Material prices today 1/3: Construction iron and steel prices today on the Shanghai Exchange

Steel price today delivered in May 2023 on the Shanghai Exchange increased 49 yuan to 4,219 yuan / ton.

The price of steel for delivery in October 2023 on the Shanghai Exchange increased by 6 yuan to 4,129 yuan / ton.

On Tuesday (February 28), iron ore futures on the Dalian Exchange (DCE) and the Singapore Exchange (SGX) showed different trends due to the mixed short-term market outlook.

Specifically, iron ore futures for delivery in May 2023 on DCE ended the day trading with a decrease of 0.78% to 888.5 yuan / ton (equivalent to 127.98 USD / ton).

Meanwhile, on the Singapore Exchange (SGX), iron ore contract SZZFH3 for delivery in March 2023 was trading at 123.8 USD/ton, up 0.87% on the same day.

2023 is expected to get off to a dismal start as global economies slow amid market fears of a higher risk of a recession. The International Monetary Fund (IMF) forecasts that global economic growth will slow to 2.7% in 2023 from 3.2% in 2022.

The IMF warned that growth might fall below 2% due to tighter monetary policies due to inflation, weaker growth in China, and food and supply chain disruptions due to the war between Ukraine and Ukraine. and Russia.

According to the OECD forecast, GDP growth of the ASEAN region is forecast at 5.2% in 2023, significantly higher than many other economies amid the gloomy global economic outlook.

According to the World Steel Association (Worldsteel), the total global crude steel production in 11 months of 2022 reached 1.691 billion tons, down 3.7% over the same period in 2021.

Worldsteel forecasts global steel demand will decline 2.3% in 2022 to 1,796.7 million tons following increasing 2.8% in 2021. In 2023 steel demand will recover 1.0% to 1,814.7 million tons.

In particular, demand in both the US and European markets is expected to decrease next year due to the economic downturn. Demand in the ASEAN market is expected to remain stable in 2023, following growing 4~6% in 2022.

However, exports to long-standing trading partners may still be affected by capacity increases in recent years in neighboring countries such as Malaysia, Indonesia, and the Philippines. Accordingly, it is forecast that finished steel exports may decrease by more than 10% over the same period in 2023.

Material prices today 1/3: Steel prices rebounded on the trading floor

With domestic steel, in a recent report, Bank for Investment and Development of Vietnam Securities Joint Stock Company (BSC) expects that by 2023, steel consumption will have a recovery thanks to the removal of policies on steel. real estate. However, the recovery rate of steel output will be slow because the domestic real estate market slows down when businesses need time to restructure projects, major economies are expected to continue to decline, dragging down the economy. according to reduced demand.

Accordingly, BSC forecasts that total steel consumption will increase by 3-5% compared to 2022. Steel prices are in a downward trend in 2022 due to weak demand. In which, the price of steel at the construction plant decreased by 11%, the price of steel pipe decreased by 20%, the price of galvanized steel decreased by 10%. Retail steel prices may have a larger decrease as mills increase dealer discounts.

By the end of 2022, with steel enterprises increasing their prices once more and agent inventories at low levels, BSC believes that the steel market is temporarily balanced. In 2023, in the first quarter, BSC expects that the general steel price level can recover 2-3% over the same period due to seasonality and the world steel price recovers when China opens. In the second and third quarters, steel price movements will depend on the level of recovery from steel demand. With the view that the speed of recovery in demand is still slow in 2023, steel supply may increase once more when China opens, BSC believes that steel prices may correct down once more.

On February 23, a number of steel manufacturers raised steel prices from 150,000 to 210,000 VND/ton with CB240 coil, to regarding 15.7-16 million VND/ton, according to Steel Online data.

Specifically, Hoa Phat steel company in the North and Central region raised VND 200,000/ton for CB240 coil, steel prices in the two regions were VND 15.96 million/ton and VND 15.88 million/ton, respectively. . In the South, Hoa Phat increased by 150,000 VND/ton with CB240 steel coil to 15.98 million VND/ton.

Similarly, Vietnam Italy steel brand also raised 200,000 VND/ton with CB240 coil to 15.91 million VND/ton.

With Viet Duc Steel, CB240 coil is currently priced at VND 15.71 million/ton following this business adjusted an increase of VND 210,000/ton.

With an increase of 200,000 VND/ton, the price of CB240 steel coil of Viet Sing brand is at 15.83 million VND/ton.

Up to 8:00 am on February 23, only some of the above brands increased the price of CB240 coil, the rest of enterprises such as Kyoei, Southern Steel, Tuyen Quang Steel, Thai Nguyen Steel, Viet Nhat Steel, Pomina… not yet. take corrective action.

Thus, from the beginning of 2023 up to now, the price of CB240 coil has had 5 upward adjustments, depending on the brand.

The Vietnam Steel Association (VSA) said that the current average domestic construction steel price increased by regarding 5% compared to the end of 2022 but still 8% lower than the same period last year.

Because the selling price of finished steel increased more slowly than the growth rate of input materials, the business performance of construction steel companies was still low, and it was difficult from purchasing input materials to consuming output finished products.

VSA said that the price of raw materials increased significantly, causing domestic factories to increase selling prices many times to compensate for production costs and reduce losses. The mills have moves to adjust the price of coil/rebar or CB4, CB5/CB3 of the mills, showing that the price increase and price structure by category is being carried out step by step.

After being adjusted, the steel prices of the brands today are as follows:

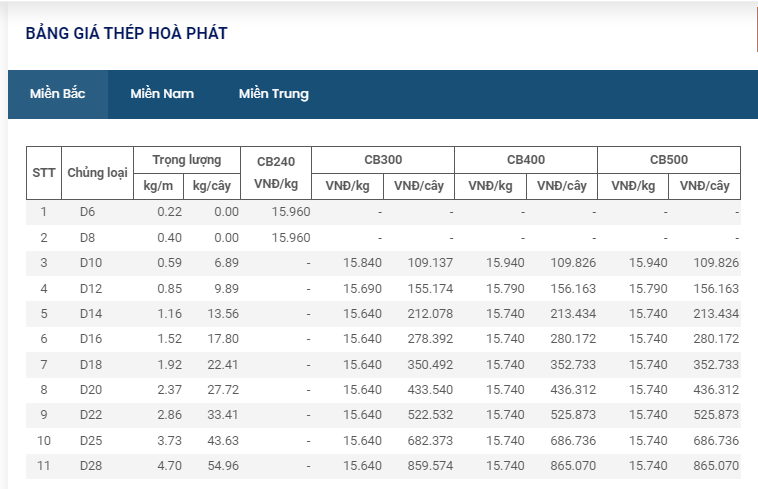

According to SteelOnline.vn, the price of Hoa Phat steel brand is as follows: CB240 coils up to 15,960 VND/kg; D10 CB300 rebar is priced at 15,840 VND/kg.

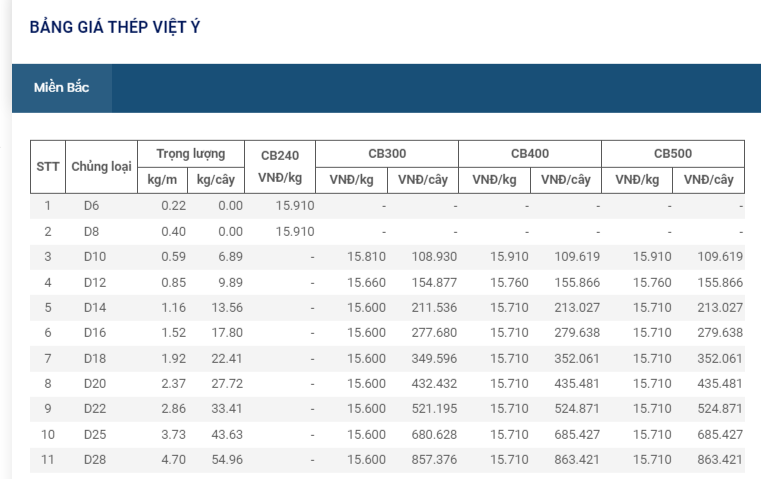

The price of Vietnam Italy Steel is as follows: CB240 coil line is at VND 15,910/kg; D10 CB300 steel is priced at VND 15,810/kg.

Viet Sing Steel, its two product lines include CB240 steel coil priced at VND 15,830/kg; D10 CB300 rebar is priced at 15,830 VND/kg.

VAS steel, currently CB240 coils and D10 CB300 rebars are priced at 15,680 VND/kg and 15,580 VND/kg.

Viet Nhat Steel, with CB240 coils and D10 CB300 rebars, are priced at VND 15,880/kg.

Viet Duc steel brand, with CB240 steel coil priced at VND 15,710/kg; with D10 CB300 rebar with the price of 15,810 VND/kg.

Material price today 1/3

Material price today 1/3

Hoa Phat Steel, with CB240 coil line at VND 15,880/kg; D10 CB300 rebar is priced at VND 15,730/kg.

Viet Duc Steel, CB240 coil line is priced at VND 16,060/kg; D10 CB300 rebar is priced at 16,060 VND/kg.

VAS steel, with CB240 coil at VND 15,680/kg; D10 CB300 rebar is priced at 15,580 VND/kg.

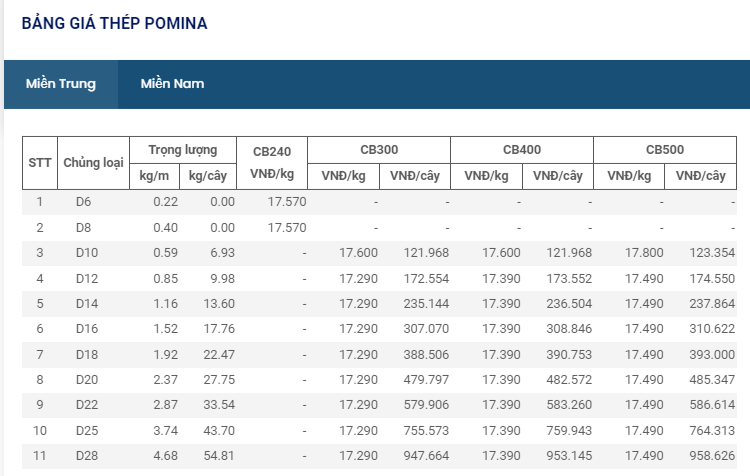

Pomina Steel, CB240 coil line is priced at 17,570 VND/kg; D10 CB300 rebar line is priced at 17,600 VND/kg.

Material price today 1/3

Material price today 1/3

Steel prices in the South

Hoa Phat Steel, with CB240 coil at VND 15,980/kg; D10 CB300 rebar is priced at VND 15,880/kg.

VAS steel, currently CB240 coil line is at VND 15,580/kg; D10 CB300 rebar is priced at 15,680 VND/kg.

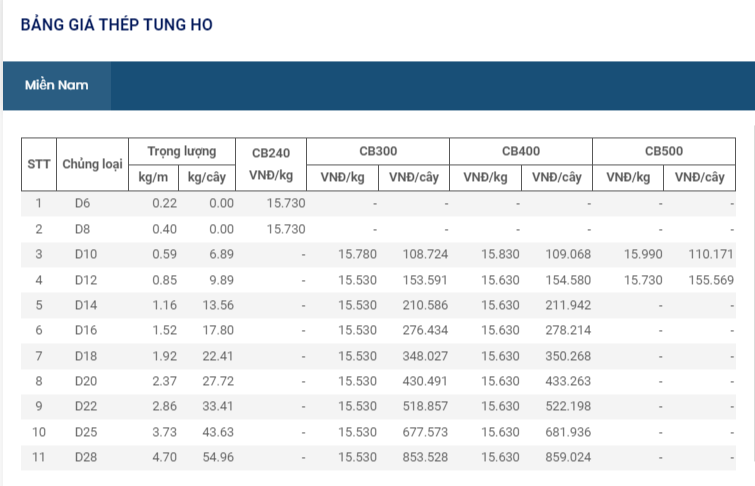

Tung Ho Steel, with CB240 coil at VND 15,730/kg; D10 CB300 rebar is priced at 15,780 VND/kg.

Pomina Steel, with the CB240 coil line, is priced at VND 17,290/kg; D10 CB300 rebar is priced at 17,390 VND/kg.

Material price today 1/3

Material price today 1/3