2024-05-31 19:04:48

The worth of Bitcoin has been extremely risky in current days, falling as little as $67,100 whereas hovering above $70,000.

After a quiet weekend, Bitcoin is buying and selling round $69,000 and sentiment is sort of upbeat. The asset as soon as once more rose above $70,000, setting a multi-day excessive.

Nevertheless, the bulls have been unable to maintain this upward pattern and Bitcoin’s value started to lose worth quickly within the following days. Sooner or later later, the cryptocurrency had misplaced $2,000 in worth.

On Wednesday, particularly Thursday, the fluctuations have been larger, with the alternate charge falling first following which rising. Nevertheless, this time it failed to succeed in the coveted $70,000 stage and is now once more round $67,000 amid wild value swings.

The week’s most necessary cryptocurrency information in a single place

In response to the courtroom ruling, the SEC abused its energy and pays a high quality of almost US$2 million. SEC v. DEBT Field started in July 2023, when the U.S. Securities and Alternate Fee filed a lawsuit towards the decentralized, environmentally pleasant blockchain expertise firm, accusing it of cryptocurrency fraud. In response to the SEC, the tokens issued by DEBT Field should not really mineable and have been linked to a $50 million fraud. Nevertheless, in accordance with the courtroom, their conduct was inappropriate.

The EU considers most recoverable worth (MEV) as unlawful market manipulation underneath MiCA. The European Securities and Markets Authority (ESMA) just lately issued a session paper to assist make clear the interpretation of a few of MICA’s findings. Professional Patrick Hansen stated the doc launched precisely defines what MEV means within the eyes of regulators. Most Extractable Worth (MEV) is an idea utilized by merchants to confer with how a lot complete revenue will be extracted by sequencing transactions inside a block, or from the ensuing arbitrage alternatives.

Ryan Salame, the previous co-chief government of FTX Digital Markets, was sentenced to 90 months, or seven and a half years, in jail by the U.S. Division of Justice. this Resolve Born on Might 28, following a plea settlement in September 2023.

BlackRock’s revenue and bond funds purchased shares of the asset supervisor’s personal spot Bitcoin exchange-traded fund (ETF) throughout the first quarter, in accordance with the corporate’s regulatory submitting. BlackRock Strategic Revenue Alternatives Fund (BSIIX) Valued at US$3.56 million He purchased shares of iShares Bitcoin Belief (IBIT). whereas the Strategic International Bond Fund (MAWIX) bought $485,000. As of now, all Bitcoin ETFs maintain greater than 1 million Bitcoins.

PayPal’s stablecoin is regarding to enter Solana’s blockchain. PayPal’s stablecoin PYUSD has solely landed on the Solana community almost a yr following launching on the Ethereum blockchain.

$69,000 Nonetheless a Questionable Bitcoin Worth Degree

Whereas Might’s shut has arrived, a rising battle in buying and selling is raging.

Practically three months following hitting its newest all-time excessive of $73,800, BTC/USD has failed to succeed in these highs once more and proceed its upward pattern.

The present state of affairs is way from stunning given the place sell-side liquidity presently sits within the order e-book.

In reality, we can’t speak regarding a everlasting breakout till the $69,000 resistance turns into assist.

“A month-to-month shut beneath $69,000 suggests there are inadequate reserves to construct the following part, and consolidation on this vary is prone to proceed.

Some analysts now imagine that Bitcoin’s value might proceed to commerce sideways throughout the present alternate charge vary. That is typical conduct on BTC charts and coincides with the interval following the block reward halving.

So as to add to this, Bitcoin as soon as once more didn’t efficiently break by the $69,000 alternate charge, which occurred on the day when the decision was introduced within the trial of US presidential candidate Donald Trump. And the judgment of Trump, who helps cryptocurrencies (now), has additionally grow to be the judgment of Bitcoin.

Nevertheless, a mix of on-chain, elementary and technical indicators may result in additional positive aspects in June.

Bitcoin is regarding to interrupt out of the Symmetrical Triangle sample

Technically, Bitcoin’s potential to succeed in $75,000 stems from a prevalent symmetrical triangle sample. Throughout a symmetrical triangle formation, value consolidates between two converging pattern strains connecting consecutive highs and lows.

Sometimes, the formation of a symmetrical triangle throughout an uptrend indicators the continuation of an additional uptrend. The sample is accomplished when the worth breaks the higher trendline: it then rises by the utmost distance between the higher and decrease trendline – in our case, this might take the worth of Bitcoin to $75,000.

BTC/USD four-hour value chart. Supply: TradingView

On Might 31, BTC value approached the highest of the triangle, and the 2 pattern strains slowly converged. Nevertheless, if the worth falls beneath 68,000, the sample will probably be revoked.

Bitcoin ETF consumers preserve coming once more

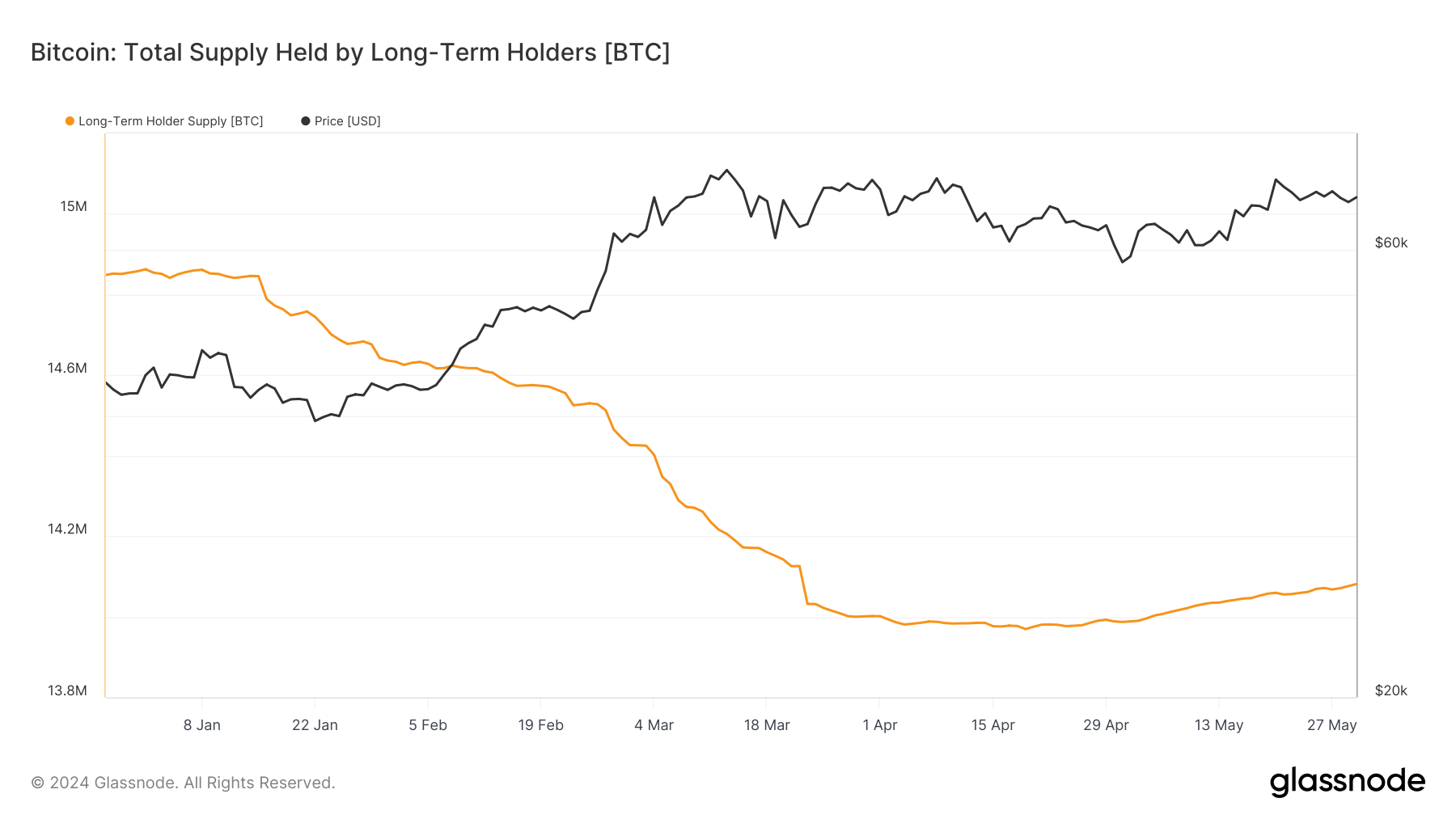

In March, the market Bitcoin alternate charge hit a brand new report of roughly $73,000. Subsequently, the worth of Bitcoin surged, whereas long-term Bitcoin holders offered off giant quantities of their holdings, resulting in an oversupply and a interval of correction and consolidation.

Bitcoin shares held by long-term holders. Supply: Glassnode

As costs fall and sellers dry up, the market regularly enters a replenishment part.

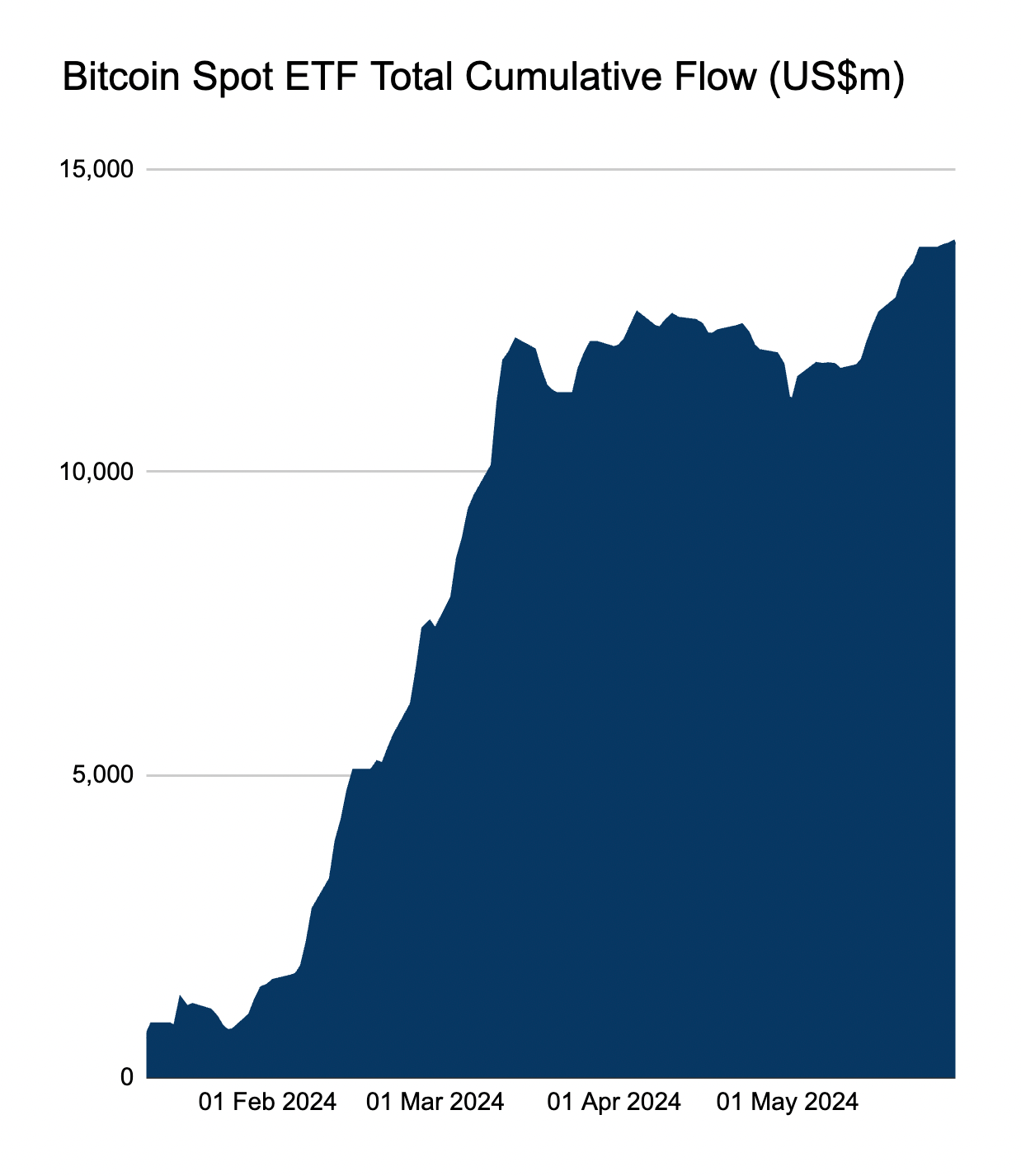

The shift is seemingly tied to inflows into Bitcoin ETFs, which noticed internet outflows all through April. This example pushed the worth to native lows round $57,500, with the ETF seeing important internet outflows averaging $148 million per day.

U.S. spot Bitcoin ETF has gathered inflows. Supply: Farside Buyers

Outflows throughout this era represented a type of slight capitulation, however the pattern has since reversed sharply.

Final week, Bitcoin ETFs reported day by day internet inflows of $242 million, signaling a resurgence in purchaser demand. Contemplating the $32 million in pure promoting strain per day from miners because the final Bitcoin halving, the ETF’s shopping for strain is almost eight occasions the promoting strain.

This helps the ETF’s important upside impression on the Bitcoin market. Subsequently, Bitcoin value is well-positioned to proceed rising in June.

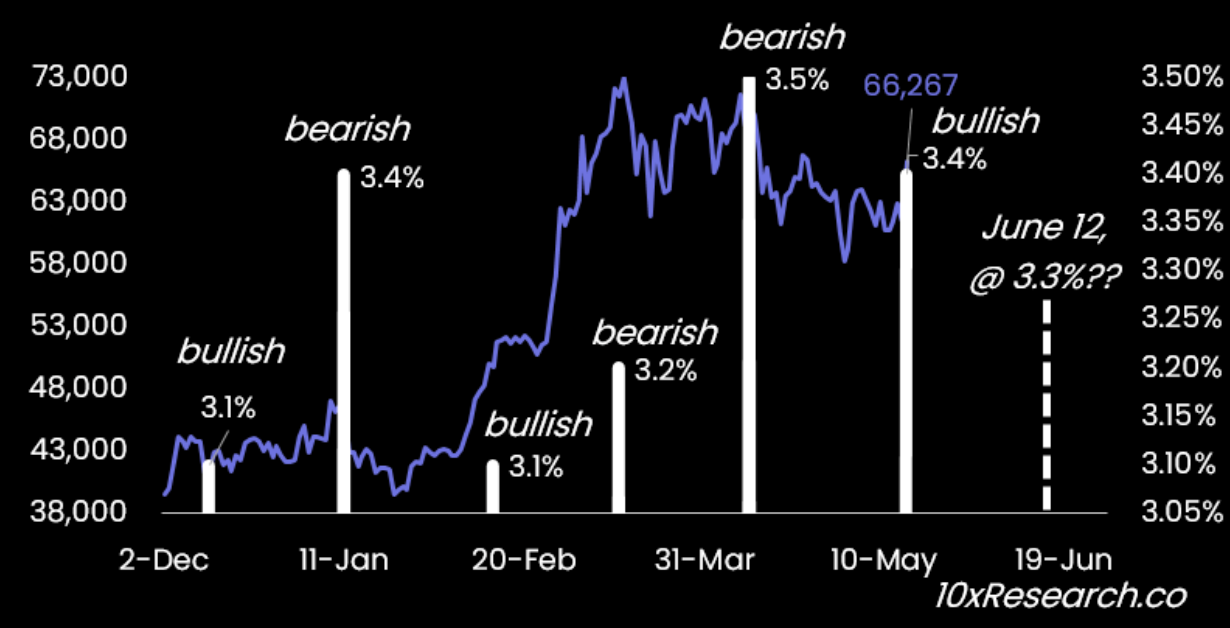

Not less than 3.3% inflation is required to succeed in new Bitcoin value report

Bitcoin value actions might seem random, however are literally pushed by key drivers comparable to inflation, in accordance with cryptocurrency analysts.

Markus Thielen, senior analyst at 10x Analysis, stated U.S. inflation is prone to gradual when outcomes are launched subsequent month. This might result in new Bitcoin alternate charge information, presumably even surpassing the March peak.

“Bitcoin ought to attain new all-time highs if inflation is 3.3% or decrease,” Markus Thielen stated in a Might 29 report.

The U.S. Bureau of Labor Statistics (BLS) will launch its subsequent Shopper Worth Index (CPI) outcomes on June 12.

The three.3% stage represents a 0.1 share level lower from the final CPI outcome (3.4% on Might 15). Thielen believes that inflows into Bitcoin exchange-traded funds (ETFs) are anticipated to extend instantly within the two weeks main as much as the Might inflation outcomes, which can assist create new highs.

Nevertheless, this momentum may wane if CPI outcomes are available greater than anticipated, as was seen earlier this yr.

Spot Bitcoin ETF inflows tracked by Farside knowledge have been rising over the previous two weeks since Might 13, with complete inflows peaking at $305.7 million on Might 21.

Thielen believes that there isn’t a random motion within the value of Bitcoin. All of it relies on the important thing driver, and the principle driver is inflation.

This yr, Bitcoin costs have seen many drops on account of higher-than-expected Shopper Worth Index (CPI) outcomes.

On April 10, the patron value index was 3.5%, solely 0.1 share level greater than anticipated. Just a few weeks later, on April 30, the worth of Bitcoin fell 6.67% to $56,000.

Thielen identified that when the spot Bitcoin ETF launched on January 11, capital inflows themselves have been disappointing in January, regardless of $611 million in inflows on the primary day.

He believes that the principle purpose is that the CPI outcomes are greater than anticipated.

Thielen wrote: “The buyer value index got here in at 3.4% in January, which was greater than the three.2% anticipated and up from 3.1% final month.” He added: “Bitcoin was weak in January and stronger in March, however It’s no coincidence that it’s been consolidating for 2 months.”

1717199817

#good #inflation #quantity #justify #Bitcoin #value #report