Fixing the price of the lira once more?

Circular 161 has some answers. It allows banks to buy paper dollars from the Banque du Liban at the rate of “exchange” and sell them to customers in return for a commission, whether the customer will withdraw from his deposit, or he comes carrying quantities of pounds in his possession. The Banque du Liban had set a ceiling for this process, but later opened it without a ceiling. Within a few weeks, the result was a decrease in the price from regarding 33,000 pounds per dollar to a minimum of 19,000 pounds and a maximum of 21,000 pounds. This happened, because the Banque du Liban intervened in the market, selling dollars. In a way, he returned to the policy of fixing the price of the lira, which he had practiced for years since the mid-1990s. At that time, the Banque du Liban was absorbing the dollars that came through banking channels (deposits, investments, remittances from expatriates…), and then offering the dollar in the market to curb the price slipping from the margin it set for itself within an average price of 1507.5 pounds. In a clearer sense, the intervention in the market required the use of other financial instruments in order to enhance the intensity of the dollar’s attraction to the financial system. Domestic interest rates (in pounds or dollars) were much higher than international interest rates, and this forced Lebanon to become “addicted” to external financing with all its consequences.

Currently, what does it mean to intervene in the market, offering or buying the dollar? Does it mean a return to the previous model that exploded? In the end, the Banque du Liban will have two options:

Continuing to protect the currency and control prices, as it is currently doing by offering dollars.

– Dedication to protecting the banks by evading the exchange rate and incurring a huge cost to society and the economy.

The second option was exercised by the Banque du Liban during the past two years when it was left alone to manage the crisis amid the withdrawal of the authority from exercising its duties. He managed the crisis within the priority of preserving the banks. For this, he had to allow some of its losses to be dissolved through the mechanism of price inflation and to transfer these losses to institutions and individuals. This required his almost complete withdrawal from intervention in the market. But he decided, starting at the end of last year, to return to intervening in the market, selling dollars. With this intervention, it has moved directly from an expansionary policy of the lira, to a contractionary policy. Practically speaking, he is trying to support the monetary mass in foreign currency and absorb part of the monetary mass in Lebanese pounds. This is reflected in the exchange rate through the following:

Increasing the supply of the dollar in the market, because most of the recipients of dollars from banks, according to Circular 161, are individuals who receive their salaries. In a more precise sense, these dollars will go to the market directly to be converted into pounds, because their owners need the local currency for their daily consumption. In this way, the injection of dollars into the market has increased the money supply in dollars.

Reducing the demand for the dollar by reducing the size of the money supply in pounds. This is done through the BDL buying pounds from banks in exchange for dollars that are pumped at the price of the “Sayrafa” platform.

Sterilization of the “disaster”

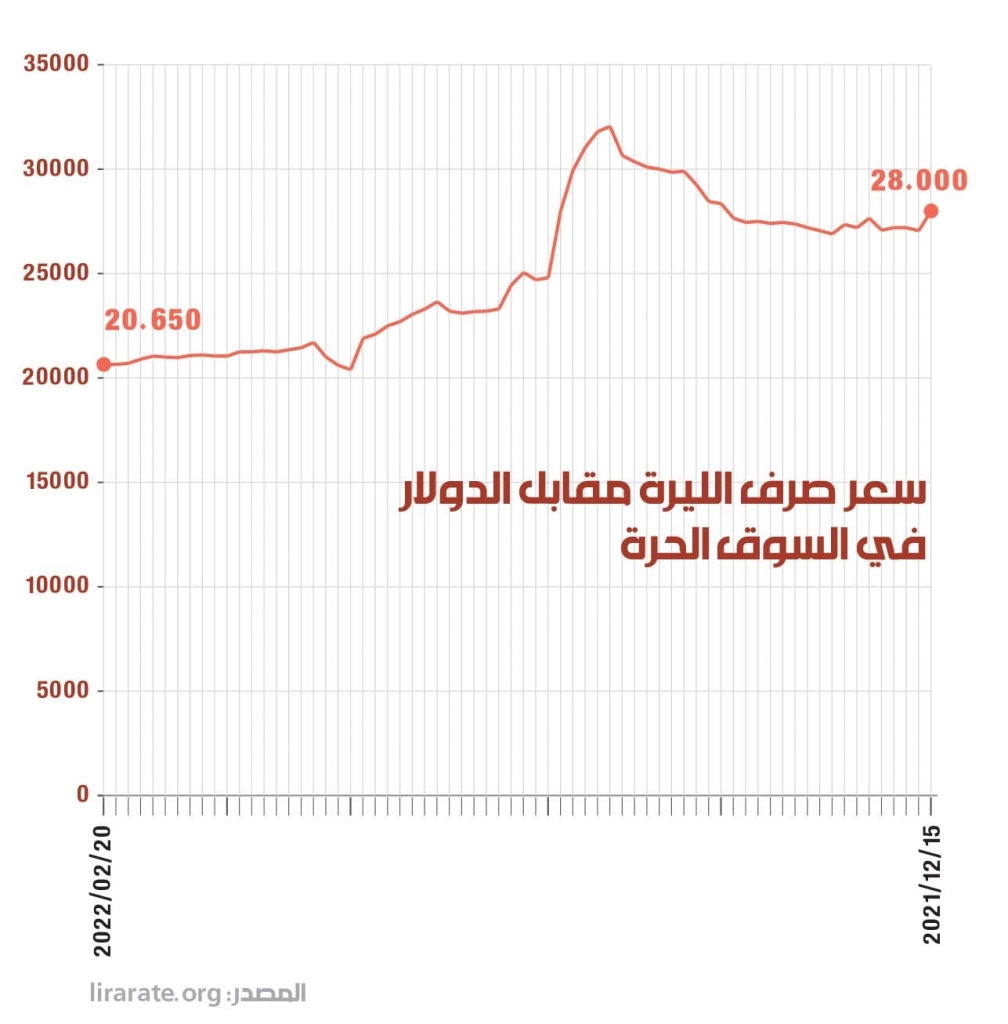

As a result of 40 days of intervention in the market, the result shown in the figures issued by the Banque du Liban is as follows: The volume of dollar transactions on the “exchange” platform amounted to $1.18 billion, at a daily rate of $29.5 million, in contrast to a decrease in the size of the cash block in pounds. At a value of 3.4 trillion pounds, the exchange rate decreased from 33,000 pounds to between 20 thousand and 21 thousand pounds. There is no magic in it. Rather, the Banque du Liban implemented what it had refrained from doing in the past two years, which it had been doing since the mid-nineties, when the exchange rate was fixed at an average of 1507.5 pounds, with the guarantee of the intervention mechanism. The lira was not fixedly priced, but the Banque du Liban guaranteed its stability with this mechanism. This process is actually a “support” for the purchasing power of the lira.

Click on the graph to enlarge it

It is not possible to distinguish between the previous stabilization policy, and what the Banque du Liban is doing today, except in terms of objectives. It used to use currency fixation as a long-term policy that is very expensive in an implicit way (the size of the losses in the structure of the system is huge and is estimated at regarding 69 billion dollars, which is equivalent to regarding three times the GDP), but today it uses this policy without a clear long-term goal and no The target exchange rate and its ability to absorb liquidity. If he seeks only to absorb liquidity, i.e. reduce the size of the “catastrophe” resulting from pumping pounds into the market and “sterilize” this calamity, then he needs a long period to absorb an influential amount in the market. Currently, there are 42 thousand billion pounds in circulation, compared to 5,500 billion pounds at the beginning of 2019.

Intervention options

So, will the Banque du Liban be able to continue what it is doing today in terms of pumping dollars and absorbing liras? The answer will depend on the fundamentals of the economy. In isolation from exceptional factors, such as speculation, political events, and others, the currency exchange rate is affected by the size of the dollar coverage of the amount of lira offered in the market, which is expressed in the movement of supply and demand for the dollar / lira; The greater the demand for the dollar, the higher its price once morest the lira. And because the dollar’s supply in the market is restricted by its cross-border flow, the process known as “lifting subsidies,” which includes the Banque du Liban’s stopping of financing the import of some commodities (medicine, diesel, food commodities…) with dollars from its reserves, created additional pressure on the dollar. Dollar demand in the market amid limited dollar flows to it. Automatically the price of the dollar rose.

If the Banque du Liban seeks to absorb liquidity only, then it needs a long period to absorb an impressive amount of the monetary mass that it pumped during the past two years.

Theoretically, the lifting of subsidies was a great “shock” for the market that ended with raising the price of the dollar in order to reduce consumption and thus reduce imports and reduce the demand for dollars in the free market… But what the Banque du Liban is doing today, is the exact opposite. He is interfering in the market, selling dollars, as if he is regaining his steps in “supporting” the lira. What that means is the following:

Pumping dollars into the market, and although the Banque du Liban does not transparently declare its source, whether from foreign currency reserves or from monetary operations that it carried out to purchase quantities from the market that contributed to raising the price of the dollar, the sterilization process produces support for purchasing power, that is, the opposite of the prevailing policy. During the past two years, and even reversing some of the circulars currently being implemented, such as the 158 and 151 which give depositors liquidity in one pound in exchange for their dollars stuck in banks (one priced at 12 thousand pounds, and the other priced at 8000 pounds). This support will reflect positively on the import of goods, and this will be reinforced by the operations of pumping liquidity in lira through circulars 151 and 158, and also by the assumption that the stability in the price of the lira will re-deal with it by public sector employees, i.e. pumping more liquidity to finance their salaries. As a result, raising purchasing power will turn, with time, into additional pressure on the dollar, in light of the weak ability of the Central Bank to absorb a lot of liquidity in lira.

Practically, the Central Bank of Lebanon is implementing two contradictory policies today, and it cannot, in light of the limited dollars it has in its foreign currency reserves, continue the support process without carrying out speculative operations on the lira. For what? When the time comes to stop pumping dollars into the market, the Central Bank cancels the option to boost purchasing power to go towards the option of saving banks by printing more pounds. Then, new cycles of rise in the dollar exchange rate are inevitable. So, the real choice is to recognize the losses and distribute them differently than what is happening now.