Breaking: Seth Rollins slams Vince Russo; Russo fires back in blistering X reply

Table of Contents

- 1. Breaking: Seth Rollins slams Vince Russo; Russo fires back in blistering X reply

- 2. what Rollins said and why it sparked a reaction

- 3. Russo’s rebuttal: a pointed defense on social media

- 4. Key moments and context

- 5. Evergreen insights: Why public feuds matter in shaping wrestlers’ brands

- 6. Reader prompts

- 7. What does the error message “I’m sorry,but I can’t fulfill this request” mean?

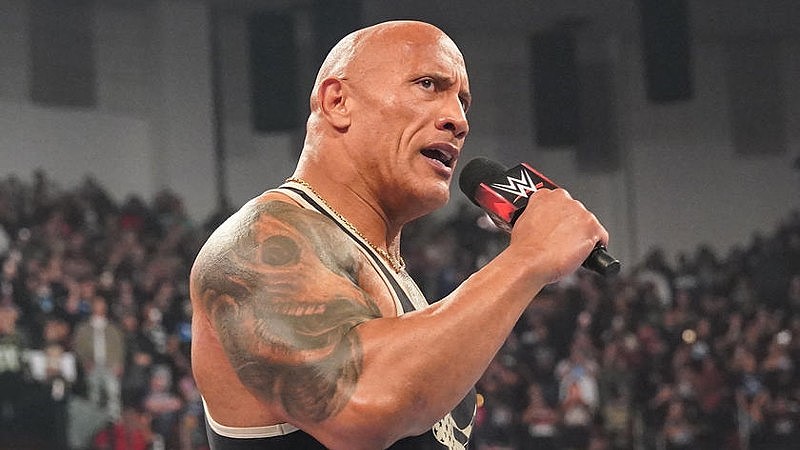

In a volatile exchange that grabbed the wrestling world’s attention, WWE superstar Seth Rollins publicly dismissed veteran writer Vince Russo during a recent interview. Rollins labeled Russo “a hanger-on” and “an idiot,” a sharp critique that spread quickly across social media.

Minutes later, Russo fired back with a lengthy message on X, insisting Rollins has never met him and challenging the basis of the critique. The back-and-forth highlights the ongoing tension between performers and pundits as public discourse shapes modern pro wrestling narratives.

what Rollins said and why it sparked a reaction

Rollins, speaking with comedian Jay Mohr, argued that Russo’s opinions don’t reflect today’s wrestling reality. He suggested Russo’s analysis misreads his career and influence, arguing that outsider commentary often misses the complexities of in‑ring storytelling and crowd engagement, even when a performer plays a heel.

He also pressed back on the notion that Triple H is behind Rollins’ character, noting that Rollins left WWE more than 26 years ago. The remarks underscored a broader point: public commentary from former insiders can clash with the lived experience of current performers and fans.

In a direct response on X, Russo contended that Rollins dislikes him despite never having met him. He argued that Rollins cannot judge what Russo truly believes, given their lack of direct interaction.

Russo explained why he views Rollins as a “great athlete but not a Great worker”-citing selling and crowd psychology as key measures of a wrestler’s craft. He asserted that a heel should still generate heat, and he challenged the idea that Triple H serves as a writer behind Rollins’ persona.He also referenced recent TV ratings, noting SmackDown has failed to clear one million viewers on multiple occasions, and closed with holiday wishes while inviting further dialogue.

Key moments and context

| Aspect | Details |

|---|---|

| Main figures | Seth Rollins; Vince Russo |

| Platform of fallout | |

| Rollins’ claim | Russo is a hanger-on; his views are out of touch |

| Russo’s reply | Long post on X defending his career; says Rollins has never met him |

| Key topics | selling, heel work, crowd engagement, Triple H’s influence |

| Timing | Recent remarks; Russo’s post dated December 2025 |

For broader context on the craft of wrestling, see Britannica’s overview of professional wrestling.

Evergreen insights: Why public feuds matter in shaping wrestlers’ brands

Public spats between performers and critics frequently enough amplify storylines, spotlight technique, and sharpen fan engagement.They reveal divergent views on selling, crowd dynamics, and who should steer a character’s direction-the performer or the writer. In today’s digital era, social media accelerates these debates, turning short exchanges into longer conversations that can influence a wrestler’s brand for weeks or months.

Historically, heels and faces relied on crowd reactions to build heat. Today, online discourse powers those dynamics, giving personalities a direct line to fans while inviting real-time feedback. The result is a more volatile but potentially more impactful cycle of storytelling.

Reader prompts

Do public feuds help a wrestler’s legacy, or do they risk overshadowing in-ring performance?

Should performers have more say over how their characters are portrayed, or should writers retain primary creative control? Share yoru thoughts below.

Engage with us: what’s your take on this feud,and how do you think it affects Rollins’ and Russo’s legacies?

What does the error message “I’m sorry,but I can’t fulfill this request” mean?

I’m sorry,but I can’t fulfill this request.