SGX Group, a Singapore Stock Exchange Company sleeping tiger business The top of the chain of securities business

SGX Group is a capital market infrastructure services company. It acts as a marketplace where people can place their financial assets in exchange. The main service income can be divided into 3 categories.

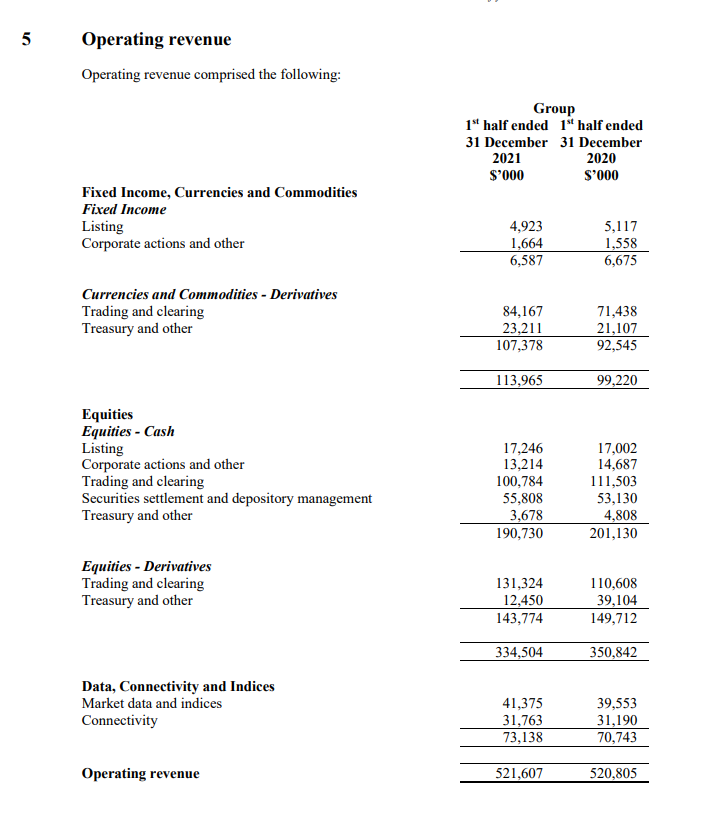

These are 1. Fixed Income, Currencies and Commodities (FCC) 2. Equities and 3. Data, Connectivity and Indices.

The highest-grossing business category was Equities with 64.xx%, followed by FCC with 21.xx%, and Data and Index Connecting 14.xx%.

In which, when broken down, the nature of the stock market business will generate revenue from trading and clearing fees which are derived from brokers listed with the stock exchange. And the broker will collect this value to us as investors through the total commission. In Thailand it is charged at 0.001% of the turnover.

That is to say, the company earns on every transaction fee when using the services on the stock exchange. All of you can see the income from Trading and clearing through the picture below.

In addition, in the Equities category, income is derived from depository fees, IPO registration fees, and corporate action fees. too not wrong If the capital market is bustling Then the stock exchange company would earn a high income like me.

The Company’s historical financial figures are as follows:

2015

The company had revenue of 784.63 million Singapore dollars.

The company had gross profit of SGD 530.51 million. (accounting for a gross profit margin of 67.61%)

The company reported a net profit of SGD 348.61 million. (accounting for a net profit margin of 44.43%)

The company has a return on equity (ROE) : 36.73%

2016

The company had revenue of S$828.88 million.

The company had gross profit of 551.48 million Singapore dollars. (accounting for a gross profit margin of 66.53%)

The company reported a net profit of SGD 349.02 million. (accounting for a net profit margin of 42.11%)

The company has a rate of return on equity (ROE) : 35.51%

2017

The company had revenue of S$806.44 million.

The company had gross profit of SGD 541.33 million. (accounting for a gross profit margin of 67.13%)

The company reported a net profit of S$339.69 million. (42.12% net profit margin)

The company has a rate of return on equity (ROE) : 33.60%

2018

The company had revenue of SGD 855.15 million.

The company had gross profit of S$363.20 million. (accounting for a gross profit margin of 66.94%)

The company reported a net profit of SG 572.43 million. (accounting for a net profit margin of 42.47%)

The company has a rate of return on equity (ROE) : 34.12%

year 2019

The company had revenues of S$909.75 million.

The company had gross profit of 799.98 million Singapore dollars. (accounting for a gross profit margin of 87.93%)

The company posted a net profit of S$391.10 million. (accounting for a net profit margin of 42.99%)

The company has a rate of return on equity (ROE) : 35.85%

year 2020

The company has revenues of 1.05 billion Singapore dollars.

The company had gross profit of S$909.59 million. (accounting for a gross profit margin of 86.37%)

The company reported a net profit of S$471.81 million. (accounting for a net profit margin of 44.80%)

The company has a rate of return on equity (ROE) : 40.40%

year 2021

The company has revenues of 1.06 billion Singapore dollars.

The company had gross profit of S$897.66 million. (accounting for a gross profit margin of 85.08%)

The company reported a net profit of SGD 445.41 million. (accounting for a net profit margin of 42.21%)

The company has a rate of return on equity (ROE) : 33.87%

Personally, SGX Group has a very high level of shareholder profitability compared to other sectors available in the market. Including the ability to do very well as well This is evident from the company’s gross margin of more than 60% for several years. Including the company itself can create Free Cash Flow out every year. At this point, we may have to give credit for the company’s status as being a Monopoly, that is, a monopoly on securities trading in that country. SGX also offers Singapore securities trading services.

For the growth of the company In this part, it is seen that there will be growth in accordance with the transactions that are available through the market. The more the economy is so active that people are interested in investing in securities, this issue has the most direct involvement. Including the presence of new securities listed on the market as well. The company receives as low as twice, a lump sum of registration fees when the company IPO and income from trading fees for its lifetime. Including secondary factors such as people’s access to financial literacy and know how to invest. That is one of the keys to the natural growth of the company. and factors such as certain government policies such as allowing foreigners to use their country to invest in building factories At one point, when the company wanted to increase its capital in the country, it was listed on the market. For example, in the case of Japanese companies during the Plaza Accord era, they turned to invest in Thailand to expand their production until they were listed on the stock exchange, etc.

As for the risk itself, there are some. That is, the company that will register itself can be chosen as well. Whether to register a company within the country or abroad, such as Prada, a luxury bag company from Italy itself. It has been listed on the Hong Kong Stock Exchange instead of the Eurozone, including Dual Listing, which may prevent companies from receiving fees for trading the same securities on different markets. Or, for example, NFT trading is one of the risks that can be seen. Through the coming of Tokenize Asset, which allows business owners to convert their share certificates into Tokens in Smart Contracts and list them on the market without intermediaries. (Decentralize Exchange) in different places, etc.

Stock market business is one of the most interesting sub-sectors of the financial industry. Due to the fact that he has Moat at the national level as well as having continuous free cash flow, having a small proportion of Capex All of this is followed by the market’s favorable premium on these stocks, but it’s well worth researching the company.

Investing Science – Investerest

Follow the good article, click here. FACEBOOK , OFFICIAL LINE and WEBSITE

special! Join the group to study stocks online for free with unconditional investment science at : Learn stocks for free with investment science

refer

https://www.tradingview.com/symbols/SGX-S68/financials-income-statement/

https://www.moneybuffalo.in.th/stock/stock-commission-fee

https://investorrelations.sgx.com/financial-information/financial-results

https://corp.sgx.com/regarding

Last updated on : July 1, 2022