2024-06-21 19:38:27

Analysts say the times of Bitcoin falling beneath $70,000 are numbered. Though Bitcoin costs fell this week, buyers are nonetheless taking a wait-and-see strategy in the meanwhile.

The week’s most vital cryptocurrency information in a single place

micro technique one other huge dose He purchased Bitcoin—this time value almost $800 million. Nasdaq-listed enterprise intelligence software program big and publicly traded firm MicroStrategy introduced that it has bought one other $800 million value of Bitcoin. This brings the overall stock to 226,331 models, at the moment valued at roughly $8.3 billion.

The Winklevoss twins will donate $2 million to Trump’s presidential marketing campaign. Tyler and Cameron Winklevoss, two co-founders of the Gemini cryptocurrency change, have introduced that they’ll donate a complete of $2 million to Donald Trump’s presidential marketing campaign, all in BTC.

The present president of Argentina, Javier Milley, spoke of his help for Bitcoin and that each citizen has the best to freely select a forex that’s useful to her or him. The South American nation chief responded on X to a tweet from former VanEck director Gábor Gurbacs, who mentioned Bitcoin belongs to everybody. The top of state careworn that his authorities will permit using totally different currencies resembling Bitcoin, West Texas Intermediate (WTI) and British Thermal Unit (BTU) currencies.

The cryptocurrency group has rallied behind the builders of former cryptocurrency mixer service Twister Money, who’ve been accused of cash laundering, sanctions violations and unauthorized monetary exercise. One in every of them has been jailed. The crypto group has now arrange a $2.3 million authorized fund to assist them.

Some analysts nonetheless anticipate the change fee to high $70,000

A bunch of analysts says the times of Bitcoin falling beneath $70,000 are numbered.

On the bullish charts, some have set a $72,000 worth goal for Bitcoin’s new worth.

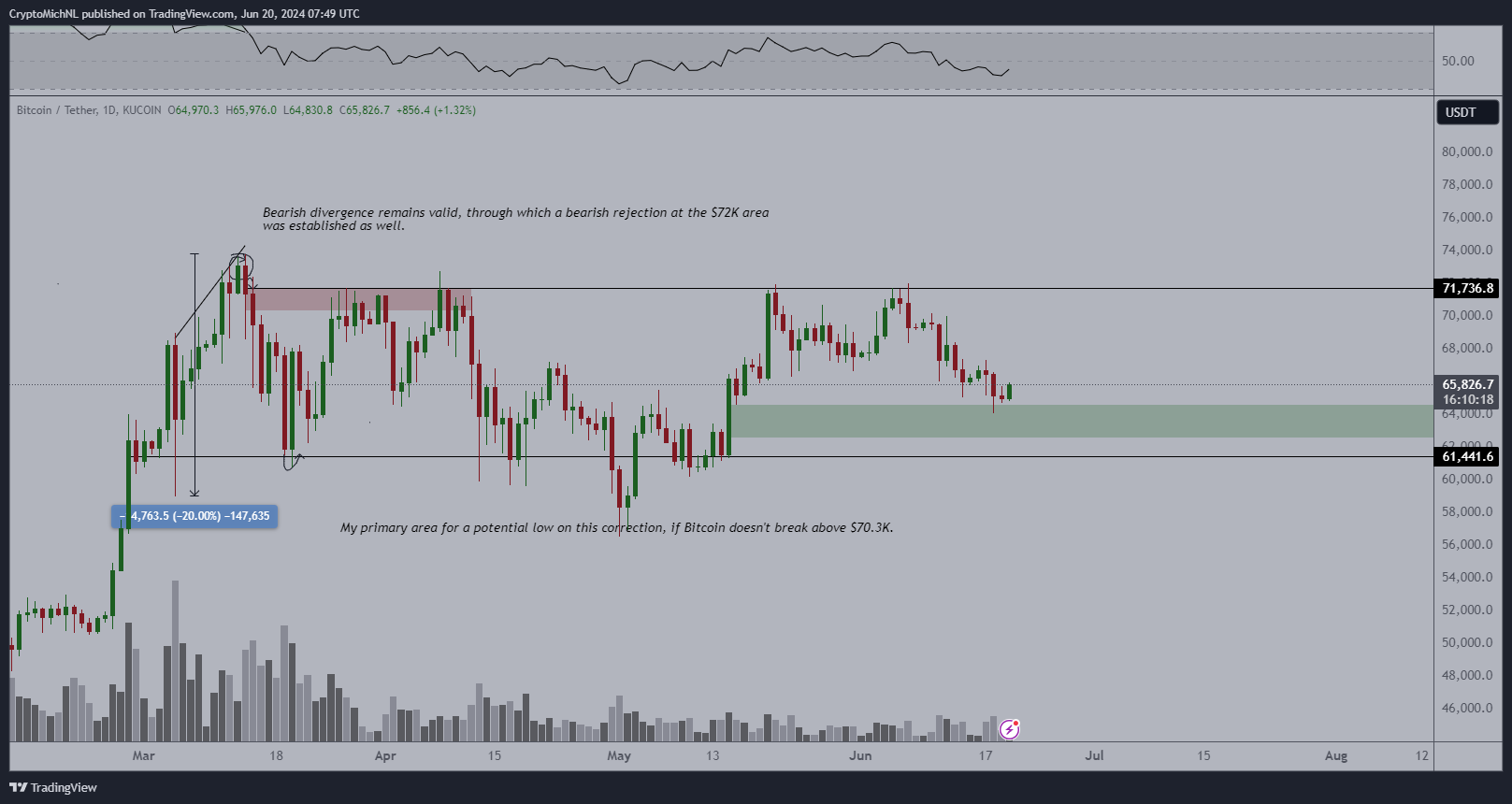

Costs have been trending downward over the previous two weeks, however many consider the cryptocurrency seems set to backside within the $63,000 to $65,000 space.

Van de Poppe’s evaluation means that BTC is rebounding from key demand ranges. That is represented by the inexperienced bar at $63,000.

If the value stays above this stage, the upward development momentum is prone to proceed.

Bitcoin/USD every day chart. Supply: Michael van de Pop

One other analyst, Jelle, held an identical view and mentioned that BTC continues to battle close to the important thing help stage of $65,000. Bulls are working to reverse the market construction to make native greater lows and better highs.

The 200-day EMA supplies the final line of protection for Bitcoin worth

Bitcoin worth has made a collection of more and more greater lows on the every day chart in current weeks. This manner, he was nonetheless capable of keep above the uptrend line. Bitcoin merchants now want to carry the value above this stage to verify the development.

Bitcoin/USD every day chart. Supply: TradingView

Nevertheless, if the bulls lose the continued battle and the value closes beneath the shifting averages for a number of days in a row, it may sign a development reversal.

Then once more, if help does maintain, this may very well be the final time we see BTC drop beneath $70,000.

An analyst named Mustache famous on Twitter that the BTC fee has fashioned an inverted head and shoulders sample on the every day time-frame, which is more and more changing into a actuality for Bitcoin.

The inverse head and shoulders sample creates an inverse alignment. That’s, it consists of an “inverted” head and shoulders, with the left and proper shoulders inverted beneath the neckline.

If this sample continues, Bitcoin’s worth may rise to the subsequent key worth stage at $72,000 following which doubtlessly assault the present all-time excessive of $73,835.

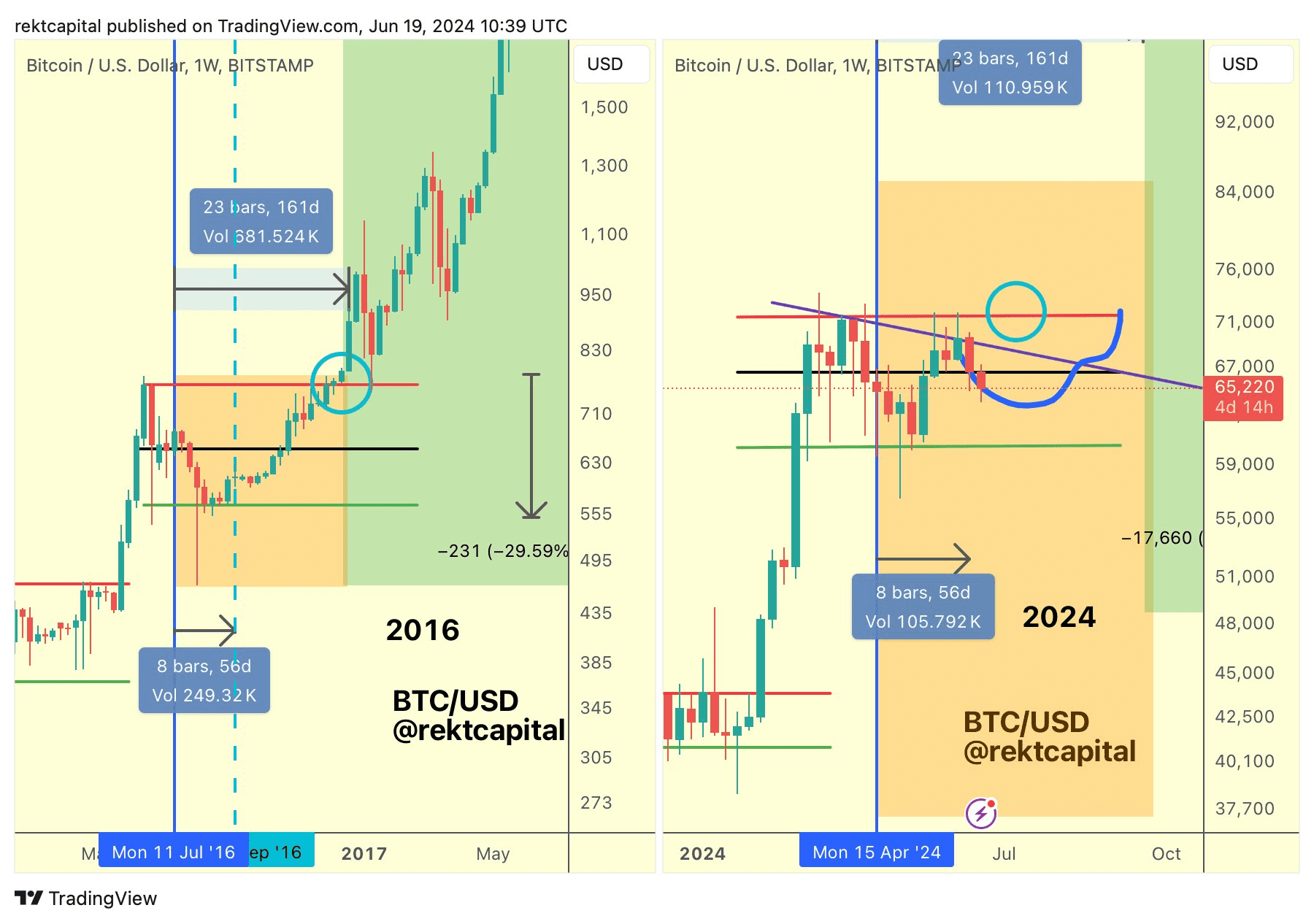

BTC worth development just like 2016

Because the final block reward halving in April, Bitcoin has been shifting in an more and more slender channel.

Wanting once more on the previous and present phases of the Bitcoin bull market, analyst and dealer Rekt Capital mentioned that in 2023, the change fee skilled a really comparable long-term volatility development.

“Bitcoin tends to kind a re-accumulation vary following halving,” X concluded in his publish.

Bitcoin worth comparability. Supply: Rekt Capital

If this state of affairs materializes now, Bitcoin will likely be caught in tight buying and selling corridors for months.

In the meantime, different analysts consider that Bitcoin’s worth correction this week is lengthy overdue primarily based on the earlier bull run.

Bitcoin miners give up right here

Bitcoin’s hash fee modifications with change charges.

The reaccumulation section is mirrored not solely in costs but additionally in mining actions.

Since miners’ block rewards have been halved, a brand new Bitcoin miner capitulation has begun, in accordance with the favored Hash Ribbon indicator.

This metric compares your 30-day common hashrate to its 60-day common hashrate. When the 30-day line fell beneath the 60-day line, Bitcoin miners started to capitulate. In earlier cycles, these intervals have proven appropriate shopping for alternatives. The final time this occurred was in Season 3 of 2023.

Willy Woo, creator of the Woobull on-chain statistics platform, commented on the phenomenon this week: “I do know it sucks, however Bitcoin isn’t going to interrupt all-time highs till there’s extra ache and tedium.”

Then once more, the excellent news is that if miners capitulate, it nearly at all times ends in a giant transfer greater.

Practically $2 Billion in Quick Positions Accumulate Once more—Can They Liquidate the Market?

Information reveals that if the value of Bitcoin returns to $70,000, quick positions of as much as $1.67 billion will likely be liquidated once more. That is the value stage at which Bitcoin has been buying and selling since June 8.

Cryptocurrency dealer Ash Crypto admitted in his X publish: “Bitcoin quick positions are piling up like loopy.”

The $70,000 worth represents a 15% enhance over present costs.

Bitcoin open curiosity (OI) – the overall worth of open or unsettled Bitcoin futures contracts throughout exchanges – has fallen greater than 10% since reaching an all-time excessive of $33.55 billion on June 7.

Nevertheless, Bitcoin OI continues to be very excessive – 82% greater than on January 1st, nonetheless exhibiting important leverage.

Whereas a lower in open curiosity might point out a deteriorating development, a rise in open curiosity means elevated market curiosity.

In early June, simply earlier than June 7, Bitcoin’s OI rose to over $2 billion in simply three days, prompting merchants to consider it would simply be a sudden fluctuation within the change fee. Nevertheless, the sudden motion disappeared.

1719006968

#capitulation #Bitcoin #miners