Hello.

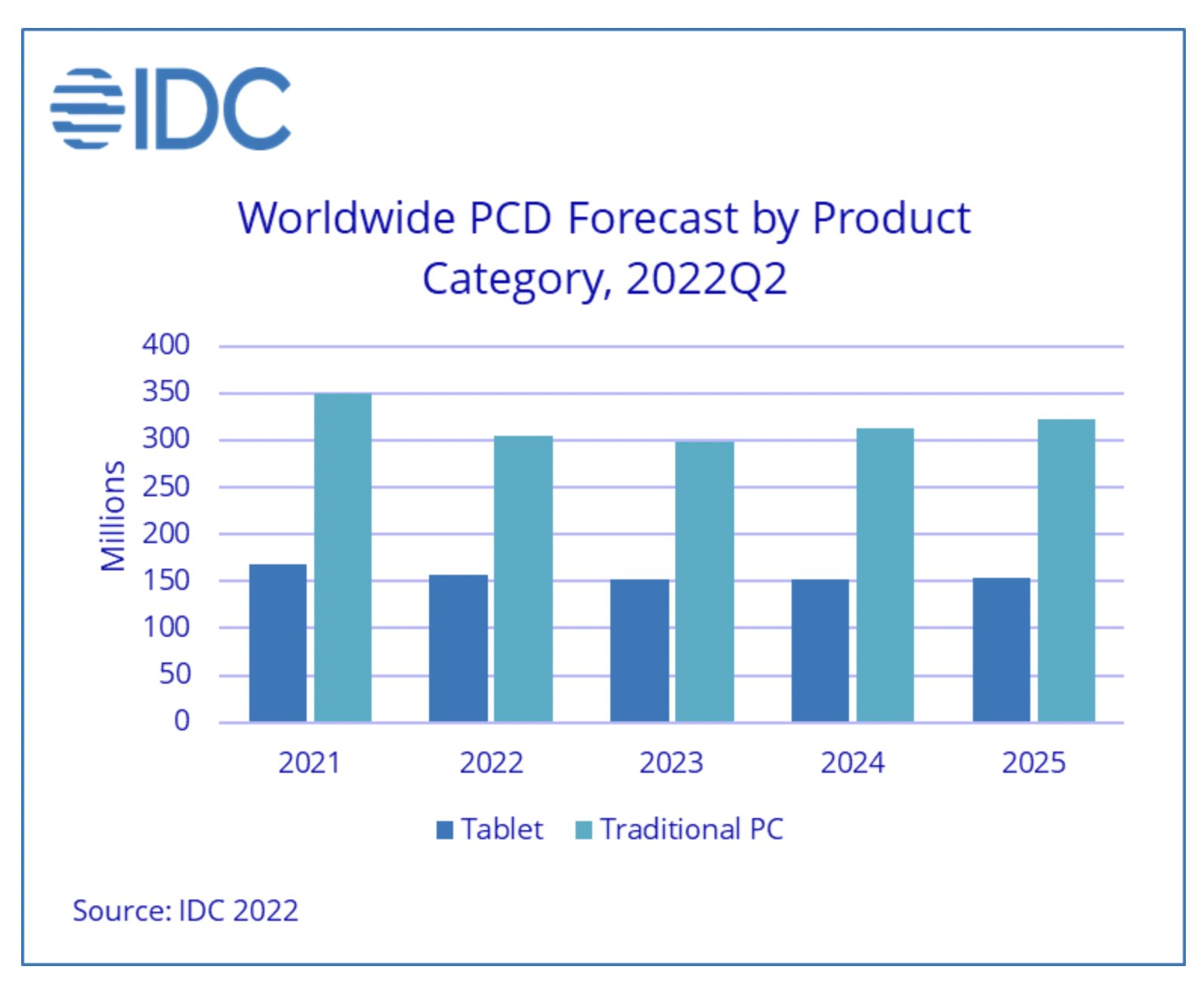

Events are developing very quickly, most recently we discussed that analysts cannot, and often do not want to describe the real state of affairs with a drop in sales. Which will force them to change their forecasts following the fact, when the fall takes place, it will not be possible to ignore it. Let’s take a look at what IDC has to say in its September forecast for the global PC market. First, let’s look at the table and the graph.

The IDC forecast has been adjusted, the fall in the PC market in 2022 will be 12.8% in unit terms, the largest decline in sales over the past ten years, the previous one was in 2015, then the fall was 10.4%. IDC predicts that the market will recover for a long time, no noticeable growth should be expected, corporations will become the main buyers, while the mass segment will suffer greatly. Unfortunately, the quality of such a forecast is lame on all four legs, since it de facto describes what has already happened. A sort of building a line into the future, when a ruler is applied to the schedule and it is believed that the situation will develop according to understandable canons. Alas, this is not the case.

Probably, here we need to remember that states around the world are faced with a food, energy and, as a result, financial crisis. Large programs to automate processes, expand their capabilities in IT are still going on in a number of countries, but the budgets allocated for them are running out or being transferred to a brighter future, when the current crisis is resolved. From a shortage of components and high prices for them, we abruptly switched to an excess of supply – there are many times more goods than there is a demand for them. And the corporations and state consumers were the first to show the fall, they simply do not have money.

Anyone who reads the news and reports of American or European corporations has noticed that everyone is unanimously talking regarding cutting costs, including personnel. The well-fed years are over, and now IT costs will be less and less. This means that more and more small companies are practicing the BYOD (bring your own device) approach, that is, they do not give out a working computer. Or they give out one, but with very weak characteristics, it should be enough for work, but not for something else. The average cost of purchased equipment is reduced, or its purchases are completely abandoned.

There is exactly the same gloom in the consumer market, there are no sales. Buyers keep the money they need to pay the bills of life – food, light and heat, transportation. Particularly popular is the secondary market, where they buy used computers, as they are cheaper and can last for some more time. And we are not talking regarding the African market, where such a scenario has always been common, today it is Europe and America, the key world markets. The heyday of sales of used equipment, in turn, hits hard on primary sales, they are declining.

Production is always aligned with the sales forecast. If the manufacturer “guessed” how the market will develop, then he will be able to sell a lot of equipment at a good price, earn money. If you didn’t guess, then there will be either a shortage, or, conversely, an excess of equipment. In the first case, the revenue does not suffer, and in the second, a big problem arises, since the equipment needs to be attached somewhere. Moreover, it is getting cheaper before our eyes and begins to eat away sales from new models.

Typically, the company’s laptop range is updated once a year. Those who correctly calculated the market sell their stocks during the year, then launch new devices. There are many 2020 models on the global market today that were not sold in 2021-2022. The reason is the drop in demand.

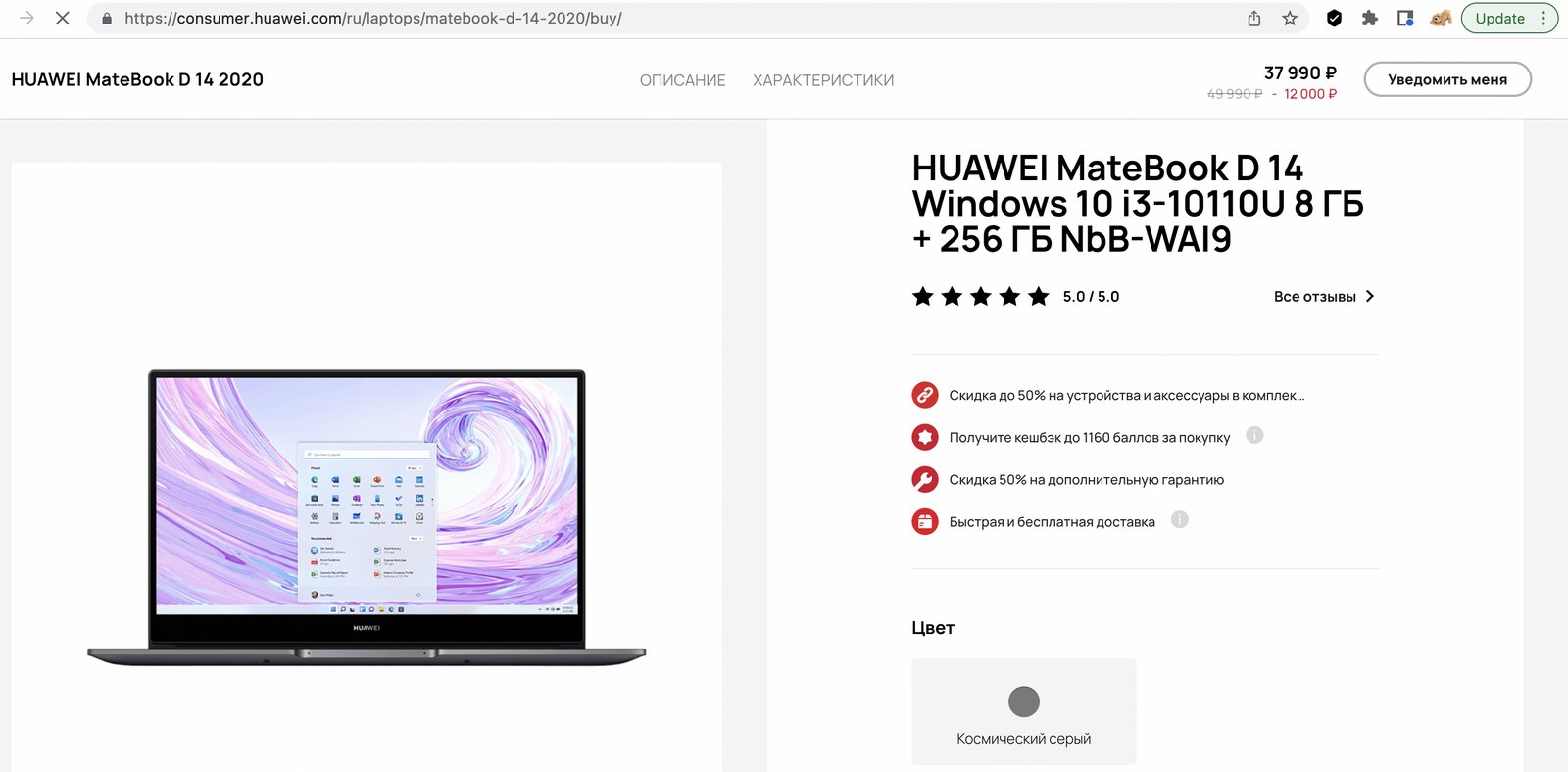

In order not to be unfounded, I will give an example. When I thought regarding which company to show, I decided to choose Huawei – not the largest computer manufacturer, they have small inventories compared to Acer, Asus, HP, Lenovo.

The 2020 model in various configurations is still available on the Russian market (and not only here), the company offers a fairly significant discount on it. Against this background, the models of 2021 are lost, they become less attractive – sales cannibalization occurs. And exactly the same thing happens in all companies without exception. They have to discount old models to clean out their warehouses, and new devices sell for a high price. Given the financial crisis, people are not buying expensive models, their demand is shifting to affordable devices – this is a fundamental change in the market for most countries. As a result, we have growing sales of manufacturers offering affordable solutions, including Chinese companies whose names you simply did not know until recently. The reason is in the cost of their decisions, in the fact that people began to save.

The curious thing here is that once such companies as Lenovo, Acer, Asus grew up precisely for these reasons, they took off on a wave of changes in consumer preferences, when they needed inexpensive alternatives for HP, Dell, Apple. Today they found themselves in exactly the same situation, history repeats itself.

Let’s take a look at the situation of Taiwanese computer manufacturers, they play a big role in the global market. According to the China Times, Asus stocked 60% more computers and parts to assemble them at the end of the second quarter than a year earlier. Half are finished computers, the rest are purchased components. The value of the hung goods is regarding $6.8 billion.

Quanta (a contract manufacturer for many companies) has $8.4 billion in inventory, up 55% year-on-year. Acer’s warehouses grew by 8.1% to $2.1 billion. A small manufacturer like MSI posted a 19% increase to $1.27 billion. In fact, these figures indicate that the next stage of the crisis has begun, when inventories in the warehouses of manufacturers have grown sharply, and in order to sell them, discounts will have to be given.

Now let’s remember that we have a decline in the PC market, which is only growing. Aggressive promotion of conventionally old models will lead to the fact that everyone will start doing the same, with the exception of Apple and a couple of other companies. The meat grinder in terms of laptop and PC prices will quickly lead to companies competing to sell their inventory at a loss. There will be no winners here, rather, only buyers benefit from this. I think that the orgy of prices can be expected at the end of the year, it will begin in November-December, and continue in January.

Tip for shoppers: Don’t rush to buy today if you want to save money. But here is an important caveat – be guided by the purchase of last year’s models, they will try to sell new items at full price, they will be expensive. Which will create a very unbalanced supply in the market.

For PC manufacturers, this crisis looks like a catastrophe not only from the point of view of the erroneousness of their forecasts, the purchase of more components that are getting cheaper in warehouses in the form of finished equipment or semi-finished products. It is important to remember regarding additional budgets from Microsoft for choosing Windows, it becomes impossible to reach the usual number of activations, additional bonuses disappear. Exactly the same story with purchases of processors from both Intel and AMD, there is no chance of reaching the agreed volumes and getting the minimum cost. The economy for iron producers becomes negative, although here, of course, it is necessary to consider the case of each company separately. The obvious solution would be to cut R&D spending, downsizing, and similar measures to save your business.

The problems that the market will face can be described by the example of Nvidia’s report for the second quarter of this year. The company’s chief financial officer, Colette Kress, explained on the results call what happened during the quarter. Listening to the numbers, I picked up a few important points – the profit margin fell from 66.7 to 45.9%, as the company wrote off $ 1.22 billion at a time related to the warehouse for servers and gaming solutions. Of these, 570 million dollars are additional stocks (de facto revaluation, devices in warehouses have fallen in price), 650 million dollars are penalties from suppliers, the need to buy out components that are not needed today.

If you look at the balance sheet, it turns out that in the company’s warehouses in the second quarter there were goods worth $3.89 billion, a year earlier it was $2.11 billion. The company also increased its obligations to purchase components, $9.22 billion compared to $4.79 billion in 2021.

Nvidia’s situation is not unique and clearly describes what the market faced with a drop in demand. The growth of inventory in warehouses, their depreciation (and this is just the beginning of this process), penalties from suppliers. You should not think that suppliers are in chocolate, they are reducing the prices of components, since their economy is also geared towards the growth of the market, and not its fall. Pay attention to the market for memory, processors and so on. There begins exactly the same bacchanalia.

The crisis with computer sales is a reflection of the general macroeconomic situation, and not a problem in the electronics market. At the same time, we can say that the PC market is still in good condition, since for many people a computer is a working tool, it is impossible to live without it. But there are a huge number of other devices that you can not buy – TVs, music speakers and the list goes on. We are facing a protracted recession that will lead to inflation and even hyperinflation in some countries. The situation is very serious, and therefore the fall of all manufacturers without exception is only a matter of time.

A few words regarding the Russian market, which is under sanctions, many manufacturers do not supply their goods here, for example, laptops. Chinese companies have taken their place, and they offer an inexpensive product with a good price / quality ratio. Their sales growth looks like winning the lottery, and most importantly, people are trying something new. The same Asus will not be able to regain its market share if it does not start selling laptops in the next month or two. And even at the beginning of sales, they will have to try very hard, give big discounts and so on. The entry of new brands into the Russian market has an even greater impact on the average cost, it goes down. Many companies that do not supply their goods scour the market and offer to buy them through parallel imports, and offer good prices and discounts. The only problem is that these are still high prices and few people are ready for them. At the end of the year, prices will be at least 20-25% lower, which means you can wait – this is how distributors argue.

This crisis becomes the time not of the supplier, but of the buyer. Those who have money begin to dictate their own rules of the game, there is no shortage of goods, it simply cannot be. And so there will be an oversupply for sure. At the same time, this perfectly demonstrates that the companies themselves, which introduced them or obediently complied with them, will overcome the sanctions. They too need all the money they can get from the market.

:max_bytes(150000):strip_icc():focal(730x245:732x247)/tyra-banks-sunrise-012025-3-5e14e9e853a247cc984ee787bc86453c.jpg)