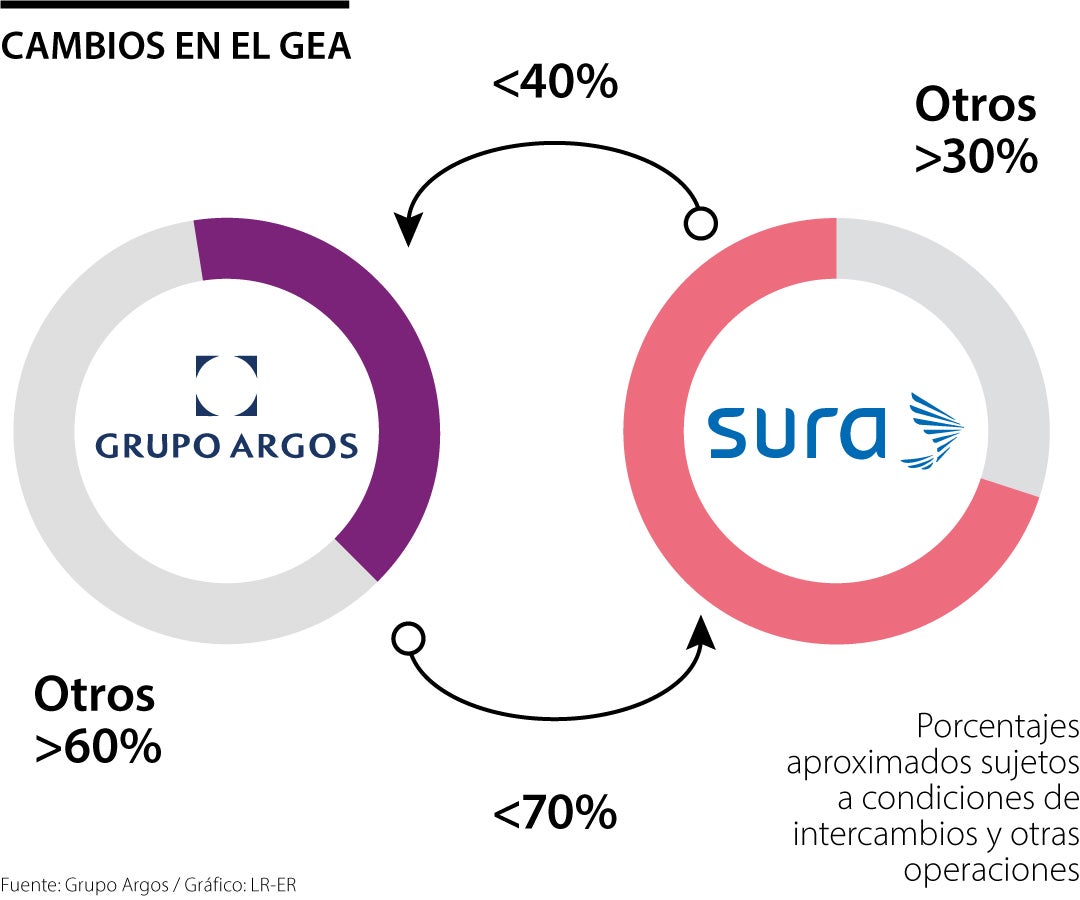

After carrying out these procedures, Grupo Argos explained that with Sura they will advance in the processes of search for partners and strategic alternatives, situation that had been planned at the start of the OPA round in January 2022.

Regarding the operation Jorge Mario Velásquez, president of Grupo Argos, explained that “the arrival of a new global investor to Nutresa with the desire to grow on its operating platform, not only represents an opportunity to reveal value for all its shareholders, but also It will allow us to preserve the principles that have historically characterized the organization, maintaining more than 46,000 jobs and investment in the country”.

Argos also reported that it will convene an investor conference on Tuesday June 20 to explain the terms of the agreement in detail.

The infrastructure company also explained that the interest of Grupo Argos is to continue consolidating itself as a manager of this type of asset and not control Grupo Suraso once you receive the shares of said company, will transfer that additional participation to an irrevocable trust whose purpose will be that the political rights are not exercised, keeping only the economic rights of said sharesuntil a divestment mechanism or other alternatives are established to capture the value of that portfolio.

Finally, Grupo Argos and Grupo Sura explained that “they will continue to search for strategic partners to focus all of their investments on their core businesses, which will enable them to continue to unlock and maximize shareholder value.”

1686921114

#business #Grupo #Argos #Sura #deliver #investments #Nutresa