San Francisco Fed President John Daly said on Thursday that the central bank will probably need to raise interest rates even further and keep them at high levels for a long time.

“There’s clearly more work to be done,” he said in a speech at Princeton University, adding, “More policy tightening will be needed for longer to make this high inflation thing a thing of the past.” would,’ he said.

Governor Daley

Photograqpher: David Paul Morris/Bloomberg

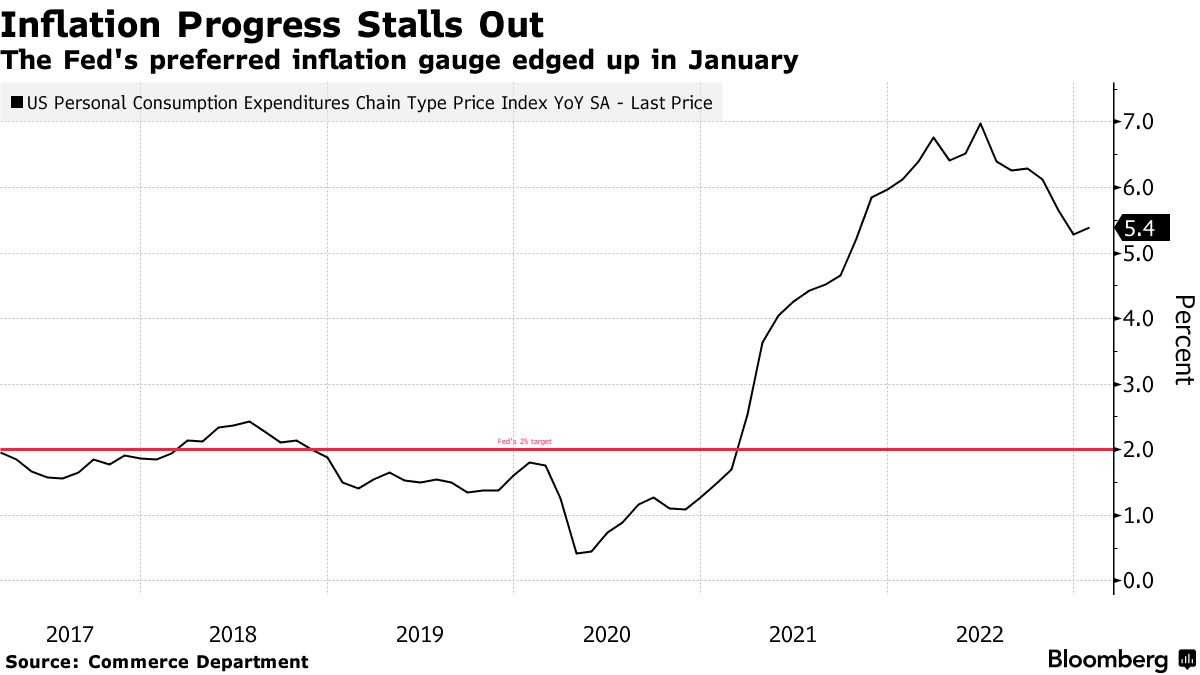

Daly said inflation remained high across sectors such as goods, housing and services, and data was highly volatile, making the trend of disinflation unclear.

The Federal Open Market Committee (FOMC), who won’t vote this year, said the FOMC’s aggressive tightening was “appropriate given the magnitude and stickiness of the rise in inflation.” In a question-and-answer session following his speech, he touched on the possibility that policy effects might be delayed, but he said that inflation was still too high to allow the FOMC to pause.

“In my judgment, it would be wrong to say that all that has to be done has been done and will continue to be done,” he said. “We have to think regarding continuing the tightening,” he said.

In a conference call with reporters following the lecture, it was said that the interest rate would not exceed 5% to 5.5%, which is almost the same as the median of 5.1% in the dot plot (interest rate forecast distribution chart) shown by the FOMC in December last year. He reiterated his support for raising interest rates.

Original title:Fed’s Daly Says More Rate Hikes Likely Needed to Cool Inflation(excerpt)