Guided readingOn September 26, northbound funds: net purchases were for banks, and net sales were for non-ferrous metals. The top five industries with net purchases are banking, electronics, pharmaceutical biology, communications, and transportation.

On the last trading day, the net sales of northbound funds was 506 million. The risk appetite has been repeated recently, so we should pay attention to remain relatively cautious.

The industries with the largest net purchases of northbound funds were banks, with a net purchase of 679 million, and the industry with the largest net sales was non-ferrous metals, with a net sales of 749 million. The top five industries with net purchases are banking, electronics, pharmaceutical biology, communications, and transportation. The top stocks in the banking sector with net purchases include Agricultural Bank of China. In addition, Northbound funds have continued to net purchases in the electronics sector for the past 5 trading days, and need to focus on tracking in the short term, and have continued to sell nets in the petroleum and petrochemical, construction materials, non-banking and financial sectors, and agriculture, forestry, animal husbandry and fishery sectors for the past 5 trading days, and need to maintain a short-term cautious.

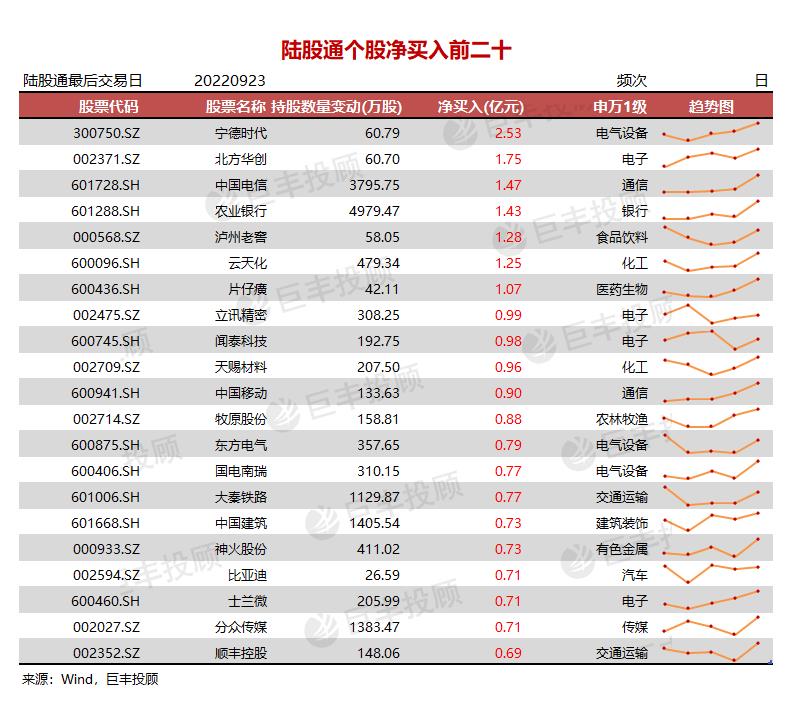

Among the top 20 net buying stocks, northbound funds have made net purchases of Luxshare Precision, Wingtech, China Mobile, and Daqin Railway for nearly 5 consecutive trading days, which can be tracked; Muyuan shares, Pien Tze Huang, Shenhuo shares, SF Holding From continuous net selling to net buying, you can focus on observation.

Among the top 20 net sales, Northbound funds continued to sell net sales of Kweichow Moutai, Sungrow, CITIC Securities, Nanshan Aluminum, and China Aluminum for the past 5 trading days. Be cautious in the short-term; Net buying has turned into net selling, and attention should be paid to follow-up observation in the short term.