Seocho-Gangnam, the only house price to jump in the first half of the year

“Cash-rich people are also waiting… Possible adjustment in the second half”

“While the real estate market was generally stagnant, expectations for easing regulations on reconstruction by the new government and the preference for ‘clear house’ kept prices in key areas such as Seocho and Gangnam. I started.” (Representative of a real estate agency in Gangnam-gu)

Gangnam house prices, which are called the Seoul house price weather vane, are shaking. The new government’s expectations for deregulation and the preference for ‘a smart house’ due to the increased tax burden have supported the price of a house in Gangnam, but even that seems to be losing power. Real estate agencies in the area evaluated that “there are no buyers due to fatigue from rising house prices and interest rate hikes.”

According to the real transaction price disclosure system of the Ministry of Land, Infrastructure and Transport on the 13th, a 157 m² dedicated to ‘Hyundai Apartments 6th and 7th cars’ in Apgujeong-dong, Gangnam-gu, was traded for 5.5 billion won last month. The previous record price was 5.8 billion won, which was traded in May, but fell by 300 million won within a month.

The 59 m² dedicated to ‘Raemian Blastige’ in Gaepo-dong was changed to 2.14 billion won on the 28th of last month. It was sold for 2.285 billion won in May of the previous month, but it fell by 145 million won in one month.

The 164 m² dedicated to Tower Palace in Dogok-dong was also sold for 4.25 billion won on the 29th of last month. This is 100 million won lower than the 4.35 billion won traded at the beginning of last month. The 152 square meter dedicated to ‘Woosung 4’ in the same building also found a new owner for 3.7 billion won the previous month, but it was 290 million won lower than the previous transaction of 3.89 billion won (April).

A certified brokerage representative in Apgujeong-dong, Gangnam-gu, said, “There are a lot of reconstructed apartments in Gangnam-gu, so expectations for the easing of regulations by the new government played a big role. It’s an atmosphere where even the rich in cash are saving themselves,” he said.

A certified real estate agent in Gaepo-dong also said, “When consumers buy a house, there should be certainty that house prices will not come down, or there should be an expectation that house prices will rise even if they are not completely bottomed out, but currently neither of them. It also moved to this Gangnam area,” he said.

Although it is not the Jangjang complex, there were also downtrends in Seocho-gu. The 84 m² dedicated to ‘Seocho Hills’ in Umyeon-dong, Seocho-gu was traded at 1.65 billion won last month and 1.635 billion won in May. This is the area sold for 1.74 billion won in August last year. It fell to less than 100 million won compared to the reported value.

An 84 m² dedicated to Hyundai in Jamwon-dong was also sold for 2.2 billion won last month. It traded 70 million won higher than the 2.15 billion won traded in April, but 100 million won lower than the 2.3 billion won reported in August last year.

“In Seocho-gu, with the exception of places where large apartment buildings such as Banpo-dong are clustered, there is a slight decrease in prices,” said an official from the C real estate agent in Jamwon-dong, Seocho-gu. If interest rates continue to rise and house prices continue to fall, it will not be adjusted to some extent in the second half of the year.”

The forecast that house prices will fall is also reflected in statistics. The Seoul June sale price forecast index announced by KB Real Estate was 78, down 14.1 points from 92.2 in May the previous month. It is the lowest level in three years and three months since recording 74.3 in March 2019. This index is a statistic surveyed by KB Kookmin Bank on its partner authorized brokers. This means that many respondents predicted that house prices would fall if it fell below 100 on the basis of 100.

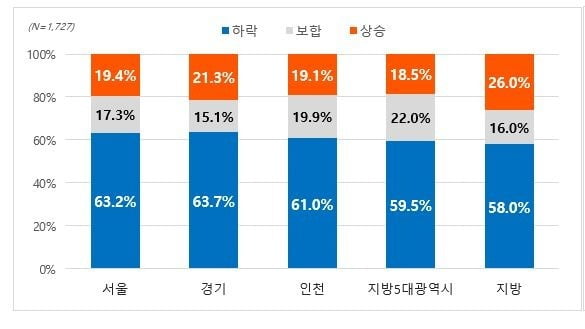

End-users also expect house prices to fall in the second half of the year. According to the real estate platform Jikbang, 61.9% (1,069 people) of the total respondents (1,727 people) thought that ‘house prices will fall in the second half of the year’. ‘Increased interest burden due to interest rate hike’ accounted for the largest share at 63.9%. It was followed by △decreased demand due to the perception that the current price level was high (15.0%), △inflation burden and economic slowdown (12.1%), and △increase in sales (4.7%) due to the easing of the transfer tax for multi-home owners.

However, there are opinions that it is difficult to see that the trend is still declining. “It is true that there are downtrends, but it is not like Sejong or Daegu, where house prices are falling,” said a D-authorized brokerage official in Daechi-dong, Gangnam-gu.

An E-authorized brokerage official in Banpo-dong also said, “The talk of ‘peaking and dropping’ in Banpo-dong has been around since last year, but it is still breaking highs.” The price has been maintained since it came out. As a result, landlords are calling the asking price higher rather than lowering it, but this situation seems likely to continue for a while.”

Meanwhile, according to the Korea Real Estate Agency, in the first half of this year, the only places where house prices rose among 25 districts in Seoul were Seocho-gu and Gangnam-gu. However, in the second half of the year, 24 out of 25 districts in Seoul, including 3 in Gangnam, showed a downward trend. Only Yongsan-gu recorded a steady record.

Buying sentiment is also sluggish. According to the Korea Real Estate Agency, the Seoul apartment sales and demand index fell to 86.8 in the first week of July (4th), down to the level of the last week (28th, 86.8) in February. It even climbed to 91.4 following the presidential election, but it returned the rise once more. This index is an index of supply and demand by the Real Estate Agency by analyzing surveys of member brokerages and the number of items for sale on the Internet. If it is below 100, it means that supply is greater than demand, meaning that fewer actual buyers are willing to buy a house, and more landlords are willing to sell.

Reporter Lee Song-ryeol at Hankyung.com [email protected]