Today, at the peak of oil prices and once morest the background of the energy crisis in Europe, Rethink Energy analysts give a comforting forecast for green energy fans. By agency data, the glut of the market with polycrystalline silicon solar panels will happen quite soon – no later than 2025. There is not long to wait.

Image Source: Pixabay

Polycrystalline silicon, as one of the most effective materials for manufacturing solar panels today, has begun to rise in price rapidly since last year. At first, the price was pushed up by US sanctions on the production of this raw material in the Xinjiang Uygur Autonomous Region of China, and in the summer the situation was aggravated by the shortage of coal and electricity in China. In 2020, a ton of polycrystalline silicon cost $6, and manufacturers’ profits have fallen to almost zero. By the end of 2021, a ton of this raw material was already worth $40, raising profits by hundreds of percent.

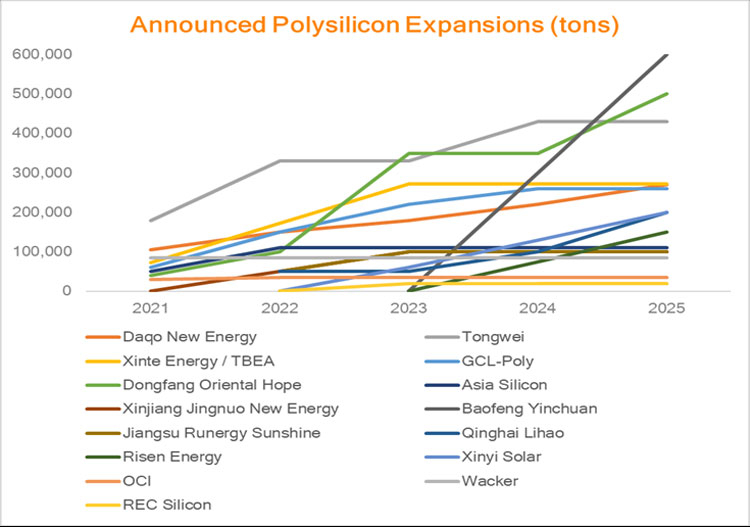

The price level for polycrystalline silicon, which has been repeatedly overestimated by today, has prompted the producers of this raw material to plan the expansion of production. In the last few weeks alone, plans to expand the production of polycrystalline silicon have been announced by several dozen companies around the world. The chart below shows only a small part of them, but they represent the general trend in the market.

The announced expansion of production should lead to the production of 4 million tons of polycrystalline silicon per year. Even partial loading of these capacities (up to 2/3 of the full load) will allow the annual production of solar panels with a total capacity of regarding 900 GW. The planned new plants will start working no sooner than in a year, which gives us the start of production around the middle of 2023.

Image Source: Rethink Energy

In 2021, polycrystalline silicon production capacity was only 621,000 tons, with a real supply of less than 579,000 tons. This limited panel production in 2021 to a total capacity of 180 GW, with market demand of 205–220 GW. With delivery issues amid the COVID-19 pandemic, demand outpaced supply by regarding 50 GW of panels per year. In such conditions, cheap polycrystalline silicon panels simply cannot be.

According to data collected by analysts at Rethink Energy, the increase in production might lead to the production of panels in 2030 with a total capacity of regarding 1000 GW per year. If we talk regarding the short term, then the production of polycrystalline silicon panels promises to triple by 2025 to 500-600 GW. All the prerequisites for this are in place and this will allow supply to exceed demand and push panel prices down.

“The shortage of polycrystalline silicon will continue to limit the installation of solar panels worldwide until mid-2023, during which 250 GW of polycrystalline solar panels will be commissioned. It will take at least five years for the price of polycrystalline silicon to return to the all-time low of 2020, but then it will drop even more.” says study author Andries Wantenaar.

Rethink Energy analysts summarize that once polysilicon prices recover and profitability returns to the sector, factories will ramp up solar module production and we can expect more offerings to hit the market by 2023. This might lead to a reduction in the levelized cost of electricity by up to 12% (LCOE). Analysts also expect an increase in China’s dominance in this industry, although I also expect India to increase production in this area.

If you notice an error, select it with the mouse and press CTRL + ENTER.