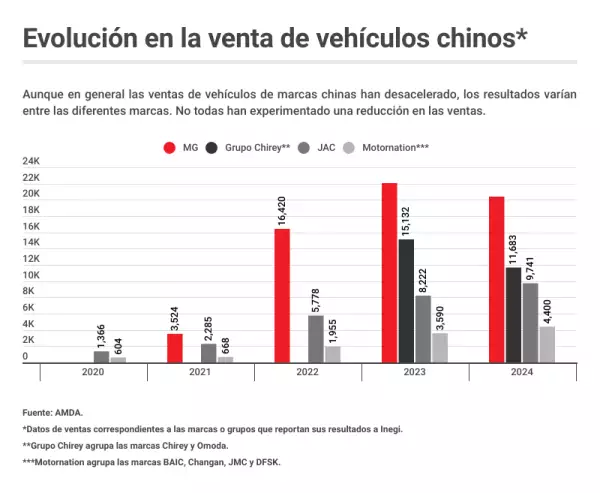

Chinese brands that make their sales data public sold 46,226 vehicles in Mexico between January and May 2024, a decrease from 49.01 units sold during the same period in the previous year, according to the latest data from Inegi. This decline is attributed, in part, to challenges with sales and following-sales service.

“Competition is fierce and they have taken a portion of the market. However, their share has been shrinking as major brands have replenished their inventory. The performance of Chinese brands has declined, it is no longer the same as it was a year or a year and a half ago,” said Alfonso Chiquini, Marketing Director of Volkswagen in Mexico.

We recommend: Chinese cars in Mexico: this is the list of the five best-selling cars

Service and spare parts, the Achilles heel

According to the 2024 Mexico Sales Satisfaction Index (SSI) Study conducted by the consulting firm JD Power, Chinese automakers scored 843 points, the lowest in the entire study. In contrast, European and American brands followed with 874 and 878 points, respectively. This study assesses customer satisfaction during the purchase of a new vehicle.

The perception is not better in following-sales service. Some owners of Chinese-brand cars in Mexico face long waiting times for repairs. This inconvenience, which can sometimes last up to four months, is caused by bureaucratic and logistical hurdles that complicate the importation of necessary spare parts for major repairs, coupled with a lack of agreements between insurance companies and dealer groups.

The problem of spare parts and following-sales service is significant. “It is frustrating to have to wait so long for a repair. When I bought my car, I didn’t expect following-sales service to be so problematic,” said Juan Carlos Ramírez, owner of a Chirey model.

These complaints are not isolated and have begun to impact consumer perception of Chinese brands. Despite their initial appeal and competitive prices, the following-sales experience is critical for customer loyalty and long-term brand reputation.

Chinese brands are taking steps to improve these aspects. Some have started investing in the creation of spare parts distribution centers in Mexico to reduce wait times. They are also working on establishing better relationships with insurers to expedite repair processes.

We recommend: Chinese car brands aim for supremacy in the pickup segment

“We know we have areas for improvement and we are working on them. We want our customers to have the best possible experience, not only at the time of purchase, but also followingwards,” Charlie Zhang of Chery International said in an interview last year.

Brands that have recently entered the Mexican market have also acknowledged the importance of ensuring the availability of spare parts. Pedro Albarrán, vice president and general manager of GWM, commented that spare parts were the first to arrive in Mexico. “Before launching our first model, we already had a large spare parts warehouse with a catalog of over 300,000 spare parts for both corrective and preventive maintenance,” he shared during an interview prior to the brand’s launch.

GAC has adopted a similar strategy. The availability of spare parts has been essential in GAC’s launch in Mexico. Osvaldo Ramírez, manager of spare parts and accessories for GAC Mexico, explained at the beginning of the year that, based on the experience of other brands, they built up an initial stock based on sales projections and estimated percentages of vehicles involved in collisions, which typically face longer import times.

(Yvet Rodríguez)

An opportunity

Western car manufacturers have viewed following-sales service as an opportunity to regain ground lost to Chinese brands in recent years.

“The only way to advance or even survive in an increasingly competitive industry is through following-sales service. This includes warranties, spare parts and vehicle repairs, among others. The Mexican consumer is very demanding and, although they may ‘stumble’ when buying something new, they are also very rational and think in the medium and long term. That is why we are focusing on following-sales,” said Miguel Barbeyto, president of Mazda in Mexico.

The automotive market in Mexico remains attractive and dynamic. Chinese brands have demonstrated their ability to be aggressive competitors, capable of adapting quickly and innovating in a highly competitive market. However, to ensure their long-term survival and growth, they must address challenges related to following-sales service and customer satisfaction.

“Each brand must develop its own strategies to ensure recognition and avoid the stigma associated with Chinese cars. The fact that one or two brands lack spare parts does not mean that this is the case for all of them,” said Isidoro Massri, general manager of JAC in Mexico.

Chinese Car Sales in Mexico Stumble as After-Sales Service Lags Behind

Chinese brands making their sales data public have reported a decline in car sales in Mexico, selling 46,226 vehicles between January and May 2024, compared to 49.01 units in the same period the previous year. This decline is attributed to various factors, including challenges in sales and following-sales service.

“The competition is present and they have taken a percentage of the market. However, their share has been decreasing as the big brands have reestablished our inventory. The performance of the Chinese brands has decreased, it is no longer the same as it was a year or a year and a half ago,” said Alfonso Chiquini, Marketing Director of Volkswagen in Mexico.

We recommend: Chinese cars in Mexico: this is the list of the five best-selling cars

Service and spare parts, the Achilles heel

The 2024 Mexico Sales Satisfaction Index (SSI) Study by JD Power highlights the challenges faced by Chinese automakers in the following-sales service domain. The study, which evaluates customer satisfaction during the purchase of a new vehicle, awarded Chinese car manufacturers 843 points, the lowest score in the entire study. European and American brands scored 874 and 878 points, respectively.

The perception is not better in following-sales service. Many owners of Chinese-brand cars in Mexico face difficulties with prolonged waiting times for repairs. This inconvenience, sometimes lasting up to four months, is attributed to bureaucratic and logistical hurdles that impede the importation of necessary spare parts for major repairs. Furthermore, the lack of agreements between insurance companies and dealer groups exacerbates the problem.

The problem of spare parts and following-sales service is not minor. “It is frustrating to have to wait so long for a repair. When I bought my car, I didn’t think that following-sales service would be so problematic,” said Juan Carlos Ramírez, owner of a Chirey model.

These recurring complaints are affecting consumer perception of Chinese brands. Despite their initial allure and competitive prices, the following-sales experience plays a crucial role in customer loyalty and long-term brand reputation.

Chinese brands are actively working to improve these aspects. Some have started investing in spare parts distribution centers in Mexico to reduce waiting times. They are also seeking to establish better relationships with insurers to expedite repair processes.

We recommend: Chinese car brands aim for supremacy in the pickup segment

“We know we have areas for improvement and we are working on them. We want our customers to have the best possible experience, not only at the time of purchase, but also followingwards,” Charlie Zhang of Chery International said in an interview last year.

Brands recently entering the Mexican market have also recognized the importance of ensuring spare part availability. Pedro Albarrán, vice president and general manager of GWM, emphasized that spare parts were their top priority upon entering Mexico. “Before presenting our first model, we already had a large spare parts warehouse with a catalog of more than 300,000 spare parts for both corrective and preventive maintenance,” he shared in an interview prior to the brand’s launch.

GAC has implemented a similar strategy. The availability of spare parts has been crucial for GAC’s launch in Mexico. Osvaldo Ramírez, manager of spare parts and accessories for GAC Mexico, explained at the beginning of the year that, based on the experience of other brands, they initially established a stock based on sales projections and estimated percentages of vehicles involved in collisions, which typically face longer import times.

(Yvet Rodríguez)

An opportunity

Western car manufacturers have recognized following-sales service as a crucial opportunity to regain ground lost to Chinese brands in recent years.

“The only way to advance or even survive in an increasingly competitive industry is through following-sales service. This includes warranties, spare parts and vehicle repairs, among others. The Mexican consumer is very demanding and, although they may ‘stumble’ when buying something new, they are also very rational and think in the medium and long term. That is why we are focusing on following-sales,” said Miguel Barbeyto, president of Mazda in Mexico.

The automotive market in Mexico remains attractive and dynamic. Chinese brands have proven to be formidable competitors, capable of adapting quickly and innovating in a highly competitive landscape. However, to ensure their long-term success and growth, they must find solutions to address the challenges associated with following-sales service and customer satisfaction.

“Each brand must develop its own strategies to ensure recognition and avoid the stigma associated with Chinese cars. The fact that one or two brands do not have spare parts does not mean that this is the case for all of them,” said Isidoro Massri, general manager of JAC in Mexico.