Putin’s Secret Son Pictured: Olympic Gymnast’s Child

“`html First Photos of Vladimir PutinS Alleged Secret Son surface First Photos of Vladimir Putin’s Alleged Secret Son Surface Amid Lingering Questions About His Personal

“`html First Photos of Vladimir PutinS Alleged Secret Son surface First Photos of Vladimir Putin’s Alleged Secret Son Surface Amid Lingering Questions About His Personal

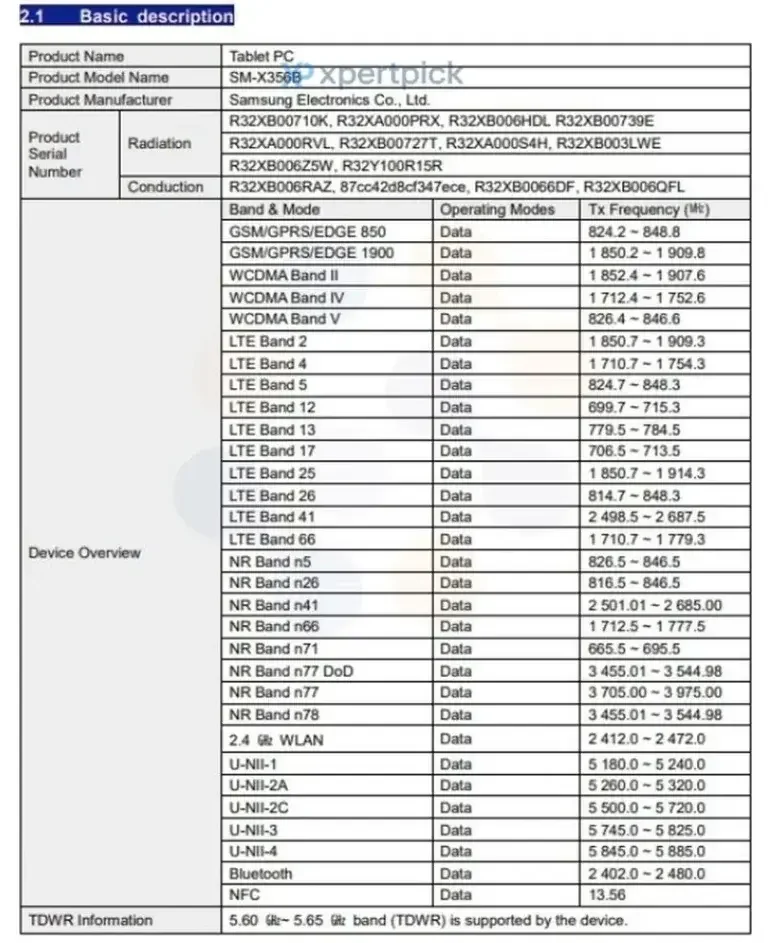

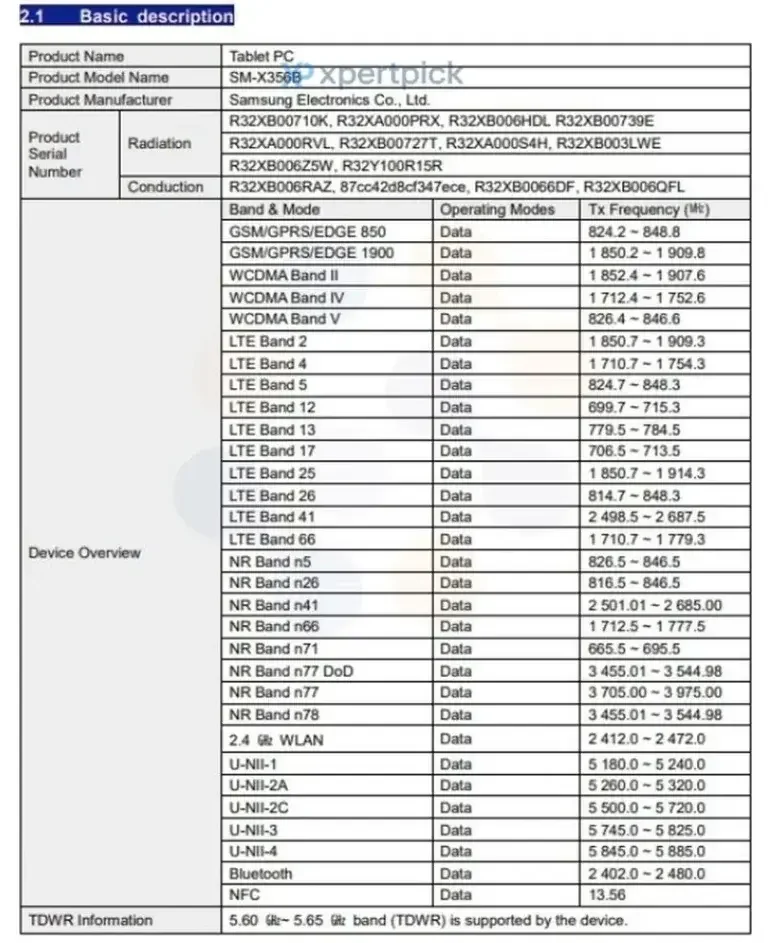

“`html Samsung Galaxy Tab Active 5 Pro Clears FCC Hurdle, Launch Imminent the ruggedized tablet, designed for demanding environments, gains key certifications ahead of its

U.S. Finalizes Tariffs on Solar cells from Southeast asia Amid Trade Dispute By Archyde News service | May 2, 2025 Washington D.C. — The United

Harvard President Joins University Leaders in Denouncing Government Overreach Table of Contents 1. Harvard President Joins University Leaders in Denouncing Government Overreach 2. Universities Call

“`html First Photos of Vladimir PutinS Alleged Secret Son surface First Photos of Vladimir Putin’s Alleged Secret Son Surface Amid Lingering Questions About His Personal

“`html Samsung Galaxy Tab Active 5 Pro Clears FCC Hurdle, Launch Imminent the ruggedized tablet, designed for demanding environments, gains key certifications ahead of its

U.S. Finalizes Tariffs on Solar cells from Southeast asia Amid Trade Dispute By Archyde News service | May 2, 2025 Washington D.C. — The United

Harvard President Joins University Leaders in Denouncing Government Overreach Table of Contents 1. Harvard President Joins University Leaders in Denouncing Government Overreach 2. Universities Call

© 2025 All rights reserved