[Weekly Report] A Rapidly Growing Pet Medicine Market

Declining Birth Rate Shrinks Infant Vaccine Market… Pharmaceutical Companies Focus on Developing Pet Treatments

Market growth expected to reach 2.2 trillion won by 2027… Development of vaccines to prevent infectious diseases accelerates

From treatments for skin diseases such as atopy to anticancer drugs and cognitive dysfunction drugs, interest

《Rapid growth of the pet vaccine-anticancer drug market

“I get a heartworm vaccine once a month and a comprehensive vaccine once a year.” This is not a story regarding people. It’s a vaccination for companion cats. As the birth rate is falling and the number of households raising companion animals is increasing, the market for companion animal medicine is growing.

“The heartworm vaccine is given once a month. The combined vaccine, rabies, leukemia, and peritonitis vaccines are given once a year.”

Mr. A (35), who lives in Mapo-gu, Seoul, is a ‘mid-level butler’ who has been raising a companion cat for 3 years. He adopted an abandoned cat that was wandering the streets following being abandoned by its owner, so he paid a lot of attention to the health of his companion cat from the beginning. Cats and dogs do not develop antibodies as easily as humans, and even if they do, they disappear quickly, so they need to get vaccinated relatively often. Heartworm medicine is cheap at around 10,000 won, but pet vaccines are quite expensive at around 70,000-80,000 won per session, although this varies depending on the hospital.

Cats and dogs do not develop antibodies as easily as humans, and even if they do, they disappear quickly, so they need to get vaccinated relatively frequently. The price of vaccines ranges from around 10,000 won to 100,000 won. Pharmaceutical companies are jumping into the pet medicine market, seeing future growth potential. The photo shows a veterinarian (left) examining a companion dog. Photo source: Getty Images Korea

● Pet market flourishes as birth rate plummets

The pet medicine market has been growing rapidly recently. It appears that this is a phenomenon occurring as the capital that was poured into the infant market is moving to the pet market due to the significant decrease in birth rates worldwide. Many pharmaceutical companies that have identified this trend are jumping into the pet medicine market, considering its future growth potential.

As the number of infants and toddlers decreases, vaccine development companies are directly affected. According to the status of childhood vaccination rates announced by the Korea Disease Control and Prevention Agency, the vaccination rate has been maintained at around 96-97%. However, the number of fully vaccinated people has decreased by regarding 30% from 364,441 people born in 2016 to 254,997 people born in 2021.

On the other hand, the number of pets is increasing. According to market research firm Markets and Markets, the number of households with pets in the U.S. was 84.9 million in 2019-2020, but it increased by regarding 7% to 90.5 million in 2021-2022. This is equivalent to 70% of the total number of households in the U.S.

In Europe, the number of companion dogs also increased from 87.5 million (2019) to 90 million (2020).

A representative of a domestic vaccine development company said, “When the number of newborns exceeded 600,000, there were many companies that tried to develop essential vaccines for infants and young children, even though it was a ‘red ocean.’ Recently, there has been an increase in the number of companies interested in developing vaccines for companion animals.”

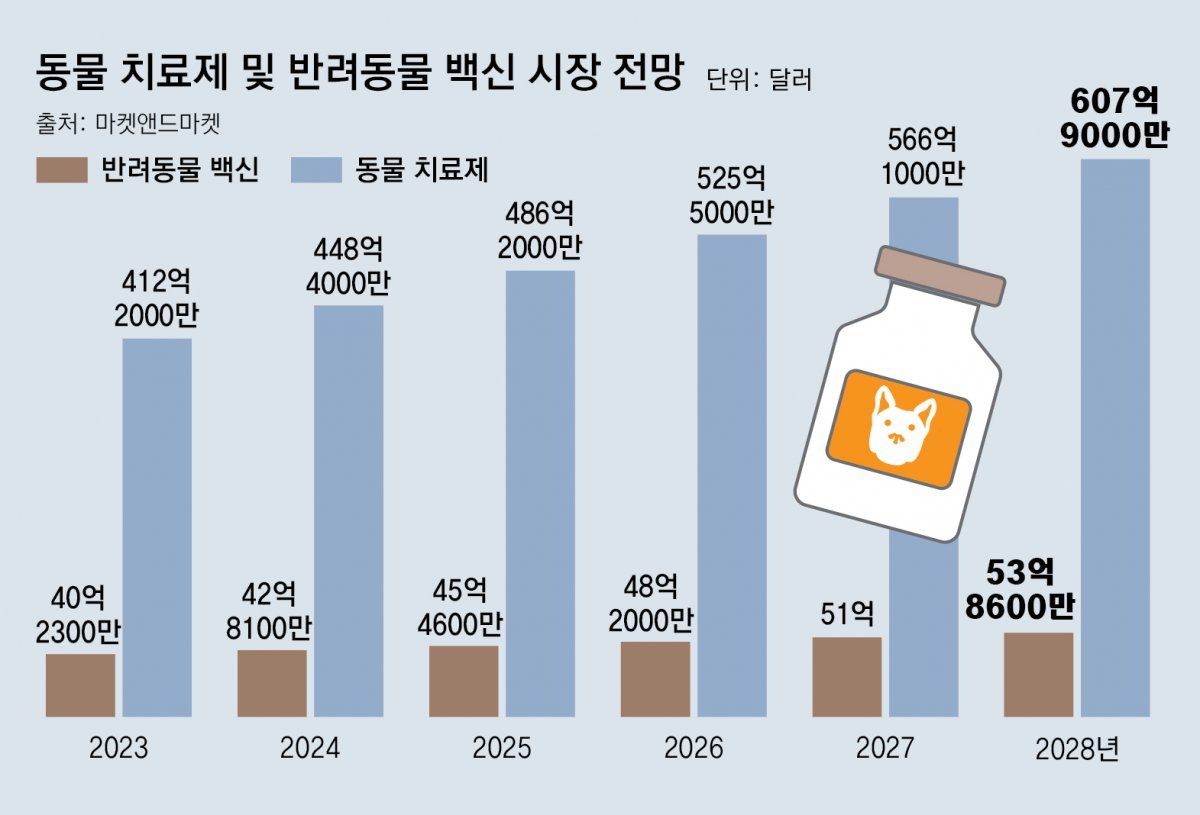

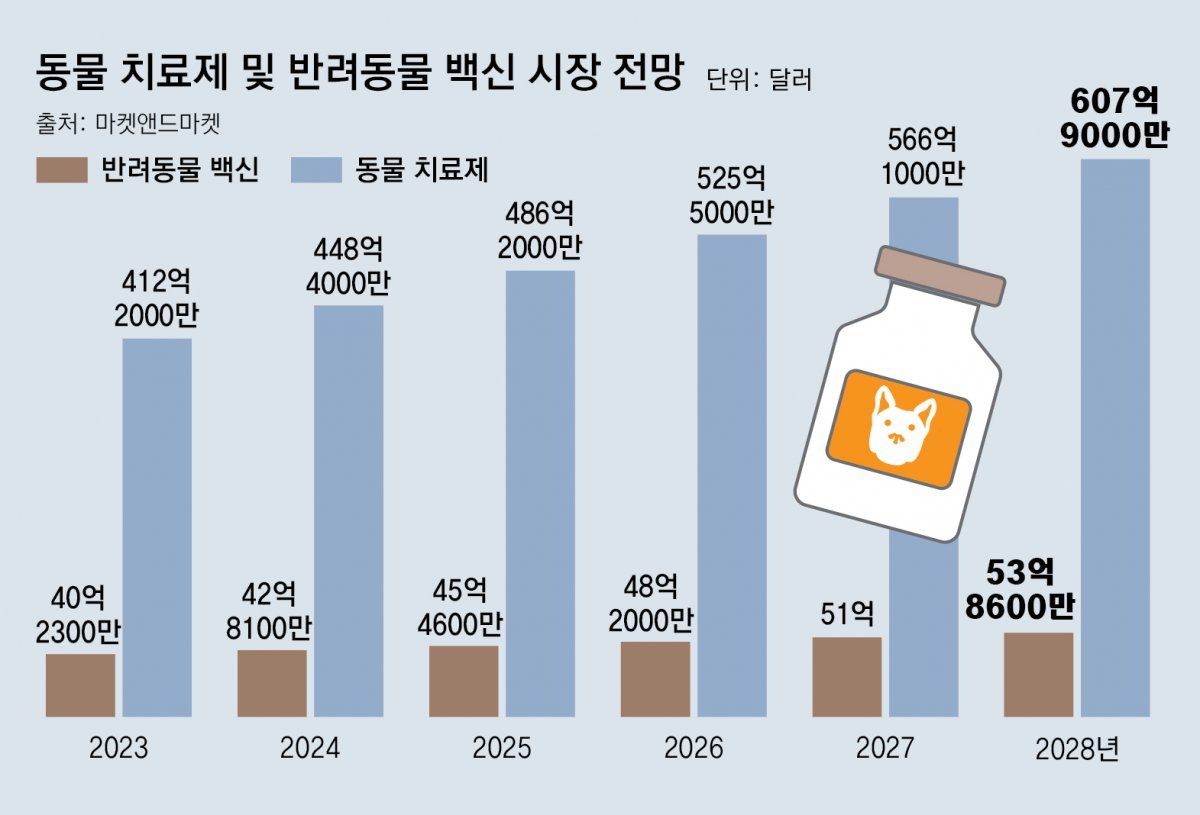

In fact, Markets and Markets forecasted that the pet vaccine market will grow by 8.5% annually to reach $1.591 billion (regarding 2.2 trillion won) by 2027.

● 3rd generation vaccines using viruses and DNA are active

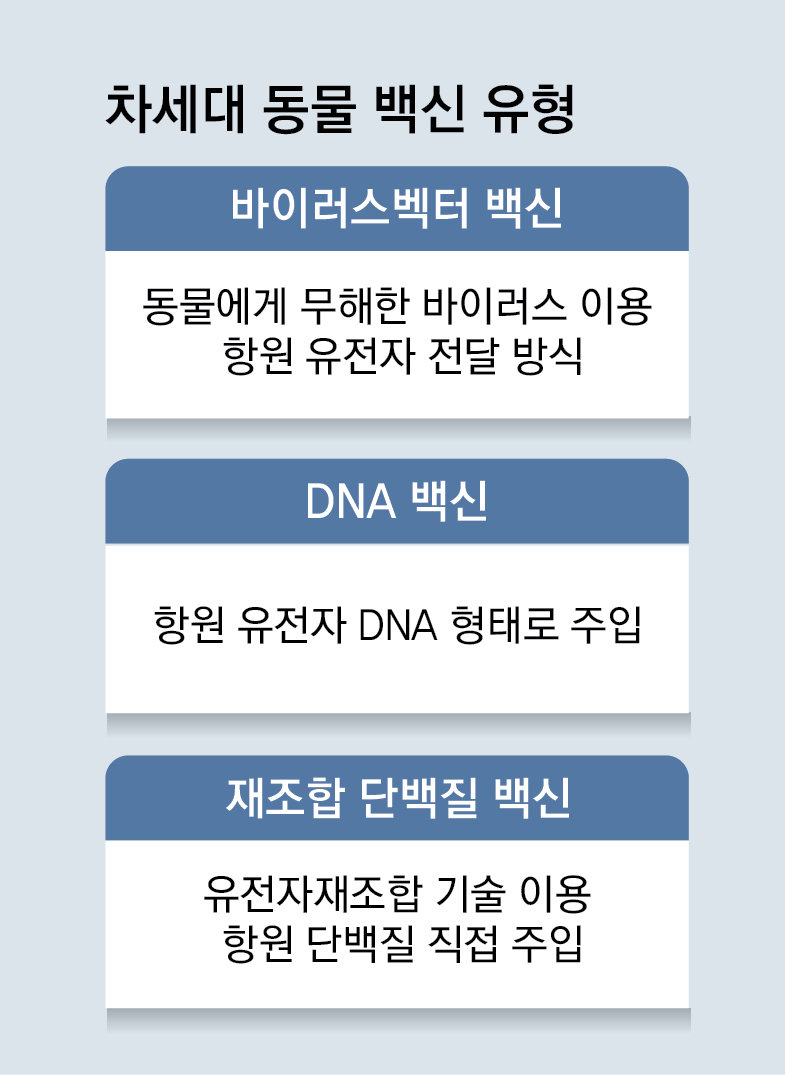

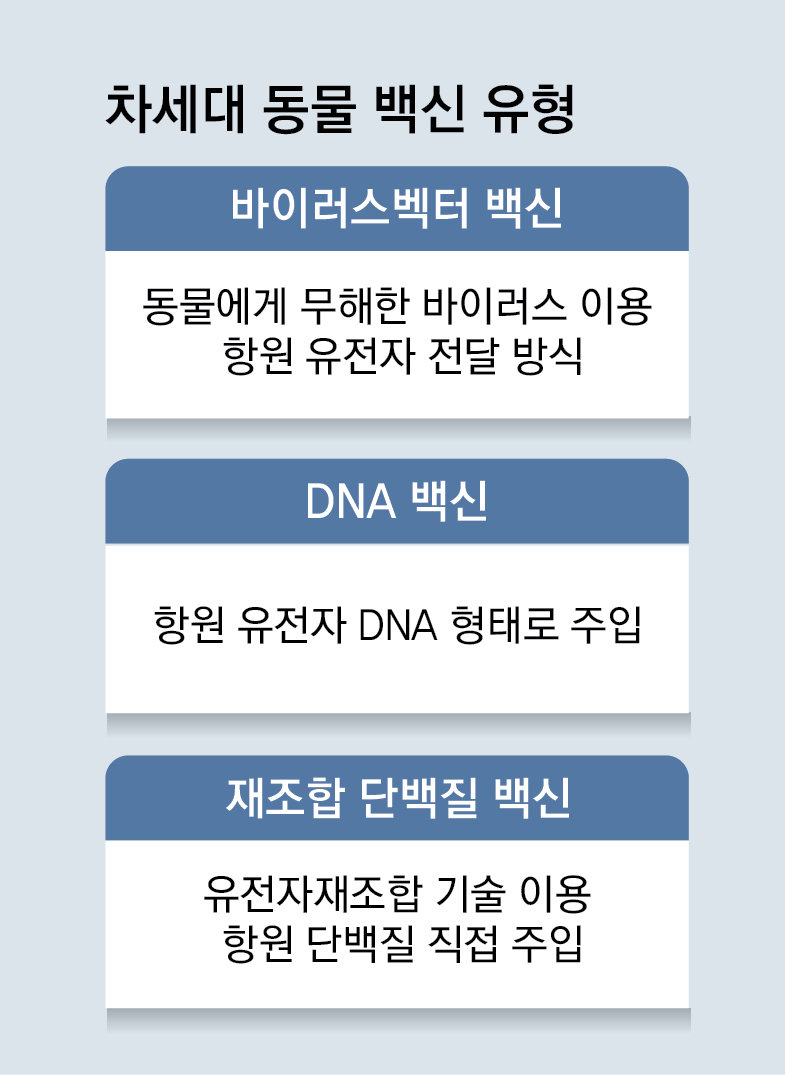

Recently, next-generation companion animal vaccines are being developed that can replace inactivated vaccines and attenuated vaccines that eliminate virus activity or weaken toxicity.

Existing vaccines are highly effective, but they take a long time to develop, so they have limitations in responding to new viruses. The problem is that many new viruses are emerging as the ecosystem, including the lifestyles and habitats of animals, changes due to climate change.

Among them, there are many viruses that cause zoonotic diseases that can be transmitted between animals and humans. Since 60% of new infectious diseases are zoonotic diseases, rapid development of vaccines to fight new viruses has become more important than ever.

Recently, the development methods that are being actively studied include viral vector vaccines and DNA vaccines. A viral vector vaccine is a method in which a part of the virus gene that causes infection is recombined and then delivered to the body by being placed on a carrier. A non-toxic, safe virus is used as the carrier. AstraZeneca’s COVID-19 vaccine uses the viral vector method. This method can be easily developed if only the genetic information of the infectious virus is known, so it can easily respond to the emergence of new viruses.

Boehringer Ingelheim Animal Health has developed several vaccines for companion animals using the viral vector method. These include ‘Recomvitec CDV’, which prevents distemper in companion dogs, and ‘PureVax’, a leukemia virus and rabies vaccine for companion cats. The company said that this vaccine has the advantage of being safer and allowing for rapid acquisition of immunity following vaccination. Another major advantage is that the immune effect lasts for a relatively long time.

A domestic pharmaceutical industry expert said, “Since companion animals need to be vaccinated so frequently, there is a high demand for vaccines that are long-lasting and have a fast effect once administered,” adding, “Research is also necessary to prepare for zoonotic infectious diseases.”

● A treatment that fails in humans is a ‘hero’ in animals

The scope of pet treatments is also expanding from eczema, atopy, diabetes to serious diseases such as cancer and cognitive dysfunction. This is because pharmaceutical companies that previously developed treatments for humans are diversifying their businesses to include treatments for animals.

Hwang Jeong-ho, group leader of the Animal Model Research Group at the Korea Institute of Animal Health and Welfare, said, “There are substances that have shown sufficient efficacy in animals but failed to be commercialized because they did not show good efficacy in humans.” He added, “From the perspective of pharmaceutical companies, these are very good substances to develop as animal treatments.”

In particular, tumors are the number one cause of death in companion animals, so demand is high. The most common cancer in companion animals is skin cancer. 35% of cats and 55.7% of dogs over 10 years old die from skin cancer. However, there are currently only five commercially available anticancer drugs for animals worldwide.

In Korea, bio ventures Baxel Bio and HLB are developing anticancer drugs for companion dogs. Baxel Bio developed ‘Baxrukin-15’, a treatment for mammary cancer (malignant mammary tumor, equivalent to breast cancer in humans), and applied for product approval to the Animal and Plant Quarantine Agency in October of last year. Animal treatments can be approved with just one test. The company is currently conducting clinical trials for lymphoma.

HLB is also developing ‘Riboceranib’, which is currently being developed as a human liver cancer treatment, as an anticancer agent for animals. It is currently conducting clinical trials targeting mammary cancer, but plans to expand the target diseases in the future.

Recently, as the pet medicine market has grown, various diseases such as anticancer drugs and vaccines are being developed. Yuhan-Yanghaeng is selling ‘Zedacure’, a treatment for cognitive dysfunction in companion dogs. Provided by Yuhan-Yanghaeng Domestic company GNT Pharma launched ‘Zedacure’, a treatment for canine cognitive dysfunction syndrome (CCDS), in 2021. According to the company, regarding 28% of companion dogs aged 11-12 and 68% of dogs aged 15-16 suffer from cognitive dysfunction. Yuhan-Yanghaeng, which is in charge of supplying Zedacure, announced that its sales of animal medicines and feed, including Zedacure, were approximately 40 billion won last year.

A representative of Yuhan Corporation explained, “Because there are many people who think of their pets as family and raise them, expensive but absolutely necessary premium medicines are being developed.”

Reporter Choi Ji-won [email protected]

[위클리 리포트] A rapidly growing pet medicine market

Declining Birth Rate Shrinks Infant Vaccine Market… Pharmaceutical Companies Focus on Developing Pet Treatments

Market growth expected to reach 2.2 trillion won by 2027… Development of vaccines to prevent infectious diseases accelerates

From treatments for skin diseases such as atopy to anticancer drugs and cognitive dysfunction drugs, interest

《Rapid growth of the pet vaccine-anticancer drug market

“I get a heartworm vaccine once a month and a comprehensive vaccine once a year.” This is not a story regarding people. It’s a vaccination for companion cats. As the birth rate is falling and the number of households raising companion animals is increasing, the market for companion animal medicine is growing.

“The heartworm vaccine is given once a month. The combined vaccine, rabies, leukemia, and peritonitis vaccines are given once a year.”

Mr. A (35), who lives in Mapo-gu, Seoul, is a ‘mid-level butler’ who has been raising a companion cat for 3 years. He adopted an abandoned cat that was wandering the streets following being abandoned by its owner, so he paid a lot of attention to the health of his companion cat from the beginning. Cats and dogs do not develop antibodies as easily as humans, and even if they do, they disappear quickly, so they need to get vaccinated relatively often. Heartworm medicine is cheap at around 10,000 won, but pet vaccines are quite expensive at around 70,000-80,000 won per session, although this varies depending on the hospital.

Cats and dogs do not develop antibodies as easily as humans, and even if they do, they disappear quickly, so they need to get vaccinated relatively frequently. The price of vaccines ranges from around 10,000 won to 100,000 won. Pharmaceutical companies are jumping into the pet medicine market, seeing future growth potential. The photo shows a veterinarian (left) examining a companion dog. Photo source: Getty Images Korea

● Pet market flourishes as birth rate plummets

The pet medicine market has been growing rapidly recently. It seems that this is a phenomenon that is occurring as the capital that was poured into the infant market is moving to the pet market due to the significant decrease in birth rates worldwide. Many pharmaceutical companies that have read this trend are jumping into the pet medicine market considering its future growth potential.

As the number of infants and toddlers decreases, vaccine development companies are directly affected. According to the status of childhood vaccination rates announced by the Korea Disease Control and Prevention Agency, the vaccination rate has been maintained at around 96-97%. However, the number of fully vaccinated people has decreased by regarding 30% from 364,441 people born in 2016 to 254,997 people born in 2021.

On the other hand, the number of pets is increasing. According to market research firm Markets and Markets, the number of households with pets in the U.S. was 84.9 million in 2019-2020, but it increased by regarding 7% to 90.5 million in 2021-2022. This is equivalent to 70% of the total number of households in the U.S.

In Europe, the number of companion dogs also increased from 87.5 million (2019) to 90 million (2020).

A representative of a domestic vaccine development company said, “When the number of newborns exceeded 600,000, there were many companies that tried to develop essential vaccines for infants and young children, even though it was a ‘red ocean.’ Recently, there has been an increase in the number of companies interested in developing vaccines for companion animals.”

In fact, Markets and Markets forecasted that the pet vaccine market will grow by 8.5% annually to reach $1.591 billion (regarding 2.2 trillion won) by 2027.

● 3rd generation vaccines using viruses and DNA are active

Recently, next-generation companion animal vaccines are being developed that can replace inactivated vaccines and attenuated vaccines that eliminate virus activity or weaken toxicity.

Existing vaccines are highly effective, but they take a long time to develop, so they have limitations in responding to new viruses. The problem is that many new viruses are emerging as the ecosystem, including the lifestyles and habitats of animals, changes due to climate change.

Among them, there are many viruses that cause zoonotic diseases that can be transmitted between animals and humans. Since 60% of new infectious diseases are zoonotic diseases, rapid development of vaccines to fight new viruses has become more important than ever.

Recently, the development methods that are being actively studied include viral vector vaccines and DNA vaccines. A viral vector vaccine is a method in which a part of the virus gene that causes infection is recombined and then delivered to the body by being placed on a carrier. A non-toxic, safe virus is used as the carrier. AstraZeneca’s COVID-19 vaccine uses the viral vector method. This method can be easily developed if only the genetic information of the infectious virus is known, so it can easily respond to the emergence of new viruses.

Boehringer Ingelheim Animal Health has developed several vaccines for companion animals using the viral vector method. These include ‘Recomvitec CDV’, which prevents distemper in companion dogs, and ‘PureVax’, a leukemia virus and rabies vaccine for companion cats. The company said that this vaccine has the advantage of being safer and allowing for rapid acquisition of immunity following vaccination. Another major advantage is that the immune effect lasts for a relatively long time.

A domestic pharmaceutical industry expert said, “Since companion animals need to be vaccinated so frequently, there is a high demand for vaccines that are long-lasting and have a fast effect once administered,” adding, “Research is also necessary to prepare for zoonotic infectious diseases.”

● A treatment that fails in humans is a ‘hero’ in animals

The scope of pet treatments is also expanding from eczema, atopy, diabetes to serious diseases such as cancer and cognitive dysfunction. This is because pharmaceutical companies that previously developed treatments for humans are diversifying their businesses to include treatments for animals.

Hwang Jeong-ho, group leader of the Animal Model Research Group at the Korea Institute of Animal Health and Welfare, said, “There are substances that have shown sufficient efficacy in animals but failed to be commercialized because they did not show good efficacy in humans.” He added, “From the perspective of pharmaceutical companies, these are very good substances to develop as animal treatments.”

In particular, tumors are the number one cause of death in companion animals, so demand is high. The most common cancer in companion animals is skin cancer. 35% of cats and 55.7% of dogs over 10 years old die from skin cancer. However, there are currently only five commercially available anticancer drugs for animals worldwide.

In Korea, bio ventures Baxel Bio and HLB are developing anticancer drugs for companion dogs. Baxel Bio developed ‘Baxrukin-15’, a treatment for mammary cancer (malignant mammary tumor, equivalent to breast cancer in humans), and applied for product approval to the Animal and Plant Quarantine Agency in October of last year. Animal treatments can be approved with just one test. The company is currently conducting clinical trials for lymphoma.

HLB is also developing ‘Riboceranib’, which is currently being developed as a human liver cancer treatment, as an anticancer agent for animals. It is currently conducting clinical trials targeting mammary cancer, but plans to expand the target diseases in the future.

Recently, as the pet medicine market has grown, various diseases such as anticancer drugs and vaccines are being developed. Yuhan-Yanghaeng is selling ‘Zedacure’, a treatment for cognitive dysfunction in companion dogs. Provided by Yuhan-Yanghaeng Domestic company GNT Pharma launched ‘Zedacure’, a treatment for canine cognitive dysfunction syndrome (CCDS), in 2021. According to the company, regarding 28% of companion dogs aged 11-12 and 68% of dogs aged 15-16 suffer from cognitive dysfunction. Yuhan-Yanghaeng, which is in charge of supplying Zedacure, announced that its sales of animal medicines and feed, including Zedacure, were approximately 40 billion won last year.

A representative of Yuhan Corporation explained, “Because there are many people who think of their pets as family and raise them, expensive but absolutely necessary premium medicines are being developed.”

Reporter Choi Ji-won [email protected]