- Cecilia Barria

- BBC News World

Updated July 13, 2022

image source, Getty Images

The euro sank to its lowest level once morest the dollar since 2002.

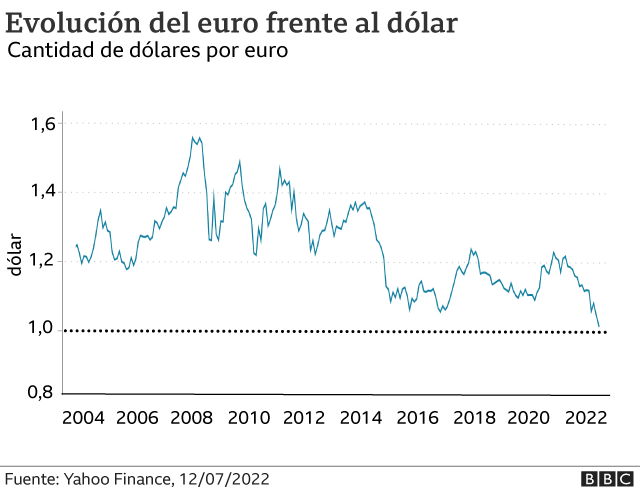

The European currency sank to its lowest level in 20 years, reaching a historic parity with the dollar.

The two currencies reached the same value this Tuesday, marking a symbolic 1:1, which represents a decrease of 15% of the euro in the last year. This Wednesday even the European currency came to trade below the dollar.

This comes as fears mount in the markets of a economic recession in Europein a context of high inflation and growing uncertainty regarding the continuity of the Russian gas supply.

Gone are the years when the euro was so strong (1.6 times the dollar during the 2008 global financial crisis) that many Europeans vacationed in the United States for cheap hotels and food, returning home with suitcases. full of electronics and clothes.

But now the situation is completely different, with Europe suffering the economic consequences of the war in Ukraine and the decision of the European Central Bank to maintain interest rates.

Why is the euro sinking?

The depreciation of the euro occurs in the midst of a energy crisis in Europe caused by the Russian invasion in Ukraine.

There is concern regarding the possibility that this crisis will cause a recession with unforeseen consequences, a shadow that intensified on Monday due to the reduction in Russian gas supply and the concern that inflation will continue to rise.

image source, Getty Images

Russian energy giant Gazprom has started 10 days of maintenance on its Nord Stream 1 pipeline, with Germany and other European countries anxiously watching whether the gas will return following this operation.

Russia might use the opportunity to close the valves.

“There is a lot of fear regarding what might happen in the energy field with the war. We’ll see if we continue to receive gas from Russia,” says Juan Carlos Martínez, professor of Economics at IE University.

To this conflict is added the blow that the currency has received because interest rates are rising much faster in the United States and that attracts capital to the world’s largest economy.

“The most important cause of the fall of the euro is the different speed in monetary policy of the United States Federal Reserve and the European Central Bank,” argues Martínez in dialogue with BBC Mundo.

image source, Getty Images

For investors, US Treasury yields are higher than those of European debt, which makes them prefer the dollar to the euro.

From that perspective the European Central Bank is in a difficult position, trying to rein in inflation and, at the same time, cushioning a slowing economy.

“The euro zone has not yet begun to raise interest rates. It will foreseeably do so at its meeting at the end of July, but it will do so more slowly,” added Martínez.

What are the consequences?

With inflation in the euro zone at its highest level since records began (8.6%), the depreciation of the euro increases The cost of life by making imports more expensive.

At other times in history, a weaker currency is not necessarily bad news because governments use it as a way to stimulate economic growth as exports become more competitive.

Now, however, that is not the case.

image source, Getty Images

“Every time the dollar continues to appreciate, it costs us more in euros to buy a barrel of oil. That is the big problem we see now,” explains the economist.

That is why a weak euro has contributed to the fact that fuels have surpassed all-time highs, piercing the pockets of consumers.

The situation is worrying for the countries of the region, considering that nearly 50% of imports from the euro zone are denominated in dollars.

image source, Getty Images

If the war in Ukraine ends soon, which experts consider unlikely, the depreciation of the euro might stop.

The second alternative to stop the devaluation is to raise interest rates in the euro zone.

“A more aggressive policy from the European Central Bank would be necessary, something that at the moment does not seem to be on the table,” says Martínez.

Latin America

In the case of Latin America, the parity between the euro and the dollar “does not have a direct impact on the region,” Elijah Oliveros-Rosen, senior economist at the Latin America Global Economics & Research division, tells BBC Mundo.

What this situation reflects, he adds, is that there is an appreciation of the dollar at a general level.

image source, Getty Images

“The strength of the dollar is not only once morest the euro, but also once morest most of the currencies of emerging countriesincluding Latin America”.

In fact, Argentina, Chile and Colombia are the three countries that have suffered the worst devaluations of their currencies so far this year once morest the dollar.

Remember that you can receive notifications from BBC World. Download the new version of our app and activate it so you don’t miss out on our best content.