© Archyde.com.

Investing.com – In his latest remarks, Fed member Philip Jefferson said, a few hours ago yesterday evening, Monday, that once the demand rate declines, inflation will return towards the Fed’s target of 2%, and we are still testing inflation and testing the effects of the fiscal tightening imposed by the Fed by reducing raise its budget.

Jefferson refused to comment on the pressures of the banking crisis or talk regarding the interest rate hike at the next May meeting.

Jefferson asserted that the current rate of inflation is very high and has maintained the high level for longer than expected, and that his goal is to reduce inflation as rapidly as possible. He said that this reduction will take time due to the fact that reducing some inflationary factors needs time.

Jefferson predicted that inflation will return to 2% levels soon, although the components of inflation will continue and the US Federal Reserve will continue to monitor the situation. But it is a signal that we should be careful and avoid causing new damage to the economy.

He also said: “If the size of small and regional banks shrinks, this might cause a change in lending standards, and it might affect small businesses disproportionately. It is necessary for the Fed to be aware of what is happening in the banking sector in terms of risks.”

Did you miss the second bitcoin train?

Digital currencies shine in light of the banking crisis.. So are they your safe haven from global financial turmoil.. Register your attendance now for free and reserve your seat to know where digital currencies are heading: http://bit.ly/3TAIORZ

The risk of raising interest

Fitch Ratings said that UBS’s takeover of Credit Suisse avoided a global banking crisis, but had significant repercussions on the Swiss economy.

In its recent statement, Fitch focused on the danger of raising interest rates on small-sized companies, and expected that the level of credit deficit for medium-sized companies in America would skyrocket. She added that the debt default rate will spread strongly among the medium-sized companies in the US market and for those with syndicated loans, rising to the highest levels since 2014.

Fitch saw that the fragility of small companies once morest high interest levels will force weak and medium-sized companies to default, and the default rate for companies defaulting on their debts is expected to rise to 5% by the end of 2023.

The Fed may use all its tools

Meanwhile, US Federal Reserve member Michael Barr said on Monday that the US banking system is strong and solid. And the Fed is ready to use all its tools to keep the financial system safe for all institutions of all sizes.

Barr added, “We are determined to take our full responsibility for any supervisory or regulatory failures, including the downfall of Silicon Valley.”

Barr said Silicon Valley waited a long time to come out with its problems. In Barr’s view, the impact of the Silicon Valley collapse appears to be spillover and ramifications for the entire banking system.

Barry revealed the Fed’s intention to propose long-term loan requirements for major regional banks, to improve the level of stress tests and check changes in liquidity rules.

Read also

Possible recession?

Minneapolis Fed President Neel Kashkari said on Sunday that the recent banking crisis in the US is “definitely” bringing the country closer to recession.

“What is not clear to us is to what extent these banking pressures lead to a large-scale credit crunch, and then, as I said, the credit crunch will lead to a slowdown in the economy,” Kashkari said in an interview with CBS.

He added that Fed officials are watching very closely the impact of the banking sector crisis, and that the current system has the “full support” of the US central bank.

And he added, “The banking system has a strong capital position and plenty of liquidity, and has the full support of the Federal Reserve and the other regulators behind it.”

On the stability of the banking system and its ability to control more risks that it may witness, Kashkari said that the US banking system is flexible and sound.

Inflation is still high

On Friday, Fed member James Bullard said that it is still up, and US data is coming in stronger than expected, indicating that the Fed may be sticking to a rate hike at the next meeting.

Here comes the discrepancy between market expectations that the Fed will cut interest rates by 100 basis points in June, while the Fed does not see any cut until 2024.

The Fed is trying to isolate the Silicon Valley crisis from the scene. “Silicon Valley is an unusual case,” says Bullard. He stresses strongly that it is difficult to find other banks in a similar situation.

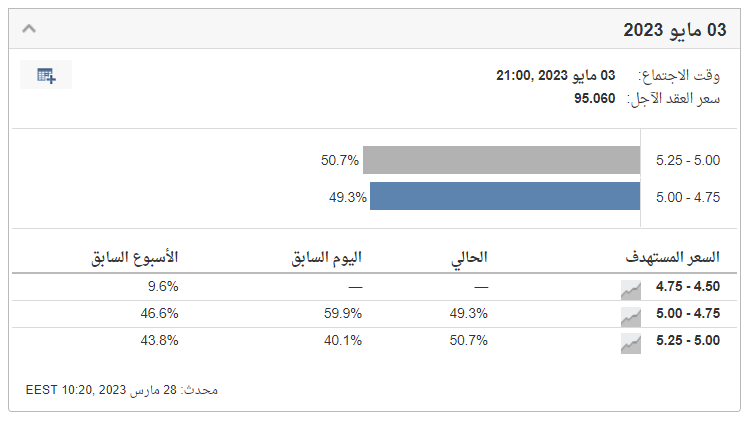

Interest pricing now

FED SWAPS interest expectations vary today, following the Fed’s recent statements, between the possibility of the Fed raising interest rates by 25 basis points at its next meeting or fixing them from current levels, and following expectations tended to fix interest by a large percentage following the calming hints that appeared during interest pricing at the last meeting, It is now turning into favor, raising it by 25 points, following the recent statements of the Federal Reserve members.

Gold and the dollar now

It fell by 0.1% at $1,955 an ounce.

While US gold futures rose 0.1% to 1973 dollars.

It decreased by 0.25%, to record 102.27 points.