2024-07-15 07:27:29

Switzerland is known for its strong economy and financial stability, but has recently undergone major changes to its tax structure, especially VAT.

Here, we take an in-depth look at the reasons behind Switzerland’s recent VAT rate increase and explore its impact on the economy and individuals.

definition

VAT

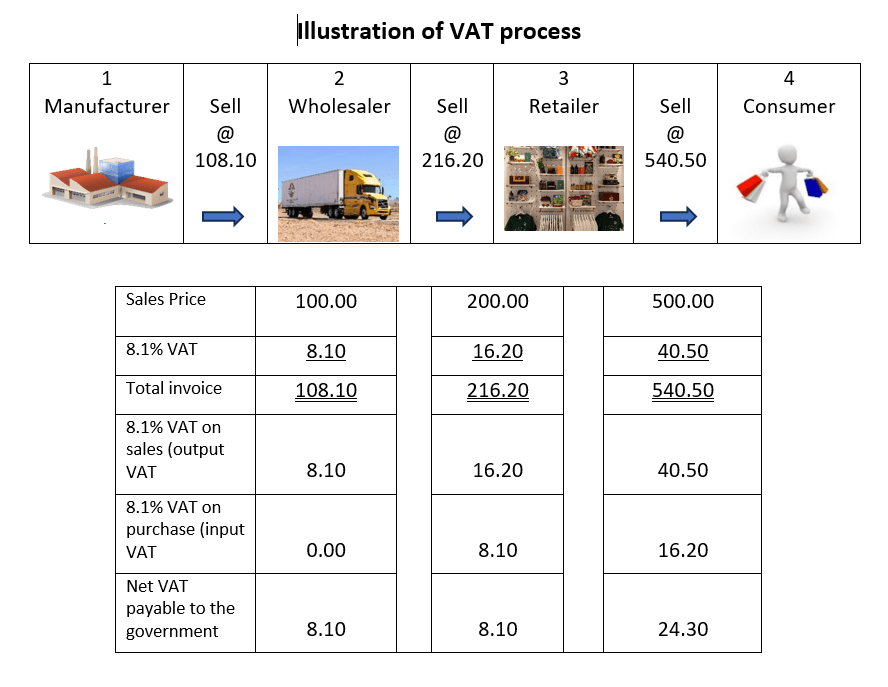

Value Added Tax (VAT) is a general consumption tax levied by the federal government.

The concept behind VAT is that consumers make a financial contribution to the state when they buy goods or services.

Rather than individual citizens reporting their consumption, VAT is levied on companies such as producers, manufacturers, traders and service providers.

Companies then pass the VAT on to consumers, either by including it in the price or listing it separately on the invoice.

Input tax deduction

Businesses subject to VAT can deduct VAT invoices issued by their suppliers (known as input tax).

This deduction occurs when a business obtains services from a third-party company for use in its taxable activities.

Net deduction principle

The system follows the net deduction principle, taking into account previous taxes. All services provided by Swiss companies (unless expressly excluded by law) are subject to VAT.

History of Swiss VAT

On January 1, 1995, the commodity circulation tax was replaced by the value added tax. The reduced tax rate at that time was 2%, and the special tax rate was 3%. The standard tax rate was 6.2%, which was later increased to 6.5% by federal decree to restore the health of federal finances.

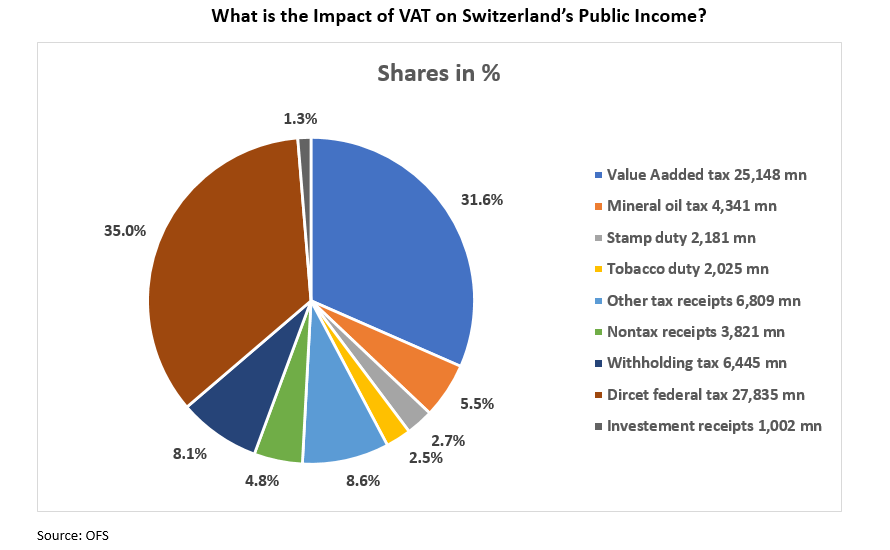

Value Added Tax (VAT) plays an important role in Swiss public revenue. Let’s explore its weight and compare it with other sources of revenue:

- VAT revenue:

- The total VAT collection in Switzerland was CHF 25.148 billion.

- VAT accounts for approximately 31.6% of total federal revenue.

- Compare and other sources:

- Besides federal direct taxes, VAT is one of the most important sources of revenue.

- Domestic consumption drives VAT revenues. This includes taxes on the acquisition of domestic goods and services as well as imports.

- It is worth noting that exports are exempt from VAT.

From 1 January 2024, the following VAT rates will apply in Switzerland:

- Standard interest rate: 8.1%

- Prime rate: 2.6%

- Prime rate: 3.8%

The decision to increase the VAT rate is the result of a careful analysis of the current economic environment. The reform aims to ensure the sustainability of the Swiss tax system by adapting it to changing economic and budgetary dynamics.

For example, the increased VAT will be used to cover the rising costs of public infrastructure, healthcare and other basic public services. In addition, Switzerland is currently reforming its Old Age and Survivors Insurance (“OASI” (AVS), which is the first pillar of the Swiss pension system). In a referendum held in September 2022, 55.1% of the Swiss voted in favor of increasing the VAT rate to finance OASI (AVS).

The previous VAT rates were as follows: –

- Standard interest rate: 7.7%

- Decrease: 2.5%

- Prime rate: 3.7%

How to determine the VAT rate

Regardless of the VAT rate, VAT liability is recognised when the invoice is issued or the services are paid for.

In Switzerland, VAT rates vary depending on the type of good or service, unlike some countries that have a single VAT rate.

- Standard Rate: Applicable to most goods and services.

- Preferential interest rates: Applies to certain categories of goods, such as food, newspapers, books, and medical services.

- Special Price: Applicable to accommodation services.

Exemption from VAT: Applies to educational services provided by public and certain private institutions; financial services and insurance; postal services provided by Swiss Post; and cultural services provided by museums, libraries and theatres.

Impact of VAT increase

Impact of VAT increase

The increase in VAT will have an impact on citizens and businesses.

- Effect on prices: Businesses will typically pass on higher tax burdens to consumers by raising the prices of their services and products. This will affect consumer behavior.

- Challenges for businesses: SMEs must prepare for the administrative requirements of the new VAT rate. They face the challenge of covering the rising tax costs while maintaining profitability and competitiveness. Strategically adjusting prices and considering short-term concessions can help mitigate the impact.

Although prices are rising, they are not universal, with only regarding 12.6% of goods seeing price increases between December and January, according to the Russian news agency Sputnik. Federal price watchdog Stefan Meierhans attributed this to a number of factors, including the elimination of industrial tariffs and careful monitoring of price trends.

For 2025 and 2026, there are proposals to further adjust VAT rates and pension taxation. For 2026, the Swiss Federal Council has proposed two financing plans to cover the increased costs of state pensions:

- Increase value-added tax from 8.1% to 8.5% and raise the wage and pension levy by 0.5%.

- Alternatively, the pension levy on wages might be increased by 0.8%.

Please keep in mind that these proposals may change based on further decisions.

The adjustment of the Swiss VAT rate was a strategic move to increase public funds for essential services while maintaining economic balance. While this has created certain challenges for both businesses and consumers, it also reflects a positive attitude towards sustainable fiscal policy amid global economic changes. As Switzerland continues to respond to these changes, it remains a key example of adaptive governance in action.

Same author:

Best accounting software in Switzerland

source:

1721036023

#Swiss #VAT #Impact #Insights