The Fed is expected to raise key rates very soon, perhaps as early as March, in order to fight rampant inflation in the United States.

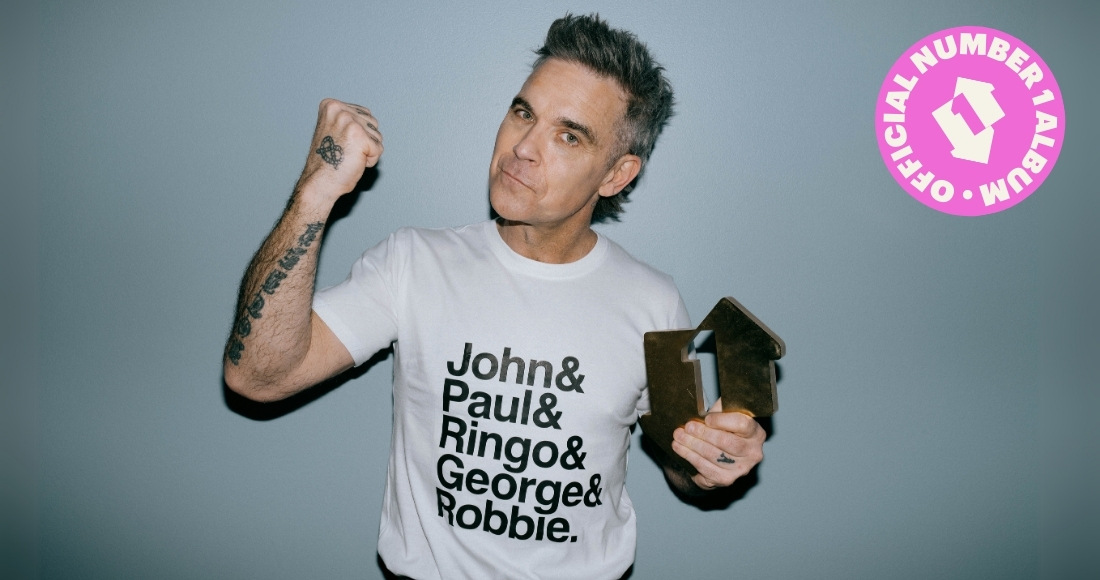

© Getty Images via AFP

Lael Brainard, the future vice-president of the American central bank (Fed), during a hearing before the Senate Banking Committee, Thursday, January 13, 2022.

The American central bank is in the process of refining its weapons to act once morest inflation which has defied all forecasts by rising in the United States to the highest since 1982, and whose trajectory for 2022 divides economists.

“I am very concerned regarding the high level of inflation,” said Lael Brainard, the future vice-president of the American central bank (Fed), on Thursday, during a hearing before the Senate banking committee. “We hear working families across the country talking regarding inflation (…). We have a powerful tool and we are going to use it, ”she said.

Faced with prices that climbed 7% in 2021, their biggest increase in nearly 40 years, the powerful Federal Reserve is therefore on the verge of war. Its weapon: key rates, which it is preparing to raise faster than expected, probably from March. The objective: to increase the cost of credit, and, by extension, to reduce consumption. “We have a tool which acts on demand, which is the key rate,” underlined the future number 2 of the Fed, which is due to take office in February.

But the exercise is delicate, because hitting too hard might weigh on the job. Lael Brainard said she is confident that the actions the Fed will take “will reduce inflation while continuing to allow the labor market to regain its full strength over time.” We are therefore going to regain full employment while reducing inflation to 2% ”.

0.25 point increase in March

“Inflation has remained higher and for longer than any of us thought,” one of the Fed’s governors, Christopher Waller, said Thursday evening on Bloomberg TV. “Inflationary pressures will ease in the second half of this year,” he added, still expecting around 2.5% by the end of the year.

The key rates were lowered to a range of 0 to 0.25% in March 2020, in the face of the Covid-19 pandemic. Christopher Waller said he was “in favor” of a first rate hike in March, of 0.25 points, but no more, because “we have not prepared the markets for something so dramatic. (…) If inflation doesn’t seem to be going down, it would certainly be in the toolbox, but we need a lot ”.

He then anticipates three hikes in 2022, but, if inflation in the second half of the year “continues to be high, we might have four or five hikes.” In contrast, “if inflation declines in the second half of the year, as many of us anticipate, as certain supply chain issues are resolved, then there may be a pause.”

Other economists, however, are less optimistic: “I expect inflation to remain high this year, perhaps even more than in 2021,” Jason Furman, former economic adviser to the president, warned Thursday. Barack Obama and professor at Harvard, in an article published by the “Wall Street Journal”.