In 2022, the rate of credit holdings by households (real estate and consumer) continues to decline, especially for consumer credit. For 2023, subscription intentions are also on the decline, particularly for mortgages.

The French Association of Financial Companies (ASF) and the French Banking Federation (FBF), both partners of La finance pour tous, published on February 14, 2023 the 35th edition of theHousehold Credit Observatory (OCM).

This edition of the OCM highlights three developments:

- a sharp decline in credit holdings in 2022, especially for consumer credit,

- a deterioration in households’ assessment of their financial situation,

- and a drop in subscription intentions, especially for mortgages, in 2023.

Sharp decline in the loan holding rate in 2022

In 2022, the loan holding rate by households continued to fall to 43.4%, i.e. the lowest level since 1989. It was 45.2% in 2021 and 46.5% in 2020. This continued fall in the credit holding rate affects both mortgage and consumer credit.

For the real estate loansthe ownership rate fell to 30.1% compared to 30.6% in 2021 and 31.4% in 2020, i.e. a level comparable to that of the years 2014-2017.

For the consumer creditthe decline is even more pronounced, since the ownership rate drops from 24% in 2021 to 21.8% in 2022, i.e. the 5e consecutive year of decline. This is the lowest level seen since 1989.

Deterioration in households’ assessment of their financial situation

in 202246.7% of indebted households considered that their financial situation had deterioratedfor the second consecutive year, compared to 38.3% in 2021 and 32.6% in 2020.

For these families, the deterioration in their financial situation stems from the loss of purchasing power and a sharp upturn in inflation, an observation shared by non-indebted households.

However, more than 85% of indebted French people believe that their reimbursement charges are bearable, even if households still consider that these charges remain high (for 35.1% of people holding loans) while the proportion of households considering their charges too high or much too high (12.7% in 2022) has “rarely been this low since the late 1980s.

For 2023, decline in credit subscription intentions

The deterioration in the financial situation of households in 2022 leads to a decline in their retirement intentions for 2023. subscription to new credits real estate or consumer.

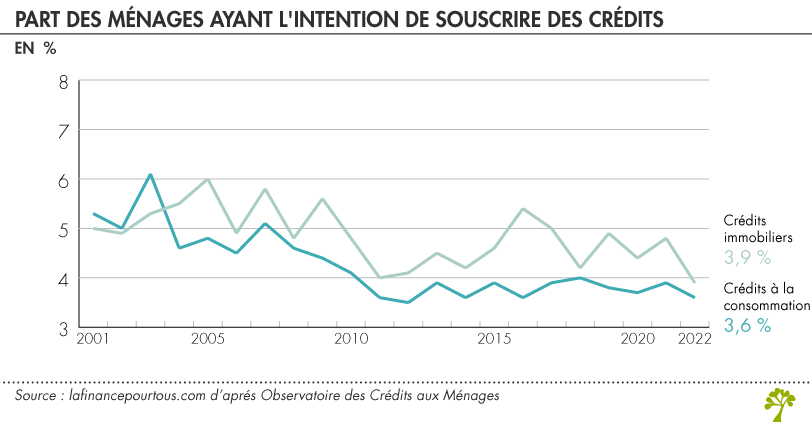

This decline is particularly marked for mortgages since only 3.9% of households intend to take out one in 2023. This is one of the lowest figures reached in the last 25 years, by far, according to the ‘Observatory, of the long-term average which is 4.8%.

This decline in credit can also be seen in the intentions of households to take out at least one consumer loan in 2023: only 3.6% of households intend to do so, compared to 3.9% last year.

Survey conducted in November 2022 by post with a sample of 13,000 households from Kantar’s “consumer” panel. 8988 responded (69.1%).