Against the backdrop of the imminent Federal Reserve (Fed) raising interest rates and shrinking the balance sheet, the ongoing Ukrainian-Russian war, and China’s epidemic containment measures, U.S. bond yields continued to climb on Friday (8th), international oil prices rose, and investors abandoned growth Shares moved into value stocks, UnitedHealth, Walmart and Coca-Cola hit new highs, transportation stocks were in trouble, the four major indexes onlyDow JonesFinishing slightly in the red more than 130 points, the S&P dropped 0.27 to 4,488.28, closing below its 200-day moving average.

Looking at this week, the S&P dropped 1.27% for the week,that fingerWeekly swallowed 3.86%,Dow JonesIt was down 0.28% for the week.

On the political front, U.S. officials have warned that the war in Ukraine might last for weeks or even years, and the European Union has approved an embargo on Russian coal and closed EU ports to Russian ships. The United States on Thursday scrapped Russia’s most-favored-nation status for trade, banning imports of Russian oil, gas and coal, while the European Union, Japan, Britain, Canada, South Korea and Australia also plan to revoke most-favored-nation status for Russia.

The United Nations Food and Agriculture Organization (FAO) on Friday announced that the global food price index (FFPI) rose 12.6% to a record high of 159.3 in March as the war stifled the supply of food crops, indicating that the global hunger crisis has intensified.

The global epidemic of new coronary pneumonia (COVID-19) continues to spread. Before the deadline, data from Johns Hopkins University in the United States pointed out that the number of confirmed cases worldwide has exceeded 496 million, and the number of deaths has exceeded 6.17 million. More than 11.3 billion vaccine doses have been administered in 184 countries worldwide.

White House communications director Kate Bedingfield admitted on Friday that the possibility of U.S. President Biden being infected with the virus has risen following many high-ranking U.S. politicians were diagnosed.

Although Biden’s latest (6th) virus test result was negative, Biden had close contact before U.S. House Speaker Nancy Pelosi was diagnosed, and Biden’s family also reported a diagnosis. At the same time, the Omicron epidemic is blooming all over Taiwan, and Taiwanese President Tsai Ing-wen has been quarantined since Friday following his family members were diagnosed.

The performance of the four major U.S. stock indexes on Friday (8th):

Focus stocks

The five kings of science and technology fell together. apple (AAPL-US) fell 1.19%; Meta (formerly Facebook) (FB-US) fell 0.28%; Alphabet (GOOGL-US) fell 1.91%; Amazon (AMZN-US) fell 2.11 percent; Microsoft (MSFT-US) fell 1.46%.

Dow JonesConstituent stocks were mixed. The Home Depot (HD-US) rose 2.76 percent; Chevron (CVX-US) rose 1.69%; Goldman Sachs (GS-US) rose 2.3 percent; JPMorgan (JPM-US) rose 1.83%; Salesforce (CRM-US) fell 1.49%; Boeing (BA-US) fell 1.56%.

half feeMore than half of the constituents closed in the dark. Core Source Systems Co., Ltd. (MPWR-US) fell 5.67%; NVIDIA (NVDA-US) fell 4.50%; Qualcomm (QCOM-US) fell 1.82%; AMD (AMD-US) fell 2.62 percent; Intel (INTC-US) fell 1.14 percent; Applied Materials (AMAT-US) fell 1.99%; Micron (MU-US) fell 1.42%; Texas Instruments (TXN-US) fell 1.97%.

Taiwan stock ADR fell endlessly. TSMC ADR (TSM-US) fell 1.22%; ASE ADR (ASX-US) fell 1.44%; UMC ADR (UMC-US) fell 1.98%; Chunghwa Telecom ADR (CHT US) fell 0.05%.

Corporate News

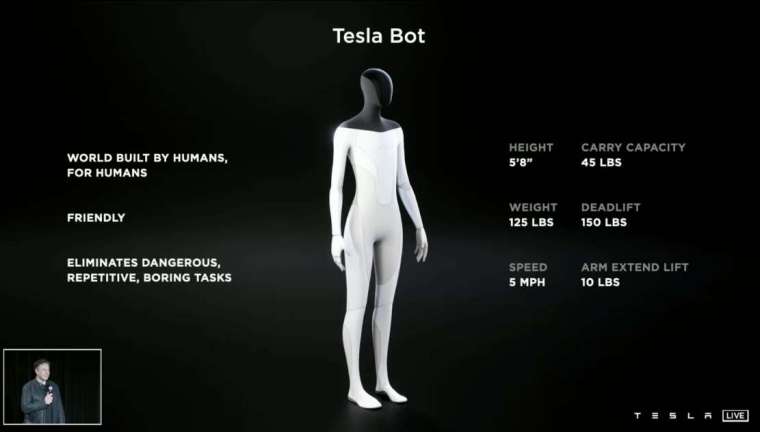

Tesla CEO Elon Musk announced at the Cyber Rodeo event at Giga Texas on the 7th that the company plans to release the Cybertruck, Tesla Semi EV, Optimus humanoid robot and other products next year. However, Tesla (TSLA-US) fell 3.00% to $1,025.49 a share on Friday.

Albemarle, the world’s largest lithium miner (ALB-US) reached an intraday high of $214.69 on Friday, before closing down 0.40% at $211.00 a share in late trade. Musk’s tweet on Friday that lithium mining prices have reached crazy levels and that Tesla may make a direct push into lithium mining and refining business, this news propped up lithium mining stocks intraday gains.

HP (HPQ-US) fell 3.57 percent to $38.63 per share. UBS downgraded HP to “Neutral” and maintained a target price of $40. Analysts believe that the consumer PC market is gradually showing signs of weakness, and buybacks may slow next year. HP’s risk-reward ratio is balanced, and the stock price May stay put.

U.S. brokerage platform Robinhood (HOOD-US) fell 6.88% to $11.24 per share. Goldman Sachs downgraded Robinhood’s stock to “sell” as it sees limited short-term profitability.

Boeing (BA-US) fell 1.56 percent to $175.20 a share. A Boeing 757-200 freighter owned by DHL, a leading brand in the global logistics industry, recently broke down following taking off at Juan Santamaria International Airport in Costa Rica and made an emergency return. The body is directly cut in half.

Economic data

- The final monthly growth rate of U.S. wholesale inventories in February was 2.5%, expected 2.1%, and the previous value of 2.1%

Wall Street Analysis

Jan Hatzius, chief economist at Goldman Sachs Group Inc., pointed out that the Fed may need to raise interest rates more sharply than it currently expects to cool the overheating U.S. economy.

Anastasia Amoroso, investment strategist at iCapital Network, said: “Investors are realizing that the Fed might also become more hawkish. The market might be wrong as they do more to keep inflation under control.”

Bryce Doty, senior portfolio manager at Sit Investment Associates, said: “As investors and economists continue to lower their growth forecasts, the outlook is getting dimmer. Sometimes the weather is sunny, sometimes it is stormy.”

The United States will usher in an important consumer price index (CPI) report next week and a new earnings season, and the Federal Reserve monetary policy-related discussions are expected to continue to dominate market sentiment.

The figures are updated before the deadline, please refer to the actual quotation.