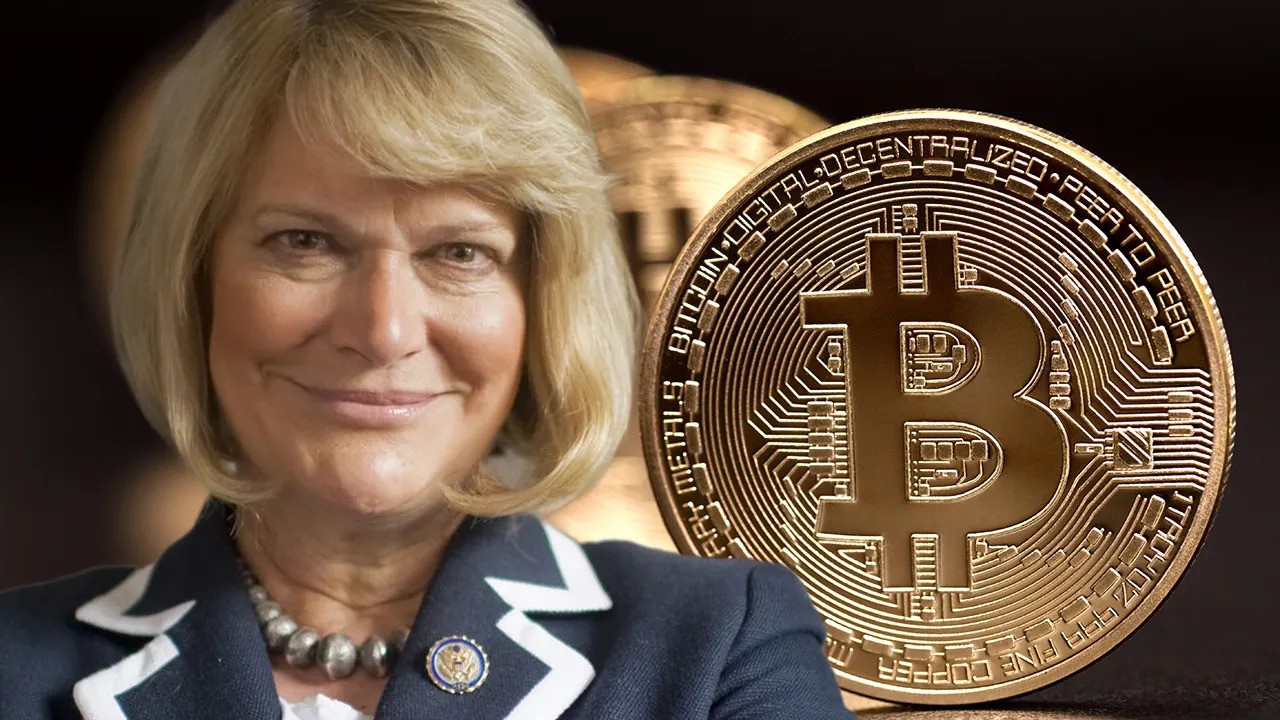

Senator Cynthia Lummis has proposed legislation that would mandate the US government to purchase 1 million Bitcoins, which currently hold a value exceeding $68 billion. Lummis believes that Bitcoin could stabilize the dollar’s value and mitigate inflation as a strategic reserve asset.

Senator Lummis’ Announcement

Senator Cynthia Lummis has revealed her intention to introduce a bill requiring the US government to acquire 1 million Bitcoins, valued at over $68 billion based on current exchange rates.

During her speech at the Bitcoin 2024 conference in Nashville, Lummis stated that her bill aims for the US Treasury to buy Bitcoin within five years. The objective is for cryptocurrency to reinforce the dollar as a strategic reserve asset. Lummis compared this initiative to the government’s strategic oil reserve.

“We know from calculations and Bitcoin’s historical performance that it can significantly impact resolving the US debt and deficit issues,” Lummis remarked.

The Purpose of Accumulating Bitcoin

The senator indicated that the government would store Bitcoin across various geographical locations. These assets would only be utilized to reduce the national debt and should be maintained for a minimum of 20 years.

Lummis is a prominent advocate for Bitcoin in Congress, asserting that acquiring it would assist in stabilizing the dollar’s value and countering inflation. The national debt has recently surpassed $35 trillion.

Political Support and Prospects

Lummis’ proposal comes in the wake of former President Donald Trump’s endorsement during the Nashville conference, where he supported the concept of an American Bitcoin reserve. Trump has expressed that he would never sell the government’s 210,000 Bitcoins.

While Lummis acknowledges that her bill is unlikely to be passed before the 2024 election, she believes the increasing political interest in a Bitcoin reserve signifies a shift in perspective. Bitcoin has emerged as a significant campaign topic, and both political parties are eager to engage with the expanding industry.

Lummis’ proposal stands as the most aggressive government initiative for Bitcoin accumulation to date. Despite the uncertain outlook, this move would validate Bitcoin as a legitimate economic asset. The senator remains hopeful that additional Bitcoin-centric legislation may be enacted later this year as Bitcoin gains a stronger foothold in the political landscape.

Senator Cynthia Lummis has introduced a bill that would require the US government to buy 1 million Bitcoins, which are currently worth more than $68 billion. Lummis believes that Bitcoin would stabilize the value of the dollar and offset inflation as a strategic reserve.

Senator Lummis’ Announcement

Senator Cynthia Lummis has officially announced her plan to introduce a bill for the US government to purchase 1 million Bitcoins, amounting to over $68 billion at current market rates. This announcement was made during her keynote address at the Bitcoin 2024 conference held in Nashville, Tennessee.

According to Lummis, the proposed legislation would mandate that the US Treasury acquire these Bitcoins within a five-year timeframe. The senator contends that this significant acquisition is aimed at reinforcing the value of the dollar and positioning Bitcoin as a strategic reserve asset, akin to the government’s strategic oil reserve.

“We know based on calculations and Bitcoin’s past experience that it can make a huge difference in solving the US debt and deficit problems,” Lummis stated during the conference.

The Purpose of Accumulating Bitcoin

Senator Lummis argues that the government would strategically store the acquired Bitcoin across various geographic locations. The proposed legislation stipulates that these assets would only be utilized for reducing the national debt, with a holding period of at least 20 years.

Recognized as one of Congress’s most ardent supporters of Bitcoin, Lummis believes that acquiring Bitcoin will assist in stabilizing the dollar and combating the ongoing issue of inflation. The national debt has recently surpassed $35 trillion, underscoring the urgent need for innovative financial solutions.

Political Support and Prospects

Lummis’ proposition follows a supportive statement from former President Donald Trump, who expressed his endorsement during the Nashville conference. Trump articulated his commitment to maintaining the government’s existing 210,000 Bitcoins without selling them.

While Lummis acknowledges that her bill’s chances of passing before the impending 2024 election are slim, she perceives a notable increase in political interest concerning the establishment of a Bitcoin reserve. Bitcoin has rapidly transformed into a significant political issue, with both major parties vying to appeal to the expanding cryptocurrency sector.

This bill is recognized as the most ambitious government initiative to amass Bitcoin to date. Although the future remains uncertain, such a move would undoubtedly serve to legitimize Bitcoin as a vital economic asset. Lummis remains optimistic that additional Bitcoin-focused legislative initiatives may gain traction later this year as the cryptocurrency enters the political mainstream.

Key Components of the Bill

- Acquisition Amount: The bill calls for the purchase of 1 million Bitcoins.

- Total Value: The proposal is estimated at over $68 billion based on current exchange rates.

- Acquisition Timeline: Bitcoin is to be purchased within a five-year window.

- Storage Strategy: Bitcoins will be kept in various geographical locations across the US.

- Holding Period: The assets must remain untouched for at least 20 years.

Potential Benefits of the Bill

The introduction of this bill could herald numerous advantages for the United States and the Bitcoin ecosystem:

- Stabilization of the Dollar: By holding Bitcoin as a reserve, the dollar’s value may gain protection against inflation fluctuations.

- Debt Reduction Strategy: Using Bitcoin to address national debt could provide a unique avenue for fiscal responsibility.

- Increased Credibility for Bitcoin: Formal recognition of Bitcoin as an economic asset could bolster its wider adoption.

- Attractive to Investors: Institutional backing may draw more investors to Bitcoin, driving its value higher.

Case Studies: Countries Embracing Bitcoin as a Reserve Asset

Several countries have started to explore the concept of holding Bitcoin as part of their national reserves, showcasing the growing recognition of cryptocurrency within traditional finance:

| Country | Bitcoin Reserves | Usage of Bitcoin |

|---|---|---|

| El Salvador | Over 2,300 BTC | Legal tender, national development projects |

| Central African Republic | Undisclosed | Legal tender, attracting foreign investment |

| Ukraine | Undisclosed | Donation support during conflict, blockchain innovations |

Practical Tips for Understanding Bitcoin as a Strategic Asset

For those curious about how Bitcoin can serve as a strategic asset for governments and individuals alike, consider these practical tips:

- Research the Basics: Understand fundamental concepts of Bitcoin, blockchain technology, and cryptocurrencies.

- Stay Updated: Follow trustworthy news sources and developments in cryptocurrency legislation.

- Engage in Communities: Join online forums or local meet-ups to discuss Bitcoin with enthusiasts and experts.

- Monitor Market Trends: Regularly assess Bitcoin market trends to grasp its price movements and investment opportunities.

First-Hand Experience: Senators’ Perspective on Bitcoin

During various discussions and forums, Senator Lummis has shared her experiences and insights on Bitcoin, emphasizing its potential and the risks associated with it:

“Bitcoin is not just a speculative asset; it is the future of money. We stand at the crossroads of financial independence. It’s time for our country to embrace this innovation,” remarked Senator Lummis, underscoring her enthusiasm for the digital currency.