2023-12-11 09:25:33

This week will be the high point of 2023 because no matter what happens this week, It will be a message sent until 2024.

This week will feature , , and in the economy. 3, 10 and 30 year treasury auctions and central bank meetings from , , and .

To cap it off, the Quadruple Witch Option expires on Friday. Did I miss something? Next week may be the last central bank meeting.

Auction

This week will begin with an auction of $50 billion in notes at 11:30 a.m., followed by an auction of $37 billion in notes the same day at 1:00 p.m. ET, then on Tuesday. The Treasury Department will auction another $21 billion worth of bonds at 1:00 PM ET.

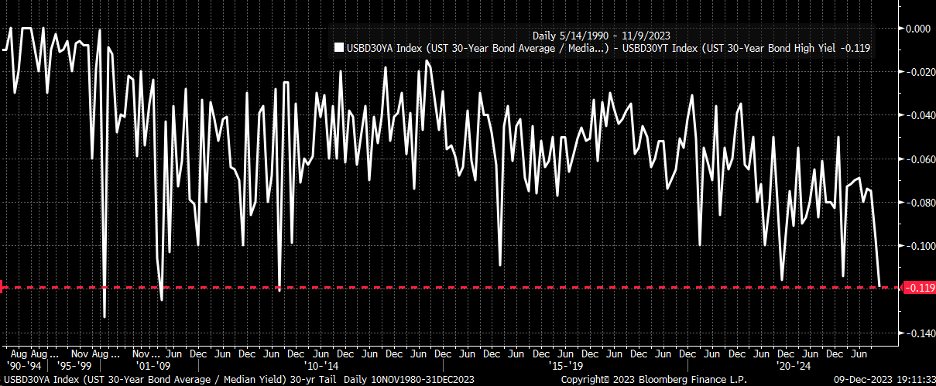

The last time the 30-year-old was auctioned off was in November. Its biggest tailwind was back in 2011 during the debt downgrade.

The CPI should not be a surprise.

Of course, until then, the 30-year auction will be inflation data. And it’s not clear to me that the CPI report will bring any big surprises.

The expectation is that the gauge will increase 0.0% m/m in November, remaining flat through October. While it increased 3.1% y/y, down from 3.2% y/y, it is expected to increase 0.3% m/m, up from 0.2%, and 4.0% y/y, stable from October.

The Fed has not yet talked regarding cutting interest rates.

I don’t see the Fed approving a rate cut. And it is probably too early to talk regarding interest rate cuts right now. I’m guessing that statement will sound similar to what Powell said in his speech before the blackout, which the market largely ignored.

That message will be sent through Powell and Dot Plot. The 2024 median remains unchanged, 2025 it increases, and it is possible that the long-term carry rate will increase as well.

I think in the end We will see a recovery in long-term rates. I’m not sure it means a new high. But the reversal seems correct.

10 years has broken the downtrend of the relative strength index. and is approaching the upper end of the downtrend. But a reversal of the recent interest rate drop of 61.8% might easily bring the 10-year back to 4.70%.

At the same time, it appears poised to rise from current levels. There seems to be an inverse head and shoulders pattern in

The dollar quickly rebounded from the 61.8% support level and now has an RSI that appears to be higher in the long term. and has just broken through the short-term downtrend, breaking through the 104.5 level back to 105.60.

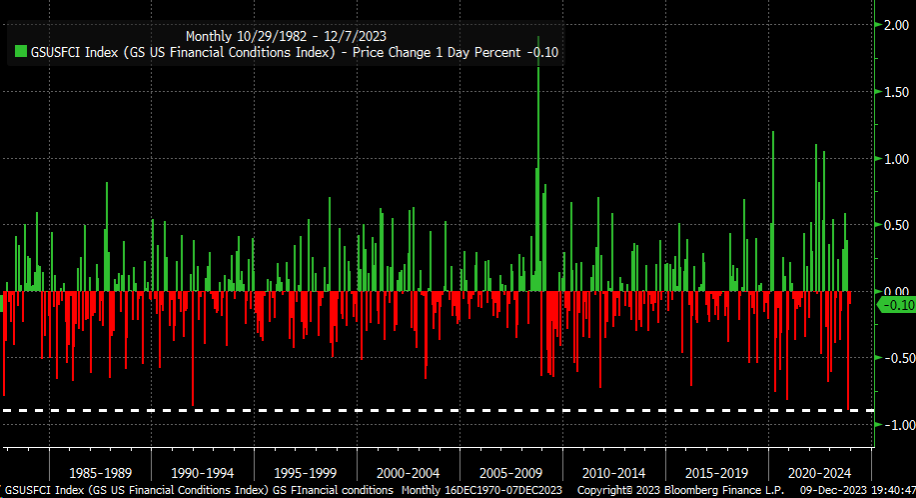

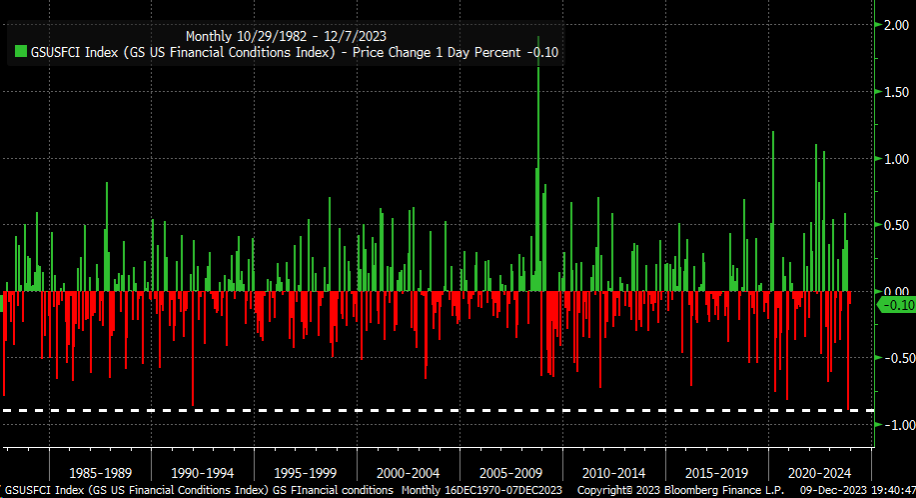

Higher interest rates and a stronger dollar are necessary for financial conditions to tighten. Especially since the Fed decided to include whether tighter financial conditions would affect economic activity in its November statement. GS financial conditions ease with highest ever amount in November

Market: Call sellers to push the index lower.

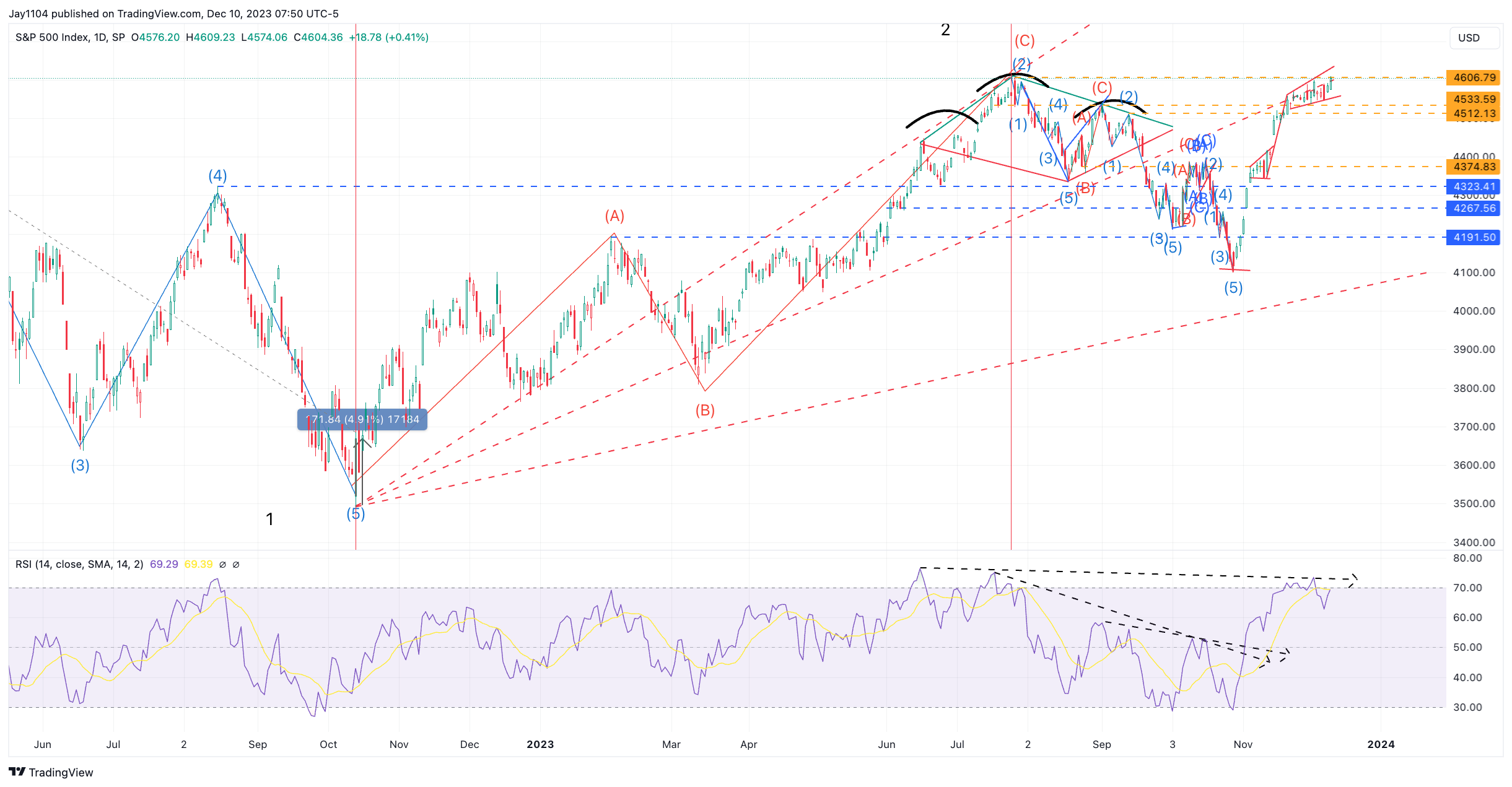

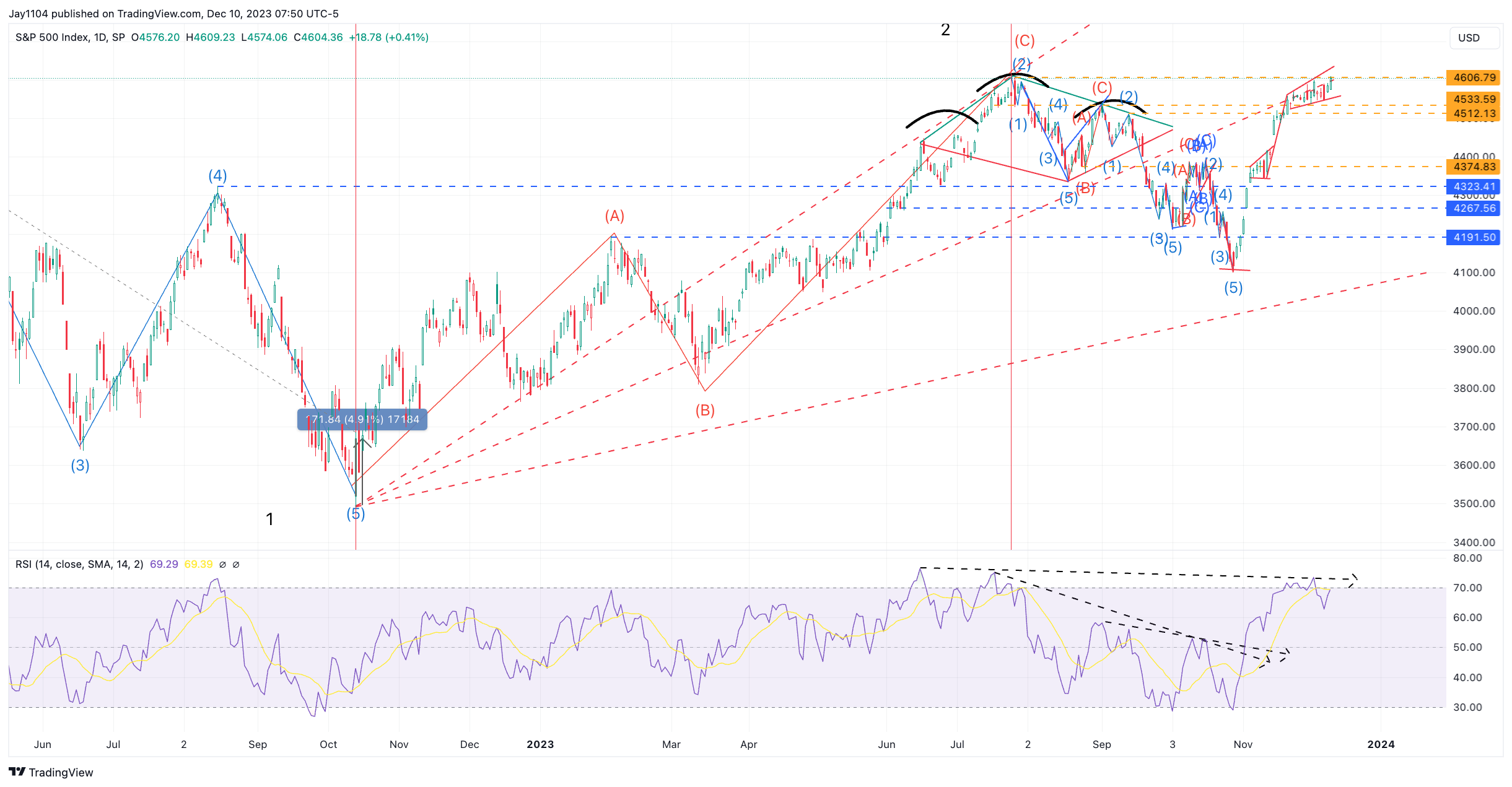

Meanwhile Prices edged higher on Friday and recently surpassed July highs. If we move down today It was not very important. But if we continue to move higher I’ll have to redraw my wave count and think harder.

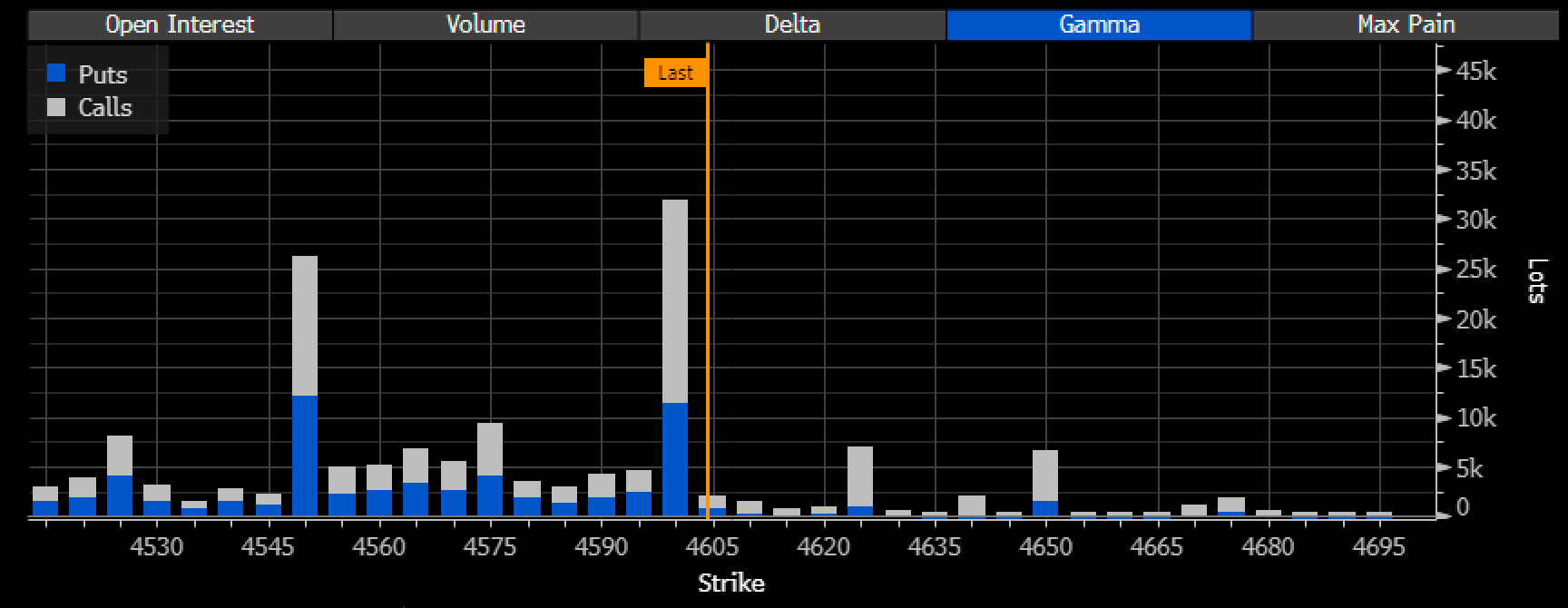

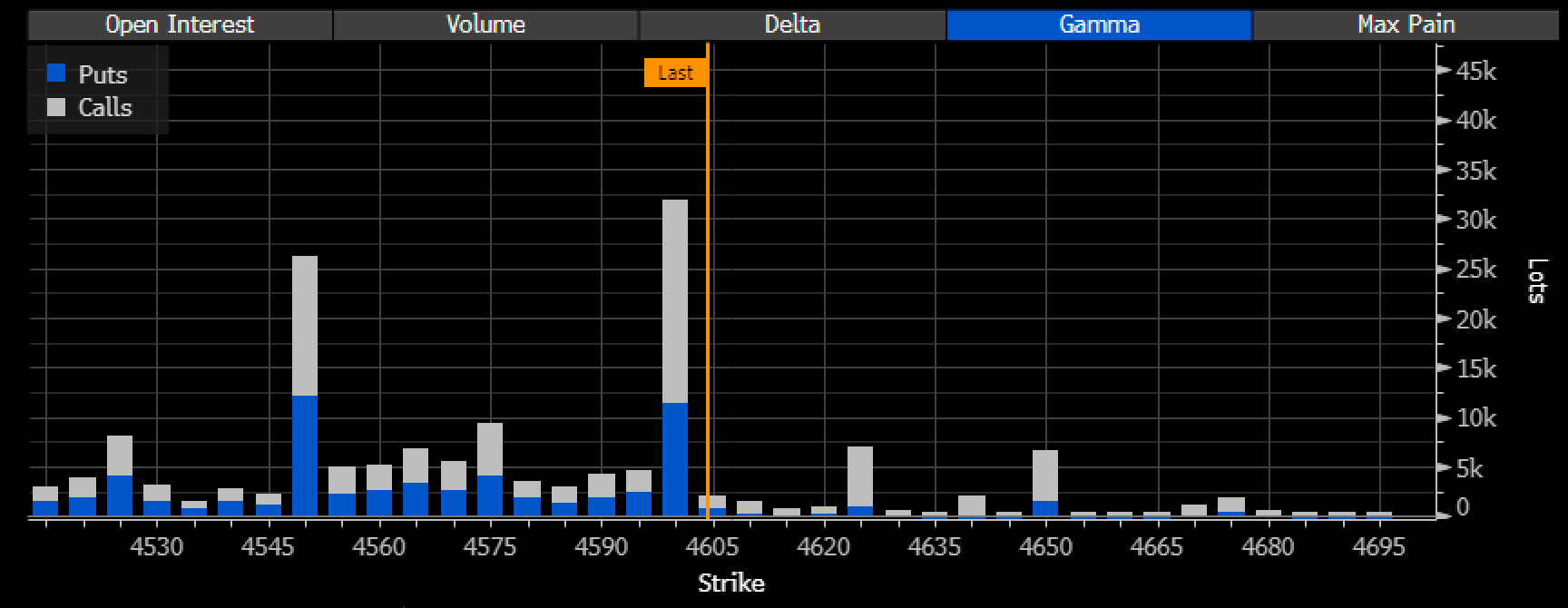

But according to reason There are several reasons why stocks shouldn’t continue to move higher. The most obvious reason is the price barrier this coming Friday at 4,600.

As far as I know That level has not changed. And as stated on Thursday There is a tendency to pull out telemarketers.

According to Goldman, the corporate blackout window will begin on Monday, with the $5 billion-a-day VWAP machine going into hibernation in mid-January.

If Friday’s price action seems like a gimmick, A lot of the above can be involved. This is because the buyback stopped at 3:00 PM ET, which is exactly when the mechanical movement ended.

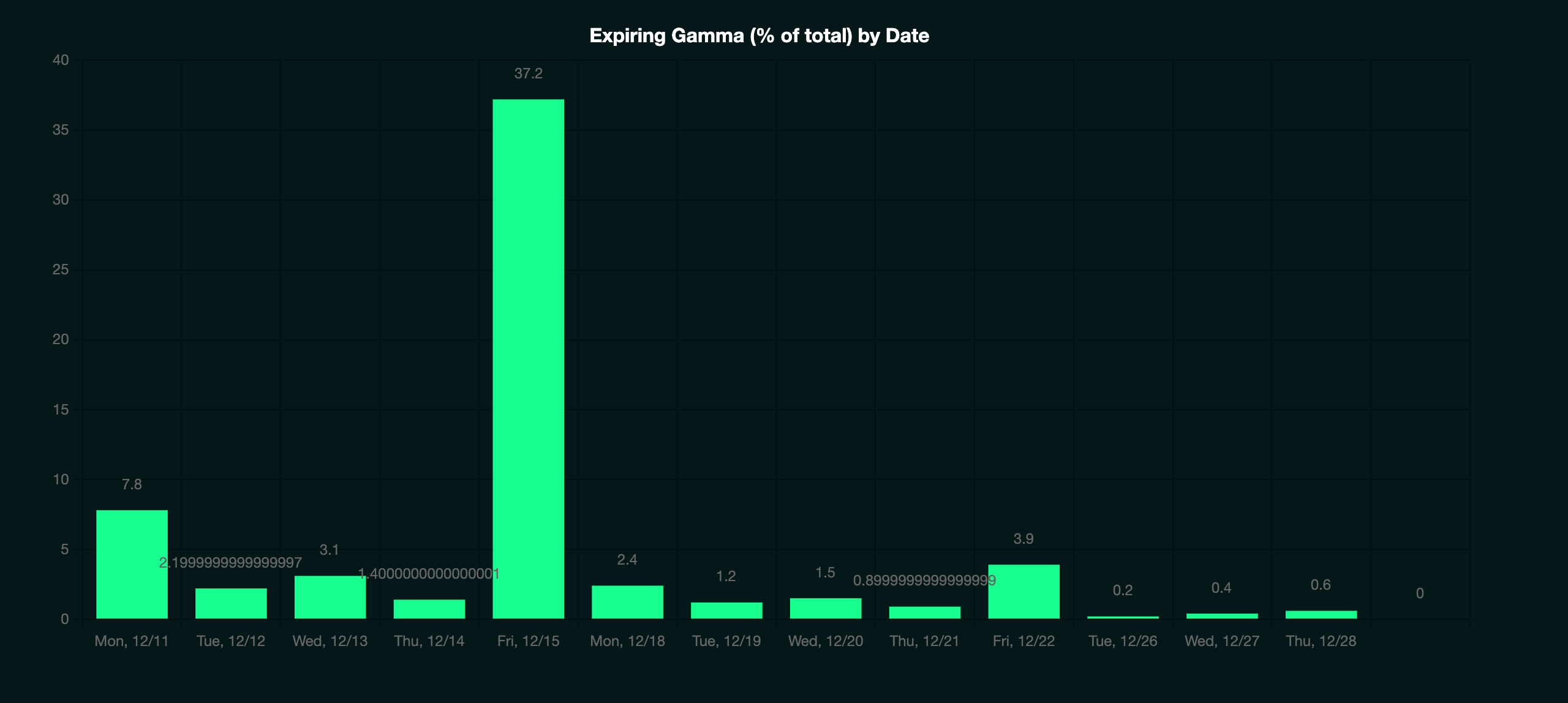

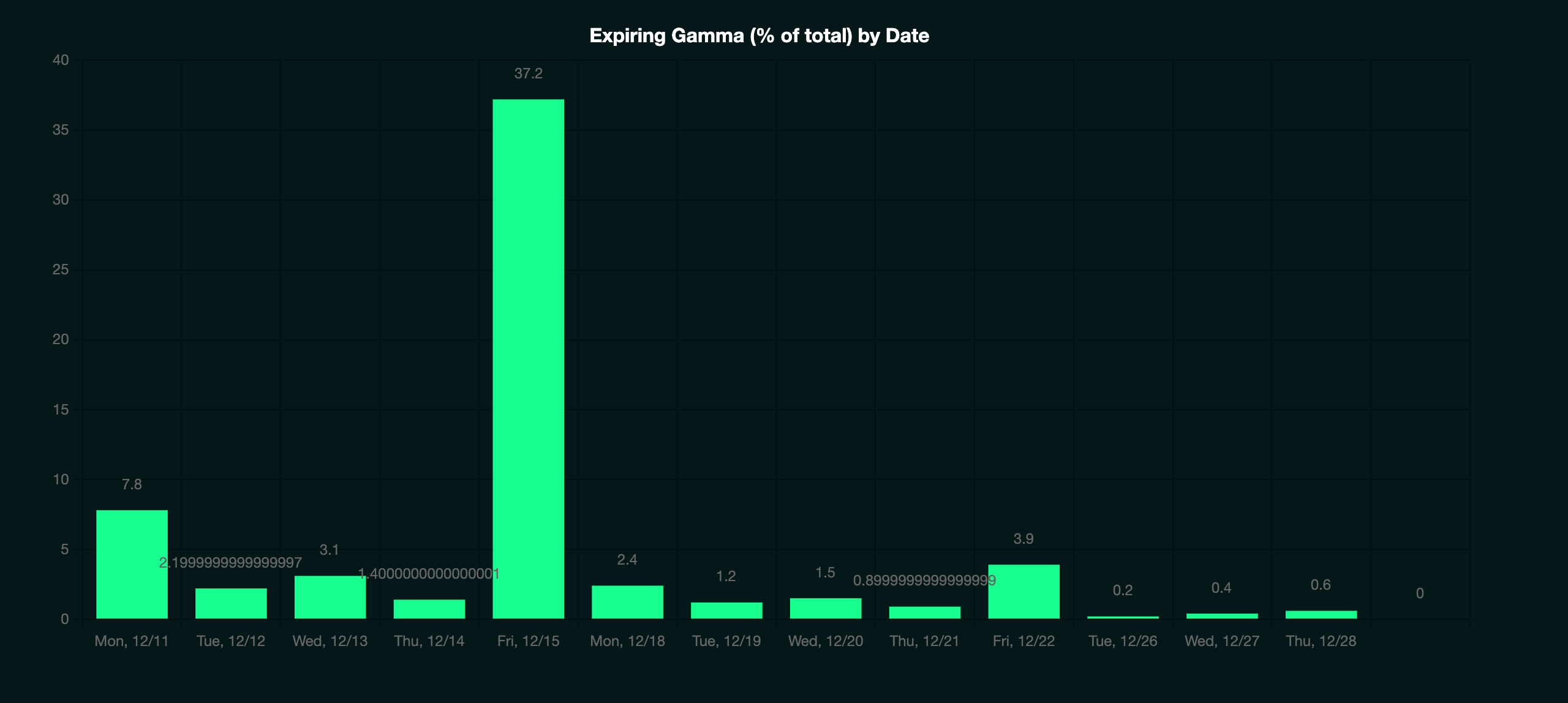

Meanwhile When we pass Opex on Friday, 37% of the S&P 500 gamma will be lost, which might increase volatility in the market.

Gamma loss and no buyback It will cause the market to become more volatile. This is especially true during many central bank meetings. The main central bank meeting will be the BOJ meeting which will take place next week.

If the BOJ decides to move on and exit the negative interest rate policy. It will begin to strengthen and the interest rate will be reduced. This puts stability at risk. This is because it is likely to begin to ease in trading. And it is difficult to Measure how much impact it will have.

The yen has begun to strengthen in anticipation of a change in policy stance from the BOJ.

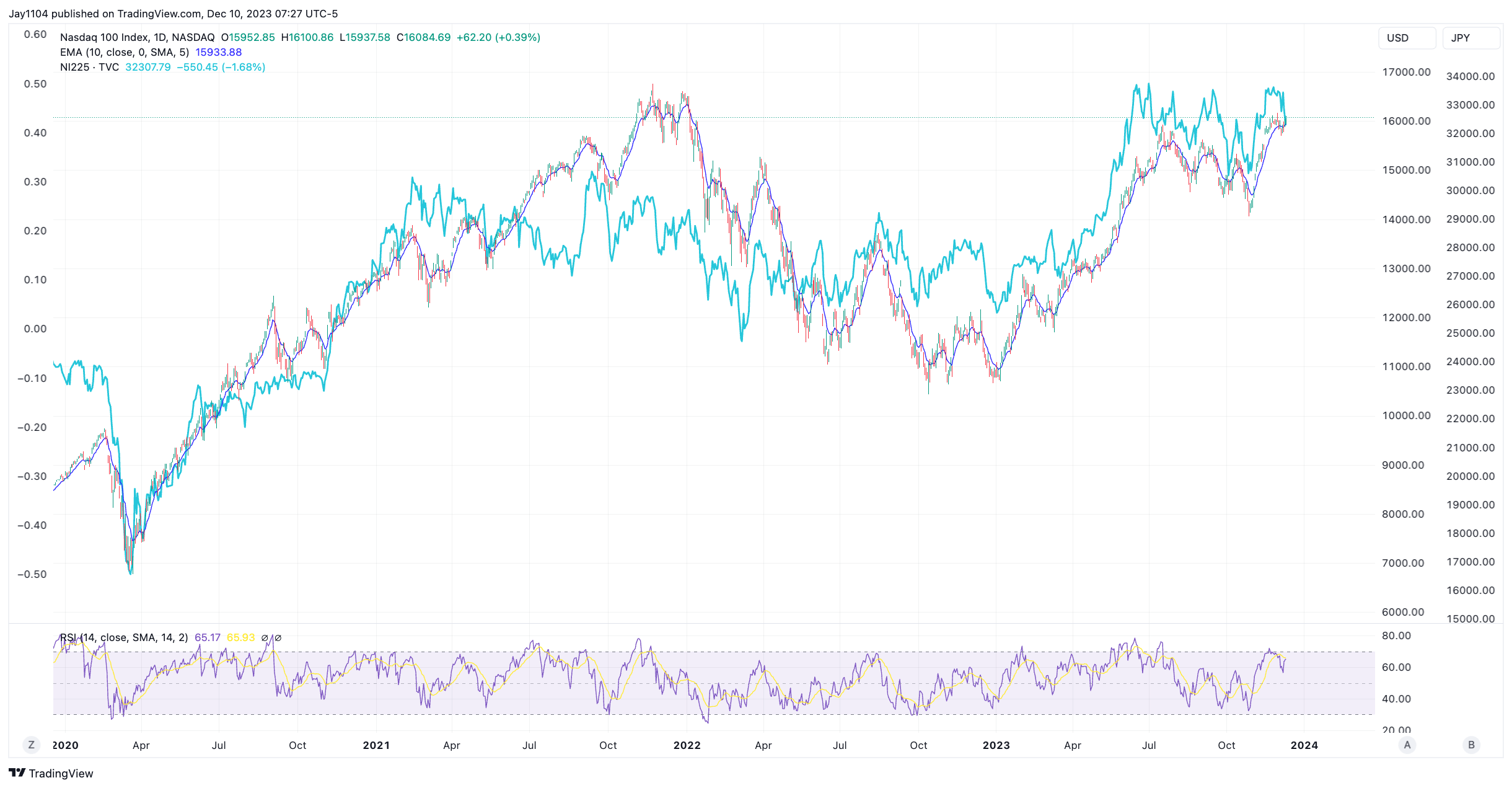

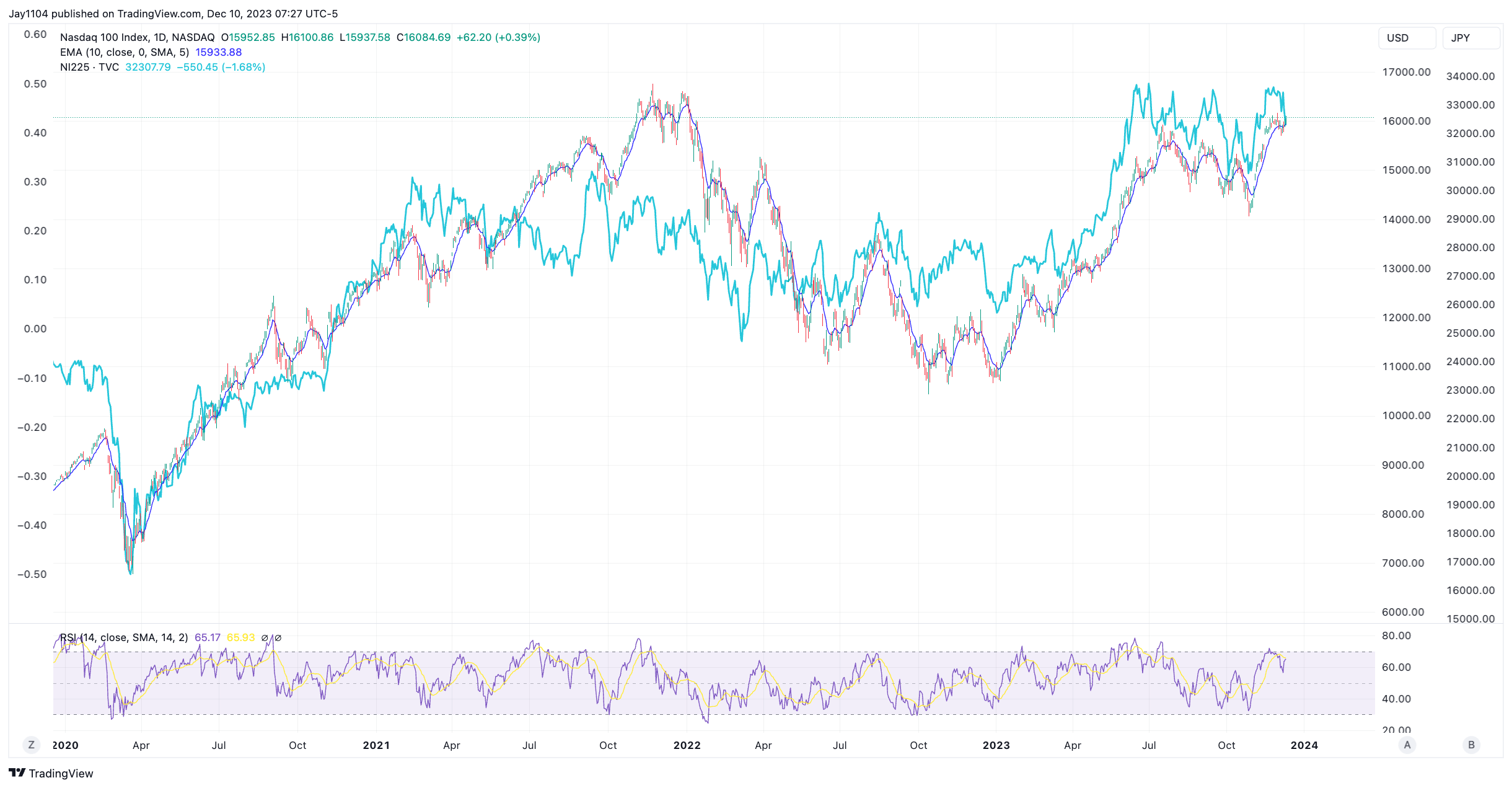

We can use the as a representative. Because if the rise of Nikkei is caused by the weakening of the yen, And it’s not because of a true bull market. A stronger yen will sink stocks in Japan.

In the end The leg higher in Japan started in March due to the depreciation of the yen.

Coincidental or not? The move higher in the Nikkei looks similar to the price rally we’ve seen over the same period.

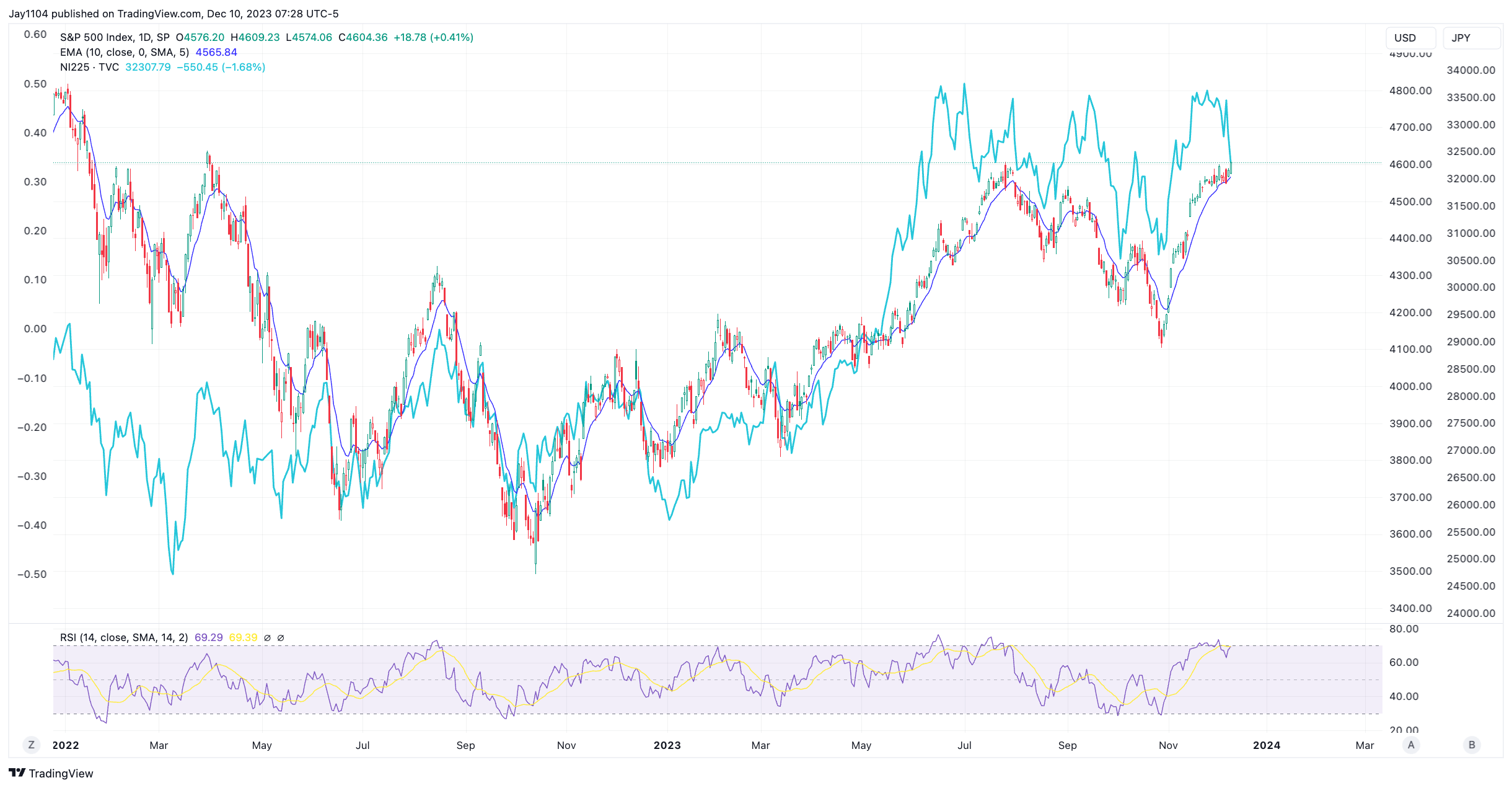

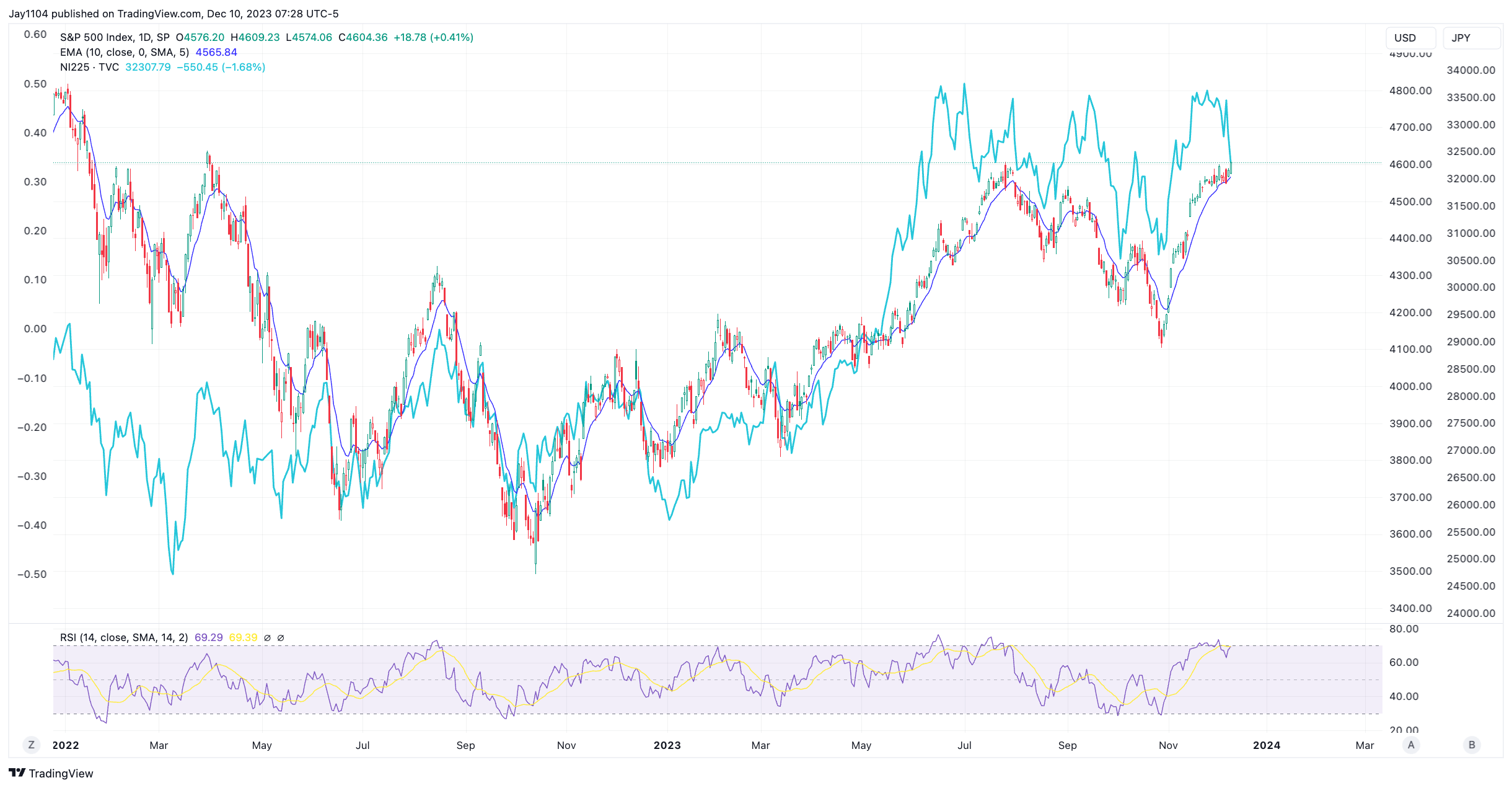

The same goes for the rally in the S&P 500.

Meanwhile The 1/3 velocity resistance line from the October 2022 lows continues to provide meaningful resistance for the S&P 500, and the rhombus pattern to me doesn’t seem valid unless we come back down sharply today.

However, the increasing extended wedge is still part of the larger pattern. And those expanding wedge tend to form a bearish pattern. There is also a Bearish Divergence pattern present in RSI.

So my thought process of the S&P 500 coming back to 4,100 and filling the gap is still valid for now. Friday’s rally did not cause enough damage to completely destroy the idea.

This week’s YouTube video is a 3-part series:

1702289335

#Stocks #week #ahead #Yearend #rally #faces #key #test #ahead #major #events #THAIFRX.com