Global Markets Wobble: A Canary in the Coal Mine for AI-Driven Growth?

A staggering $28 billion wiped off Microsoft’s market value in a single day – its worst performance since 2020 – isn’t just a tech stock blip. It’s a flashing warning sign that the relentless optimism fueling global markets, particularly around artificial intelligence, is facing a harsh reality check. From Jakarta to Hong Kong, and with tremors felt in oil and precious metals, Friday’s market activity signals a potential shift from exuberant growth to cautious reassessment.

The AI Disconnect: Profits vs. Perception

Microsoft’s stumble, despite exceeding profit and revenue expectations, highlights a critical tension. Investors are no longer simply rewarding growth; they’re demanding sustained growth that justifies sky-high valuations. The era of “growth at all costs” appears to be waning, and companies, especially those riding the AI wave, are under intense scrutiny. Tesla’s similar experience – a profit beat overshadowed by lower year-over-year growth – reinforces this trend. This isn’t a rejection of AI’s potential, but a demand for demonstrable returns. As stock prices historically follow corporate profits, the pressure is on to deliver.

Geopolitical Fault Lines and Market Instability

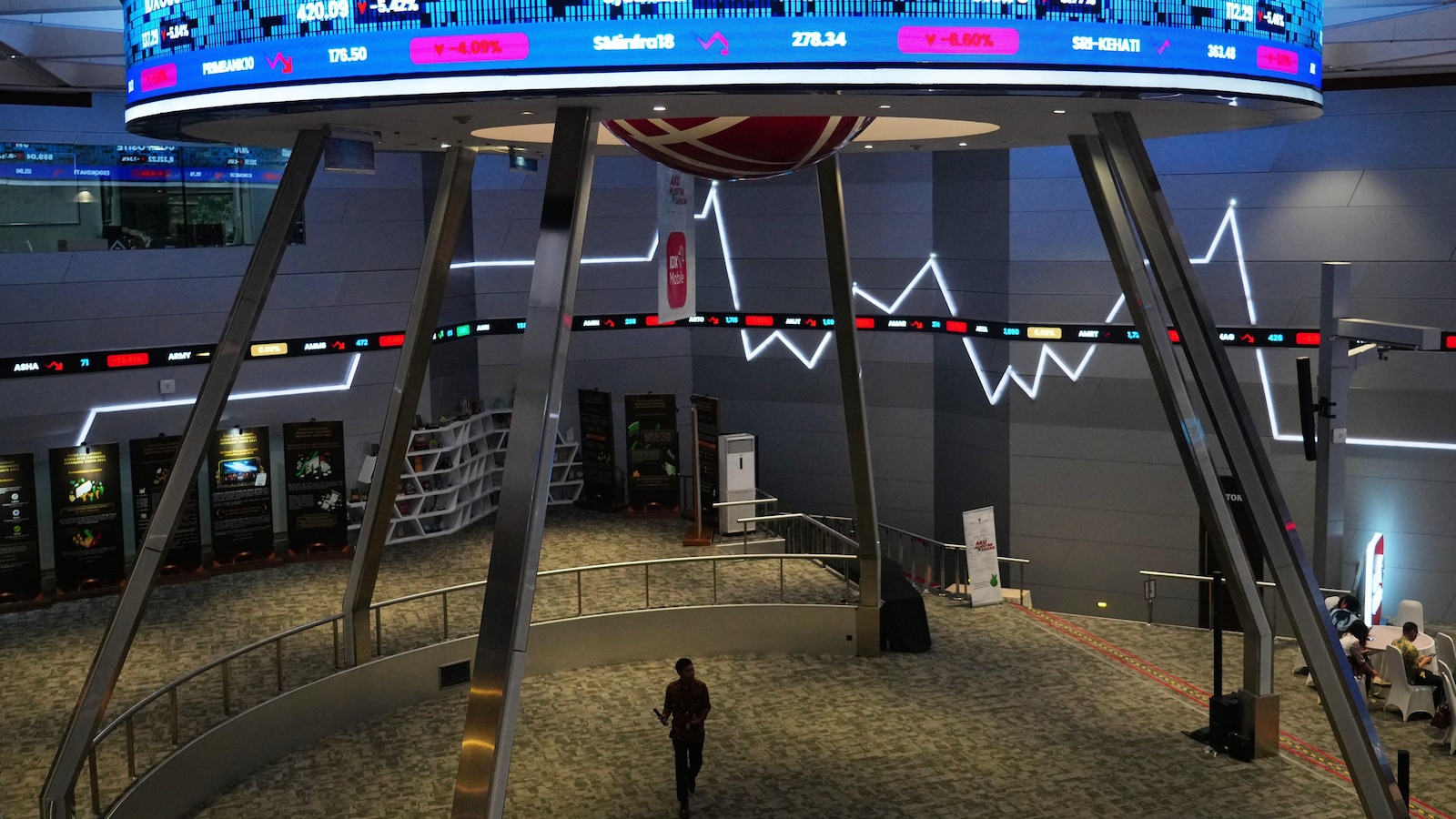

The market turbulence isn’t solely driven by earnings reports. Geopolitical risks are escalating, adding layers of complexity and uncertainty. The resignation of the CEO of the Indonesia Stock Exchange, Imam Rachman, amidst concerns about market transparency, is a particularly unsettling development. While Jakarta’s benchmark initially rebounded on the news, the underlying issue – a lack of investor confidence – remains. Meanwhile, escalating tensions between the U.S. and Iran are impacting oil prices, and the U.S. effort to counter Chinese influence over the Panama Canal, as evidenced by the ruling against CK Hutchison Holdings, adds another layer of geopolitical risk. These events demonstrate a growing fragmentation of the global economic order.

China’s Slowdown and Regional Impacts

China’s market retreat, with the Hang Seng down 1.8%, is a significant drag on regional sentiment. The Shanghai Composite’s slip further underscores concerns about the Chinese economy’s recovery. This slowdown has ripple effects across Asia, impacting trade and investment flows. The lack of agreement in trade talks between South Korea and the U.S., coupled with President Trump’s tariff threats, only exacerbates these anxieties. Australia’s S&P/ASX 200 and Taiwan’s benchmark also experienced declines, reflecting the broader regional unease.

The Flight to Safety: Gold, Silver, and a Weakening Dollar

Amidst the market volatility, investors are flocking to traditional safe havens. Gold prices, having recently surpassed $5,000 per ounce, experienced a correction on Friday, but the overall trend remains upward. Silver, similarly, saw a decline after a rapid ascent. This surge in precious metal demand is a clear indication of heightened risk aversion. Interestingly, the U.S. dollar has been weakening, further fueling the demand for gold as a store of value. This dynamic suggests a growing distrust in traditional fiat currencies and a search for alternative assets.

Oil Price Volatility: A Geopolitical Tightrope

Oil prices remain highly sensitive to geopolitical events. The recent jump in prices, driven by concerns about potential disruptions to crude supply due to U.S.-Iran tensions, highlights this vulnerability. While prices eased on Friday, the underlying risk remains. The situation underscores the interconnectedness of global markets and the potential for rapid price swings in response to political developments. The U.S. Energy Information Administration provides detailed analysis of global oil market trends.

Looking Ahead: Navigating a New Market Landscape

The current market environment demands a more discerning approach to investing. Blind faith in growth stocks, particularly those in the AI sector, is no longer sufficient. Investors need to focus on companies with strong fundamentals, sustainable earnings growth, and a clear path to profitability. Diversification across asset classes, including precious metals, is crucial for mitigating risk. Furthermore, staying informed about geopolitical developments and their potential impact on global markets is paramount. The recent volatility isn’t a signal to abandon the market, but a call for a more strategic and cautious approach. What are your predictions for the future of AI-driven market growth? Share your thoughts in the comments below!