Bitcoin’s recent price dip has stirred the crypto community, with many investors questioning whether this is a moment of crisis or prospect. While bearish sentiment dominates the market, deeper analysis of key metrics reveals a more nuanced picture, offering insights for both cautious and opportunistic traders.

Understanding the Current Bitcoin Market Sentiment

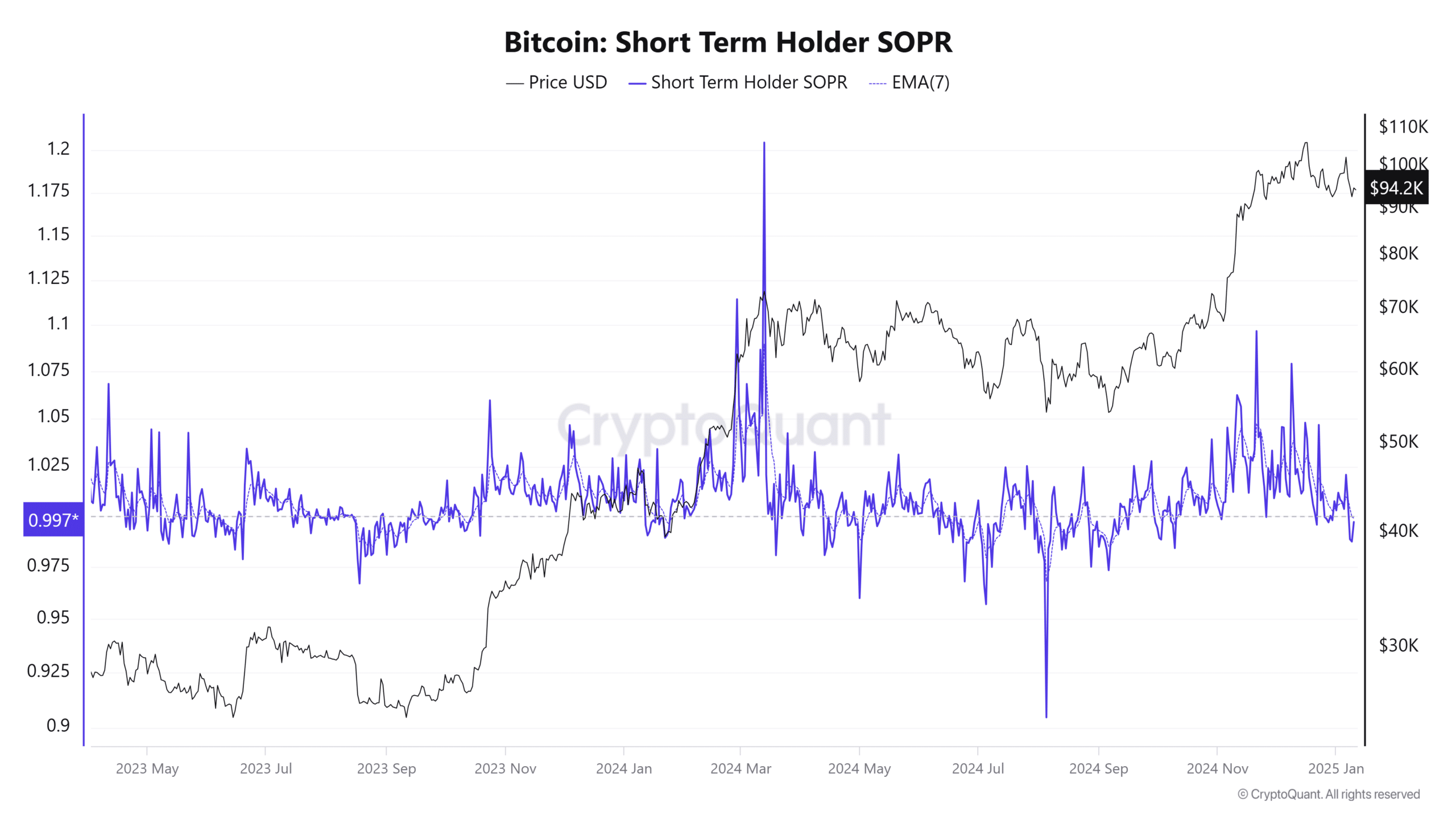

The crypto market is no stranger to volatility, and bitcoin’s recent downturn is no exception. short-term investors appear to be leading the sell-off, as evidenced by the Short-Term Holder SOPR (Spent Output Profit Ratio) chart, which recently dipped to 0.987. This metric, which measures whether coins are being sold at a profit or loss, suggests that many are offloading their holdings at a loss. Historically, SOPR values below 1.0 have frequently enough signaled accumulation phases, where long-term investors step in to buy at discounted prices.

The Short-Term Holder SOPR chart highlights a dip to 0.987, indicating that many investors are selling Bitcoin at a loss.

HODL Waves and Long-term Investor Behavior

Another critical metric to consider is the HODL Waves chart, which tracks the age of Bitcoin holdings. Recent data shows a significant increase in older coins being held,suggesting that long-term investors are staying put despite the market turbulence. This behavior aligns with past patterns where seasoned investors view price dips as opportunities to accumulate more Bitcoin at lower prices.

What Does This Mean for Investors?

For those with a long-term perspective, the current market conditions may present a strategic buying opportunity. As short-term holders exit the market, the reduced selling pressure could pave the way for a price rebound. Though,it’s essential to approach this phase with caution,as market sentiment can shift rapidly.

“Historically, SOPR values below 1.0 have frequently enough marked points of accumulation, where patient investors capitalize on discounted prices.”

Key Takeaways for Strategic Investors

- Monitor SOPR and HODL Waves: These metrics provide valuable insights into market sentiment and investor behavior.

- Stay Patient: Market downturns can be stressful, but they frequently enough create opportunities for those willing to wait.

- Diversify Yoru Portfolio: While Bitcoin remains a cornerstone of the crypto market, diversifying into other assets can mitigate risks.

while Bitcoin’s recent dip has fueled bearish sentiment, it also opens the door for strategic investors to capitalize on potential opportunities. By keeping a close eye on key metrics and maintaining a long-term perspective, investors can navigate this volatile phase with confidence.

Bitcoin’s recent market behavior has been marked by a wave of bearish sentiment, driven largely by social media negativity and panic-driven selling. This has created a challenging environment for investors, but historical trends suggest that such downturns often pave the way for recovery and accumulation opportunities.

Understanding Bitcoin’s Liquidity Shift

One of the most telling indicators of Bitcoin’s current state is the Realized Cap HODL Waves Chart. This chart reveals a significant shift in Bitcoin’s liquidity structure, with coins aged less than three months now accounting for 49.6% of network liquidity. This suggests that mature investors have been distributing a considerable portion of their holdings,potentially making room for new demand.

“The Realized Cap HODL Waves Chart is a critical tool for understanding Bitcoin’s market dynamics,” says a leading analyst. “The current data indicates a redistribution phase, which frequently enough precedes periods of renewed growth.”

Bearish Sentiment and Recovery Patterns

despite the prevailing bearish sentiment,the SOPR (Spent Output Profit Ratio) chart offers a glimmer of hope. Historically, Bitcoin has shown a tendency to recover after significant dips, with bearish phases often serving as accumulation opportunities for savvy investors. This pattern suggests that the current downturn might potentially be a temporary setback rather than a long-term trend.

“Bearish phases are frequently enough followed by periods of recovery,” notes another expert. “The key is to identify the right entry points and avoid being swayed by short-term market noise.”

the Role of New Demand

As mature investors distribute their holdings,the market is increasingly influenced by new demand. This influx of fresh capital can definitely help stabilize prices and drive future growth.The Realized Cap HODL Waves Chart highlights this shift, showing a growing proportion of younger coins in the market.

“New demand is essential for sustaining Bitcoin’s long-term growth,” explains a market strategist. “The current redistribution phase could be setting the stage for the next wave of adoption and price gratitude.”

Key Takeaways for Investors

For investors navigating Bitcoin’s volatile market, understanding these trends is crucial. Here are some actionable insights:

- Monitor the Realized Cap HODL Waves Chart: this tool provides valuable insights into Bitcoin’s liquidity structure and investor behavior.

- Look for Accumulation Opportunities: Bearish phases often present opportunities to accumulate Bitcoin at lower prices.

- Stay Informed About new Demand: Keep an eye on indicators of new demand, as this can signal future growth potential.

By staying informed and focusing on long-term trends, investors can navigate Bitcoin’s market dynamics with greater confidence and strategic insight.

Understanding Bitcoin’s Market Dynamics: Trends,Sentiment,and Key Levels

Bitcoin’s market behavior is a interesting blend of investor psychology,technical analysis,and historical patterns. As the cryptocurrency hovers around $94,330, it’s worth diving deeper into the factors shaping its current trajectory. From seasoned investors cashing out to new demand absorbing sell-side pressure, the market is in a state of flux. Let’s explore what this means for Bitcoin’s future.

Market redistribution: A Sign of Stability or Consolidation?

Recent trends reveal an interesting dynamic: experienced investors are taking profits after a significant uptrend, while fresh capital is stepping in to absorb the selling pressure.This redistribution isn’t just a random occurrence—it’s a historical pattern that often stabilizes the market.As new money flows in, it creates a buffer against further declines, suggesting that Bitcoin is entering a consolidation phase rather than heading for a crash.

This phenomenon highlights the cyclical nature of cryptocurrency markets. When seasoned players exit, it paves the way for new participants, ensuring a balanced ecosystem. as one analyst noted, “Historically, such redistributions often stabilize the market as fresh capital flows in.” This insight underscores the importance of understanding market cycles to make informed decisions.

short-Term Holder SOPR: A Window into Market Sentiment

The Short-Term Holder Spent Output Profit Ratio (SOPR) is a powerful tool for gauging market sentiment. Currently, the SOPR stands at 0.987, indicating that short-term holders are selling at a loss.This pattern is typically observed during periods of heightened fear and uncertainty.

However,history shows that SOPR values below 1.0 frequently enough signal market bottoms. In other words, when panic dominates, it can be an ideal time for accumulation. As the data suggests, “SOPR values below 1.0 frequently enough signal market bottoms.” This cyclical behavior has been a consistent feature of Bitcoin’s price movements, offering valuable insights for both traders and long-term investors.

Price Action: Key Levels to Watch

Bitcoin’s price chart provides critical insights into its current dynamics. At $94,330,the cryptocurrency is trading below its 50-day moving average of $97,470 but remains comfortably above its 200-day moving average of $73,293. These moving averages serve as key support and resistance levels, guiding traders in their decision-making.

bitcoin’s price chart showing key support and resistance levels.

For traders, these levels are crucial. The 50-day moving average acts as a resistance point, while the 200-day moving average provides strong support. Understanding these technical indicators can help navigate the market’s volatility and identify potential entry or exit points.

What’s Next for Bitcoin?

As Bitcoin continues to evolve, its market dynamics remain a blend of technical patterns and investor behavior. The current redistribution phase, coupled with SOPR insights, suggests a period of consolidation rather than a sharp downturn. For investors, this could be an opportunity to accumulate during periods of fear, while traders can leverage key technical levels to make informed decisions.

Ultimately,Bitcoin’s resilience lies in its ability to adapt and attract new participants. Whether you’re a seasoned investor or a newcomer, understanding these trends can provide a clearer picture of where the market is headed. As the data shows, “This MA provides key resistance and support levels for traders.” By keeping an eye on these indicators, you can navigate the ever-changing landscape of cryptocurrency with confidence.

bitcoin’s Relative Strength Index (RSI) currently stands at 45.93, signaling that the cryptocurrency is nearing oversold territory. Historically, such RSI levels have frequently enough preceded price recoveries, offering a glimmer of hope for traders eyeing a potential rebound.

Key levels to watch include the $95,000 resistance and $92,000 support zones.A decisive breakout in either direction could set the tone for Bitcoin’s next major move.

Is This a Market Crash or a Golden Buying Opportunity?

While the prevailing bearish sentiment and increased selling activity by short-term holders might raise red flags, deeper analysis reveals a more nuanced picture. The absorption of selling pressure by new investors, combined with historical trends in the Spent Output Profit ratio (SOPR), suggests that the current phase may be more of a consolidation than a full-blown crash.

Charts tracking Bitcoin’s Realized Cap HODL Waves and Short-Term SOPR present a mixed outlook.For long-term investors, this could be an ideal moment to accumulate assets at lower prices. However, short-term traders should remain cautious, as volatility could still play a significant role in the near term.

The Bitcoin market is currently walking a tightrope between fear and opportunity. while the overall sentiment leans bearish, indicators like SOPR and HODL Waves hint at a possible recovery on the horizon. Investors must carefully consider these signals alongside broader macroeconomic factors to make well-informed decisions.