The expectations of a cost of living or high inflation as well as a lower growth of the economy in 2023 led the board of directors of the Banco de la República to increase its interest rate for the eighth time this year.

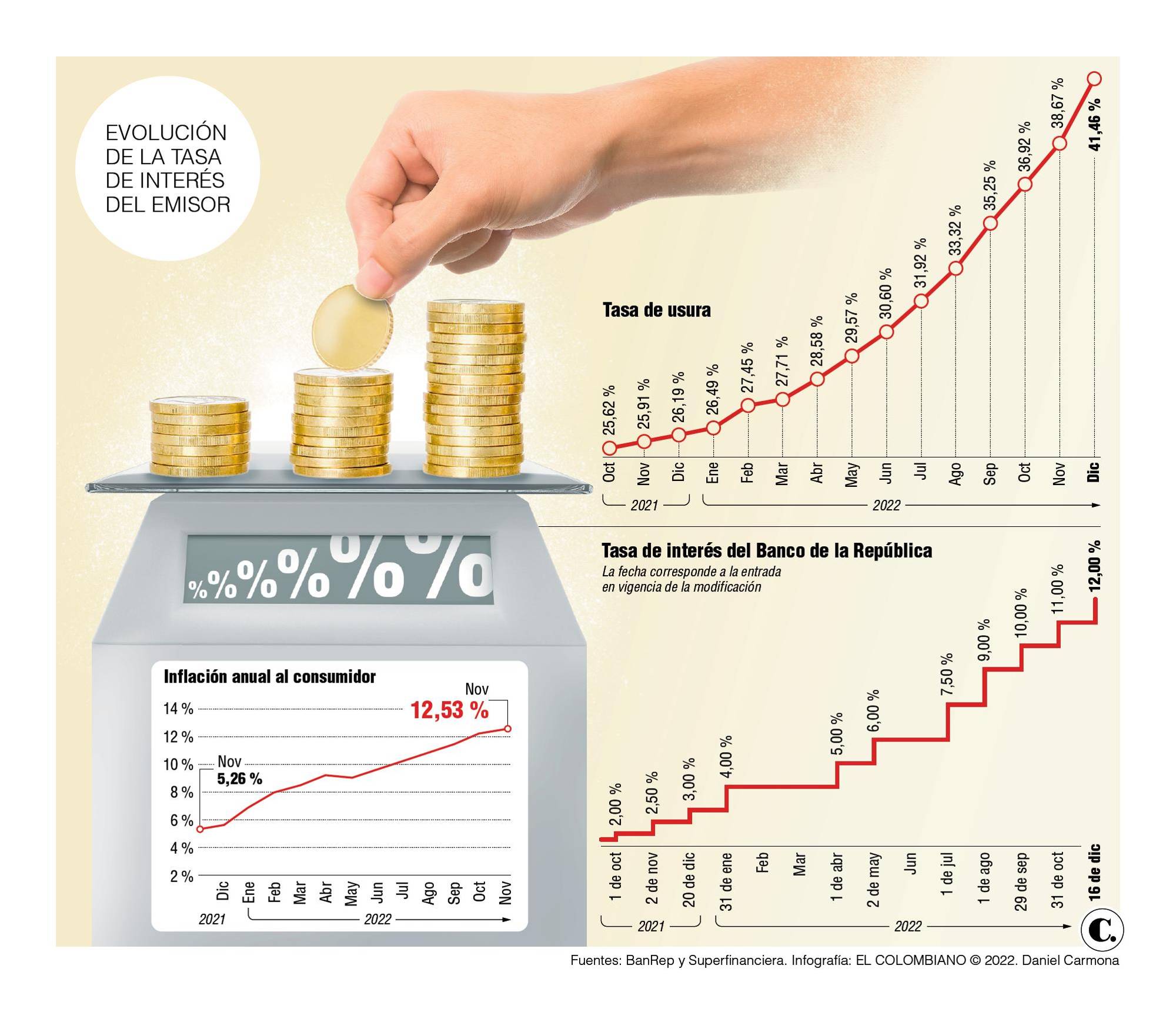

The indicator that ended last year at 3% was adjusted upwards during 2022 until it was located, following yesterday’s session, at 12%, a level not seen in the last 20 years. The Issuer justified its decision by stating that “inflation expectations continue to be above the target at all horizons. In the case of the Banco de la República expectations survey carried out in December, total inflation would be 7.5% at the end of 2023”, that is, it would remain above the target, which is 3%.

José Antonio Ocampo, Minister of Finance, mentioned that the inflationary outlook must be added to the slowdown in the economy, which according to the Issuer will grow 0.5% next year, although the portfolio he heads estimates that growth would be a little more than 1.3%

Thus, the minimum interest rate that the Issuer charges financial institutions for the money it lends them went from 11% to 12%. In December 2021, that rate was 3%, that is, it has increased by 900 basis points since then.

The adjustment of this percentage is transmitted to the credits that the bank grants to its customers, so that to a large extent the effective annual interest for the consumer and ordinary credit modality that a year ago was at 17.46% is located today at 27.64%, while the usury rate climbed from 26.19% to 41.46% in the last twelve months (see graph and To learn more).

According to Jackeline Piraján, an economist at Scotiabank Colpatria, we will continue to see how this increase in interest rates is transmitted to lending rates in the economy for both loans and deposits.

“In this sense, the message to consumers continues to be to prefer savings instruments or remunerated deposits, instead of acquiring new debts, since the cost of credit is increasing, we see that the usury rate exceeds 40% and the signals from the Bank of the Republic suggest us to be a little more prudent with those spending decisions”, he explained.

For her part, María Claudia Llanes, an economist at BBVA Research, highlighted that the manager of Banco de la República, Leonardo Villar, mentioned that consumer credit should tend to grow at lower rates, more in line with the growth of income from people, and that its slight deceleration is already being observed, thanks in part to the increases in the monetary policy rate.

End of cycle?

From the point of view of Bancolombia’s economic analysts, following this decision taken by the majority, the margin of movements in the reference rate is running out. It is worth noting that one director voted for an increase of 125 points and another did so for an increase of only 25 basis points.

In fact, the Issuer’s manager, Leonardo Villar, admitted it at the press conference, stating that “we are approaching the end of the bullish cycle.” However, given the division in the vote for the increase, uncertainty grows regarding the magnitude of the increase in the decision that the board will take in January.

“We believe that a remaining margin of between 50 and 100 points of increase persists, which will materialize in the first two meetings of 2023 (January and March),” Bancolombia noted.

In turn, Ocampo was blunt: “As long as inflation does not go down, it will be impossible to lower interest rates and at the meeting of the board of directors no one voted to lower the rate.”