Overview of the stock market session 1/2. Source: Vietstock

VN-Index dropped nearly 36 points, officially “broken” 1,100 points

Following the recovery trend of the previous session, VN-Index opened the first session of February (1/2) with an increase of nearly 4 points. Food production, seaports, steel, oil and gas were the groups that attracted strong cash flow from the beginning of the morning session.

As of 9:25 a.m., VN-Index increased by more than 5 points and traded around 1,116 points; HNX-Index increased by nearly 2 points, trading around 224 points.

The VN30 basket at this time had 20 gainers, 7 losers and 3 standstill stocks. The most active transactions in the basket were VIB, NVL, and HDB. On the other side, VJC, TPB and VRE were leading losers.

Banking stocks at this time are also positively affecting the VN-Index with prominent names such as VCB, CTG, HDB, TCB…

However, towards the end of the morning session, selling started to appear, causing the VN-Index to gradually retreat to reference. At 10:20 am, VN-Index only increased by more than 2 points, HNX-Index increased by more than 1 point.

At 11 am, the group of banking stocks started to turn around, followed by the decline of a series of large-cap stocks. Specifically, the leading codes in the banking group at this time such as VCB, CTG, TCB turned to decline. Other codes like ACB, STB… were all in red.

Stock codes strongly influenced VN-Index in session 1/2. Source: Vietstock

In the VN30 basket, red dominated with 18 losers and 12 gainers. Stocks like GAS, HDB and NVL were the ones with the most positive impact when contributing to nearly 2 points up the VN-Index. Meanwhile, on the other side, VHM, MSN and CTG are the codes that have the most negative impact on VN-Index when removing more than 3 points from this index.

The focus in this morning session were the two “big guys” in the steel industry. Accordingly, by the end of the morning session, Hoa Phat Group’s shares recorded the number of matched shares up to nearly 22.8 million units, equivalent to nearly 510 billion dong. Second in terms of transaction value is another “big man” in the steel industry – HSG with nearly 219 billion dong.

At the end of the morning session, VN-Index dropped 4.75 points, back to 1,106.43 points; HNX-Index inched slightly 0.5 points, reaching 222.93 points. While UPCoM-Index increased 0.3 points (0.4%) to reach 76.14 points.

VN-Index dropped to 35.21 points. Source: Vietstock

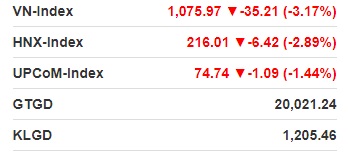

Entering the followingnoon session, selling pressure appeared from the middle of the session and lasted until the end of the session, making the market red. The VN-Index fell 10 points, 20 points, and then 30-35 points, respectively. Before closing time, VN-Index fell to 35.21 points and VN-Index broke through 1,100 points once more.

The efforts of HDB, MWG or even NVL to reach the limit at the end of the session might not support the falling momentum from key stocks such as VCB, VHM, BID, MSN, VPB, etc.

At the close, VN-Index dropped 35.21 points (3.17%) to 1,075.97 points, HNX-Index dropped 6.42 points (2.89%) to 216.01 points.

Market turnover reached more than 20,102 billion dong.