[서기열의 집터뷰] Kim Young-ik is a professor at Sogang University’s Graduate School of Economics.

Promising assets in times of rapid economic downturn and optimal portfolios in times of low growth

▶ Reporter Seo Ki-yeol

Professor, you just said that the factor that greatly affects house prices is ‘the economy’, but then you also mentioned the economic slowdown. So, how much do you think regarding the economic growth forecasts of Korea and the US this year?

▷Professor Young-ik Kim

I think our economic growth rate will be around 2.5%. Of course, the Bank of Korea is looking at 3.0%, and the government is looking at more than that. If I view the growth rate lower than that of public institutions, the consumption growth rate will be a little lower than what they predicted.

And exports went well last year, and until February, things went really well. But since March, global economic growth has slowed. Looking at the growth rate of Korea’s exports, it is almost in the same direction as the OECD leading index. However, the OECD leading index has continued to decline following peaking in June last year. It means that global economic growth is slowing. So maybe the export growth rate is much lower than expected.

And in January, our trade balance was in a deficit of regarding $4.8 billion, and in February, it turned into a surplus of regarding $900 million.

▶ Reporter Seo Ki-yeol

It turned black.

▷Professor Young-ik Kim

Yes, but I think the raw material price will drop towards the second half of the year, but since it will remain high for the time being, I think the import will increase further. Therefore, income is a factor that undermines economic growth. So, while imports increase due to the price of raw materials, the economic growth rate will be around 2.5% (lower) than 3%.

After that, the IMF continues to lower the US economic growth rate to 4.0% this year, and then today’s Bloomberg consensus shows the US economy growth rate to 3.8%. I think it’s in the low 3% range. In the US, consumption is also unlikely to grow as much as expected. Consumption accounts for 70% of U.S. GDP.

▶ Reporter Seo Ki-yeol

Wow, that’s very high.

▷Professor Young-ik Kim

But US asset prices, stock prices, and house prices go up, and it’s called the ‘wealth effect’. This has the effect of further increasing consumption.

▶ Reporter Seo Ki-yeol

It went up a lot last year, so I spent a lot of money.

▷Professor Young-ik Kim

But now, stock prices are falling and house prices are likely to fall sooner or later, and I think this is the effect of wealth. In particular, stocks account for 53% of US household assets in financial assets.

▶ Reporter Seo Ki-yeol

It’s very high.

▷Professor Young-ik Kim

It’s the highest in history. What level is this? 48% just before the 2000 IT bubble burst.

▶ Reporter Seo Ki-yeol

Wow, that’s higher than that.

▷Professor Young-ik Kim

right. And in 2008, there was a financial crisis in the United States. Even before that, it was also 48%.

▶ Reporter Seo Ki-yeol

It’s almost like we’re on the verge of such a crisis.

▷Professor Young-ik Kim

Yes that’s right. That means the stock price has risen a lot, and if it goes down, it might fall once more. So if you look at the US Conference Board or the University of Michigan Consumer Sentiment Index, they move in the same direction as stock prices. So, if stock prices fall and house prices fall, the psychological index will contract considerably, which will actually act as a factor in reducing consumption.

So, since consumption accounts for 70% of US GDP, it is highly likely that the US economic growth rate will be lower in the second half of the year than predicted by professional institutions.

▶ Reporter Seo Ki-yeol

The overall economic growth rate is inevitably going to fall further due to the contraction in consumption.

▷Professor Young-ik Kim

Yes that’s right.

▶ Reporter Seo Ki-yeol

That’s what you’re expecting. If that happens, then, macroeconomically, Korea and the United States have no choice but to go towards a slowing economy.

▷Professor Young-ik Kim

When we think of asset prices, we now have to think regarding the economy rather than interest rates. In the meantime, we’ve only talked regarding interest rates in our stock market house prices. In particular, interest rates are reflected in the stock market, and even if interest rates rise, the stock price can also rise if the economic growth rate and corporate profits increase. However, in a situation where interest rates rise a little, corporate profit growth and economic growth are likely to fall. I think this is a more important factor for wealthy people.

▶ Reporter Seo Ki-yeol

If a company fails to make a profit due to the economic slowdown, stock prices will fall and asset prices will fall overall.

▷Professor Young-ik Kim

As I mentioned regarding economic growth, corporate profits will likely be much lower than expected. In the first quarter, companies did not raise the price of this product very much. I have already received the order. But now the raw material prices are going up a lot, so the production cost has gone up a lot.

▶ Reporter Seo Ki-yeol

Then the profit will decrease.

▷Professor Young-ik Kim

Yes. If you go to the beginning of the second quarter, when the first quarter data is released, the earnings forecast is much lower than expected, and it is expected that the downward revision will continue.

▶ Reporter Seo Ki-yeol

i See. In addition, another variable that is actually happening right now, which is very important right now, is the war being waged by Russia’s invasion of Ukraine. I think it will have a very diverse impact on the financial and commodities markets. How do you see it?

▷Professor Young-ik Kim

Yes, the most important thing is the price of raw materials. Isn’t the price of oil over $110 a barrel now and then the price of various grains soaring? This can make the inflation problem worse in the short term and accelerate the slowdown.

Of course, I don’t know how the war will go. So, if you look at the foreign press, will the Ukrainian-Russian war end in Ukraine or will it expand to NATO? That would be a really big deal.

▶ Reporter Seo Ki-yeol

It’s a really big battle.

▷Professor Young-ik Kim

Yes. Because of this, as the price of various raw materials rises, the price rises more, corporate profits decrease, and consumption immediately decreases. When the price of oil rises, I have to reduce other consumption as the price of oil rises. Also, when oil prices rise, consumer prices rise immediately following one month in places like the United States.

▶ Reporter Seo Ki-yeol

That’s directly affecting it.

▷Professor Young-ik Kim

following 1 month. In Korea, the time lag of regarding two months is greatly affected by consumer prices. When the price level goes up, I get paid, but my real purchasing power goes down as the price level goes up. We have no choice but to reduce consumption. So this Ukraine crisis probably has the effect of lowering the economic growth rate faster through consumption.

▶ Reporter Seo Ki-yeol

In fact, if the inflation and the economic slowdown overlap, I think it might be said that stagflation is actually a reality. When did something like this happen in the past?

▷Professor Young-ik Kim

It was typically in the late 70’s. In the late 1970s, the first and second oil shocks caused oil prices to rise significantly. At that time, the US consumer price level rose by 14%. If I think regarding it now, it is 7% higher now, but then it will rise to 14%.

▶ Reporter Seo Ki-yeol

Wow, that must have been awesome.

▷Professor Young-ik Kim

And as prices rise, now the supply curve shifts to the left and growth slows down. So, now, the policy makers have to choose between choosing the price level or the economy. Another notable one is that Fed Chairman Paul Volcker boldly raises interest rates.

▶ Reporter Seo Ki-yeol

I’ll take the price.

▷Professor Young-ik Kim

Yes. That’s when the federal funds rate goes up to 19%.

▶ Reporter Seo Ki-yeol

Oh, that’s unimaginable right now.

▷Professor Young-ik Kim

It’s unimaginable. So, even though the price has been fixed, the US economy will have negative growth in 1980 and 1982.

▶ Reporter Seo Ki-yeol

Instead of catching the price, the game was forced to retreat.

▷Professor Young-ik Kim

Yes. Well, it’s not at that level now. In recent years, inflation has remained high and the economy has slowed, showing signs of partial stainflation. But it’s not negative growth, so it’s not stagflation. But now, there are signs of stagflation, but I think in the first half of next year, the economic growth rate will turn to negative growth, especially in the US, and prices will drop a lot.

We are talking regarding inflation and inflation right now, but I think a completely different story will come out in the first half of next year.

▶ Reporter Seo Ki-yeol

In order to reach stagflation, inflation must be high and the economy must slow down. Looking at it that way, it seems that going to stagflation will not be easy.

In such a situation, in fact, in this situation now, what changes will occur in the asset markets such as stocks, bonds, and real estate?

▷Professor Young-ik Kim

Korean stocks have entered a phase of undervaluation by 4% from the average daily export amount. So I can go further from here. However, I think it is better to buy stocks gradually and increase the weight a little.

After that, I think we should increase our investment in bonds a bit. Focus on long-term bonds. Because the 10-year Treasury yield is 2.78%, I think that’s near the peak. Since bond yields may decline toward the second half of the year, when bond yields fall, as we know, bond prices rise and we have to invest in bonds.

Now is not the time to increase the proportion of real estate. Also, doesn’t Korea announce the total household financial assets and household financial assets once a year by the National Statistical Office of the Bank of Korea? According to the announcement made in March of last year, 77% of real assets and 23% of financial assets. The deposit for monthly rent for financial assets is included. If you deduct the monthly rent deposit, it’s only 17%.

▶ Reporter Seo Ki-yeol

Really? It’s very different from America.

▷Professor Young-ik Kim

It’s really different. The proportion of real assets is too high. So, in the medium term, we need to reduce the proportion of real estate and increase financial assets. Among financial assets, I believe that our economy has structurally entered an era of low growth and low interest rates.

So, an era has come when the KOSPI dividend yield is higher than bank interest. And there are many good companies that pay dividends around 5%. So, increase financial assets, but invest in stocks and dividends. Right now, our share is around 23%. that’s not high I’m watching this right now.

▶ Reporter Seo Ki-yeol

Given the current economic slowdown and such, it is necessary to bring regarding a change in such a portfolio amidst these macroeconomic changes.

▷Professor Young-ik Kim

yes yes That’s right.

▶ Reporter Seo Ki-yeol

Actually, the last question. You have observed the ups and downs in the market for over 30 years.

▷Professor Young-ik Kim

Simply put, holding good stocks for a long time makes money. The closest relatives tell me that Samsung Electronics sent their two children to study abroad.

▶ Reporter Seo Ki-yeol

Samsung Electronics?

▷Professor Young-ik Kim

Whenever I had money, I bought Samsung Electronics stock. It depends on the timing, but since the 1997 Asian financial crisis, the stock price of Samsung Electronics has risen nearly 100 times. It went up like that, and then I got a dividend, so something like that is likely to come out. So holding good stocks for a long time makes money.

And as I said before, dividend investment is a must, regardless of the time period, because structurally we have entered an era of low growth and low interest rates. Let me tell you this.

And didn’t the host ask me, what does money mean?

▶ Reporter Seo Ki-yeol

right. Finance philosophy and know-how.

▷Professor Young-ik Kim

As Schopenhauer said, “Money is like seawater, the more you drink it, the more thirsty you are.” So, while working for a financial company, I dealt with a lot of rich people. Most of the rich people do this to make more money even though they have that much money.

But George Bernard Shaw said, “Money is not everything, but more is better.” But as I continue to live now, I sometimes think regarding money. Money is what makes you do what you want to do when you want to.

▶ Reporter Seo Ki-yeol

It’s giving me freedom.

▷Professor Young-ik Kim

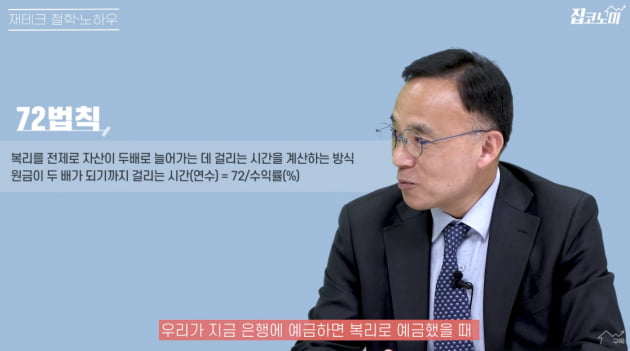

That gives freedom. So you have to make money. But where should you get this money? For example, there is a ‘Rule of 72’. If we deposit in a bank today, if the interest rate is 1% when depositing with compound interest, it will take 72 years for the principal to double.

▶ Reporter Seo Ki-yeol

72 years.

▷Professor Young-ik Kim

But when I was born, when I was living, my presenter, reporter Seo, my age, the interest rate was 9%. If the interest rate is 9%, the principal will double following 8 years. But now the interest rate is 1%. In the future, I might fall below 1%. It would take 100 years to double your money. So we can invest in real estate, but we have no choice but to invest in financial assets, especially stocks.

Also, while I was attending a financial company, I saw some rich people, but as I moved to a securities company, some media reported that I received a high salary and moved. What kind of report are you making? These reports are out, so please bring some money from the reunion club.

▶ Reporter Seo Ki-yeol

Do you want to donate?

▷Professor Young-ik Kim

A lot of people in need came to me personally, and their circumstances were difficult. Ask for help, and I thought that even those poor people had a deepening of this income inequality. So, I started thinking that money was to be shared. So now, I’ve written regarding 13 books so far, but I donate all the royalties with the books I’ve written, and then automatically transfer them little by little to a few places every month.

▶ Reporter Seo Ki-yeol

That’s right.

▷Professor Young-ik Kim

So money is free. and it will be shared So we have to make money, but we cannot be satisfied with bank deposits, so we have to study real estate, especially stocks. I want to tell you this.

▶ Reporter Seo Ki-yeol

After all, you are saying that money gives you freedom and makes you able to give to others. For that, he said, study hard on finance, do research, and make investments.

▷Professor Young-ik Kim

In particular, I think it would be good for young people to look a little further and invest.

The 2030 generation has the lowest rate of return. After analyzing why it is low, don’t the 2030 generation have a lot of accumulated financial assets? Because this seed money is small, it is a credit loan. I borrowed money from a securities company and bought stocks. But when a securities company lends money, it is not a long-term loan. Well, 3 months, 6 months, or 1 year, the interest is also very high.

▶ Reporter Seo Ki-yeol

That’s a high interest rate.

▷Professor Young-ik Kim

So, it is a short-term investment. Some of my classmates at the securities firm made a lot of money.

▶ Reporter Seo Ki-yeol

in stock?

▷Professor Young-ik Kim

Yes. For example, Park Young-ok.

▶ Reporter Seo Ki-yeol

Ah, stock farmer.

▷Professor Young-ik Kim

stock farmer. When I see that friend, I look really far away and invest. I really didn’t have any money. We were close, so we were the same classmates, and we continue to meet up to this day, but we’ve accumulated wealth like that by looking at it from afar.

▶ Reporter Seo Ki-yeol

long term investment.

▷Professor Young-ik Kim

So, young people, the 2030 generation is entering an era of low growth and low interest rates structurally with our economy, so you will probably have to invest until you are 100 years old. So, I think it would be better to look a little further and invest in a house, real estate, stocks, or bonds like this.

▶ Reporter Seo Ki-yeol

Invest with interest in investing with the idea of investing until you die.

▷Professor Young-ik Kim

Yes that’s right.

▶ Reporter Seo Ki-yeol

All right. Today, with Professor Young-Ik Kim, we had a good conversation regarding macroeconomic diagnosis and advice on future financial technology.

▷Professor Young-ik Kim

Yes, Thank you.

plan Home Economy TV general Seong-Geun Cho, Director of Video Division progress Reporter Seo Gi-yeol

filming Jung Joon-young PD edit Producer Yunhwa Kim produce Korea Economic Daily, Hankyung.com, Hankyung Digital Lab

:strip_icc():format(jpeg)/kly-media-production/medias/5036795/original/095429800_1733393557-mimpi-gerhana-matahari-1.jpg)