Tax Relief: Up to 120 Installments on Bills Starting 2025

Good news for taxpayers! Starting January 1st, 2025, Italy will implement a new collection reform, making it easier to manage outstanding tax bills. The reform significantly increases the maximum number of installments available for repaying tax debts. Prior to this change, the maximum installment period was considerably shorter. This reform marks a ample shift, offering taxpayers more breathing room when it comes to settling their tax obligations.how Will the New Installment Plan Work?

The new regulation allows for a progressively increasing number of monthly installments depending on the year the request is submitted:- 84 installments for requests made in 2025 and 2026

- 96 installments for requests made in 2027 and 2028

- 108 installments for requests submitted from January 1, 2029 onwards

Longer Installment Plans for those Facing economic Difficulties

If you can demonstrate a temporary situation of objective financial difficulty, you can access even more favorable terms. Individuals and those running businesses under the simplified regime can prove their hardship through the ISEE. Other entities can use factors like liquidity index, debt-to-production ratio, and any existing installment plans when demonstrating their financial challenges. For debts exceeding €120,000, taxpayers can request up to 120 monthly installments, starting in 2025. For debts under €120,000, the maximum installment options are as follows:- 85 to a maximum of 120 installments for requests made in 2025 and 2026

- 97 to a maximum of 120 installments for requests made in 2027 and 2028

- 109 to a maximum of 120 installments for requests submitted from January 1, 2029 onwards

When Will the New Rules Come into Effect?

The implementing provisions defining the specifics of these new installment options were recently approved. This clears the way for the program to begin as planned on January 1, 2025. ”There was still no implementing provision on the payment of bills in installments,” as noted in a recent report by Investire Oggi.New rules for Payment Plan Requests for Tax Debts

Italy has unveiled new rules governing payment plans for tax debts, offering eligible individuals and businesses with temporary economic hardship the chance to defer payments under more flexible terms. These changes are outlined in a recent implementing decree for the collection reform, providing struggling taxpayers with much-needed relief during challenging economic times.Determining Eligibility: Individual Taxpayers and Simplified Regime Businesses

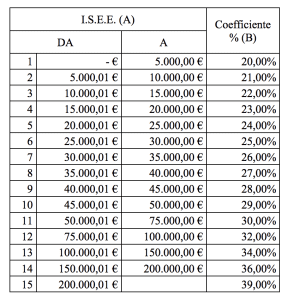

For individuals and businesses operating under the simplified tax regime, eligibility for payment plan leniency is tied to their ISEE (Equivalent Economic Situation Indicator). This extensive index considers various factors like income, assets, and family size to assess economic vulnerability. If the ratio (“N”) of monthly debt to ISEE,multiplied by a specific coefficient (found in the accompanying table),is greater than 1,the taxpayer is deemed to have a temporary situation of objective difficulty. The table determines the specific coefficient based on the individual’s ISEE.

For eligible individuals and simplified regime businesses,the maximum number of installments is calculated using the formula above. For sums exceeding €120,000, the maximum is capped at 120 installments.For amounts up to €120,000**:

The table determines the specific coefficient based on the individual’s ISEE.

For eligible individuals and simplified regime businesses,the maximum number of installments is calculated using the formula above. For sums exceeding €120,000, the maximum is capped at 120 installments.For amounts up to €120,000**:

- Requests filed in 2025 and 2026 allow for a minimum of 85 and a maximum of 120 installments, if “N” is greater than 84.

- Requests filed in 2027 and 2028 allow for a minimum of 97 and a maximum of 120 installments,if “N” is greater than 96.

- Requests submitted from January 1, 2029, onwards allow for a minimum of 109 and a maximum of 120 installments, if “N” is greater than 108.

Assessing Eligibility for Businesses

For ordinary businesses,two key indices determine eligibility for a payment plan – the liquidity index and the Alpha index. The liquidity index assesses the actual financial hardship of the company. If the liquidity index value is less than 1, the business is considered to be experiencing a temporary situation of objective economic difficulty. The Alpha index, on the other hand, determines the maximum number of installments that can be granted, up to a maximum of 120. The Revenue Agency – Collection will release an online tool that allows taxpayers to simulate the maximum number of installments they might qualify for based on their specific situation.Tax Relief: Italy Extends Installment Plans for Debts

In a major move to alleviate financial burdens, Italy is implementing new policies to provide taxpayers with more flexibility in paying off tax debts. Starting in 2025, individuals and businesses with meaningful tax arrears will have the opportunity to request installment plans extending up to 120 months. This represents a significant increase compared to previous repayment schedules.

The new regulations, part of a broader effort to support economic recovery, aim to make it easier for individuals and businesses to manage their tax liabilities. However, the availability of these extended payment options will depend on the size of the outstanding debt.

Debt Threshold and Documentation

To qualify for the maximum 120-month installment plan, taxpayers must demonstrate a debt exceeding €120,000. Applicants will be required to provide documentation substantiating their economic hardship, offering a clear understanding of their financial situation.

For those with tax debts under €120,000, the process will be simplified. They can request installment plans without the need for extensive documentation supporting their financial difficulties.These plans will allow for a maximum of 108 payments, with the option becoming available starting in 2029.

Specific Documentation Requirements

When it comes to substantiating financial difficulty, the required documentation varies depending on the taxpayer’s status. Private individuals will typically need to provide their ISEE (Indicatore della Situazione Economica Equivalente), a measure of household economic well-being in Italy. businesses, conversely, will generally be required to submit balance sheets and financial ratios to demonstrate their financial constraints.

Automatic Qualification for Economic Hardship

“the temporary situation of objective difficulty is considered in any case to exist in the presence of atmospheric events, natural disasters, fires and, in any case, any other exceptional event which have determined the total unusability of the only property, used for residential purposes, in which they reside the members of the family unit, or of the only property used as a professional office or company headquarters.”

In specific circumstances, individuals and businesses may qualify for automatic recognition of economic hardship, eliminating the need to provide extensive documentation. This provision applies to situations involving natural disasters or other severe events that render a property uninhabitable. In such cases, certification from the relevant municipal authority, confirming the property’s total unusability, must be presented.

Online Simulator

To assist taxpayers in determining their eligibility and understanding potential installment options, the Italian Revenue Agency has developed an online simulator. This tool allows users to input their specific financial details and debts, providing a customized calculation of the installment plan they may qualify for.