The full text of the Fed’s March decision statement

Economic activity and employment continued to strengthen. Employment growth has been strong in recent months, and the unemployment rate has fallen sharply. Inflation remains high, reflecting supply-demand imbalances related to the pandemic, higher energy prices and widespread price pressures.

The Russian aggression once morest Ukraine resulted in enormous humanitarian and economic hardship.The impact on the U.S. economy is highly uncertain, butIn the short term, aggression and related events might put additional upward pressure on inflation and weigh on economic activity。

The committee seeks to achieve full employment and a longer-term inflation rate of 2%. With the stance of monetary policy tightening appropriately, the Committee expects inflation to return to its 2% target and the labor market to remain strong. To support these goals,Committee decides to raise the target range for the federal funds rate to 0.25% to 0.5% and anticipates that further increases in the target range will be appropriate. In addition to that, the committee is expected to begin reducing its holdings of Treasuries, agency debt and agency mortgage-backed securities at a future meeting.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of subsequent information for the economic outlook and will be prepared to adjust the stance of monetary policy as appropriate if risks arise that might hinder the Committee’s achievement of its objectives. The committee’s assessment will take into account a wide range of information, including public health data, labor market conditions, indicators of inflation pressures and inflation expectations, and data on financial and international developments.

Supporting this monetary policy resolution are FOMC Committee Chairman Powell (Jerome Powell), Vice Chairman John Williams (John Williams), Bowman (Michelle Bowman), Brainard (Lael Brainard), George (Esther George), Kazakhstan Patrick Harker, Loretta Mester and Christopher Waller.James Bullard voted once morest, arguing that the meeting would raise the target range for the federal funds rate by 0.5 percentage points to 0.5% to 0.75%. Harker is a proxy voting member for this meeting.

The original Fed statement in March:please click me

The chart below shows the GDP, unemployment and PCE inflation forecasts released in March, including downward revisions to 2022 gross domestic product (GDP) growth forecasts and upward revisions to 2022 to 2024 inflation forecasts:

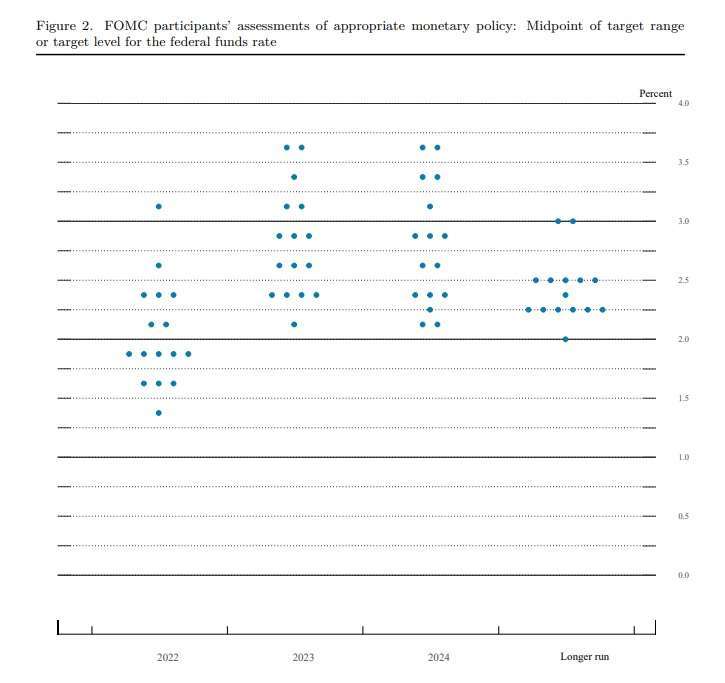

The following picture shows the FOMC federal funds rate forecast point chart, which is expected to raise interest rates regarding six times this year to a level close to 2%: