The recent rise in inflation internationally is not due to mistakes in economic policy or increased demand, but to external shocks, such as the war in Ukraine and the rise in fuel prices, stressed the governor of the Bank of Greece, Giannis Stournaras.

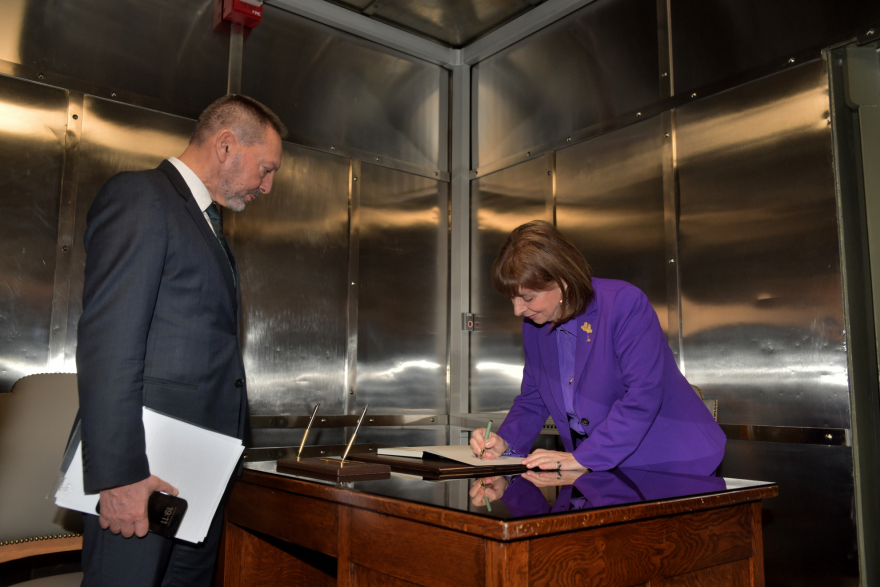

As added by Mr. Stournarasspeaking Monday at the opening of its renovated Central Treasury Bank of Greecein the presence of the President of the Republic Katerina Sakellaropoulou and the Prime Minister Kyriakou Mitsotakis“already, for several months, there has been a significant de-escalation of inflation worldwide and, within 2024, it is expected that the reduction of the main interest rates of the central banks will also begin”.

The head of the Bank of Greece, speaking regarding the renovated area of the Central Treasury of the bank, where the country’s gold reserves are kept, emphasized that it now has state-of-the-art means of classification, inventory and security.

According to the protothema, making a historical review regarding the safekeeping of gold, Giannis Stournaras noted that following the 1930s the Bank not only increased the percentage it held in pure gold, while much of it was held abroad, to be able to deal with emergencies.

“The same applies today: 47% of the gold is kept in Greece, with the rest being shared between the United States (29%), Britain (20%) and Switzerland (4%),” noted the central banker.

Read the speech of Governor Yiannis Stournaras at the Inauguration of the renovated Central Treasury of the Bank of Greece: pic.twitter.com/Dy92BLTdeg

— Bank of Greece (@BankofGreece) February 5, 2024

The entire speech of the commander of the CoE:

“Your Excellency Madam President of the Republic, Your Excellency Mr. Prime Minister, Honorable Mr. Speaker of the Parliament, Honorable Ministers, Dear colleagues at the Bank of Greece,

It is with great pleasure that I welcome you to the renovated area of the Main Gold Reserve of the Bank of Greece. As is the case with any central bank, this space, the “Central Treasury”, is surrounded by a special glamor as it is where the gold reserves of the country’s central bank are kept. With the completion of its renovation and modernization, this iconic space now features state-of-the-art sorting, inventory and security facilities.

In preparing for today’s event, I have been reflecting on how paradoxical, in one sense, this ceremony is. In an age where we are all familiar with electronic transactions and where the money in our wallets is just pieces of paper or, to be precise, cotton, we gather in a space dedicated to the safekeeping of gold, a precious metal, intertwined primarily with the past, and not with the future of money.

The only gold coins in the world are now issued for collecting or investment purposes rather than for trading. And the gold standard, which imposed the convertibility of banknotes into gold or equivalent amounts of foreign currency, has abandoned us since the 1970s, when US President Nixon devalued the dollar and suspended its convertibility into the precious metal.

And yet, for centuries, gold and silver guaranteed the value of most coins, either directly, when they were the raw material for their manufacture, or indirectly, when paper banknotes might be converted into certain grams of metal. The palm of Kapodistrias contained 3.747 grams of silver, while the original provision was to mint gold coins of 20 and 10 palm. In practice, the finances of the fledgling state did not permit any gold coinage, and very few silver palms were printed.

Otto’s drachma was also set in silver, and this time a few gold icosadrachms and forty-drachms were also issued. The paper banknotes of the National Bank, first issued in 1842, were redeemable for such metal drachmas. In practice, of course, most settled with foreign currencies, and the Greek coins were minimal. It is no coincidence that, even today, any buying and selling of gold coins is done in British pounds and not gold drachmas. The Greek State never had the comfort to issue a sufficient number of gold coins.

Gold and silver coexisted internationally and until the mid-19th century functioned harmoniously in a bimetallic system. The eventual predominance of gold is more a coincidence than a historical necessity. One the fact that the pioneer England had – due to an earlier coincidence – ended up with gold, the other the defeat of the French by the Germans in 1870, which was accompanied by large reparations in gold, something the decision of the Germans to follow the example of the English – in end of the 19th century most countries found themselves tied to the chariot of gold.

Greece, although formally a member of the bimetallic Latin Monetary Union, was not particularly affected by the developments. Its war and fiscal adventures had not allowed it the luxury of a stable currency before 1910, when the drachma was also stabilized. Unfortunately, the stability did not last long, as the deficits and inflation brought on by the Asia Minor Campaign sent inflation skyrocketing and the drachma’s parity collapsed.

The next stabilization coincided with the establishment of the Bank of Greece and the return to the gold-currency rule, in May 1928. The newly established central bank then undertook to exchange drachma banknotes for English currency, at a fixed rate of 375 drachmas per sterling .

Why sterling and not gold pounds? Because 4/5 of the reserves of the Bank of Greece, like the other banks of the interwar period, were held in foreign currency, not in gold bars. Unlike gold, which requires expensive vaults, foreign currency deposits did not take up space, and they also paid interest. Thus, the central banks of peripheral countries, such as Greece, did not buy so much gold as foreign exchange from countries with convertible currencies, such as England, the USA and Switzerland.

The idea was good, provided none of these countries devalued their own currency. This is exactly what happened in September 1931 when England, under the weight of the Great Depression, abandoned the gold standard. On that day, the Bank of Greece, which held significant amounts in sterling, lost a significant portion of its reserves. He allocated the rest in the following months, trying to stabilize the drachma, until the final abandonment of the gold standard, in April 1932.

From then on, the lesson became a lesson, and in the 1930s the Bank took care not only to restore its foreign exchange reserves, but also to increase the percentage it held in pure gold. Many of them were kept abroad, to be able to deal with emergencies. The same is true today:

47% of the gold is held in Greece, with the rest shared between the United States (29%), Britain (20%) and Switzerland (4%). Since 1938, when the building we are in today was inaugurated, the Bank also acquired a safe space to protect its gold. Safe under normal conditions of course! We all know, for example, the famous story of the flight of gold, during the Second World War, from this very room, to South Africa, with intermediate stations in Crete and Alexandria.

Why this obsession with the yellow metal? Part of the answer is definitely trust. Or, rather, the lack of confidence in the ability of the governments of the day to ensure the value of money. A gold coin has a fixed value. A piece of paper, probably not. Therefore, a paper currency issued by a government has value only if it is converted into gold. After the collapse of Bretton Woods in the 1970s, many economists predicted an uncontrollable rise in inflation.

The rise came, but it was not uncontrollable. In most countries, governments have learned to avoid the sirens of inflation and maintain the value of their currencies without tying their hands to a gold bullion. They granted greater independence to central banks and tasked them with maintaining price stability. The same happened in Greece, especially when it was decided, and especially when the country’s entry/integration into the Euro zone was decided, one of the most important sections in the economic policy since the birth of the Greek state.

The importance of gold changed, but it did not disappear. Instead of a cover for the circulation of banknotes, gold today is another asset, part of the Bank of Greece’s asset portfolio, which allows it to respond to different conditions and requirements. For citizens, it is no longer a medium of exchange, but a refuge of value in times of uncertainty and crisis. It is no coincidence that gold demand soared during the Great Financial Crisis.

It is worth noting, however, that similar phenomena have not been observed even following the recent rise in inflation internationally, which is attributed not to mistakes in economic policy or increased demand, but to exogenous shocks, such as the war in Ukraine and the rise in the price fuel. This demonstrates the stability of citizens’ inflation expectations and the credibility of central banks in terms of their commitment to fighting inflation, and their ability to control it without increasing unemployment and without major financial stability issues.

Already, for several months, there has been a significant de-escalation of inflation worldwide and, within 2024, it is expected that the reduction of the main interest rates of the central banks will also begin.

In this environment, the Bank of Greece continues to carry out the traditional activity of buying and selling gold coins and managing monetary gold, which forms part of the country’s foreign exchange reserves. And the heart of the management system beats in this modern and renovated space, where we gathered today.”

Read also:

Agricultural mobilizations: Today is the time for decisions – Producers of Aegialia in the “blockades” of Larissa

“Frozen” Britain for the health of King Charles – The next moves of his sons William and Harry

Crete – Rape of a 14-year-old girl: The authorities’ investigations and the “mysterious” death of the minor’s father

Patras: Rally once morest the marriage of same-sex couples – The call of Metropolitan Chrysostomos

Borrowers – Settlement: How Debtors Can Stop Auctions

#Stournaras #Greek #gold #country #rest #shared #USA #Britain #Switzerland