Posted Sep 7, 2022, 4:04 PMUpdated on Sep 7, 2022 at 5:13 PM

Times are going to be tougher for the French economy. This Wednesday, INSEE revised downwards its forecasts for the end of the year. The institute is now counting on a modest increase in GDP of 0.2% in the third quarter and on zero growth over the following three months once morest 0.3% still anticipated in June for each of the two quarters.

Thanks to the upturn in spring, which had allowed the business to increase by 0.5% between April and June , and subject to all the vagaries likely to disrupt the situation, growth in 2022 should nevertheless reach 2.6%, i.e. more than the 2.3% then expected for the year as a whole. A figure close to the government objective, which is 2.5%. The growth overhang for 2023 would however be limited to 0.2%, auguring a serious cold snap on the French economy next year.

Soaring food prices

Given the high levels of inventories of finished products, manufacturing production should contract in the fall according to INSEE.

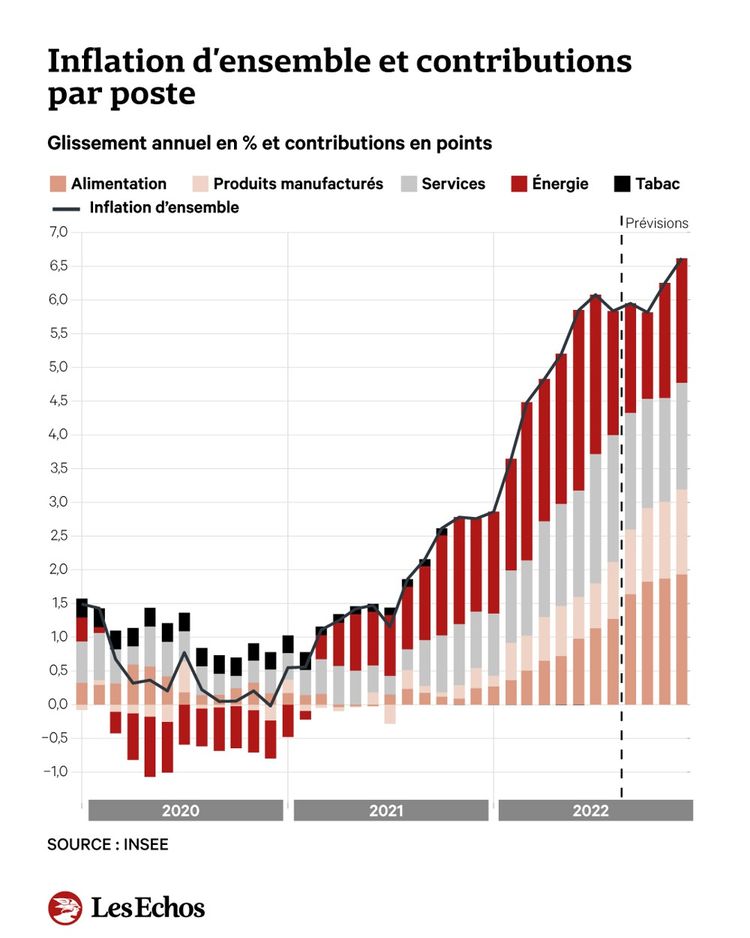

Inflation also remains at historically high levels. Public aid should, however, calm things down a bit . Thanks to the strengthening of rebate at the pump from 18 cents to 30 cents in September and October, the surge in prices should be contained around 6% during these two months, thus avoiding the dreaded peak of 7% . The tariff shield on gas and electricity prices and the rebate on gasoline reduced inflation by 2.5 points in September, estimates INSEE. The gradual reduction of the discount to 20 cents in November and then to 10 cents in December will also cause inflation to rise once more. It should be close to 6.6% over one year in December, ie 0.3 points less than anticipated three months ago and should stand at 5.3% on average over the year.

Stagnation of purchasing power in 2022

While the executive has striven to protect the French once morest the explosion in energy prices, tensions are likely to appear on another front: the soaring prices of food products, with an expected increase in December of almost 12%, year-on-year compared to 7.7% in August. A direct consequence of the surge in agricultural production prices: they have jumped by 35% in two years. Even in the event of an easing in prices, it would be necessary to wait “a few quarters” for the drop to be visible to the consumer. The rise in the prices of manufactured goods should be more moderate, around 5% over one year.

Faced with these inflationary pressures, the question of purchasing power will therefore remain for many months still at the heart of the concerns of the French. The improvement in their incomes, stimulated by wage dynamics (rise in the minimum wage and the index point for civil servants), the revaluation of social benefits and the reduction in levies (housing tax, audiovisual license fee) should lead to a rebound in the purchasing power over the second half of the year.

Rise in savings

Measured per consumption unit, it would increase “by at least 1.5%” in the third quarter and by “at least 0.5%” during the last three months of the year according to INSEE. After the sharp contraction experienced in H1, purchasing power should nevertheless remain stable throughout 2022, with significant disparities at the individual level.

In this context, the French should not be in a spending mood. The dynamism in services, driven by the hotel and restaurant industry since the spring, should further support economic activity in the fall, but the effect should diminish at the end of the year according to INSEE. Consumption of goods, already at half mast since the beginning of the year, should remain on a bad slope.

Faced with the economic slowdown, households might exercise greater caution in the coming months and decide to “smooth their purchasing decisions”. This is in any case the scenario of INSEE, which anticipates in the wake of a rise in the savings rate in the second half, following the decline recorded in the spring.