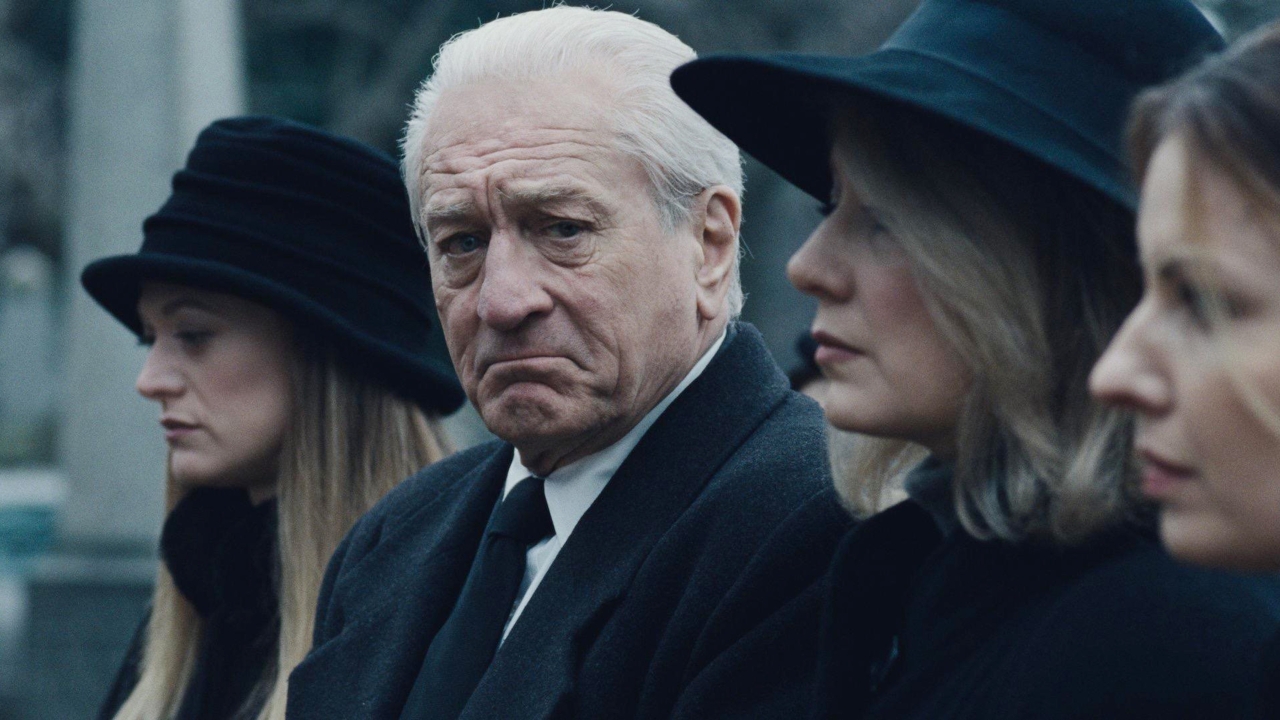

A trader works on the floor of the New York Stock Exchange. (Photo: Bryan R Smith | Reuters)

Wall Street enjoyed a important boost on Wednesday,fueled by a mix of positive inflation data and strong earnings reports from leading U.S. banks. The Dow Jones Industrial Average surged by 742 points, a 1.7% increase, while the S&P 500 and nasdaq Composite rose by 1.9% and 2.6%, respectively.

The Bureau of Labor Statistics released its December Consumer Price Index (CPI) report, showing that core inflation—which excludes volatile food and energy prices—rose by 3.2%. This figure was slightly lower than the previous month’s reading and below the 3.3% forecast by economists surveyed by Dow Jones. Headline inflation, which includes all categories, increased by 2.9% year-over-year, matching expectations.

“The market is breathing a sigh of relief as back-to-back inflation gauges, PPI yesterday and CPI this morning, came in slightly below expectations,” said john Kerschner, head of U.S. securitized products and portfolio manager at Janus Henderson Investors. He added, “Perhaps most importantly, today’s CPI number takes additional rate hikes off the table, which some market participants were beginning to prematurely price in.”

The 10-year Treasury yield,a key benchmark for borrowing costs,dropped sharply following the CPI report,falling by approximately 13 basis points to 4.663%. This decline in yields provided a boost to growth-oriented stocks, with Tesla and Nvidia seeing gains of around 5% and 2%, respectively.

The fourth-quarter earnings season also kicked off on a high note, with major U.S.banks surpassing analysts’ expectations. This strong performance further fueled investor optimism, contributing to the day’s market rally.

As markets continue to digest these developments,the focus now shifts to how these trends might influence future monetary policy decisions and corporate earnings. For now, investors are celebrating the dual tailwinds of easing inflation and strong financial results, which have injected fresh momentum into the stock market.

Major Banks Surge as Earnings Season Kicks Off with Strong Results

Table of Contents

- 1. Major Banks Surge as Earnings Season Kicks Off with Strong Results

- 2. JPMorgan Chase Leads the Charge

- 3. Goldman Sachs and Wells Fargo Deliver Strong Results

- 4. Citigroup Joins the Rally

- 5. What This Means for the Economy

- 6. How Major Bank Earnings and Inflation Data Are Shaping the Market in 2025

- 7. Inflation Data and Market Reaction

- 8. Bank Earnings as an Economic Bellwether

- 9. The Federal Reserve’s role

- 10. Looking Ahead

- 11. Market Rally Gains Momentum as Earnings Season Kicks Off

- 12. Earnings Season: A Promising Start

- 13. key Factors Shaping the Market’s Future

- 14. Conclusion: A Balanced Outlook

- 15. How are Wells Fargo and Citigroup’s earnings results impacting market sentiment?

- 16. Wells Fargo and Citigroup Set the Tone

- 17. Inflation Data Supports Market Optimism

- 18. The Federal Reserve’s Impact on the Market

- 19. What’s Next for the Market?

The financial sector is off to a strong start in 2025,with major banks reporting impressive earnings that have sparked a surge in their stock prices. These results not only highlight the resilience of the banking industry but also signal a positive trajectory for the broader economy.

JPMorgan Chase Leads the Charge

JPMorgan Chase kicked off the earnings season with a bang, as its shares rose nearly 2% following the release of its fourth-quarter results.The bank exceeded expectations, delivering both an earnings per share (EPS) and revenue beat. This success was driven by standout performances in fixed income trading and investment banking, showcasing the bank’s ability to thrive in a competitive market.

Goldman Sachs and Wells Fargo Deliver Strong Results

Goldman Sachs also made waves, with its stock price jumping 6% after surpassing both top- and bottom-line estimates for the quarter. This performance has reinforced investor confidence in the bank’s strategic direction and operational efficiency.

Wells Fargo joined the rally with an even more impressive 7% surge in its stock price. The bank’s proclamation of a projected 1% to 3% increase in net interest income by 2025 has been met with widespread optimism, reflecting strong expectations for future profitability.

Citigroup Joins the Rally

Citigroup rounded out the positive news with a 7% increase in its stock price, driven by fourth-quarter earnings that exceeded estimates. This strong performance underscores Citigroup’s ability to navigate challenging market conditions and maintain its position as a key player in the financial sector.

What This Means for the Economy

The robust earnings reports from these banking giants are more than just a win for investors—they also serve as a key indicator of the overall health of the economy. As Larry Tentarelli, chief technical strategist at Blue Chip Daily Trend Report, noted, “We got a good start today to earnings season. The bank earnings are key because the financial sector is so tied to the general economy. So for these big banks to put up bullish numbers today, I think it does bode well.”

these results highlight the resilience of the banking sector and its critical role in driving economic growth. As the year progresses,all eyes will be on how these institutions continue to adapt and innovate in an ever-evolving financial landscape.

How Major Bank Earnings and Inflation Data Are Shaping the Market in 2025

The financial sector has kicked off 2025 with a bang,as major U.S. banks like JPMorgan Chase, Goldman Sachs, Wells Fargo, and Citigroup reported robust earnings.These results have not only bolstered investor confidence but also provided a glimpse into the broader economic landscape. With inflation easing and the Federal Reserve possibly pausing rate hikes, the market is buzzing with optimism. But what does this mean for the economy, and how should investors interpret these developments?

Inflation Data and Market Reaction

Recent inflation data has been a key driver of market sentiment. The December Consumer Price index (CPI) report showed core inflation—excluding volatile food and energy prices—at 3.2%, slightly below expectations. This, coupled with the Producer Price Index (PPI) data, has reassured investors that inflationary pressures are easing. john Kerschner, Head of U.S.Securitized Products and Portfolio Manager at Janus Henderson Investors, noted, “The market’s reaction to the CPI report has been quite positive, and for good reason. The numbers suggest that inflationary pressures are continuing to ease, which is a critical factor for the Federal Reserve’s monetary policy decisions.”

The 10-year Treasury yield also saw a significant drop following the CPI report, which has had a ripple effect across the market. Kerschner explained, “When yields fall, borrowing costs decrease, which is especially beneficial for growth-oriented companies that rely on financing for expansion.” This dynamic has been evident in the performance of stocks like Tesla and Nvidia, which posted gains of around 5% and 2%, respectively.

Bank Earnings as an Economic Bellwether

The strong earnings reported by major U.S. banks have been another critical factor driving market optimism. The financial sector is often viewed as a barometer for the broader economy, and when banks perform well, it signals economic stability and growth. Kerschner highlighted, “The strong earnings from major U.S. banks were a significant catalyst for the rally. When banks report strong earnings, it signals that the economy is on solid footing.”

This quarter, JPMorgan Chase, Goldman Sachs, Wells Fargo, and Citigroup all exceeded expectations, setting a positive tone for the year ahead. Their performance reflects not only their resilience but also the strength of the U.S. economy as a whole.

The Federal Reserve’s role

As the market digests the latest inflation data and bank earnings, all eyes are on the Federal Reserve. With inflationary pressures easing, the likelihood of additional rate hikes has diminished.Kerschner noted, “The market is now more confident that additional rate hikes are off the table, at least for the near term.” This shift in expectations has created a favorable environment for both equities and fixed-income securities.

Though, the Fed’s future actions remain a critical variable. Any unexpected changes in monetary policy could disrupt the current market momentum.For now, though, investors are enjoying a period of relative stability and growth.

Looking Ahead

As earnings season continues, the financial sector will remain in the spotlight. The strong start by major banks has set a positive tone, but the coming weeks will reveal whether this momentum can be sustained. For now, investors and analysts alike are celebrating a promising beginning to 2025.

In the words of John Kerschner, “The market is re-pricing risk in a lower-rate habitat.” This sentiment reflects the broader implications of the banking sector’s performance. When major financial institutions thrive,it often signals stability and growth in the economy,which can have a ripple effect across various industries.

As we move further into 2025, the interplay between inflation, interest rates, and corporate earnings will continue to shape the market. Investors would do well to stay informed and agile, ready to adapt to the ever-changing economic landscape.

Market Rally Gains Momentum as Earnings Season Kicks Off

The stock market is riding a wave of optimism as major financial institutions like Wells Fargo and Citigroup report earnings that have exceeded analysts’ expectations. This strong performance has considerably boosted investor confidence, creating a favorable environment for a sustained market rally.the combination of easing inflation and robust corporate earnings has set the stage for what many are calling a “perfect storm” for growth.

Earnings Season: A Promising Start

With the fourth-quarter earnings season now in full swing,the initial results have been nothing short of encouraging.John Kerschner, a seasoned market analyst, shared his thoughts on the current momentum. “It’s still early in the earnings season, but the initial results are certainly encouraging,” he said. “If other sectors follow the lead of the financials and report strong earnings, we could see this momentum continue.”

However, Kerschner also emphasized the importance of corporate guidance. “Earnings are backward-looking, but guidance gives us a sense of what to expect in the coming quarters,” he noted. “If companies provide optimistic outlooks, that could further fuel the rally.On the flip side, any signs of weakness in guidance could temper the market’s enthusiasm.”

key Factors Shaping the Market’s Future

Looking ahead, several critical factors are expected to influence the market in the coming months. Kerschner highlighted inflation trends, Federal Reserve policies, and corporate earnings as the primary drivers. “if inflation continues to ease, that will give the Fed more room to possibly cut rates later in the year, which would be a positive for the market,” he explained.

He also stressed the need for strong corporate earnings to justify current valuations. “Corporate earnings will need to remain strong to justify current valuations,” Kerschner said. “Geopolitical risks and global economic conditions will also play a role, so investors will need to stay vigilant.”

For now, the market is benefiting from the dual tailwinds of easing inflation and strong financial results, which have injected fresh momentum into the stock market.This combination has created a sense of optimism among investors, who are closely watching how these trends unfold in the months ahead.

Conclusion: A Balanced Outlook

While the current market rally is fueled by positive earnings and easing inflation, the road ahead remains uncertain. Investors are advised to keep a close eye on corporate guidance, inflation data, and Federal Reserve policies.As Kerschner aptly put it, “The market is enjoying the dual tailwinds of easing inflation and strong financial results, but vigilance is key in navigating the months ahead.”

How are Wells Fargo and Citigroup’s earnings results impacting market sentiment?

Tions. This strong start to the earnings season has fueled a broader market rally, with investors buoyed by the positive results and the implications they hold for the economy. As inflation data continues to show signs of easing, the Federal Reserve’s monetary policy decisions are also playing a pivotal role in shaping market sentiment. here’s a closer look at how these factors are driving the market in 2025.

Wells Fargo and Citigroup Set the Tone

Wells Fargo and Citigroup have emerged as standout performers this earnings season, with both banks reporting results that surpassed expectations. Wells Fargo’s stock surged by 7% following its announcement of a projected 1% to 3% increase in net interest income by 2025. This optimistic outlook has been met with enthusiasm from investors, who see it as a sign of the bank’s resilience and potential for growth.

Citigroup, on the other hand, reported a 7% increase in its stock price after delivering fourth-quarter earnings that exceeded estimates. The bank’s strong performance in navigating challenging market conditions has reinforced its position as a key player in the financial sector.These results have not only boosted investor confidence in the banking industry but also signaled a positive trajectory for the broader economy.

Inflation Data Supports Market Optimism

Recent inflation data has further bolstered market optimism. The December Consumer Price Index (CPI) report showed core inflation at 3.2%, slightly below expectations, while the Producer Price Index (PPI) data also indicated easing inflationary pressures. This has reassured investors that the Federal Reserve may pause its rate hikes,creating a more favorable environment for both equities and fixed-income securities.

John Kerschner, Head of U.S. Securitized Products and Portfolio Manager at Janus Henderson Investors, noted, “The market’s reaction to the CPI report has been quite positive, and for good reason.The numbers suggest that inflationary pressures are continuing to ease, which is a critical factor for the Federal Reserve’s monetary policy decisions.” This sentiment has been reflected in the performance of growth-oriented stocks like Tesla and Nvidia, which posted gains of around 5% and 2%, respectively.

The Federal Reserve’s Impact on the Market

As the market digests the latest inflation data and bank earnings,the Federal Reserve’s role remains a key focus.With inflationary pressures easing, the likelihood of additional rate hikes has diminished, creating a more stable environment for investors.Kerschner explained, “The market is now more confident that additional rate hikes are off the table, at least for the near term.” This shift in expectations has contributed to the current market momentum, with investors enjoying a period of relative stability and growth.

However, the Fed’s future actions remain a critical variable. Any unexpected changes in monetary policy could disrupt the current market trajectory. For now,though,the combination of strong bank earnings and easing inflation has created a favorable backdrop for the market rally.

What’s Next for the Market?

As earnings season continues, the financial sector will remain in the spotlight. The strong start by major banks like Wells Fargo and Citigroup has set a positive tone, but the coming weeks will reveal whether this momentum can be sustained. investors and analysts alike are closely watching how other sectors perform and how the broader economic landscape evolves.

In the words of John Kerschner, “The market is re-pricing risk in a lower-rate habitat.” This sentiment reflects the broader implications of the banking sector’s performance. When major financial institutions thrive, it often signals stability and growth in the economy, which can have a ripple effect across various industries.

As we move further into 2025, the interplay between inflation, interest rates, and corporate earnings will continue to shape the market. Investors would do well to stay informed and agile, ready to adapt to the ever-changing economic landscape. the current market rally, driven by strong bank earnings and easing inflation, offers a promising start to the year, but vigilance and strategic planning will be key to navigating the months ahead.